Source: TopHash

Compilation & Translation: Janna, ChainCatcher

Editor's Note

This article originates from the latest research report published by Tophash Digital, a consulting and investment company in the digital asset domain, in July 2025. The report reveals the profound transformation in the token listing landscape of cryptocurrency exchanges from 2024 to the first half of 2025. Binance continues to lead through Alpha airdrops and IDOs, with secondary listings rising and demonstrating performance superior to initial listings. On-chain issuance and perpetual contract listings have become new trends, with significant differences in listing strategies, project performance, and paths across various exchanges. This article will comprehensively unveil the dynamics of exchange listings from multiple dimensions including activities, performance, and distribution.

ChainCatcher has organized and translated the content (with some omissions).

This research conducted a comprehensive analysis of cryptocurrency token listing dynamics across major centralized exchanges and Binance-related issuance plans from January 2024 to June 2025. The research subjects include multiple mainstream trading platforms such as Binance, Binance Perpetual Contracts Market, Coinbase, OKX, Upbit, Bithumb, and Bybit. The research scope covers spot, perpetual contracts, and decentralized exchange (DEX) issuance channels, focusing on two types of listing behaviors: initial listings (new assets directly distributed through mechanisms like airdrops, i.e., Token Generation Events or first exchange listings) and secondary listings (tokens already with trading history on other platforms being listed on a new exchange). The study systematically combed through listing trends, fully diluted valuation (FDV) distribution, token performance after listing, and cross-platform listing paths, with the core objective of deeply understanding Binance's leading role as a primary listing channel and comparatively analyzing strategy and performance differences of platforms like Coinbase, OKX, Upbit, Bithumb, and Bybit. Ultimately, it aims to reveal the diverse modes and intrinsic mechanisms of token issuance, price performance, and market expansion in different liquidity environments.

- Exchange Listing Activities

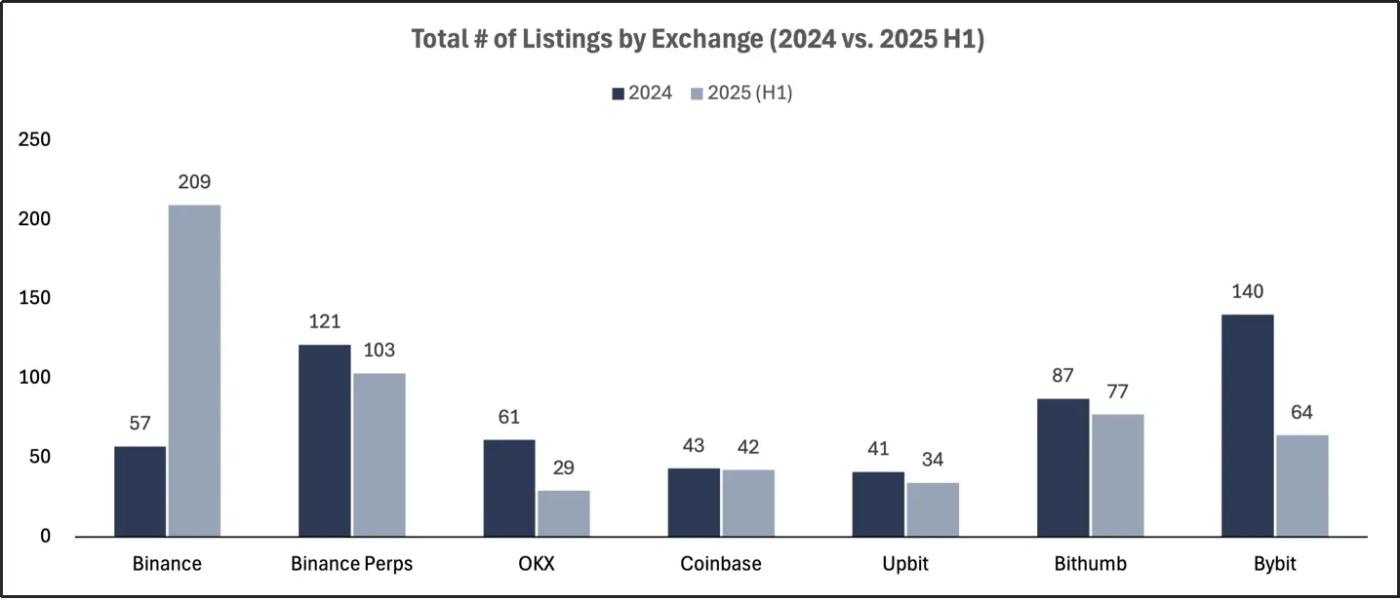

Total Number of Listings for Each Exchange in 2024 and First Half of 2025

In the first half of 2025, cryptocurrency exchange listing activities significantly grew, but initial and secondary listings showed distinctly divergent development paths. Binance notably expanded its token listing ecosystem's coverage through DEX-based issuance business and continuous perpetual contract market expansion; in contrast, many other mainstream exchanges experienced a slowdown or maintained stable listing paces, with an overall trend towards centralization.

