XRP has posted 12 consecutive green hourly candles at a stretch, preceding the recent hour. This hourly win streak remains significant for XRP, indicating increased short-term buying pressure following a prior drop of the market. On the hourly chart, XRP found support at a low of $3 on July 30, after which it began to rise.

While XRP's 12 consecutive green candles on the hourly chart remain significant, XRP faces a barrier at the hourly SMA 200 at $3.173, as evidenced by the recent decline. If bulls overcome it, XRP may rise to $3.33 and then to $3.66.

Breaking through these levels would be critical for XRP to resume upward momentum and set the stage for higher price targets, potentially $4.

XRP is currently trading within its hourly SMA 50 and 200, now eyeing support at the hourly SMA 50 at $3.12. The hourly RSI is above the 50 midpoint level, suggesting an advantage to the bulls.

XRP to $4?

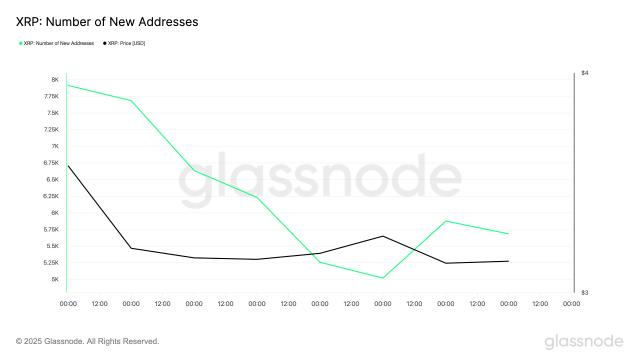

After a sharp drop to a low of $2.96 on July 24, XRP has consolidated in a range between $3 and $3.33. XRP touched $3 twice on July 25 and 30, suggesting bulls are attempting to defend this key level and prevent a drop below it.

At press time, XRP was up 1.65% in the last 24 hours to $3.16 and up 2.37% weekly.

Major cryptocurrencies recovered from their initial losses following the Federal Reserve's decision to keep interest rates unchanged on Wednesday. However, the market remains hesitant, anticipating new economic data. Chairman Jerome Powell again lowered hopes for fresh rate cuts beginning in September, underlining that the central bank is focused on controlling inflation.

If the price falls below the $3 support, the next stop is anticipated to be $2.96. Buyers are expected to vigorously defend the $2.96 level, as a break below it might trigger a further fall to $2.65. On the other hand, XRP has the potential to reach $4 if the $3.66 high is decisively breached.