Written by: 1912212.eth, Foresight News

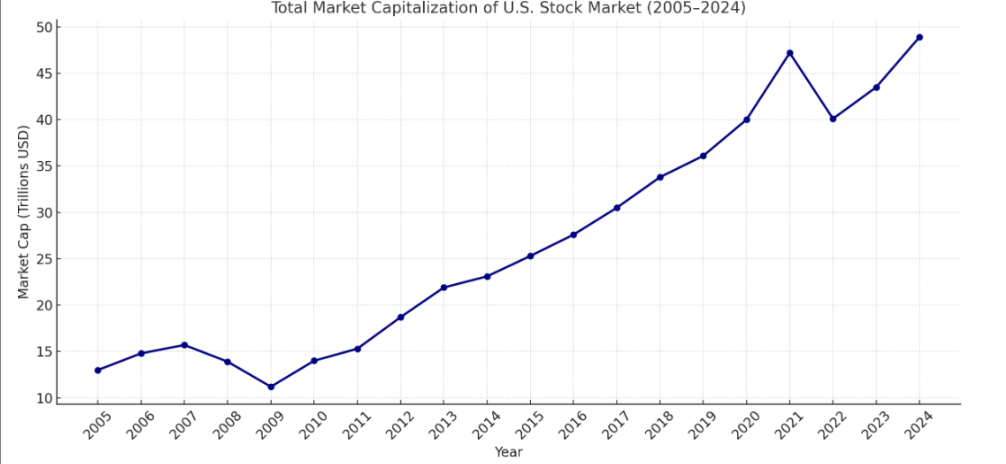

Buying U.S. stocks is betting on the fate of the United States. If you invested $10,000 in the S&P 500 index in 2002, it would now be worth $85,900. If those $10,000 were invested in the Nasdaq index, you might have received $114,900 in returns.

As the world's largest securities market, U.S. stocks have rarely disappointed investors, but many countries and regions still cannot access these assets, missing out on potential wealth.

What would happen if purchasing such assets no longer required an account, was not limited by region or trading hours, and could be done with just a mobile phone and crypto wallet balance? Buying "stocks" of U.S. stock giants anytime, anywhere is no longer a fictional scenario, but a real transformation brought by "U.S. stock tokenization".

In the next era, the stock market will not wait for the bell to ring, and investing will not require a broker's order.

Tokenization is simply the process of converting real-world assets into programmable, tradable digital tokens. These tokens are based on blockchain technology, typically complying with ERC-20 or similar standards, ensuring transparency and security. U.S. Stock Tokenization refers to mapping or anchoring stocks of U.S. listed companies (such as Apple, Tesla, etc.) to the blockchain in token form, allowing them to be traded, transferred, and held on-chain like cryptocurrencies.

In essence, "replicating" a traditional stock in the blockchain world, turning stocks into "on-chain assets". For example, a stock worth tens of thousands of dollars can be fragmented into thousands of small units, allowing ordinary investors to participate with a low threshold. The advantages of tokenization include 24/7 trading, reduced intermediary costs, and enhanced liquidity, but also face regulatory uncertainty and technical risks.

For investors, the investment threshold for U.S. stocks is lowered after tokenization. For enterprises, the motivation to explore tokenization stems from multiple factors. The liquidity bottleneck in traditional financial markets is increasingly prominent, especially during non-trading hours. Secondly, institutional investors like BlackRock and JPMorgan are viewing tokenization as a tool to reduce financing costs. The improved regulatory environment provides policy support for this wave.

So why is the tokenization wave surging into U.S. stocks?