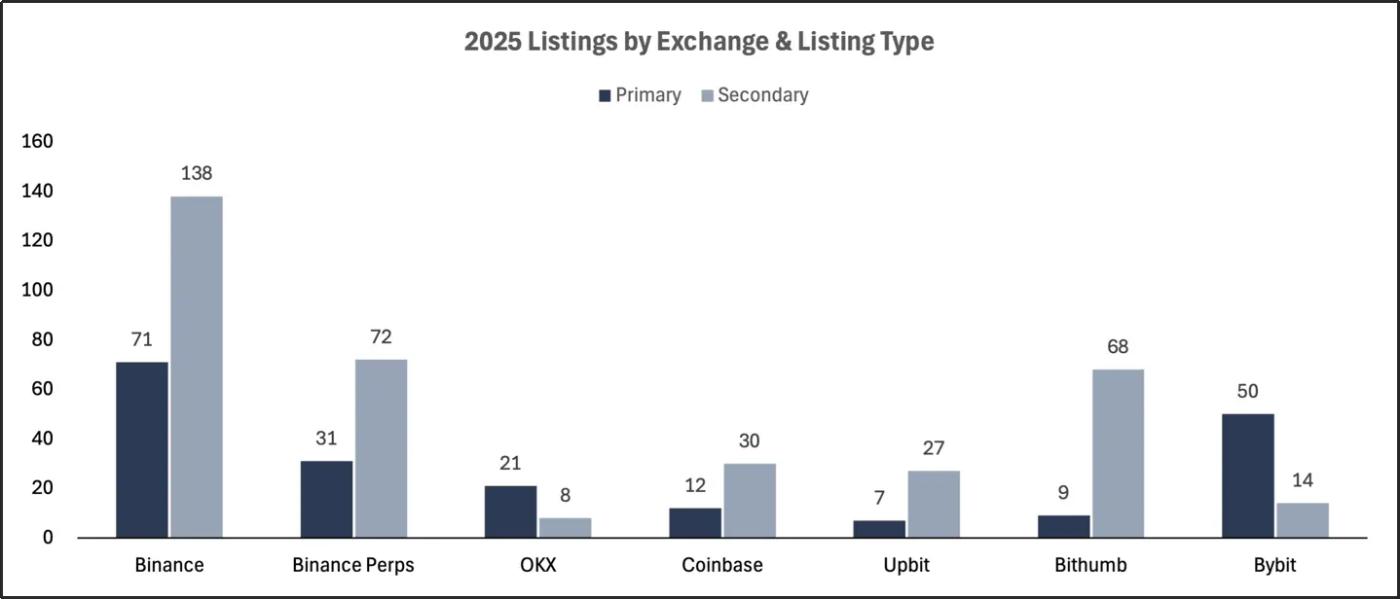

Number of Initial and Secondary Listings for Each Exchange in 2025

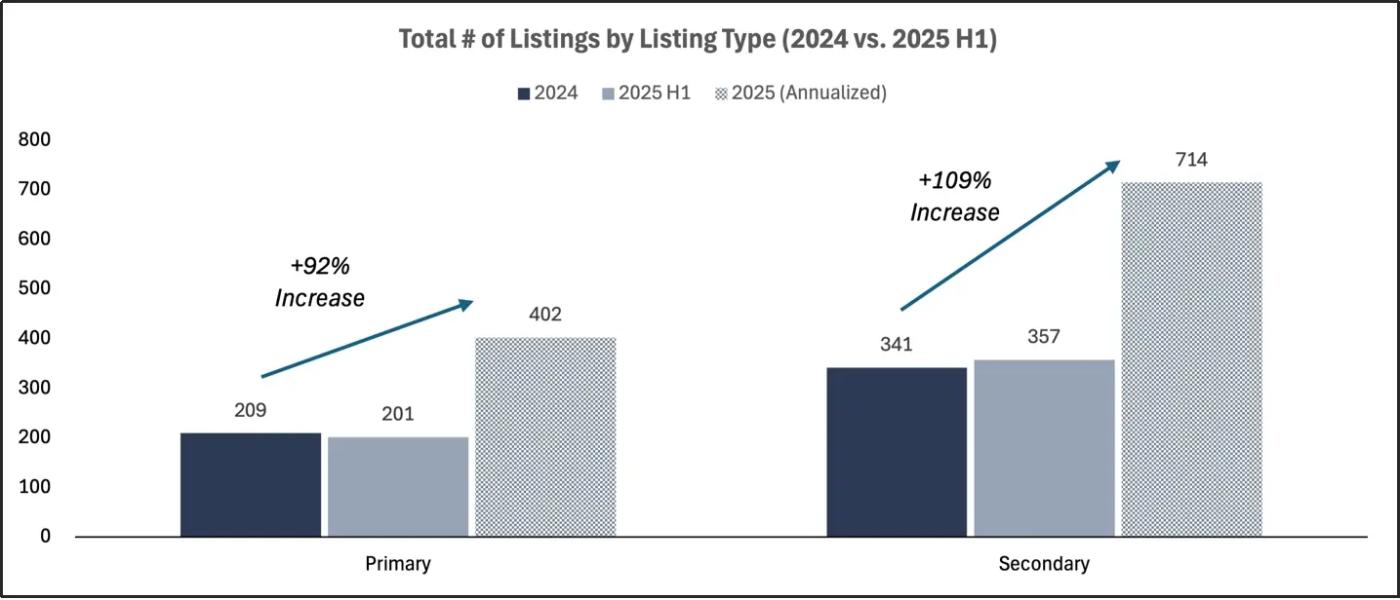

Total Listings for Each Exchange in 2024, First Half of 2025, and Projected for Full Year 2025

In the first half of 2025, Binance remained the most active global exchange for initial listings, launching 71 initial listing projects, all driven by DEX issuance channels, specifically including airdrops from the token discovery platform Binance Alpha and Initial Decentralized Offerings (IDOs). Upbit and Coinbase maintained relatively stable initial listing paces, launching about 12 projects in the first half, primarily focusing on mainstream cryptocurrencies with larger market capitalizations. In comparison, Bybit and OKX significantly reduced their initial listing scale, dropping from double-digit numbers in 2024 to single digits in the first half of 2025. Overall, the industry's initial listings are expected to dramatically increase from 209 in 2024 to 402 in 2025, a 92% year-on-year rise, primarily driven by decentralized issuance methods like Binance Alpha and IDOs.

In terms of secondary listings, Binance simultaneously listed 138 secondary listing projects, with the vast majority promoted through the Binance Alpha platform for re-listing existing tokens. Coinbase, Upbit, and Bithumb also focused more on secondary listings, with these projects accounting for approximately 80% of their total listings in 2025. The Binance Perpetual Contracts Market similarly showed a clear preference for secondary listings, with numbers nearly double those of initial listings. Annual secondary listings are expected to achieve a 109% year-on-year growth, jumping from 341 in 2024 to 714 in 2025. Led by Binance and its Alpha program, secondary listings are rapidly becoming the dominant form of exchange listing activities in 2025.

[The rest of the translation follows the same professional and accurate approach]

