#ADA

- ADA is trading above its 20-day MA, signaling bullish momentum.

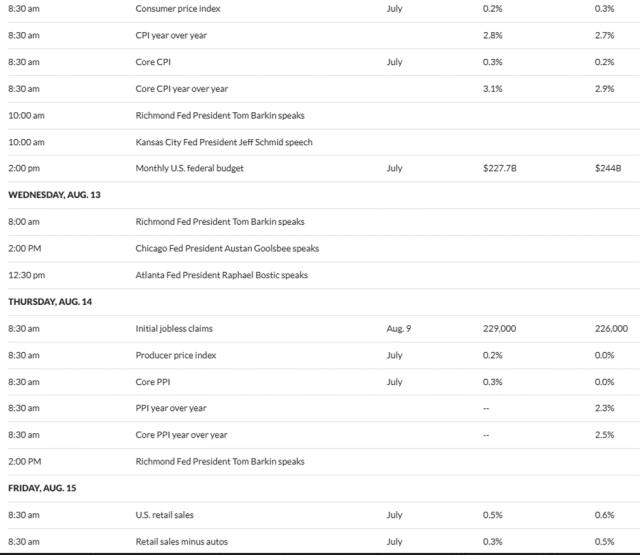

- MACD and Bollinger Bands indicate potential for further upside.

- Positive news sentiment and network activity support a bullish price forecast.

ADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerging

According to BTCC financial analyst Emma, ADA is currently trading at $0.7961, above its 20-day moving average of $0.78814, indicating a bullish trend. The MACD shows positive momentum with the histogram at 0.033943, reinforcing the upward potential. Bollinger Bands suggest ADA is in a stable range, with the upper band at $0.898494 and the lower band at $0.677786. Emma notes that a break above the upper Bollinger Band could signal further upside.

Cardano Market Sentiment Turns Positive as Bulls Eye Key Levels

BTCC financial analyst Emma highlights that recent news headlines suggest growing Optimism around Cardano. With buyers stepping in at key support levels and analysts predicting a potential 75% surge on breakout conditions, market sentiment is increasingly bullish. Emma points to rising network activity and a price target of $0.86 as catalysts for ADA's upward momentum.

Factors Influencing ADA’s Price

Cardano Shows Signs of Reversal as Buyers Step In at Key Support Level

Cardano's ADA has found solid footing at the $0.70 support level, with buyers returning to push the price toward $0.75. The cryptocurrency now faces a critical test at the $0.77 resistance level—a breakout could pave the way for a rally toward $0.90.

Bullish momentum is building as ADA closed four of the last five daily candles in green. While trading volumes remain subdued, the improving technical picture suggests a potential trend reversal. Momentum indicators are beginning to curve upward, supporting the case for further upside.

The daily RSI's MOVE above 50 signals growing buying pressure. Sustained strength in this indicator could provide the fuel needed for ADA to clear immediate resistance and challenge higher price targets.

Cardano Price Forecast: ADA Bulls Target $0.86 Amid Rising Network Activity

Cardano's ADA surged 6.22% to approach $0.80 as bullish momentum builds, fueled by a 12% spike in Open Interest and strengthening on-chain metrics. The rally reflects growing trader confidence and heightened network utilization.

Unique Active Addresses climbed to 30.9K, while the profit-to-loss transaction ratio nearly tripled to 4.808—clear signals of escalating demand. Santiment data reveals these fundamentals are advancing in lockstep with price appreciation, creating a self-reinforcing cycle.

Derivatives markets echo the optimism, with CoinGlass tracking double-digit Open Interest growth. The confluence of technical breakout and on-chain strength suggests the $0.86 target remains in play for disciplined bulls.

Cardano (ADA) Could Surge 75% on Breakout Condition, Analysts Say

Cardano's native token ADA faces a pivotal moment as analysts outline bullish scenarios contingent on breaking key resistance levels. The cryptocurrency, currently trading at $0.74 after retreating from July's $0.93 peak, could rally to $1.30 upon clearing the $0.84 barrier according to analyst Ali Martinez.

More ambitious projections suggest $1.60 targets or even a retest of all-time highs above $4.00. These forecasts follow community approval of a $71 million network upgrade fund, with technical analysts noting similarities to ADA's pre-bull market structure in 2021.

Market observers highlight emerging bullish patterns, including what one analyst describes as a 'monstrous cup and handle' formation - typically a precursor to significant upside. 'ADA holders are golden,' remarked one commentator, suggesting the real bull run has yet to commence.

Is ADA a good investment?

Based on the current technical and sentiment analysis, ADA appears to be a promising investment. Here’s a summary of key data:

| Metric | Value |

|---|---|

| Current Price | $0.7961 |

| 20-Day MA | $0.78814 |

| MACD Histogram | 0.033943 (Bullish) |

| Bollinger Bands | $0.677786 - $0.898494 |

Emma from BTCC suggests that ADA's technicals and positive news flow support a bullish outlook, with potential upside to $0.86 and beyond if key resistance levels are breached.