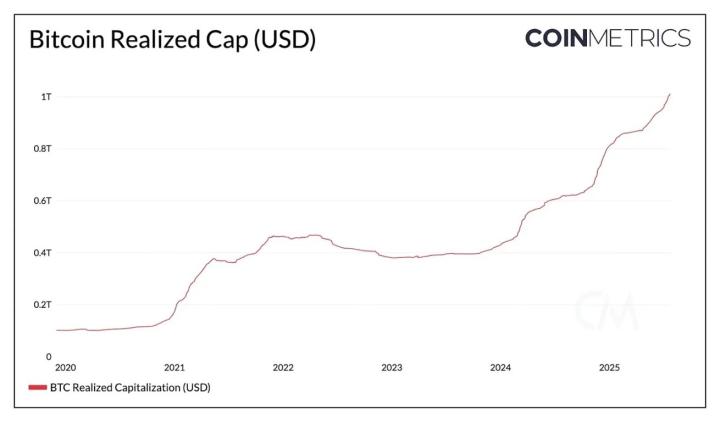

U.S. stocks have unique advantages not found in other assets. First, as the world's largest stock market, the total market capitalization of U.S. stocks reached between $52 trillion and $59 trillion in 2025, far exceeding stock markets of other countries or regions. The global stock market total value in 2025 was approximately $124 trillion, with U.S. stocks accounting for over 40%.

High returns are another key factor, with the S&P index recently hitting a historical high of $6,336. The S&P 500 index has an average annual return of about 10.4% since 1957 (adjusted for inflation, about 6.5%), with an average annual return of 10.364% over the past 20 years and 9% over the past 30 years. The threshold for non-U.S. regions to trade U.S. stocks is high, with traditional investment requiring opening a brokerage account, meeting minimum investment amounts, adhering to trading hours (only weekdays 9:30-16:00 Eastern Time), and navigating cross-border regulatory and tax complexities, especially for overseas investors with a cumbersome and expensive account opening process.

Surging Wave

Retail investors are rushing to tokenized U.S. stocks to bypass thresholds and for wealth effects. How are institutions moving? Crypto exchanges, on-chain protocols, and internet brokers are gearing up.

On May 22, crypto exchange Kraken collaborated with Backed Finance to launch "xStocks" tokenized stock and ETF trading service, initially covering over 50 U.S. listed stocks and ETFs including Apple, Tesla, and NVIDIA.

Another crypto exchange, Bybit, chose to enter the U.S. stock market by collaborating with Swarm. Notably, Kraken and Bybit themselves do not issue stock tokens but choose to enter by partnering with third parties. Those truly issuing stock tokens include Backed Finance and Securitize. The former collaborates with protocols like Uniswap, and under MiFiD and Swiss DLT regulations, can provide freely transferable tokenized stocks supporting on-chain trading. Securitize collaborates with well-known institutions like BlackRock and VanEck, offering end-to-end tokenization services.

However, the most heated and closely watched tokenization in the crypto circle involves blockchain platform Ondo Finance and U.S. broker Robinhood.

Ondo Finance is an institutional-level platform focused on tokenizing traditional financial assets and introducing them to the blockchain. It is currently the most well-known and comprehensive RWA project. Ondo's flagship product USDY is a tokenized U.S. Treasury, with a total TVL of $1.39 billion. However, the market seems lukewarm, with its token price sliding from $2 to around $0.7 and lingering.

With the U.S. stock tokenization wave approaching, Ondo took action. In early July, it first partnered with Pantera Capital to plan a $250 million investment to promote RWA tokenization, then acquired SEC-regulated broker Oasis Pro on July 4 to obtain licenses for various U.S. securities. Ondo also plans to launch tokenized stock trading in the coming months.

In just one month, Ondo has become particularly aggressive on the U.S. stock tokenization path.