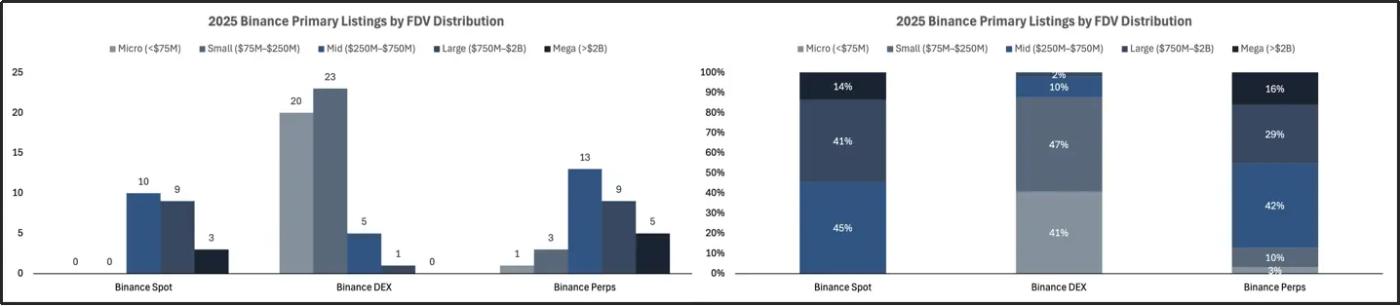

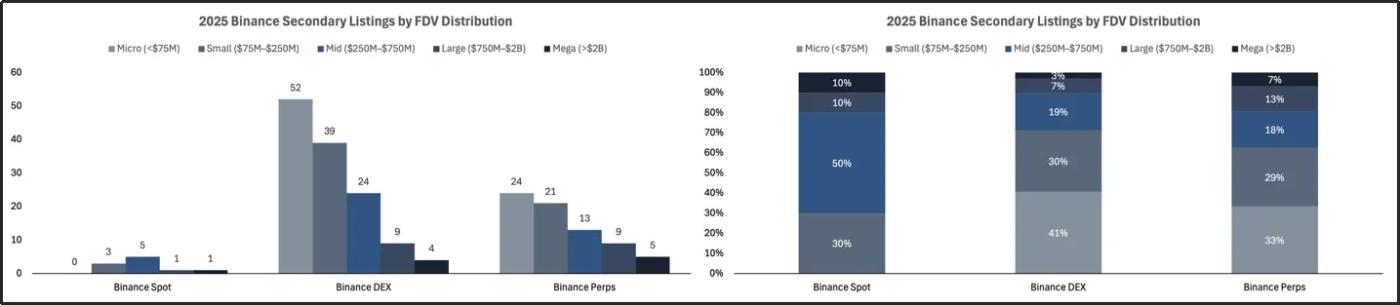

Here is the English translation: The initial decentralized exchange offering (IDO) average return is +1.5%, but the median of -4.8% highlights the limited coverage of successful cases. Alpha airdrop's first listing performance ranks the worst, with an average return of -11.2% and a median of -13.8%. Spot first listing average return is -8.0%, with a median of -19%, ranking bottom among all projects. Both spot and futures second listings perform better than their respective first listings, further confirming that existing tokens perform better when listed on new exchanges compared to their token generation event (TGE) debut. Binance's strongest performances have always been second listings, while first listings, especially through Alpha and spot channels, generally perform poorly. [The rest of the text follows the same translation approach, maintaining the technical terminology and structure of the original text.]Binance's spot listing project is biased towards large-cap tokens, without micro-cap projects, with most projects having a fully diluted valuation (FDV) above $250 million, concentrated above $750 million. Alpha airdrop targets small-cap