The crypto winter thawed overnight as institutional money flooded into Bitcoin and Ethereum ETFs—half a billion dollars worth of 'smart money' chasing the rally. Wall Street's late to the party again, but at least they brought champagne.

Green lights across the board: BTC ETFs swallowed $350M like a black hole absorbing light, while ETH products vacuumed up $150M faster than a degenerate trader spotting leverage.

Why it matters: This isn't retail FOMO—it's the big players finally admitting digital gold 2.0 isn't going away. Even the SEC's foot-dragging couldn't stop the stampede.

The cynical take: Watch hedge funds rebrand this as 'Web3 exposure' while quietly dumping their fossil fuel stocks. Nothing like a 10% pump to suddenly make 'risky assets' palatable.

Crypto ETFs Inflows Are Big Market Drivers – Here’s Why

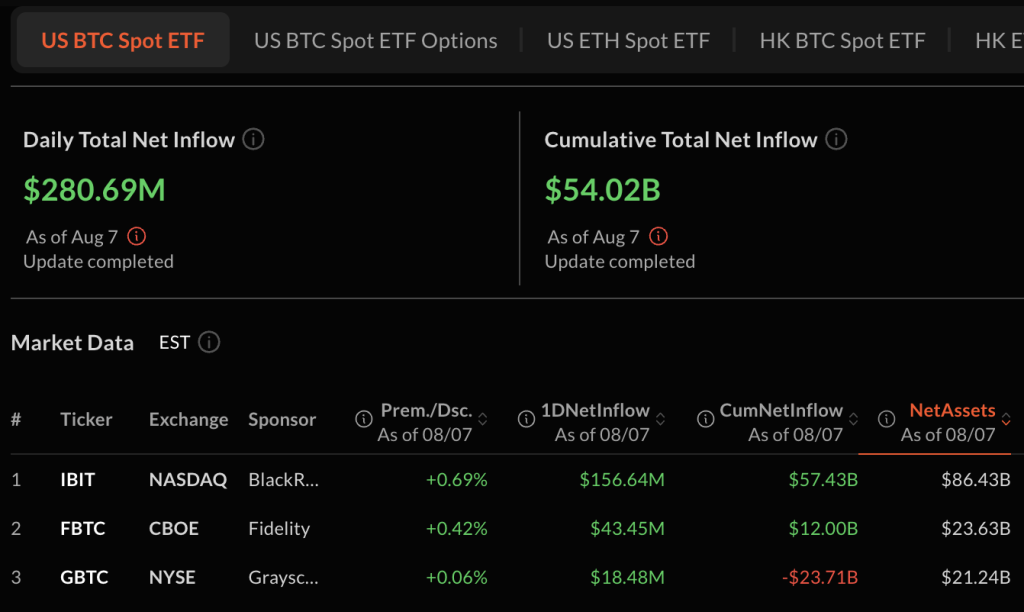

Besides, the US Bitcoin and Ether exchange-traded funds (ETFs) have rebounded, marking another big day for crypto inflows.

Spot bitcoin ETFs, led by BlackRock’s IBIT, saw over $280.69 million in net inflows on August 7, according to Sosovalue data. BlackRock’s IBIT alone saw $156.64 million in net inflows, followed by Fidelity’s FBTC, which recorded $43.45 million inflows as of Thursday.

Additionally, Ether ETFs witnessed $222.34 million in net inflow on Thursday, led by BlackRock’s ETHA, recording $103.52 million.

In total, more than $503 million was poured into BTC & ETH ETFs in a single day.

![]() US SPOT ETF FLOW – Aug 7

US SPOT ETF FLOW – Aug 7![]() $BTC: +$280.69M net inflow (BlackRock $IBIT leads w/ +$156.64M)$ETH: +$222.34M net inflow (BlackRock $ETHA leads w/ +$103.52M)

$BTC: +$280.69M net inflow (BlackRock $IBIT leads w/ +$156.64M)$ETH: +$222.34M net inflow (BlackRock $ETHA leads w/ +$103.52M)![]() Total: Over $503M poured into $BTC & $ETH in a single day! pic.twitter.com/lvdj84Ft7Y

Total: Over $503M poured into $BTC & $ETH in a single day! pic.twitter.com/lvdj84Ft7Y

“Inflows are back, regulators are moving, and altcoins are positioning for breakout. Keep faith in institutional flows and token-level triggers,” one user wrote on X.

Regulatory Progress, Institutional Adoption Led to Bullish Impact

Further, XRP climbed more than 13% on Friday, after the US SEC and Ripple agreed to dismiss appeals, ending their four-year legal battle. This means a reduced legal risk for XRP holders, boosting sentiments.

XRP is trading around $3.34 at press time, with bulls anticipating that a break above the resistance level $3.40, could lead $3.70 mark.

Additionally, ethereum is up more than $3,900 on Friday, following a fresh institutional interest in ETH treasury. Analysts have predicted that a test of the $4,000 mark could be imminent.

The price increase comes as SharpLink Gaming announced Thursday that it has secured $200 million in a direct offering led by four global institutional investors, which will be used to expand its Ethereum treasury.

![]() @SharpLinkGaming announces $200M direct offering at $19.50/share, led by 4 global institutional investors. #Ethereum #CryptoTreasury $SBET https://t.co/Lrz6hPJbCY

@SharpLinkGaming announces $200M direct offering at $19.50/share, led by 4 global institutional investors. #Ethereum #CryptoTreasury $SBET https://t.co/Lrz6hPJbCY

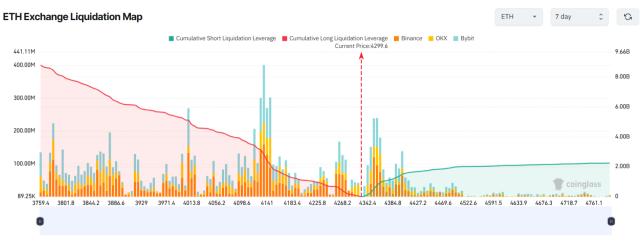

On the technical front, the total BTC futures open interest (OI) stands at 691,550 BTC, equivalent to $80 billion, according to Coinglass.

CryptoQuant analyst Axel Adler Jr reported that the SMA-120 line has reversed upward, thus indicating a shift from a prolonged bearish trend since late July.

“A similar attempt a week ago failed,” he wrote on X. Currently, the market has transitioned from aggressive short pressure phase to neutral-bullish.”