Mars Finance News, on July 28, QCP released a daily market analysis report stating that Ethereum is gradually approaching the $4,000 mark, which it first touched last December. With spot Ethereum ETF inflows exceeding Bitcoin ETF inflows for seven consecutive days, market attention and speculation for ETH are increasingly heating up. Considering that ETH's market cap is currently only one-fifth of BTC's, and the threshold for attracting institutional and corporate funds is relatively lower, it is more sensitive to price movements.

Although ETH has dominated market headlines in recent weeks, Bitcoin has demonstrated a quietly resilient strength. Despite slowing inflows into spot BTC ETFs, its price trend remains stable. Even when a long-term holder sold 80,000 BTC last Friday, the market showed strong absorption, with traders quickly buying the dip, and the brief volatility spike was quickly suppressed.

BTC's dominance rate remains around 60%, with almost no fluctuation over the past week, reflecting the market's long-term confidence in BTC as a value storage asset, rather than a comprehensive rotation into Altcoin markets. This also means that ETH and other mainstream cryptocurrencies still have room to compete for market share. In comparison, during ETH's historical high in November 2021, BTC's dominance rate fell below 45%, while ETH approached 20%.

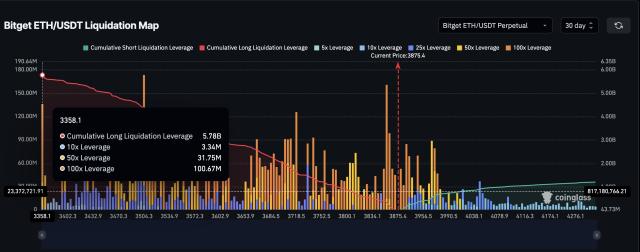

However, in the short term, the market's long positions are relatively crowded. BTC and ETH's perpetual contract Open Interest are near one-year highs, reaching $45 billion and $28 billion respectively; the main exchanges' Funding Rates are generally over 15%. Although not yet at a level of "irrational exuberance" or extremely high liquidation risk, even a slight negative impact could trigger a chain reaction similar to last Friday.

Notably, some large holders have started to take profits on their long positions. For example, a large ETH 26SEP25 3.6k/4k/4.2k bullish spread has been closed; simultaneously, a large number of BTC 8AUG25 $110,000 put options were bought as a hedge against short-term downside risks.

Based on options flow and the flattening of front-end Risk Reversal, the market expects some profit-taking pressure for ETH around $4,000 and BTC around $120,000. However, given the current strong momentum, powerful narrative, and supportive macro environment, QCP believes that long-term holders and institutional investors will continue to "buy the dip", just as seen last Friday.

QCP: The market expects Ethereum and Bitcoin to face pullback pressure around $4,000 and $120,000

This article is machine translated

Show original

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content