projects, with about 80% of listed projects having an FDV below $250 million and a high proportion of micro-cap projects. Binance IDO listing projects are concentrated, with almost all projects' FDV between $75 million and $250 million, with no projects exceeding $750 million. Each of Binance's listing plans targets different market segments, with almost no overlap in FDV levels. Clearly, Binance's strategy is specifically targeted: the spot section is for scaled tokens, Alpha is for early projects, and IDO is for carefully selected growth-stage project issuances.

Binance's First Token Issuance Project Valuation Levels in 2025 Based on Fully Diluted Valuation (FDV)

Binance's Second Token Issuance Project Valuation Levels in 2025 Based on Fully Diluted Valuation (FDV)

- Binance's Listing Path

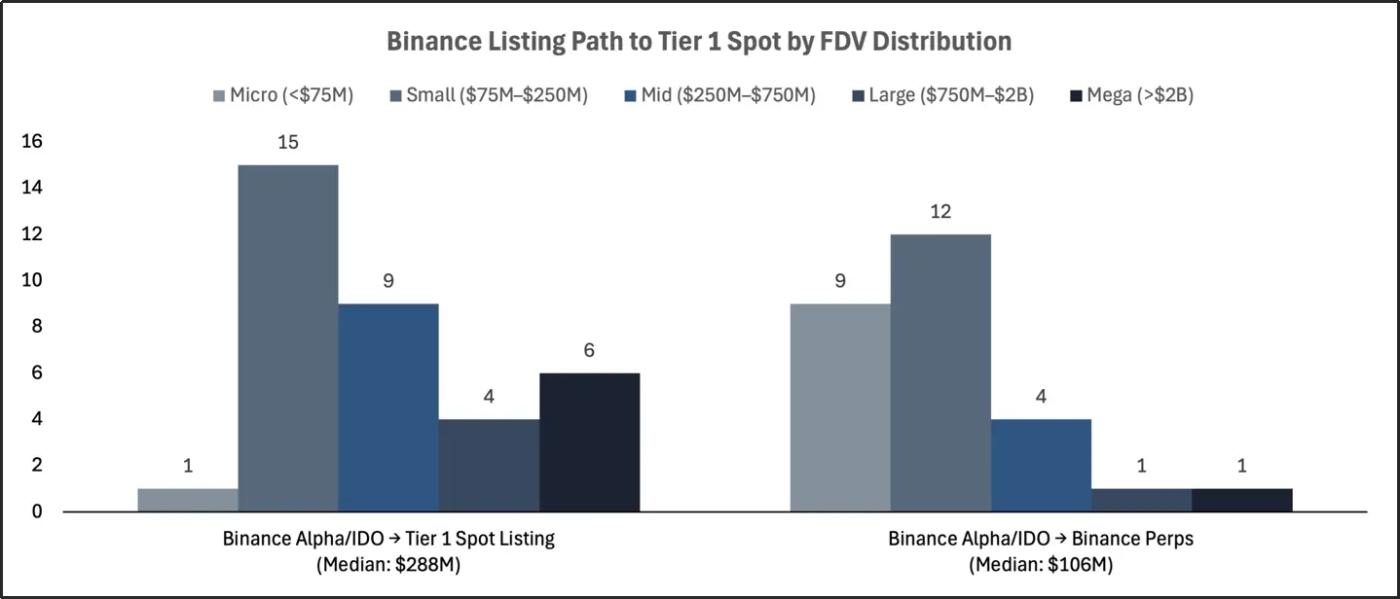

Binance's First-line Spot Listing Path Divided by Fully Diluted Valuation (FDV) Distribution

This section will analyze the downstream listing path of Binance Alpha airdrop and Binance IDO, tracking how these tokens subsequently land on Binance Perpetual Contracts, Binance Spot, and spot sections of other first-line centralized exchanges (CEX) such as OKX, Coinbase, Upbit, and Bithumb.

