Written by: Sleepy, Kaori, Peggy

"I've been having phone meetings that go on until two in the morning every day recently."

These words came from a veteran financial professional with over a decade of experience in the traditional securities industry. As he spoke, he placed his phone face down on the coffee table. His eyes were slightly reddened, but his tone remained casual.

His office in Beijing was located in a traditional courtyard house in the West City District, with doors slightly peeling. Afternoon light slanted into the yard, with dust floating in the light beam. He sat at an old wooden table, dealing with regulatory, business collaboration, and project scheduling issues.

Having started in the financial industry over a decade ago, he had experienced the previous financial crisis and navigated global markets, managing funds, developing products, and leading teams across nearly all continents. In recent years, he began turning towards a direction that the entire traditional financial industry initially thought was "uncertain" - virtual assets.

Traditional finance's focus on Web3 did not begin in 2025. If tracing the starting point, many would mention Robinhood.

This platform, known for "zero-commission stock trading", had already launched Bitcoin and Ethereum trading functions in 2018. Initially just a product line supplement, users could buy crypto like buying Tesla stocks, without needing a wallet or understanding blockchain. This feature wasn't heavily promoted that year but became an explosive point years later.

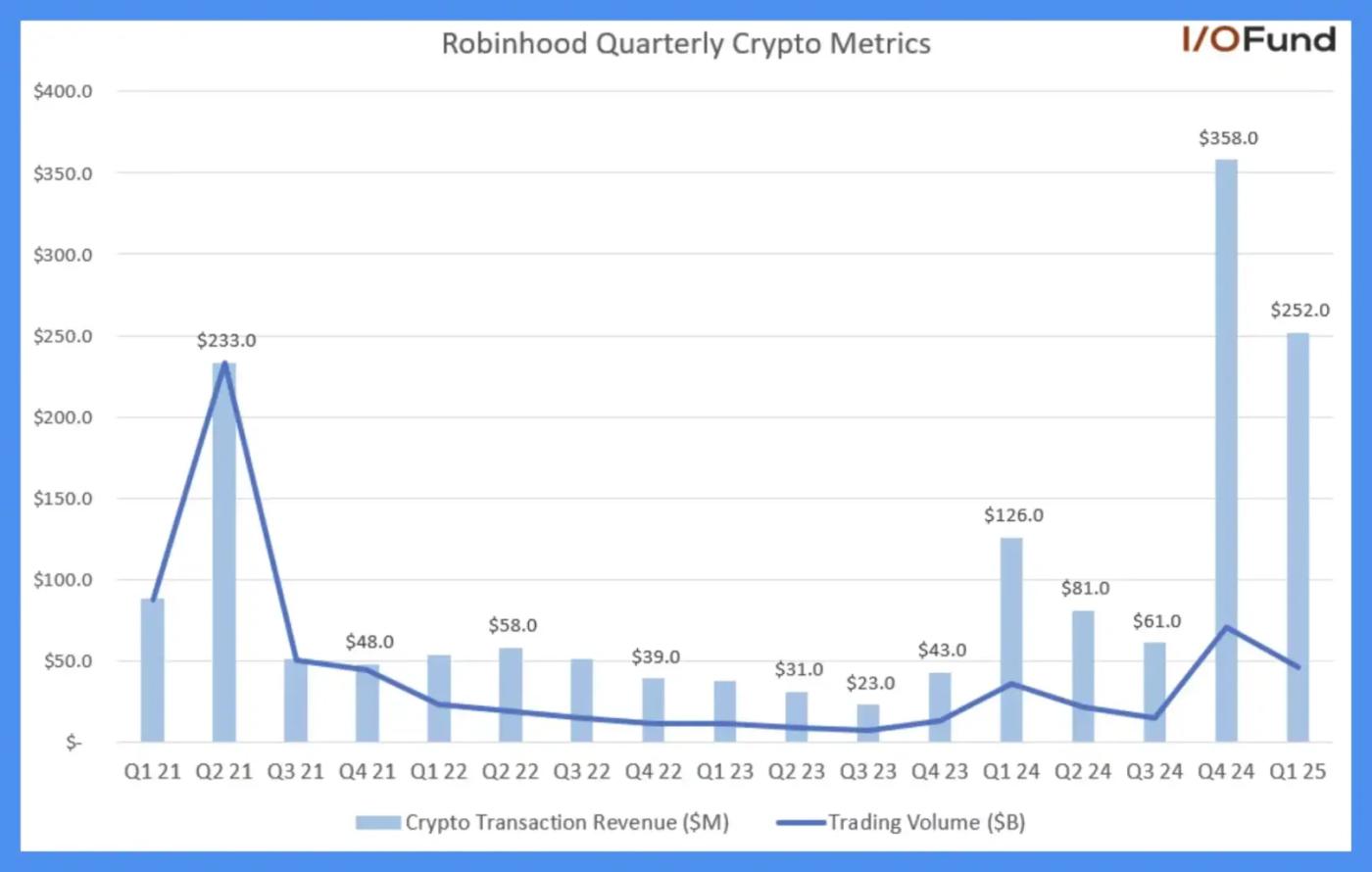

