Pi Coin’s price has slipped nearly 15% over the past month. In the last 24 hours, it edged higher by about 1%, but overall momentum still looks weak.

With the token hovering near $0.34, many traders fear a retest of its all-time low around $0.32. Yet an unlikely signal could offer a short-term lift. It may come from the Dogecoin ETF launch.

Correlation With Meme Coins Could Drive The Price Up

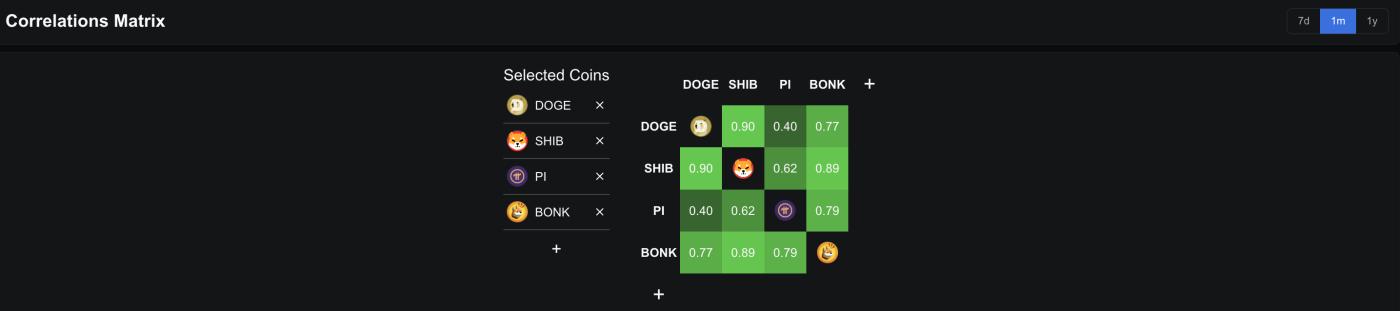

One of the clearest signals comes from correlation. Pi Coin has shown a one-month Pearson correlation of 0.79 with BONK and 0.62 with Shiba Inu.

The Pearson correlation metric measures how closely two assets move together, with 1.0 meaning perfect correlation. At 0.79, Pi Coin and BONK are strongly aligned.

Pi Coin Correlation: DeFillama

Pi Coin Correlation: DeFillamaWant more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This matters because Bonk is one of the leaders in the meme sector. If the Dogecoin ETF (DOJE) launch sparks a rally across meme coins, Pi Network (PI) could follow suit, thanks to its close ties to meme coins.

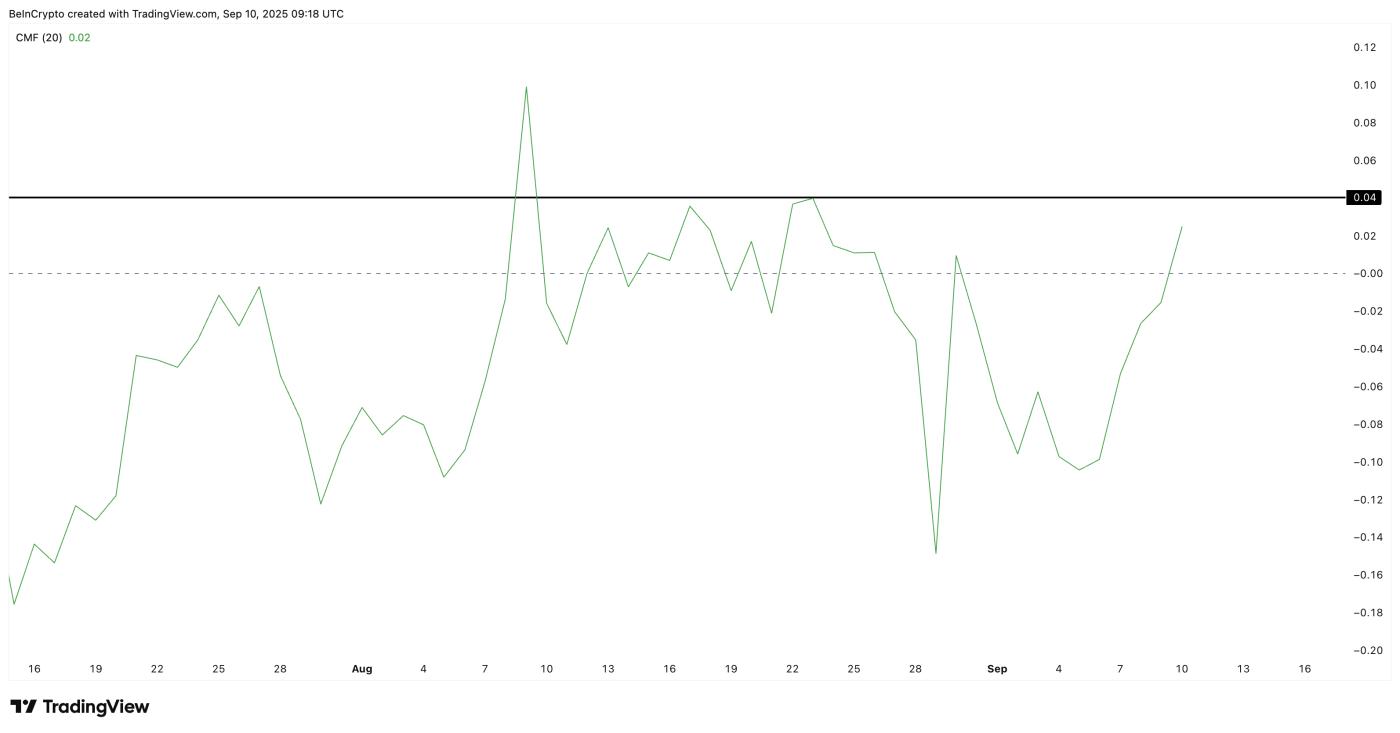

At the same time, money flows are turning slightly bullish. The Chaikin Money Flow (CMF), which tracks whether money flows in or out of an asset, has flipped positive at +0.02.

Pi Coin Sees New Money Inflows: TradingView

Pi Coin Sees New Money Inflows: TradingViewThe last time CMF made such a shift, on August 30, Pi Coin saw a quick green bounce. With CMF rising just as Pi Coin price strengthens its link with BONK, the timing may not be coincidental. The two signals suggest buyers are positioning if the meme coin space gets a boost from the $DOJE ETF launch.

For a stronger move, CMF would need to rise toward +0.08, the level seen in late August. That would confirm that larger money flows are backing the correlation story. But right now, Pi Coin traders would take anything, even a small CMF uptick.

Bearish Grip on Pi Coin Price Weakens but Not Broken Yet

Another indicator, the Bull-Bear Power (BBP), helps traders measure the strength of buying versus selling. Since September 2, BBP has shown that selling pressure is easing.

Bears still control the Pi Coin price chart, but their edge is shrinking. In past cases, this softening has led to short-lived upward bursts. If sellers lose strength, even a small push from buyers can trigger a bounce.

Pi Coin Price Analysis: TradingView

Pi Coin Price Analysis: TradingViewThe bear power waning before the big meme coin ETF event further validates the angle.

The technical chart still leans bearish, though. The Pi Coin price trades inside a descending triangle, a pattern usually linked to breakdowns. Price support sits near $0.33 and $0.32, and if broken, the PI price could test new all-time lows, defeating the bounce thesis.

Unless bulls can push Pi above $0.36, the bearish setup remains intact, and even a bounce might just end up being one green candle and not a grouping.