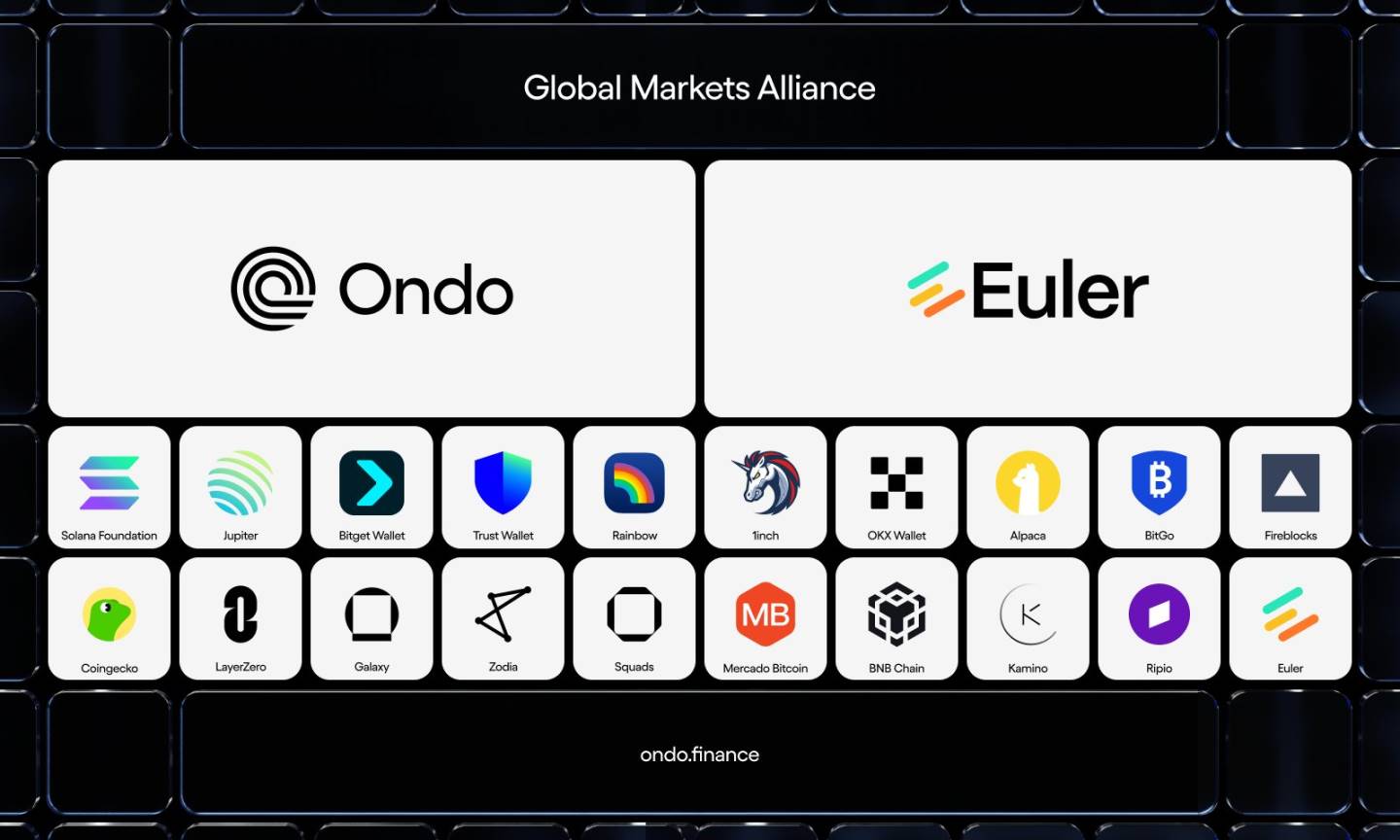

On July 10, Ondo acquired Strangelove to accelerate the development of a full-stack RWA platform and recently initiated a global market alliance, collaborating with public chains, DEXs, wallets, data service providers, cross-chain protocols, and DeFi products to unify industry standards.

It can be anticipated that after launching tokenized U.S. stocks, Ondo will leverage its strong resource integration capabilities to push into every corner of the crypto market, making it easy for crypto players to purchase tokenized U.S. stocks.

Robinhood has also personally entered the U.S. stock tokenization arena, becoming the first listed U.S. broker to do so.

This player, who disrupted the traditional broker industry with a zero-commission trading model, attracts many young investors, especially millennials, with low thresholds and ease of use. Its average user age is 35, with 25.8 million funded accounts and $221 billion in assets.

In June, Robinhood launched over 200 on-chain stock tokens, even issuing OpenAI and SpaceX tokenized equity, with each qualified user receiving 5 euros of OpenAI tokens.

Robinhood founder Tenev directly stated that the fundamental problem in the private market is that the best companies have too many choices and won't actively consider retail investors, leading to an "adverse selection problem". The key innovation of tokenization is that it can work "without needing to be chosen by the tokenized company", which is the breakthrough Robinhood can promote.

