Somnia (SOMI) is showing signs of losing momentum after its recent surge, as the altcoin’s price has fallen sharply from All-Time-High.

The current price drop is raising concerns that SOMI could slide below $1.00 if the situation worsens.

Somnia traders step back

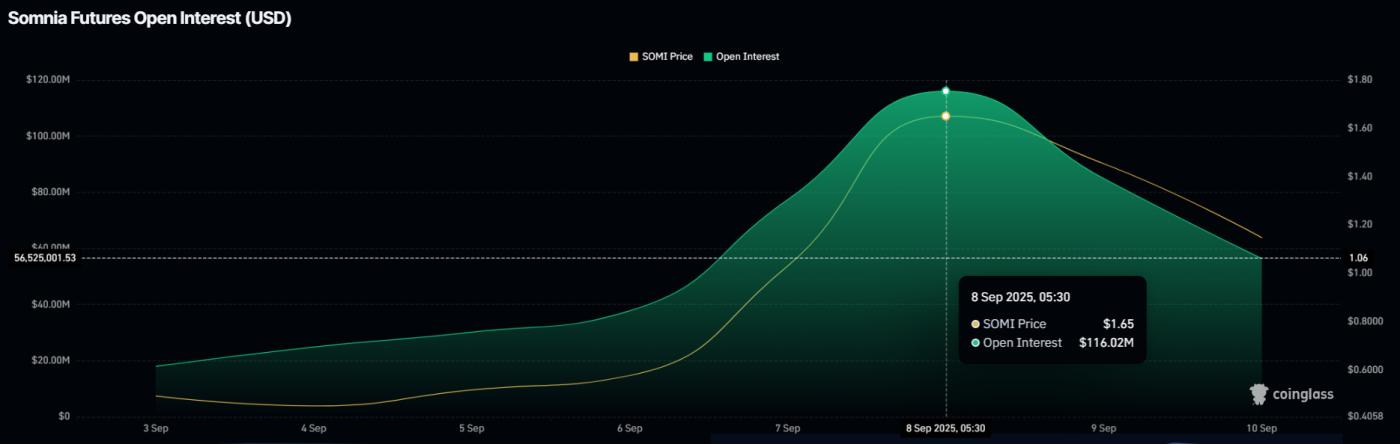

SOMI's decline is closely linked to a drop in open interest. Open interest has dropped 51% in the past 48 hours, reflecting traders pulling back due to concerns about liquidation. This drop suggests investors are reducing risk.

The value of open interest has dropped from $116 million to $56 million, indicating waning confidence among SOMI traders . This sharp decline suggests that the rally to the All-Time-High may have run out, leaving the Token vulnerable to further price declines.

Want more information about Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

SOMI Futures Contract open interest. Source: Coinglass

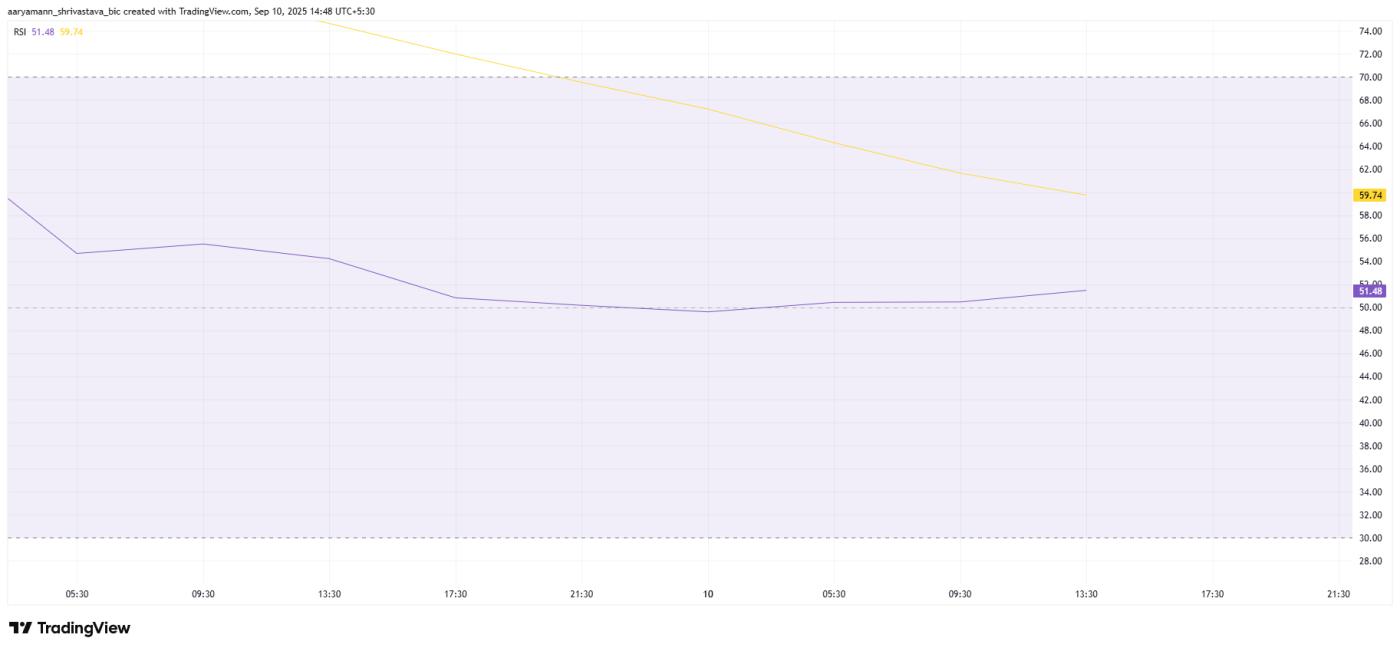

SOMI Futures Contract open interest. Source: CoinglassDespite the negative sentiment in the Derivative market, overall conditions appear to be more favorable. The Relative Strength Index (RSI) remains above the neutral level of 50.0. This suggests that SOMI still has some underlying market support.

If the RSI remains above 50.0, this signals that the Token could resist further declines. While the recent decline in open interest is worrying, the overall bullish momentum in the broader market could help SOMI stabilize and potentially recover from current levels.

SOMI RSI. Source: TradingView

SOMI RSI. Source: TradingViewSOMI price may recover

At the time of writing, SOMI is trading at $1.19 after falling nearly 18% over the past 24 hours. The Token is now at risk of sliding below its immediate support at $1.03, which could create further bearish pressure.

If SOMI loses this important support level, it risks sliding below $1.00 and possibly dropping to $0.57. Such a move would represent a sharp reversal from recent highs and confirm the dominance of the short-term downtrend.

SOMI Price Analysis. Source: TradingView

SOMI Price Analysis. Source: TradingViewHowever, if the Token regains momentum, SOMI could reverse and reclaim $1.44. Converting this level into support would open the door for a rally back to the All-Time-High of $1.90, invalidating the bearish outlook and restoring investor confidence.