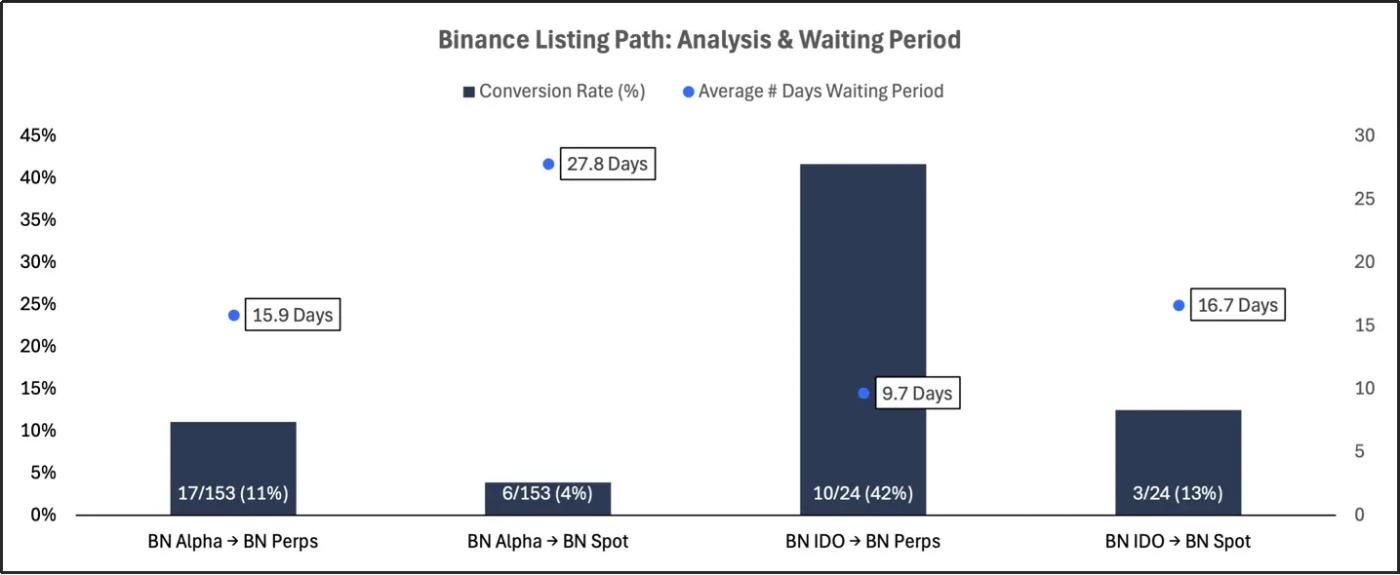

Binance's Listing Path: Conversion Rate and Average Waiting Days

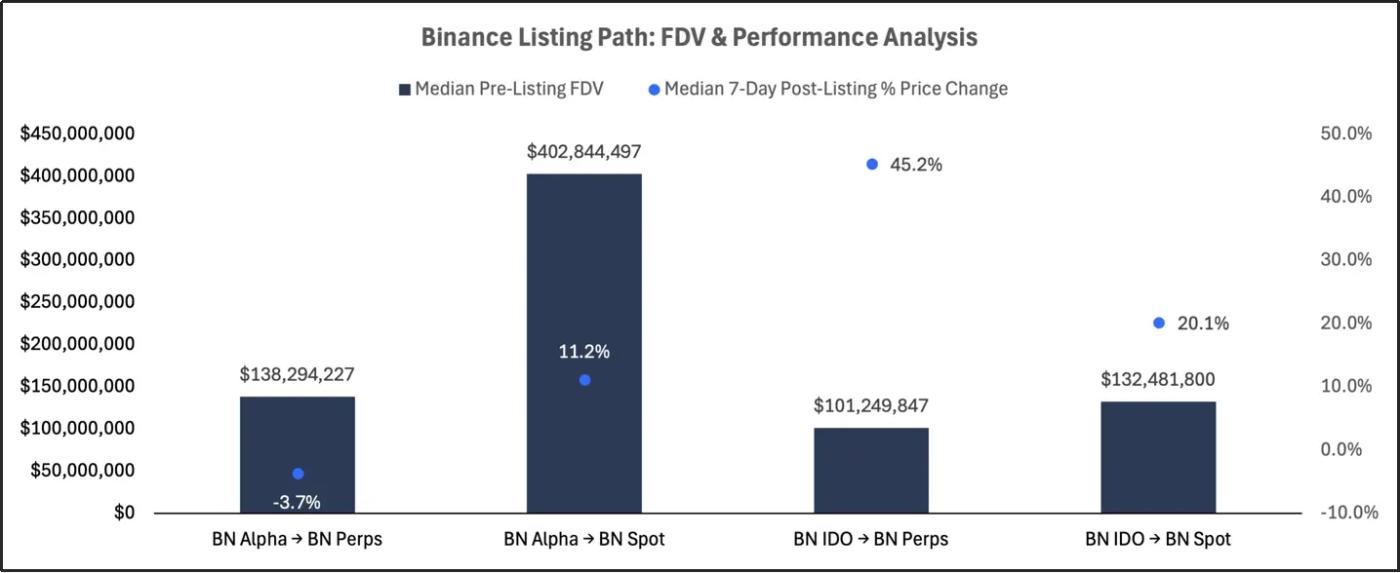

Binance's Listing Path: Fully Diluted Valuation (FDV) and Performance Analysis

Binance Alpha airdrop rarely advances to quality listing stages, with low conversion ratios to perpetual contracts and spot, and generally weak performance after listing. Tokens entering spot through Alpha are mostly high FDV projects with some subsequent performance. Binance IDO has significantly stronger downstream attractiveness, especially in perpetual contract listings, with fast progression and impressive 7-day returns. Although IDO to spot conversion is not common, its performance still surpasses Alpha. Overall, Binance Alpha has low downstream conversion and fragmented performance, while IDO is a more robust path to downstream listing (especially perpetual contracts).

