Rises will eventually pull back. After experiencing a period of "only rising, not falling," risk assets declined under the impact of non-farm employment data that was comprehensively below expectations. The overall employment data was weak (unemployment rate increased from 4.117% to 4.248%), once again confirming the trend of a slowing job market. Additionally, the U.S. Bureau of Labor Statistics released the largest two-month employment data downward revision in recent years (excluding the pandemic period) of -258,000.

To make matters worse, the ISM Manufacturing Employment Index fell to its lowest level since the second quarter of 2020, and other leading indicators also suggest that the job market may further deteriorate.

The market reacted quickly and dramatically, with U.S. stocks closing down 2% to 3%, the U.S. dollar falling 2.2% against the Japanese yen to 147, and the year-end rate cut expectations reflected in the interest rate market pricing increased by almost 25 basis points compared to the previous day.

The yield change was particularly significant, with the 2-year yield plummeting nearly 30 basis points that day, one of the largest single-day declines in the past five years. At the end of last week, the market's rate cut expectations for this year rose to about 60 basis points, up from around 35 basis points the day before, prompting Trump to fiercely criticize Federal Reserve Chairman Powell for not cutting rates in time and criticizing the "inaccurate" employment data published by the U.S. Bureau of Labor Statistics.

"We need accurate employment data... The data now is done by people appointed by the Biden administration."

"In my view, the current employment data has been manipulated, with the purpose of embarrassing the Republican Party and me." - President Trump

The market's violent reaction last Friday also overshadowed the recent hawkish Fed meeting. Powell emphasized that the Fed is trying to address commodity inflation by maintaining interest rates. Meanwhile, with the resignation of Fed Governor Kugler, Trump may nominate a new candidate in the short term, and pressure on the Fed will only further escalate.

Regarding policy impact, President Trump has again postponed the implementation of a new round of tariffs from the originally scheduled August 1st to August 7th, paving the way for intensive negotiations this week. The focus will be on Switzerland (with tariffs as high as 39%), Taiwan, Canada, and Brazil, while the market will continue to pay attention to the escalation of the Russia-Ukraine situation and the subsequent development of U.S. submarine deployment.

Despite various opinions and mockery about tariff negotiations, U.S. income in July indeed reached a record $150 billion, with a surplus of $27 billion the previous month, significantly reversing the $71 billion deficit a year ago. Moreover, with the return of the U.S. exceptionalism narrative, market demand for U.S. assets has rebounded sharply since May, and any concerns about capital outflows have vanished.

The U.S. dollar subsequently rebounded, with the dollar index rising more than 3% from its recent low, while safe-haven assets like gold began to weaken.

In terms of stocks, the earnings season has performed well so far. Visa, Mastercard, and Amex all reported robust growth in payment volume and consumer momentum, and bank earnings were largely in line with expectations. In the tech sector, consumers continue to show resilience in goods and transportation, with Meta and Microsoft delivering impressive earnings, but ultimately dragged down by disappointing reports from Amazon and Coinbase.

Lastly, in the cryptocurrency sector, Coinbase's revenue grew 3.3% year-on-year to $1.5 billion but fell short of analyst expectations and was below the $2 billion in the first quarter of 2025. Net profit was boosted by unrealized gains from cryptocurrency and Circle holdings, but global and U.S. spot trading volumes were overall sluggish in the second quarter.

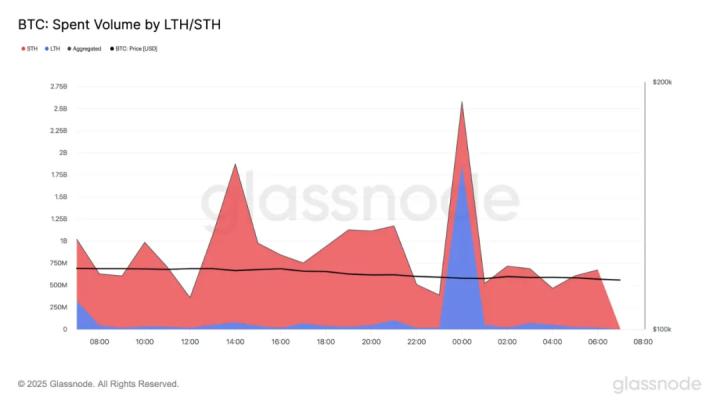

Coinbase's stock has fallen 25% from its July high, and as overall market sentiment weakens, BTC price dropped to $112,000, with over $1 billion in long futures liquidated last Friday, the most brutal since May.

As expected, BTC and ETH both experienced significant capital outflows last week. BTC saw a $1 billion outflow on Thursday/Friday, one of the worst single-day performances this year, while ETH ended its nearly month-long consecutive net inflow, with an outflow of $152 million last Friday.

Overall, given the speed and scale of capital outflows, market performance is actually more stable than expected, which is related to the significant improvement in market depth for BTC and Altcoins. With the entry of institutional funds and professional investors, secondary market liquidity has improved, avoiding the kind of violent sell-off before the ETF launch.

Looking ahead, the market is currently at a delicate juncture, with both bulls and bears expected to be in a tug-of-war, making it difficult to determine a winner in the short term. The bull camp believes the market overreacted to the non-farm employment data, while the bear camp will point out that this could be an initial signal of market reversal given the overheated performance of the past three months. Continuous tariff news and increasingly aggressive Trump rhetoric will inevitably further amplify market noise, and as summer enters its latter stage, reduced trading activity may further magnify market volatility.

We expect no clear directional breakthrough in the short term, and this month's price movement will be more volatile compared to July. The fourth quarter will be crucial, when the Fed will fully resume operations, and the combined effects of tariffs and inflation will begin to impact the real economy. In this context, we believe now is an opportune time to moderately reduce risk exposure in preparation for the busy September and year-end. Wishing everyone smooth operations and enjoyable trading!

Click to learn about BlockBeats job openings

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Communication Group: https://t.me/BlockBeats_App

Twitter Official Account: https://twitter.com/BlockBeatsAsia