In the fourth quarter of last year, crypto contributed over 35% of Robinhood's total net revenue, with trading volume surging 455%, driving trading revenue to grow 733% year-on-year to $358 million, making crypto Robinhood's largest revenue source that quarter. In the first quarter of 2025, crypto contributed over 27% of total revenue, with trading revenue doubling year-on-year to $252 million.

Robinhood quarterly crypto asset trend, source: IO.FUND

What drove this change wasn't technology, but thousands of users' clicks. Robinhood didn't narrate Web3, simply adapting to user trading habits, and discovered crypto trading was no longer a marginal business but had become the company's core growth engine.

Subsequently, Robinhood gradually transformed from a centralized broker to a digital asset trading platform.

With Robinhood's example, traditional finance finally decided to collectively enter the market in 2025, no longer just observing the crypto industry. They weren't coming to experience Web3 or invest in projects, but with the belief that "traditional finance will take over the crypto industry within 10 years."

We are already in the midst of this reshuffling of traditional securities against crypto natives.

In March 2025, Charles Schwab, one of the world's largest retail brokers with over $10 trillion in assets under management, announced opening spot BTC trading services within a year.

In May 2025, Morgan Stanley, one of Wall Street's most influential investment banks, announced plans to formally integrate BTC and ETH into its E*Trade platform, providing direct trading channels for retail users.

In May 2025, JPMorgan Chase, the largest asset bank that had long been critical of crypto, announced it would allow clients to purchase Bitcoin.

In July 2025, Standard Chartered, a long-established British bank focusing on Asian, Middle Eastern, and African markets, announced spot trading services for Bitcoin and Ethereum for institutional clients.