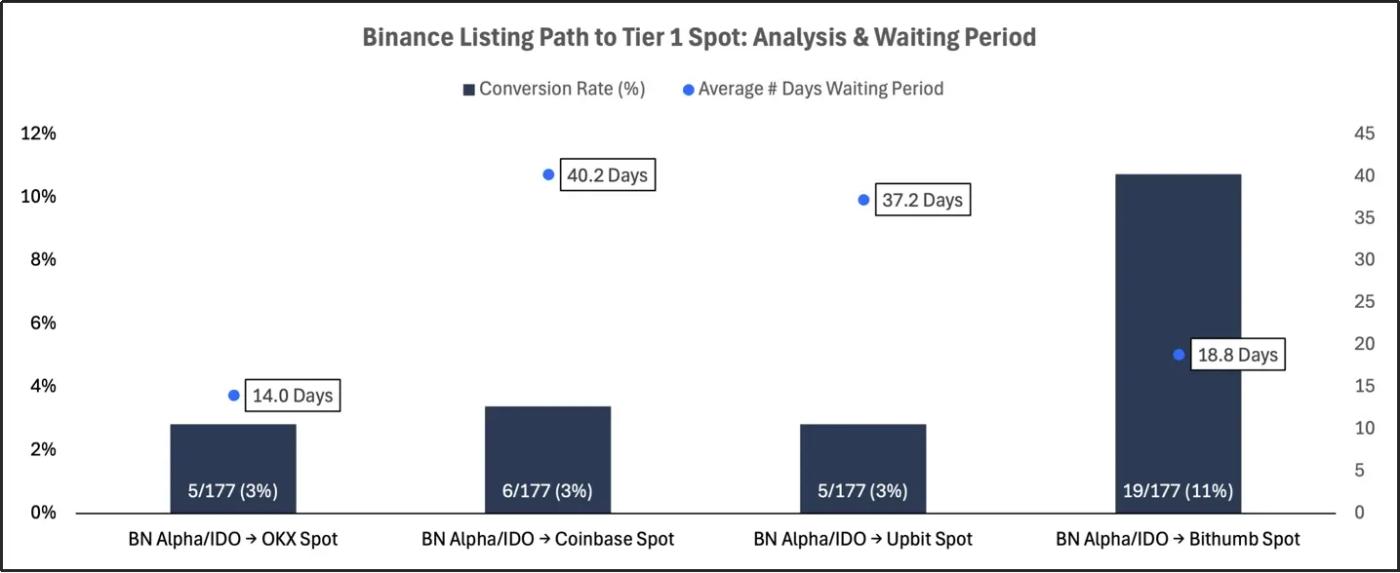

Binance's First-line Spot Listing Path: Conversion Rate and Average Waiting Days

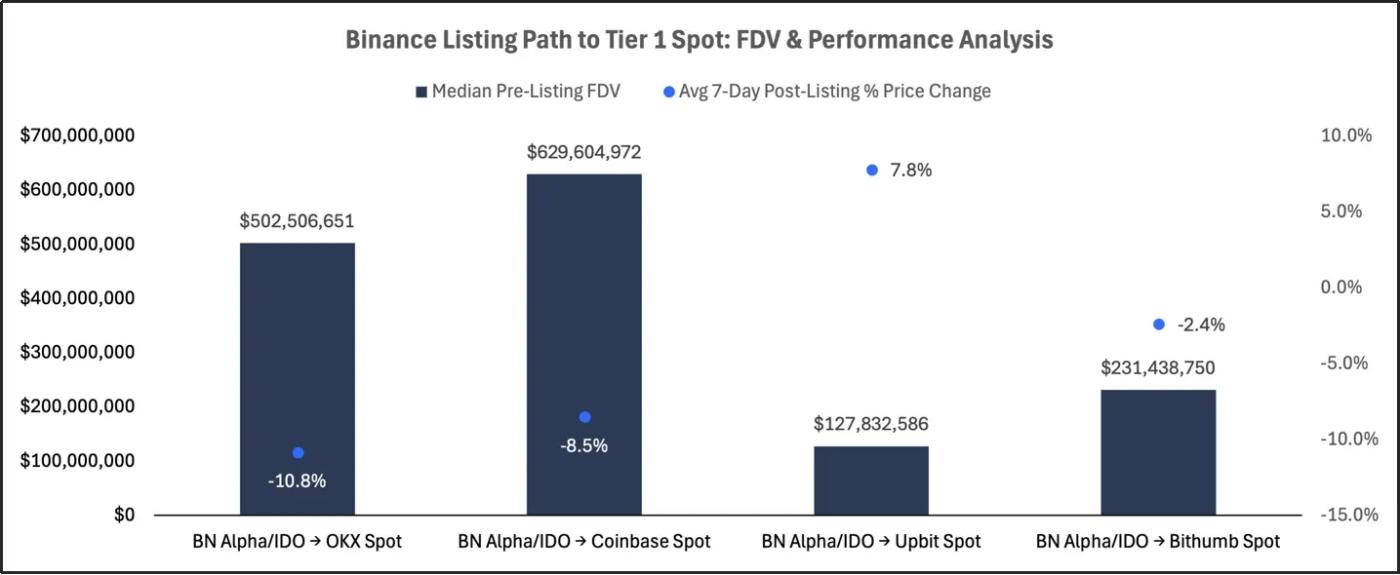

Binance's First-line Spot Listing Path: Fully Diluted Valuation (FDV) and Performance Analysis

Tokens issued through Binance Alpha or IDO rarely make it to first-line exchange spot sections, with low conversion rates and often significant delays before listing on other mainstream exchanges. These tokens generally perform poorly after listing on other exchanges, with mostly negative returns, with only slight increases on Upbit. Such listings tend to favor large-cap tokens, further confirming that projects with higher FDV are more likely to obtain listing opportunities