The Ethereum (ETH) derivatives market is entering an era of unprecedented high leverage. On-chain data from August 2025 shows that numerous whale investors, using platforms like Hyperliquid, have accumulated long positions worth billions of dollars in notional value, using leverage ratios ranging from 15x to 25x, with the goal of driving up ETH prices.

The whale are back, are you optimistic about ETH's surge again?

According to community analyst Aunt Ai, the most talked-about case is a whale who "rolled long on $125,000". The account started with a principal of $125,000 and once expanded its position to $300 million. Even though the funds recently fell back to $58,000, it still added $92,000 in margin last night and opened a long order of $2.297 million in ETH with 25x leverage. The liquidation price was approximately $4,488, and the latest floating profit was approximately $11,000.

Another whale holds a 15x position of 51,000 ETH, with a notional value of over US$2.3 billion; an even larger account holds 86,800 ETH, also betting with 15x leverage.

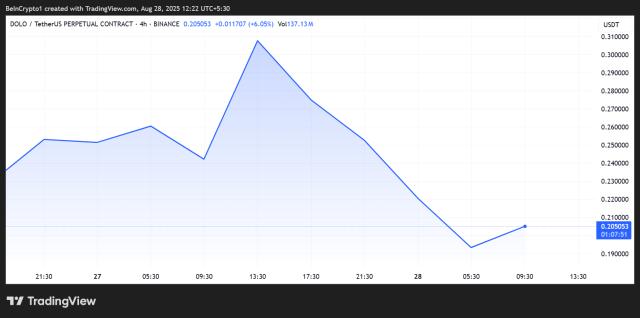

These highly leveraged positions have accelerated market volatility. A recent record of $4.7 billion in forced liquidations highlights the potential for a chain reaction of liquidations to spread across the broader market should prices experience a short-term pullback.

Institutional buying compresses circulating supply

Whale are not isolated retail investors. In August this year, 48 new addresses holding more than 10,000 ETH were added to the market, attracting approximately US$240 million in currency to institutions such as Galaxy Digital in a single month.

Whale accounts coordinated the movement of approximately $1.2 billion, and within 48 hours, 200,000 ETH flowed out of centralized exchanges, most of which went into staking or cold wallets, further shrinking the circulating supply. Currently, whale control approximately 22% of the total supply and continue to absorb 800,000 ETH per week, significantly reducing the floating chips in the market.

The technical outlook also favors a bullish outlook, with multiple analysis outlets citing indicators such as a bullish flag pattern, a positive MACD, and a Money Flow Index of 83. Market expectations are high that ETH will challenge $7,000. Coupled with the $13 billion in net ETF inflows in the second quarter of 2025 and the long-term effects of deflation, whales' leveraged bets appear to have found psychological support.

However, investors still need to be very careful. The current ETH market has gathered record-breaking bullish consensus and liquidation pressure. The future trend will depend on whether the price is sufficient to maintain the safety margin of highly leveraged positions.

*This article is not an investment advice. Please carefully study before making any investment decisions.