On July 29, U.S. Trade Representative Greer stated that more negotiations are needed with India ahead of the August 1 tariff deadline and expressed uncertainty over whether a deal can be reached. While India has shown willingness to offer zero tariffs on select goods, it continues to protect key sectors like agriculture and dairy. A breakdown in talks could weigh on global risk sentiment.

In the crypto market, BTC rebounded after repeatedly testing $117,400 and is now consolidating within the $118,000–$120,000 range.

Bitunix Analyst’s View:

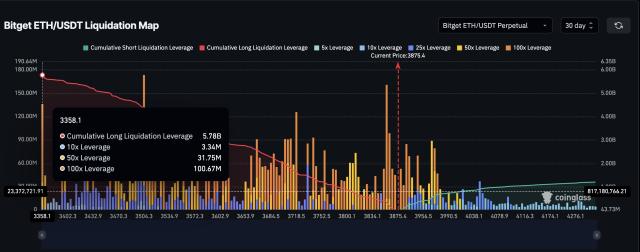

Stalled trade talks between the U.S. and India have increased demand for safe-haven assets. BTC remains supported in the short term, but upward momentum is limited. Investors should monitor support around $118,000 and maintain tight stop-loss levels. If BTC fails to break above $120,000, chasing the rally is discouraged—wait for a pullback to re-enter. Short-term traders are advised to track macro headlines and liquidation heatmaps closely.