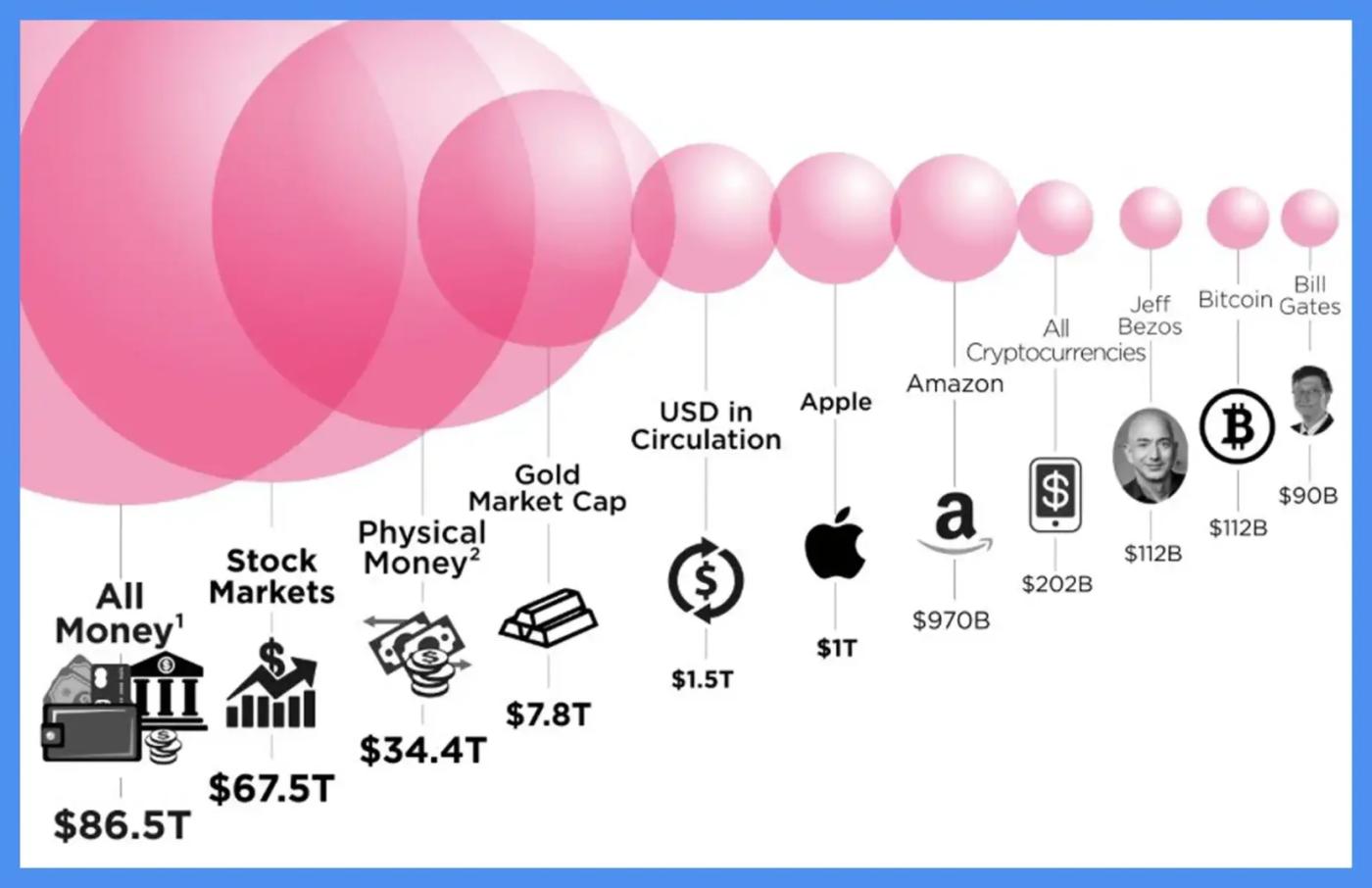

These are the behemoths controlling global financial system operations, traditional financial institutions controlling global fund flow channels, clearing networks, and fiat payment systems, holding tens of trillions of dollars in assets. In comparison, the current crypto market's total market value is only $4 trillion.

Mainstream asset market value ranking, source: Steemit Community

They are gradually completing their layout in the crypto field based on traditional financial compliance frameworks. When an institution possesses both compliance trust and user traffic with clearing and settlement capabilities, it has all the elements to construct a crypto trading network.

In the traditional financial system, whoever controls account opening rights can control fund flow, customer relationships, and ultimately pricing power. For a long time, crypto trading platforms defined narratives by listing assets and controlled liquidity through deposits, but now, the "asset entry" role seized by CEX for nearly a decade is gradually being taken back by traditional finance.

"Those crypto trading platforms should be getting anxious now."

His tone remained restrained, without a hint of schadenfreude. The source of anxiety might not just be due to a specific institution's entry or a policy's implementation, but an industry-wide awareness that crypto trading platforms might no longer be the sole dealers at this financial table.

(Translation continues in the same manner for the rest of the text)Perhaps he had already seen that the largest future competitor for crypto trading platforms would be securities firms, so he took the initiative. Looking back now, this model has been picked up by the industry again, but with a different flavor. After FTX's collapse, crypto stocks became a hemostatic bandage, no longer a battering ram.