On July 21, design software giant Figma's revised IPO S-1 filing notably differed from the early month's submission by explicitly stating the company has authorized a new stock class of "blockchain common stock". This gives the company's board the power to issue stocks in blockchain token form in the future. In a sense, institutions can reach potential global investors through borderless blockchain platforms, gaining more potential buyers.

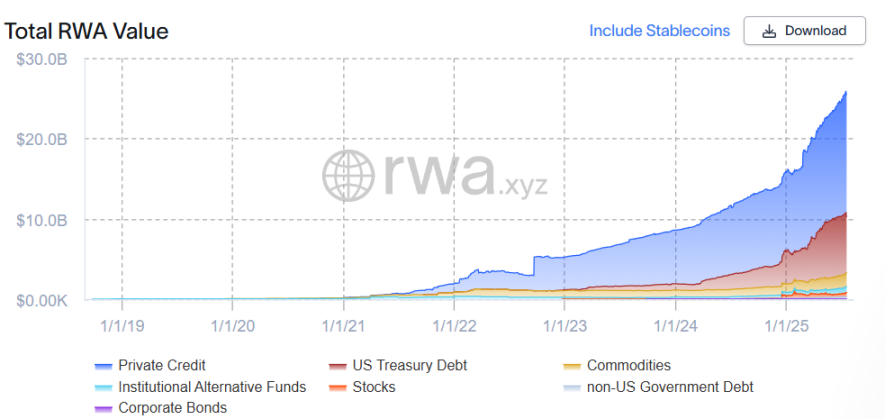

In the first half of 2025, on-chain U.S. stock tokenization has transformed from concept to reality. According to rwa.xyz data, its total TVL has risen to $530 million, with monthly active addresses surging to 70,000.

Tokenization is penetrating from pure crypto to traditional finance: no longer a speculative tool, but a bridge to improve efficiency.

Past of the Wild Frontier

The current stock token wave in the US market is not a new phenomenon, but rather a price paid for innovation.

Early attempts at US stock tokenization can be traced back to the decentralized protocol experiments of the previous cycle. Synthetix was one of the first platforms supporting synthetic stock asset trading, where users could hold tokens like sTSLA and sAAPL on-chain to simulate stock price performance. However, these assets lacked real stock endorsement, relying solely on collateral mechanisms and oracle pricing, leading to fragile liquidity and de-pegging risks. Statistics show that the cumulative trading volume of sTSLA on the Synthetix platform was less than 800 trades, with most projects ultimately transforming due to regulatory pressure and unsustainable business models.

Although lacking shareholder equity, this approach opened the door to mapping crypto assets to real-world assets. The model provided price information through oracles, bypassing traditional custody mechanisms and offering a reference paradigm for subsequent players.

Simultaneously, centralized exchanges became the primary drivers of early stock tokenization. In 2020, FTX collaborated with German licensed broker CM-Equity to launch stock tokens for Tesla, Apple, etc., allowing non-US users to trade 24 hours a day, with tokens backed by actual stock custody. In 2021, Binance followed suit by launching "stock tokens", enabling users to trade Tesla and other targets with zero commission using USDT.

However, these models were essentially derivatives within CEX, lacking on-chain transparency and compliance endorsement, quickly triggering warnings from multiple regulatory bodies. FTX's stock token trading volume reached $94 million in the fourth quarter of 2021, but the service abruptly stopped with the platform's bankruptcy in 2022; Binance withdrew the product after just three months due to regulatory pressure.

Ideals were plump, but reality was harsh. The FTX collapse in 2022 became a watershed moment for US stock tokenization, with the market shifting from "wild growth" to "compliance reconstruction".

These cases exposed the core contradiction of early stock tokenization: the imbalance between technical feasibility, compliance costs, and market demand. However, these practices laid the foundation for today's more compliant and structured tokenization attempts, promoting market recognition of the potential for asset on-chain mapping.

Truly meaningful on-chain US stock assets emerged after 2022, with the RWA concept gaining momentum. Representatives like Backed Finance generally adopt relatively friendly jurisdictions such as Switzerland and Liechtenstein, using a "1:1 custody + verifiable reserves + on-chain issuance" approach to map actual held US stock securities into ERC-20 standard tokens, with stronger compliance and traceability.