on first-line exchanges. While external exchange listings can provide broader exposure, this conversion is not only rare but often unsatisfactory, especially for high FDV projects where liquidity events are more likely to be used for token distribution rather than project growth.

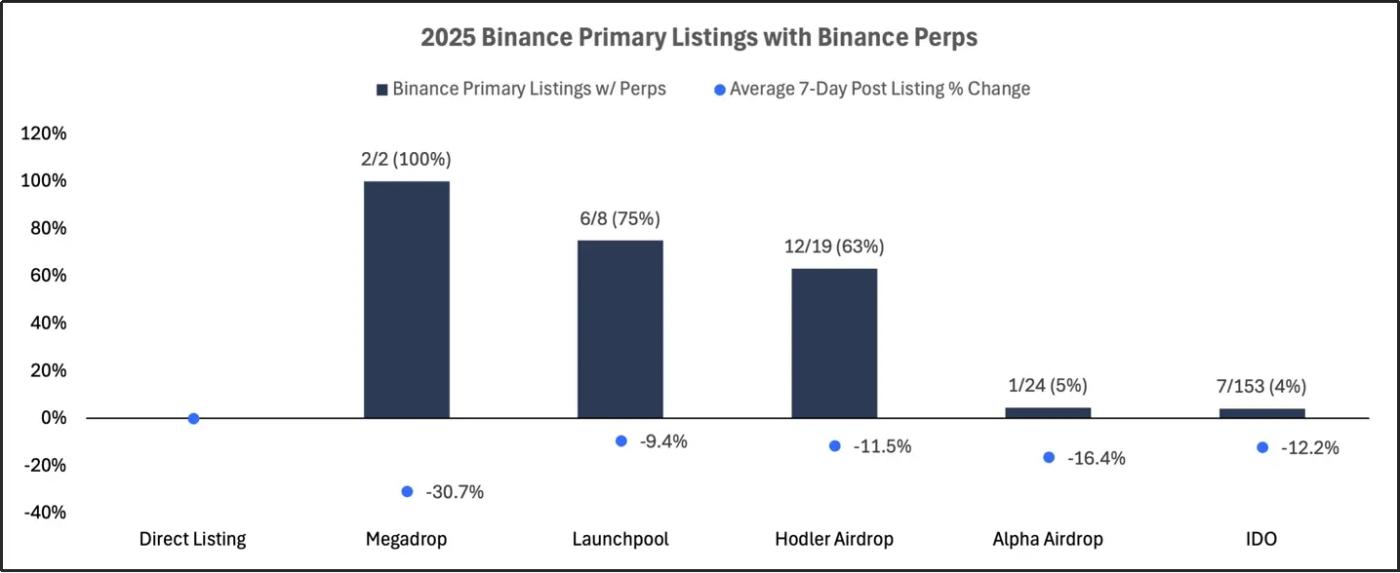

Projects Simultaneously Conducting First Listing and Perpetual Contract Listing on Binance in 2025

The above chart analyzes projects simultaneously conducting perpetual contract listing during Binance's first listing in 2025. The data shows that Binance is clearly more inclined to pair perpetual contract listing with token generation events (TGE) through first-day spot projects, rather than Alpha airdrop or IDO.