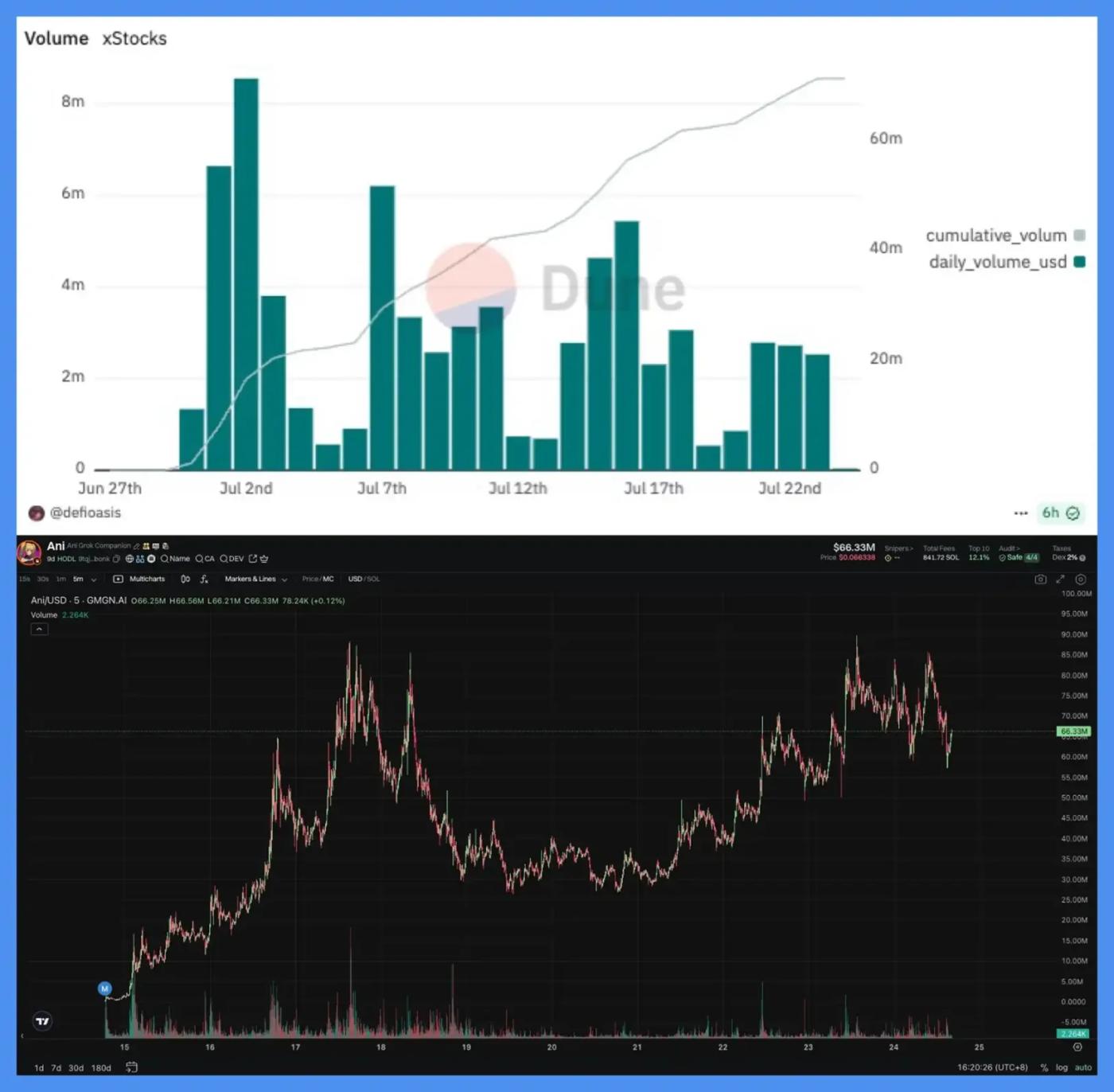

Data also confirms this point.

After the crypto stocks model was launched, it indeed gained initial community attention, but activity quickly fell, and attempts by various platforms failed to create much of a splash.

On the other hand, in contrast, the meme coin trend on Solana during the same period took a completely different path. With a single tweet from Musk, related meme coins could quickly reach a market value of hundreds of millions, with daily trading volumes of tens of millions of dollars, much higher than the weekly trading volume of many crypto stock trading pairs.

Top: XStocks trading volume, source: Dune; Bottom: meme coin Ani trading volume, source: gmgn

New features, no new users.

At this stage, what features CEX launches are no longer important. What matters is why they are launching these features and whether these features can reclaim the role they are losing.

This wave of crypto stocks is not because the industry has progressed, but because no one dares to do nothing.

Kant said: "Freedom is not doing whatever you want, but being able to not do what you don't want to do."

Compliance is just an illusion

During this period, almost all crypto trading platforms have been talking about compliance. Each is trying to apply for licenses, adjust business structures, introduce executives from traditional financial backgrounds, and attempt to prove that they have moved beyond the wild era and become a financial institution that can be regulated.

This is an industry consensus and a collective anxiety.

But in the eyes of traditional finance professionals, this understanding of compliance is still too thin.

"Many trading platforms obtain licenses from small countries to prove compliance, but licenses from small countries are not real licenses and cannot be taken seriously," he said, not sharply, but more like stating an industry common sense.

By "taken seriously," he means not whether you have a business license, but whether you can access the real financial system - whether you can open accounts with mainstream banks, use clearing networks, be trusted by regulatory agencies, and truly collaborate with them.

This implies a reality that in the view of traditional finance, the crypto world has never been truly treated equally.

The traditional financial system is built on responsibility chains and trust loops, emphasizing transparent customer structures, risk control, audit capabilities, and explainable fund paths. Crypto platforms, however, mostly grew in institutional gaps, maintaining high profits and growth in ambiguous areas, rarely having the ability to build these compliance foundations.