In 2024, Exodus Movement became the first US-listed company to tokenize common stocks, issuing EXOD tokens on the Algorand blockchain, allowing users to convert on-chain tokens to NYSE stocks 1:1. This marks a shift in SEC's attitude towards on-chain stocks, though the tokens only support price tracking, excluding voting rights and other shareholder equities.

Challenges and Risks

A field full of opportunities is always accompanied by risks. On-chain stock liquidity is the real challenge.

On July 3rd, the Apple-tracking token AAPLX price momentarily surged to $236.72, a 12% premium over the stock's trading price. A similar Amazon-tracking token on July 5th rose to $891.58, four times the previous trading day's closing price. More extreme situations occurred on the peer-to-peer crypto trading platform Jupiter. Blockchain data shows that on the morning of July 3rd, an unidentified user attempting to purchase about $500 of Amazon token AMZNX briefly pushed its price to $23,781.22, over 100 times the previous day's closing price.

The "xStocks" issued by Backed Finance in collaboration with Kraken and others primarily map various stock tracking tokens. However, due to thin trading on multiple crypto exchanges, these tokens are prone to dramatic price fluctuations when user transactions exceed market capacity. These fluctuations can be exacerbated during nighttime and weekend stock market closures.

Market liquidity, oracles, and potential manipulation clouds deter many on-chain stock players.

Moreover, user rights protection has drawn market attention. After Robinhood announced the launch of OpenAI stock equity tokens, OpenAI quickly responded on X: "These 'OpenAI tokens' are not OpenAI stock equity. We have not collaborated with Robinhood, nor participated in or endorsed this. Any stock transfer requires our approval—which we have not given. Please be cautious."

Elon Musk also mocked: "Your 'equity' is fake." EU regulators like the Lithuanian Central Bank intervened to investigate, SEC warned of potential violations, and Robinhood's stock price reversed. Bernstein analysts noted the company is betting on SEC policy support and the CLARITY Act's passage to open the tokenized asset market.

Amid huge controversy, Robinhood's founder and CEO Vlad Tenev recently suggested that OpenAI and SpaceX's reactions were understandable but unfair. He used a vivid analogy: it's like "digital NIMBYism" - in principle, everyone supports tokenization, but when it happens to them, the appeal diminishes. People don't truly want complex financial instruments but "capital as a service" - press a button, and funds enter your account, he stated.

Whether potential market demand can support the on-chain stock track remains questionable. A seasoned player told Foresight News, "Doing US stocks on-chain is essentially finding stock investors among crypto players. How many of these players accustomed to 24x7 global trading and the crypto market's dramatic fluctuations would actually engage with US stocks is worth questioning."

He added, "For non-crypto players, learning about on-chain wallets just to trade stocks is also a barrier."

Another challenge comes from regulation, as finance is typically a heavily regulated domain.

Recently, US SEC Chairman Paul Atkins stated he is considering introducing a crypto "innovation exemption" policy to encourage market tokenization progress.

However, this is not a universal shield.

When Apple stock is "replicated" on-chain, who ensures it truly represents shareholder rights? Who is responsible for information disclosure, compliant trading, and anti-money laundering? Under US securities law, any security's issuance and transfer require registration or exemption, and the decentralized nature of on-chain assets is precisely at odds with traditional compliance logic.

The SEC's recent security tokenization statement indicates, "Tokenization may facilitate capital formation and enhance investors' ability to use assets as collateral. However, despite blockchain technology's potential, it lacks 'magic' to change the underlying asset's nature. Tokenized securities remain securities. Therefore, market participants must carefully consider and comply with federal securities laws when trading such instruments."

Once involving cross-border custody, KYC gaps, or liquidity leading to unregistered platforms, tokenized US stocks are highly likely to be viewed as illegal securities issuance by the SEC. This is a test for innovators and a blind spot for regulators - they can neither ignore it nor easily govern new paradigms with old rules.

Therefore, how subsequent tokenization companies and protocols will "dance in shackles" in this gray regulatory zone becomes an unavoidable critical issue.