Written by: Kevin, Joint Investment Director of Penn Blockchain

Translated by: Odaily Azuma (@azuma_eth)

Although the crypto community has long been enthusiastic about introducing traditional assets in tokenized form on-chain, the most significant recent progress has actually come from reverse integration of crypto assets into traditional securities. The recent public market's pursuit of "crypto asset treasury" stocks perfectly illustrates this trend.

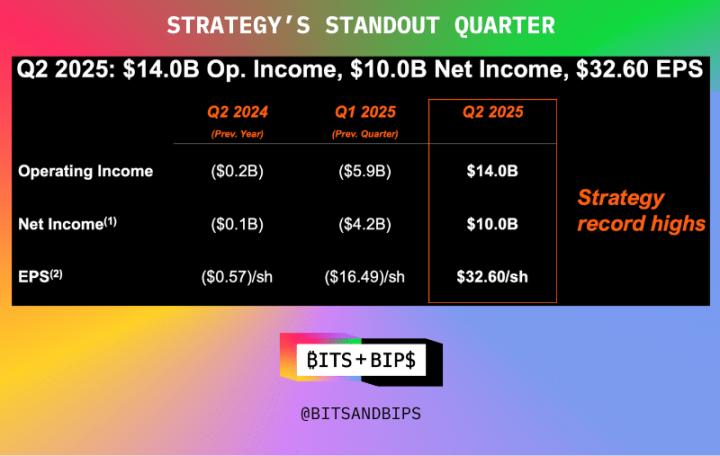

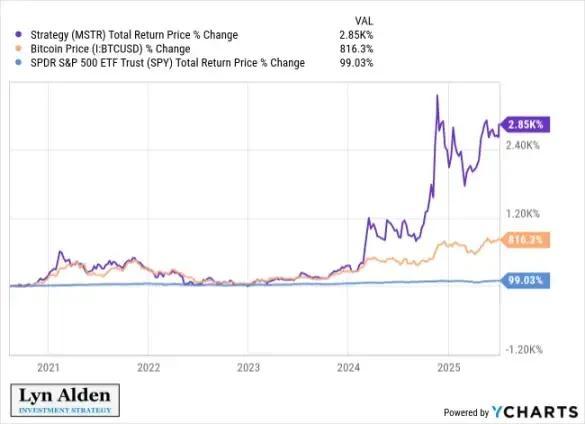

Michael Saylor pioneered this strategy through MicroStrategy (MSTR), pushing its market value beyond $100 billion, with growth even surpassing Nvidia. We have conducted a detailed analysis in our special report on MicroStrategy (an excellent learning resource for newcomers to the treasury field). The core logic of such treasury strategies is that listed companies can obtain low-cost, unsecured leverage that ordinary traders cannot reach.

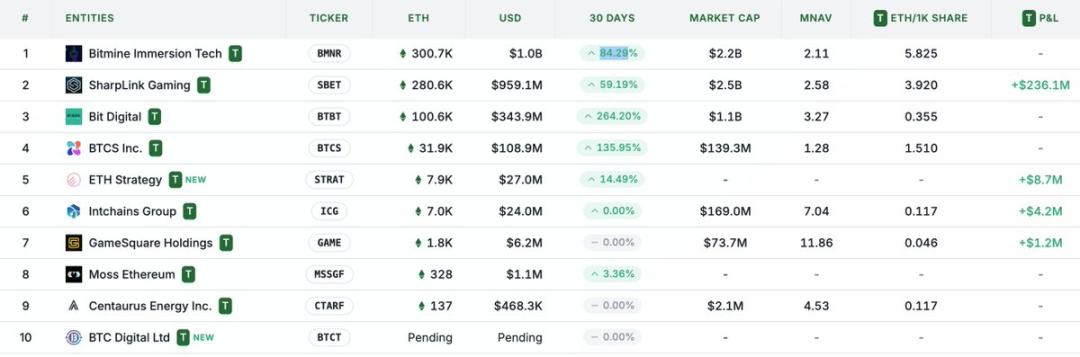

Recently, the market's focus has expanded from BTC treasuries to ETH treasuries, such as Sharplink Gaming (SBET) led by Joseph Lubin and BitMine (BMNR) helmed by Thomas Lee.

But is an ETH treasury really reasonable? As we argued in the MicroStrategy analysis report, treasury companies are essentially trying to arbitrage the difference between the long-term compound annual growth rate (CAGR) of the underlying assets and the cost of capital. In our earlier article, we outlined our view on ETH's long-term CAGR: As a programmable scarce reserve asset, ETH plays a fundamental role in maintaining on-chain economic security as more assets migrate to blockchain networks. This article will elaborate on the bullish logic of ETH treasuries and provide operational advice for enterprises adopting this strategy.

Liquidity Acquisition: The Cornerstone of Treasury Companies

One of the main reasons tokens and protocols seek to create these treasury companies is to open up channels for obtaining traditional financial (TradFi) liquidity - especially in the context of altcoin liquidity shrinking. These treasury companies primarily acquire liquidity to accumulate assets through three methods. It's worth noting that these liquidities/debts are unsecured, meaning they cannot be redeemed in advance.

Convertible Bonds: Financing debt that can be converted into stocks, with funds used to purchase more cryptocurrencies;

Preferred Equity: Financing by issuing preferred stocks that pay fixed annual dividends;

At-the-Market (ATM) Issuance: Directly selling new stocks in the open market to obtain flexible real-time funds for purchasing cryptocurrencies.

