The decentralized original intention has consolidated the status of centralized sovereign currency through the stablecoin mechanism.

Some scholars point out that the White House establishing a "strategic Bit reserve" threatens its dollar hegemony, arguing that Bit is opposed to traditional fiat currency because it is "decentralized", and Bit's power would pose a major challenge to the "dollar". While this argument seems plausible, if considering the "blood transfusion" function played by stablecoins, the answer might be exactly the opposite.

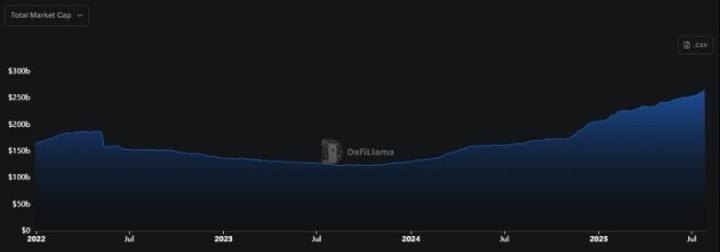

One fact is that the total market value of US dollar stablecoins is highly positively correlated with Bit prices. For example, in 2017, Bit prices rose 19 times, and the market value of US dollar stablecoins (USDT) quadrupled; in 2021, Bit prices rose 1.2 times, and USDT's market value tripled; from Q4 2023 to Q1 2024, Bit prices rose 1.6 times, and the total market value of US dollar stablecoins (USDT, USDC, Dai, FDUSD) increased by 30%; from Q2 2024 to Q3 2024, Bit prices remained relatively stable, and the market value of US dollar stablecoins also remained largely unchanged. The following chart fully reveals their strong positive correlation.

Chart 1: Stablecoin Market Value Highly Correlated with Bit Prices

This transmission chain is quite clear: Bit price rises → New funds flow into the crypto market → Investors must first convert fiat currency to stablecoins (core deposit tool for exchanges) → Stablecoin demand surges → Issuers increase stablecoin issuance → Stablecoin market value rises.

This indicates that while stablecoins have real application scenarios such as cross-border payments and quick transfers, which are important factors driving stablecoin development, it cannot be denied that the more critical reason is actually the investment demand brought by Bit's "bullish" market, which promotes stablecoin development.

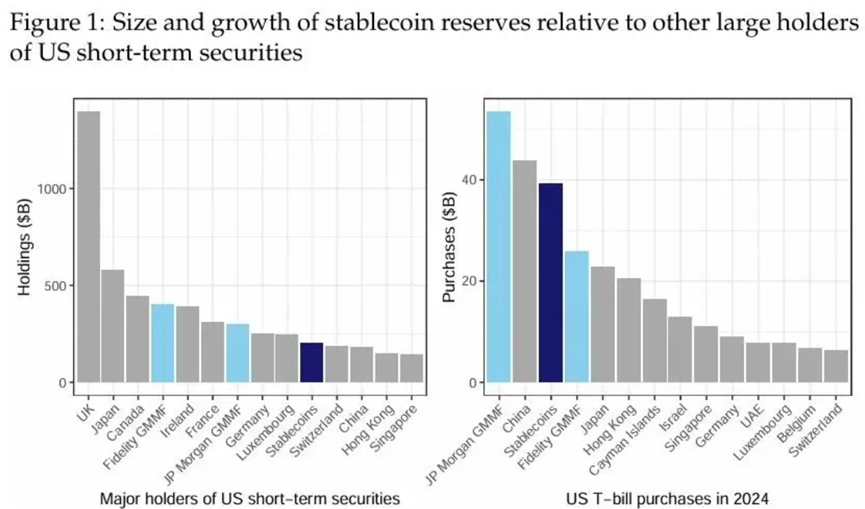

The value of stablecoins is supported by real US dollar reserve assets, with 80% invested in short-term US Treasury bonds (usually within 3 months). Data from the New York Federal Reserve shows that in 2024, stablecoins backed by US dollars purchased nearly $40 billion in short-term US Treasury bonds, with a purchase scale almost equal to the largest government debt money market fund and exceeding the purchase volume of most foreign investors. This indicates that stablecoins have become one of the important buyers of short-term US Treasury bonds.

Based on the total stablecoin market value of $250 billion, stablecoin issuers hold around $200 billion in short-term US Treasury bonds, a scale that already exceeds the amount of short-term US Treasury bonds held by major foreign investors like China.

According to the New York Federal Reserve's quantity model, an additional $10 billion in short-term bond demand can lower the yield of short-term bonds by about 0.06 percentage points. Therefore, in 2024, the incremental demand from stablecoins could lower the yield of short-term US bonds by around 0.3 percentage points.

Chart 2: Stablecoins Have Become Important Buyers of US Short-Term Treasury Bonds

Bit's decentralized original intention, through the stablecoin mechanism, is closely connected with centralized US dollar assets (US Treasury bonds): Bit bullish → Stablecoin market value increases → Demand for short-term US bonds increases → Short-term US bond yields decrease. In other words, Bit bullish → Dollarization.

At the Lujiazui Financial Forum, Vice Chairman of the 12th National Committee of the Chinese People's Political Consultative Conference and former Governor of the People's Bank of China, Zhou Xiaochuan, stated that US dollar stablecoins may promote dollarization and must be vigilant at all times. This judgment is insightful. The strategic reserve plan for Bit and the rapid development of stablecoins represent the extension of US dollar sovereign currency in crypto assets.

The Hong Kong SAR government's "Stablecoin Regulation" will take effect on August 1st, which is a key step in embracing stablecoins and gaining an advantage. If Hong Kong can explore and issue stablecoins pegged to offshore RMB or a basket of currencies (such as including US dollars, euros, Japanese yen, offshore RMB, and even Singapore dollars), while expanding application scenarios and enriching stablecoin investment fields, it may help increase the weight of RMB in crypto assets and become an important force in balancing dollarization.