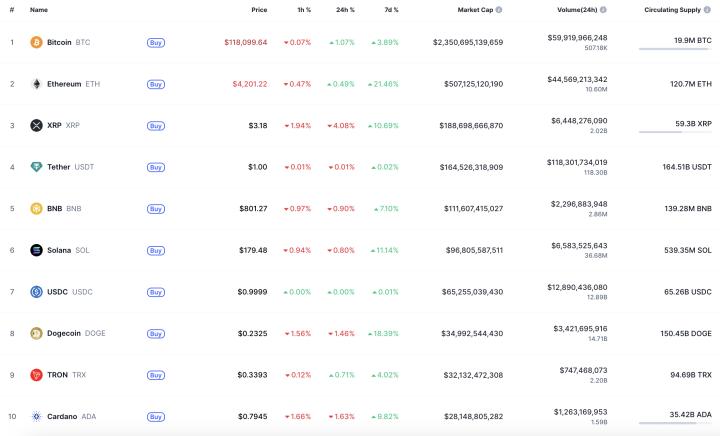

Ethereum (ETH) has been outstanding this August to say the least, but according to pro-XRP lawyer John E. Deaton, the rally itself is not the real story — it's the opportunities that he believes the market is offering right now.

In his view, buying ETH for under $5,000 in August 2025 would be more "asymmetrical" — meaning the potential upside far outweighs the potential downside — than buying it three years ago, despite prices now being well above $4,000.

Deaton’s reasoning ties back to a similar prediction he made in April when Bitcoin was trading at around $94,000. At that time, he observed that retail search interest in BTC was close to long-term lows, while the investor mix was shifting toward institutions, corporations and sovereign entities.

The prominent crypto lawyer now argues that Ethereum has reached a comparable inflection point, but with a better entry price and clearer regulatory path than in previous cycles.

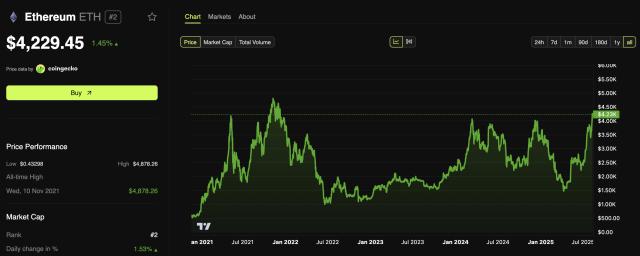

Ethereum (ETH) price outlook

The market seems to be lending weight to his comments. ETH's price chart shows a pivot from the low of around $3,280 on Aug. 2, with prices climbing by more than 28% in just over a week and breaking strongly through $4,000.

What makes the "under $5K" threshold notable is that it indicates long-term positioning rather than short-term trading. The $4,150-$4,200 zone is now acting as the immediate test: Holding this level could pave the way for a retest of ETH’s all-time high of around $4,878. Should this level not be held, buyers may wait for a pullback before loading up.

In Deaton's framing, these aren't just volatile price swings — they are moments where market structure, regulation and adoption align to offer the chance for outsized returns, a situation that has been rare even in the history of crypto.