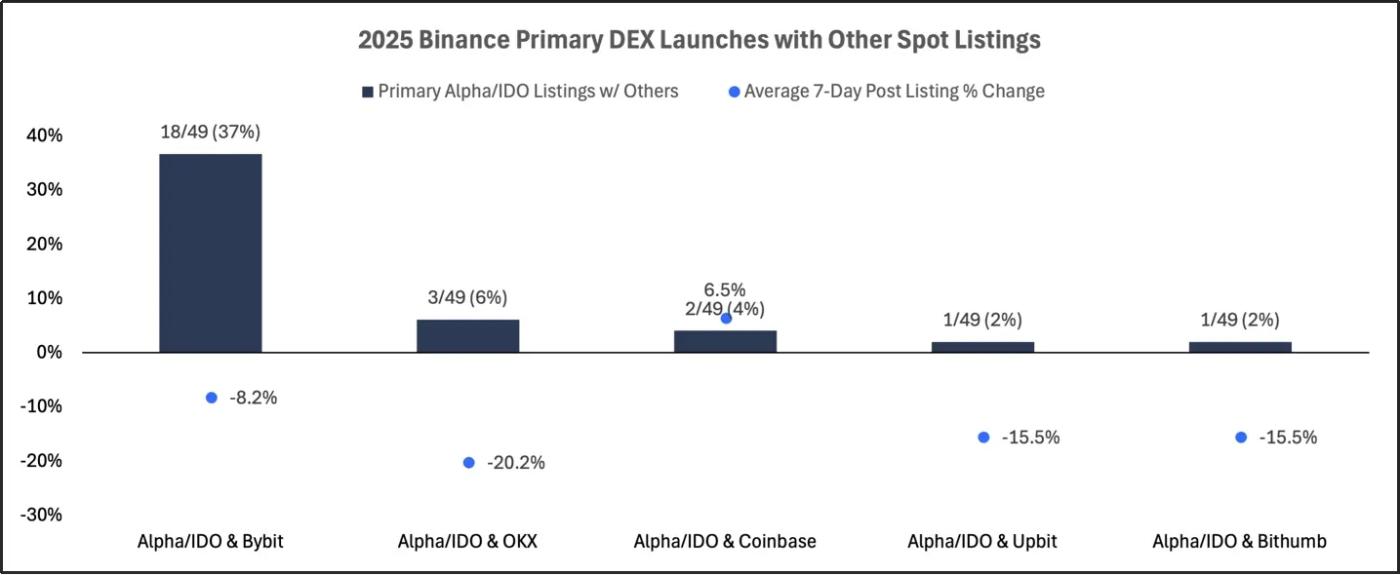

Frequency and Performance of Binance's First DEX Issuance Projects Synchronously Listed on Other Exchanges in 2025

The chart analyzes the frequency and performance of Binance's first DEX issuance projects (including Alpha airdrop and IDO) synchronously listed on other mainstream exchanges (such as Bybit, OKX, Coinbase, Upbit, and Bithumb). The performance after these joint listings is generally poor, with all exchanges showing negative 7-day average returns, with OKX, Upbit, and Bithumb showing particularly significant declines.

- Summary

In the first half of 2025, the listing landscape of cryptocurrency exchanges underwent significant changes, driven by the rise of on-chain issued projects, the increased dominance of secondary listings, and clearer segmentation of listing paths across different valuation levels and platforms.

Binance maintains a clear lead in total listing numbers, but its strategy has decisively shifted towards "on-chain priority" projects - especially Alpha airdrop and IDO, which now occupy the majority of new token issuances. However, the effectiveness of these projects varies dramatically: Alpha airdrop can achieve large-scale issuance but lacks subsequent performance and conversion; IDO has become a more strictly screened and better-performing path, particularly outstanding in landing on Binance Perpetual Contracts. Among all exchanges, secondary listings continue to outperform first-time issuances in 7-day return rates and peak FDV ratios, reflecting the advantages of listing tokens with pre-existing liquidity and market presence. Notably, Binance, Coinbase, and Upbit show the strongest subsequent performance in secondary listings, while OKX and Bybit lag relatively.

Valuation segmentation has now deeply integrated into the project systems of various exchanges: Binance spot listings favor large-cap, high FDV tokens, while Alpha and IDO channels precisely focus on early and growth-stage projects. This reflects more targeted screening methods in token listing processes and clear hierarchical differences in accessing quality trading channels. Cross-exchange liquidity remains rare and slow, with only a few projects from Binance successfully landing on spot sections of other first-line exchanges. Even when such conversion occurs, it is mostly concentrated in high FDV projects and often results in underwhelming performance after listing.

In summary, these trends highlight the maturing ecosystem of token listings, emphasizing the unprecedented importance of project types, token development stages, and listing sequence. For project teams, investors, and exchanges, understanding these structural dynamics is key to navigating the increasingly layered path from token generation to long-term exchange liquidity.