After turning profitable in Q2, GLXY stock tokenization enters the implementation stage.

Written by: ChandlerZ, Foresight News

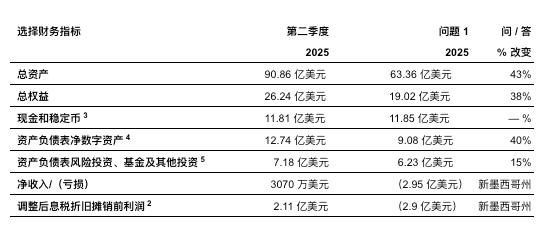

On August 5th, after experiencing structural adjustment and strategic restructuring in the first half of the year, Galaxy Digital released its Q2 2025 financial report. Despite a significant reduction in total assets, Galaxy achieved a rare quarterly net profit, thanks to the rebound in digital asset markets and improved trading business.

At the same time, the company officially disclosed that it is discussing the feasibility of "tokenizing" its listed stock GLXY with the U.S. Securities and Exchange Commission (SEC).

Q2 Profit Recovery, Digital Assets Driving Overall Performance

According to the financial report, Galaxy Digital achieved a net profit of $30.7 million in the second quarter of 2025, reversing the losses from the previous quarter and the same period last year. This corresponds to a diluted earnings per share of $0.08.

This quarter, Galaxy recorded an Adjusted EBITDA (non-GAAP) of $211 million, mainly driven by digital asset appreciation and investment business performance. However, its revenue performance remained weak, at only $8.7 million, almost flat compared to the same period last year. More notably, its "total revenue and income" declined by about 30% quarter-on-quarter, exposing the high dependence of revenue structure on digital asset price fluctuations.

However, Galaxy's asset-side data is not ideal. As of June 30th, Galaxy's total assets were $6.3 billion, a 43% decrease from $11.1 billion in the previous quarter. This was mainly due to asset price fluctuations and position adjustments. Galaxy did not directly disclose a comparison of revenue with the previous quarter but noted that "total income and revenue" decreased by 30%. The total revenue was $8.7 million, basically flat with the same period last year.

The company emphasized in its report that it completed a large-scale transaction of over 80,000 Bits during the quarter, one of the largest in the market. This transaction was executed by Galaxy on behalf of its clients.

Trading Business Becomes "Cash Cow", Asset Management Faces Short-term Pressure

In its core businesses, digital asset adjusted gross profit was $71.4 million, a 10% quarter-on-quarter increase, benefiting from global market growth, but partly offset by weak performance in asset management and infrastructure solutions.

Although the overall spot market trading volume of digital assets declined this quarter (with an industry average drop of around 30%), Galaxy's own trading volume decreased by 22%. However, the trading business still achieved a gross profit of $55.4 million, a 28% quarter-on-quarter increase. The lending business maintained growth, with an average of $1.1 billion in assets lent during the quarter and stable customer demand. Galaxy also mentioned that it served as the exclusive financial advisor in the Bitstamp acquisition by Robinhood, bringing investment banking service revenue.

The asset management and infrastructure solutions segment faced some downward factors. The segment's gross profit was $16 million this quarter, a 26% decline from the first quarter. The main reason was the decrease in on-chain transaction activity, leading to a decline in Galaxy's revenue from validator nodes.

However, influenced by the recovery of digital asset prices and net capital inflows, the total assets managed by Galaxy increased. By the end of the quarter, its managed and custodied assets totaled $9 billion, a 27% quarter-on-quarter increase. This includes Galaxy's asset management products and staking business. Galaxy also completed integration with Fireblocks this quarter, the third custody system connection of the year, aimed at expanding staking service access channels.

Additionally, Galaxy is positioning its Helios data center park as one of its main growth points in the future. AI and HPC client CoreWeave exercised the remaining lease option in the third quarter, locking in the full 800MW IT load capacity.

CoreWeave had previously signed a 15-year lease agreement with Galaxy. The full subscription of this capacity means that the first phase of Helios data center resources has been completely absorbed by the market. Galaxy also signed another land and power resource acquisition agreement this quarter, adding 160 acres of land and a 1GW power access request around Helios. After completion, the park area will expand to 1,500 acres, with total potential load capacity rising to 3.5GW. Currently, the Helios project is still under construction, expected to start contributing revenue from the first half of 2026. Project expenditures are currently in the capitalization stage and not yet included in the income statement.

Galaxy clearly hopes to gain infrastructure advantages in the long-term trend of "AI driving increased computing demand" and shift its growth curve with the Helios project.

Stock Tokenization Plan Surfaces: Experiment or Turning Point?

Beyond the financial report, another item drawing market attention is Galaxy's official disclosure of its stock tokenization exploration plan.

According to documents submitted to the SEC, Galaxy is "evaluating the feasibility of on-chain tokenization of Class A common stock" and signed a "Digital Asset Transfer Agency Agreement" with Superstate Services in May. The latter is a registered RWA platform and an early participant in the tokenization market.

Founder Mike Novogratz previously stated in media interviews that Galaxy has met with the SEC's crypto asset special group to discuss how to promote tokenization within a compliant framework. He mentioned that they are developing a version of GLXY stock that can be used in DeFi applications, hoping to tokenize more assets in the future, including ETFs and fixed-income products.

However, Galaxy also stated in its declaration that it cannot currently confirm whether the tokenized stock will gain sufficient market acceptance, nor is it clear if an active trading market will be established. On-chain trading systems still have significant differences from traditional exchanges in terms of transparency, liquidity, and regulatory coverage.

Summary

After the financial report was published, GLXY stock price dropped 4.19%, closing at $27.68, with a market value of approximately $10.66 billion. The market generally believes that the quarterly profit recovery is worth noting, but asset shrinkage and revenue base remain weak.

The stock tokenization plan is seen as Galaxy's attempt to explore new markets, but its actual short-term valuation promotion is limited. Institutional investors generally tend to first observe project implementation and regulatory feedback before evaluating the actual significance of this attempt. In the data center business, although CoreWeave's lease completion provides Galaxy with order assurance, this revenue will not be reflected until mid-next year at the earliest. The Helios project is currently in the capital expenditure stage, with no cash returns established. Galaxy Digital achieved profitability this quarter, with stable trading and investment business performance. Asset management is strongly linked to on-chain activity fluctuations. Data center expansion has completed initial customer bookings, but the revenue cycle has not yet begun. The stock tokenization plan has been officially disclosed, with a clear direction, but regulatory and market acceptance still need time to verify.

In the short term, Galaxy still needs to face the reality of revenue pressure and asset shrinkage; in the medium to long term, whether it can establish an on-chain securities issuance platform and AI infrastructure leasing revenue model will affect its valuation logic and business expansion path.