Screening Treasury Companies Based on First Principles

ATM issuance can be viewed as financing for retail investors, while convertible bonds and preferred stocks are typically aimed at institutional investors. Therefore, the key to a successful ATM strategy lies in building a strong retail base, which often requires credible and charismatic spokespersons, as well as continuous transparent strategic disclosure to win long-term retail trust. Conversely, convertible bonds and preferred stocks require robust institutional sales channels and relationships with capital market departments. Following this logic, I believe SBET has a stronger retail-driven advantage (benefiting from Joe Lubin's leadership and the team's ongoing transparency in increasing ETH per share), while BMNR is more likely to obtain institutional liquidity through Tom Lee's deep connections in traditional finance.

Ecological Significance and Competitive Landscape of ETH Treasury

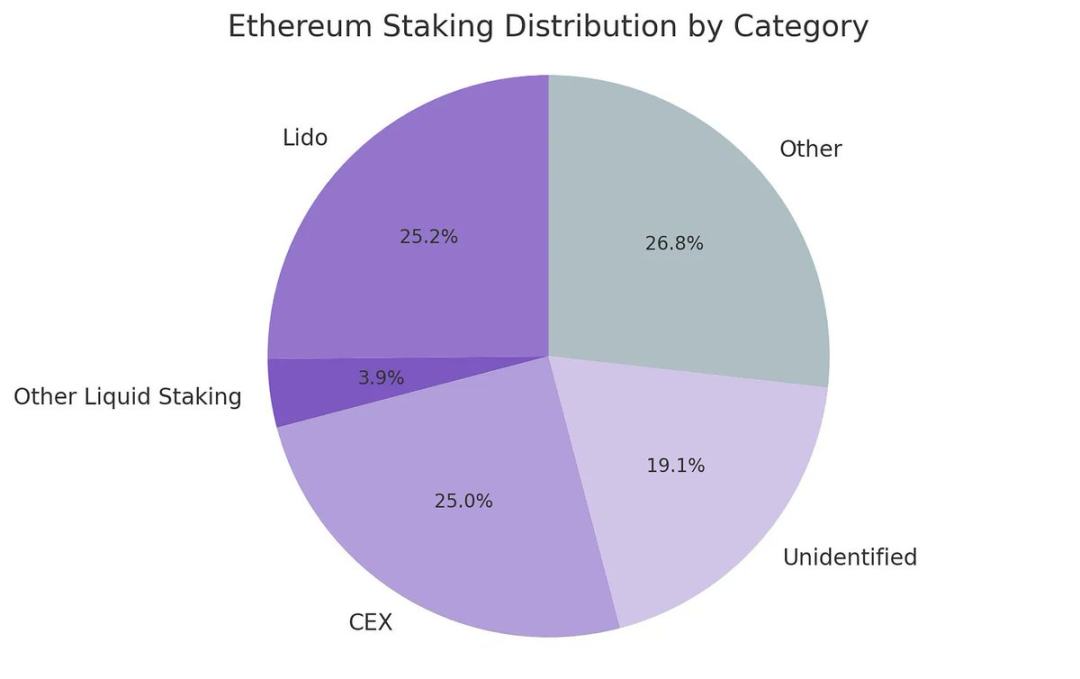

One of the biggest challenges facing Ethereum is the increasing centralization of validators and ETH staking (primarily on liquid staking protocols like Lido and centralized exchanges like Coinbase). ETH treasury helps offset this trend and promotes validator decentralization. To enhance long-term resilience, these companies should distribute ETH across multiple staking service providers and operate their own validator nodes when possible.

Odaily Note: Distribution of Ethereum staking categories.

In this context, I believe the competitive landscape of ETH treasury companies will differ fundamentally from BTC treasury companies. The Bitcoin ecosystem has formed a winner-takes-all situation (MicroStrategy's holdings are over 10 times that of the second-largest corporate holder), dominating the convertible bonds and preferred stocks market through first-mover advantage and strong narrative control. In contrast, ETH treasury starts from scratch, with no single dominant entity, and multiple projects developing in parallel. This state without first-mover advantage is not only healthier for the network but also fosters a more competitive and accelerated development environment. Given the similar ETH holdings of leading companies, SBET and BMNR are likely to form a duopoly.

Odaily Note: Comparison of ETH treasury company holdings.

Valuation Framework: A Combination of MicroStrategy and Lido

Broadly speaking, the ETH treasury model can be viewed as a fusion of MicroStrategy, designed for traditional finance, and Lido. Unlike Lido, ETH treasury companies can capture a larger proportion of asset appreciation by holding the underlying assets, far superior in value accumulation.

Here's a rough valuation reference: Lido currently manages about 30% of ETH staking, with an implied valuation of over $30 billion. We believe that within a market cycle (4 years), driven by the speed, depth, and reflexivity of traditional financial capital flow (as demonstrated by MicroStrategy's growth strategy), SBET and BMNR could potentially surpass Lido in total scale.

To provide additional context, Bitcoin's market cap is $2.47 trillion, while Ethereum is $428 billion (17-20% of Bitcoin's). If SBET and BMNR reach 20% of MicroStrategy's $120 billion valuation, their long-term value would be around $24 billion. Currently, their combined valuation is less than $8 billion, leaving significant growth potential as ETH treasury matures.

Conclusion

The emergence and development of digital asset treasuries represent a major evolution in the further integration of crypto markets and traditional finance, with ETH treasury becoming a powerful new force. Ethereum's unique advantages (including higher convertible bond volatility and native yields from preferred stocks) create differentiated growth space for treasury companies. Its ability to promote validator decentralization and stimulate competition further distinguishes it from the BTC treasury government bond ecosystem.

The combination of MicroStrategy's capital efficiency and ETH's embedded yields can unlock enormous value and push the on-chain economy deeper into traditional finance. Rapid expansion and growing institutional interest suggest transformative impacts on crypto and capital markets in the coming years.