BTC Stumbles as Capital Rotates to ETH

Bitcoin lost momentum after a sharp weekend sell-off, triggered by an early holder unloading 24,000 BTC (~$2.7B) during thin Sunday liquidity. The move erased around $500M in leveraged positions and pushed BTC dominance down to 57%, as capital briefly rotated to ETH and other majors before broader weakness set in.

This shift unfolds against a supportive macro backdrop. Jerome Powell’s Jackson Hole remarks reignited expectations of rate cuts, with September odds climbing back toward 87%. Historically, such cuts — when not tied to recessions — have been bullish for risk assets, including crypto.

Still, cracks are appearing in institutional demand. Spot BTC ETFs have seen six straight sessions of outflows (~$1.2B), while the U.S. Treasury’s TGA rebuild is keeping near-term volatility high. Yet, structural drivers like ETF adoption, tokenization, and steady institutional accumulation keep the long- term outlook constructive.

ETH now leads the spotlight, fuelled by rotation flows, aggressive institutional buying, and optimism around potential staking ETF approvals. While BTC faces selling pressure, the dip-buying narrative remains intact — echoing July’s rapid absorption of 80,000 BTC in legacy supply. In short, this correction is masking a market still positioned for growth as liquidity cycles and policy shifts align in crypto’s favour.

Volatility Surges, Gamma Short Positions Struggle

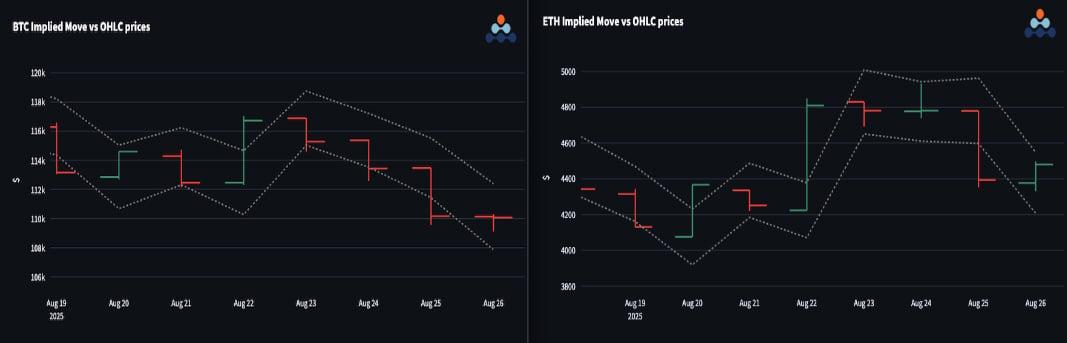

Realized volatility spiked this week, with BTC nearing 40 and ETH above 80;

- Front-end BTC vol rose by 7 vols, while ETH gained around 4 points.

- Carry flipped negative in both assets after sharp post–Jackson Hole moves.

- Repeated breaches of implied ranges made short gamma positions hard to manage, just as warned last week.

- With BTC threatening to break below 110K, the risk of shorting gamma remains high.

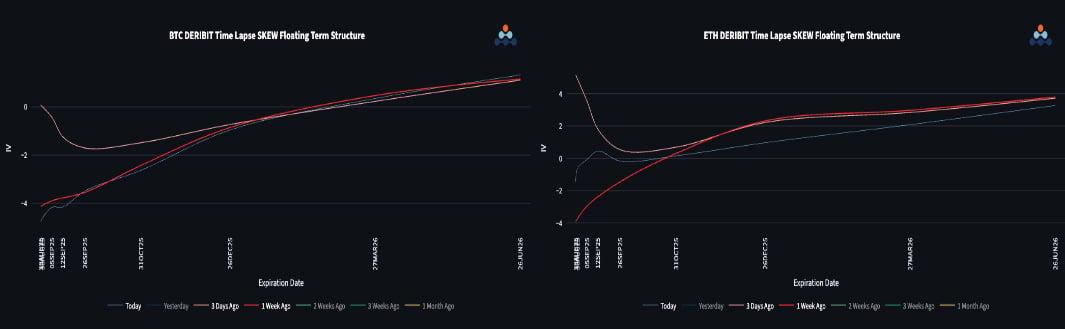

Skew Still Signals a Healthy Bull Market

Both BTC and ETH skew curves saw short-dated call buying after the Jackson Hole rally;

- The momentum was brief; as spot faded, front-end demand shifted back to puts.

- Long-term BTC skew stayed firm, holding a call premium, while ETH call skew faded across the curve.

- The persistence of call premium in long-dated BTC options signals that the market still views this move as a correction within a medium-term bull trend.

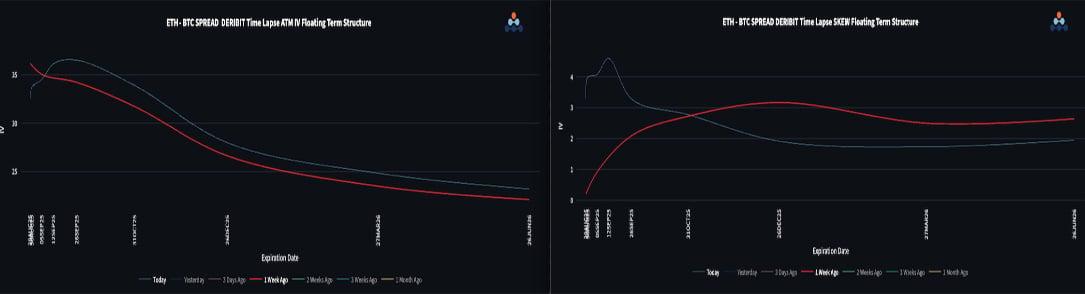

ETH/BTC Breakout Reshapes the Vol Landscape

The ETH/BTC pair broke through downtrend resistance at 0.039 and climbed above 0.043, consolidating now but eyeing a first target of 0.05;

- Front-end vol spread slipped as BTC gamma caught a bid, but the rest of the curve moved higher — reflecting ETH’s outperformance in realized vol.

- Front-end skew spread flipped higher for ETH calls, consistent with the momentum and the approach to a new all-time high near 5000.

- Long-term skew spread still favours ETH upside, though it has eased back to around 2 vols on the long end.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)

Imran Lakha is an expert at using institutional options strategies to capitalize on investment opportunities across global macro asset classes. Learn more here.

RECENT ARTICLES

Crypto Options: Volatility On The Rise

Imran Lakha2025-08-27T10:01:32+00:00August 27, 2025|Industry|

Crypto Derivatives: Analytics Report – Week 35

Block Scholes2025-08-27T09:48:18+00:00August 27, 2025|Industry|

BTC Longer Dated Skew Flipping Into Put Premium

Imran Lakha2025-08-20T09:39:17+00:00August 20, 2025|Industry|

The post Crypto Options: Volatility On The Rise appeared first on Deribit Insights.