In fact, everyone in the industry understands these issues. But before, no one cared because no one was competing for this territory. Now that traditional financial institutions have entered, they play by their own rules, and the crypto industry's "industry practices" suddenly become fatal flaws.

Some platforms are indeed making adjustments, introducing compliance audits, establishing offshore trust structures, separating businesses, and trying to appear more regulated.

But many countries' regulatory agencies don't buy it at all. They may superficially cooperate with your process, but deep down, they never intended to include you as part of the formal financial system. No matter how much you look like it, it doesn't mean they will actually keep you.

However, not all trading platforms are just going through the motions. Bybit is one of the few platforms that truly broke through the regulatory shell. This year, they became one of the first centralized exchanges to obtain the European MiCA license and established their European headquarters in Vienna, Austria.

Bybit does not deny the difficulty of this process and does not shy away from the industry's regulatory doubts. But as Emily said, regulators are no longer the ones who didn't understand crypto five years ago. Now, regulatory agencies are beginning to truly understand the industry's business logic and technical structure. From technology and models to market promotion, their understanding is deepening, and the basis for cooperation is becoming more solid.

Additionally, Bitget's Chinese-language head, Xie Jiayin, told us that Bitget has currently obtained virtual asset licenses in multiple countries and has built local compliance frameworks according to regional regulatory requirements. He revealed that the team is actively pursuing the MiCA license, hoping to establish a more stable business channel in the European market and lay the groundwork for cross-border operations under a unified regulatory framework in the future.

But even so, such cases are still rare. For most platforms, they neither have licenses, networks, and trust endorsements within the traditional financial system nor are they maintaining the high-growth dividends from the previous institutional vacuum. They find the threshold for compliance transformation too high, and when trying to return to crypto native operations, they find other competitors eyeing the market.

So they can only continue to move closer to regulation, continue to discuss compliance, apply for licenses, and follow procedures. Often, these actions are not strategic choices but a sense of anxiety of being pushed forward.

Midpoint of the game

At five in the morning in the community, Xie Jiayin is still replying to users' questions one by one. Some ask how to play crypto stocks, some ask about the platform's recent compliance progress, and others ask about the PUMP subscription situation. He says he and his colleagues often stay up late, and an all-nighter is nothing.

On a hot Beijing afternoon, in a courtyard house, a senior executive from a Hong Kong securities firm is having tea and discussing cooperation with several executives from listed companies. The reception room is separated by a carved wooden door, with a courtyard paved with blue bricks and insect sounds in the tree shade.

Zooming out further, in Vienna, Austria, Bybit's new European headquarters has just completed the ribbon-cutting ceremony and officially started operations, established after obtaining the MiCA license. They are the first batch of centralized exchanges to complete the crossing, and they are also clear that the vast majority of peers are still feeling their way across.

They are in different places, different emotions, different rhythms, but their words have subtle echoes: all talking about "changes happening too fast," all saying "take it slow," all thinking about how the industry should continue.

And the premise of moving forward is different from a few years ago.

Crypto trading platforms may no longer be the most central role in this world, no longer the starting point for all traffic and narratives. They are standing on the edge of a new order, gradually being squeezed out of the core by an invisible set of rules.

More complex systems and larger capital are gradually replacing the original narratives and structures.

Crypto trading platforms still exist, new product features are still being launched, and announcements are being issued one after another. Their mode of expression is changing, their tone of voice is changing, and the context they want to integrate into is changing - everything is changing.

Some changes are actively chosen, some are passively accepted, but more often, they are just trying to maintain a sense of existence without being eliminated by the times.

However, not everyone is pessimistic. Both Xie Jiayin and Emily believe that crypto's impact on traditional finance is greater than the latter's squeeze on CEX. They are both optimistic about the trend of traditional financial institutions entering the market because each industry evolution needs new players and participants. Centralized exchanges have also been continuously expanding institutional clients, starting to do wealth management, asset allocation, and more. The businesses of both sides are intersecting and merging, "Two financial worlds echoing each other is a romantic moment."

But at the same time, everyone is also clear that this advantage itself does not eliminate anxiety.

Many questions will not have clear answers. Such as whether regulators will truly allow these crypto trading platforms, or whether traditional finance is truly willing to co-build rather than replace.

Also, whether they have another chance to define themselves before the next industry main theme arrives.

No one dares to speak too definitively about these issues. Everyone is dealing with their own part of the work, attending meetings, improving products, running licenses, waiting for feedback, maintaining the status quo while waiting for an opportunity to regain the initiative.

Waiting for the wave of industry reshuffling.