Non-Fungible Token Market Shows True Signs of Recovery.

After months of consolidation, a warming trend is finally visible: floor prices are rising, market value is rebounding, and some familiar names are surpassing established Non-Fungible Tokens. From Pudgy Penguins overtaking BAYC to Art Blocks' unexpected return, the market atmosphere is changing.

This article will analyze the latest data, focus on the best-performing categories and series, and explore whether this is a temporary fluctuation or the beginning of a larger trend.

Key Points:

- In July, Non-Fungible Token market value surged 94%, reaching nearly $7 billion, the highest level since early 2025.

- Weekly trading volume jumped 51%, reaching $136 million, making July one of the best-performing months since February.

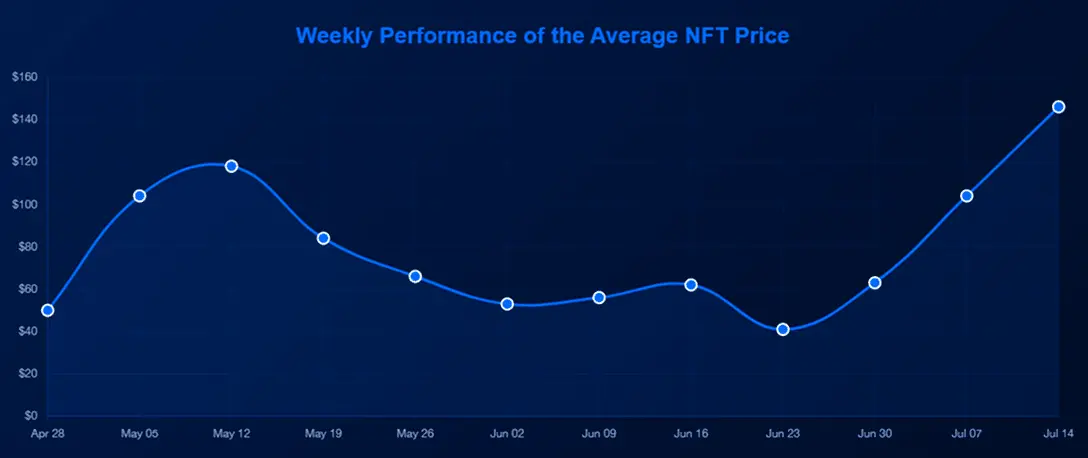

- Non-Fungible Token average price rose 40% in 7 days, reaching $146, but transaction amount only grew 7%, clearly indicating traders are shifting towards higher-value assets.

- Pudgy Penguins' market value exceeded BAYC, with floor price rising 539% since launch, increasing 7% this week alone.

- CryptoPunks floor price rose 53%, signaling renewed interest in blue-chip tokens and Web3 resilience culture.

- Moonbirds' trading volume surged 600% due to new ownership and airdrop hype, but floor price has dropped 64% since launch.

1. Non-Fungible Token Market Overview

The Non-Fungible Token market is showing strong recovery signs. Since the beginning of this month, market value has increased 94%, reaching $6.6 billion, the highest level since early 2025.

Weekly trading volume leaped 51%, reaching $136 million, potentially making July one of the best-performing months since February.

Sales volume increased by 7% quarter-on-quarter, but this month's total volume won't exceed June's. Last month's volume exceeded 5 million, while July has just crossed 3 million. The reason? ETH is rising, and Non-Fungible Tokens are rising too. In just 7 days, Non-Fungible Token average price soared 40% to $146.

Decreased trading volume, rising prices - the market is changing. Blue-chip token fever is returning.

2. Popular Non-Fungible Token Categories - Weekly Performance

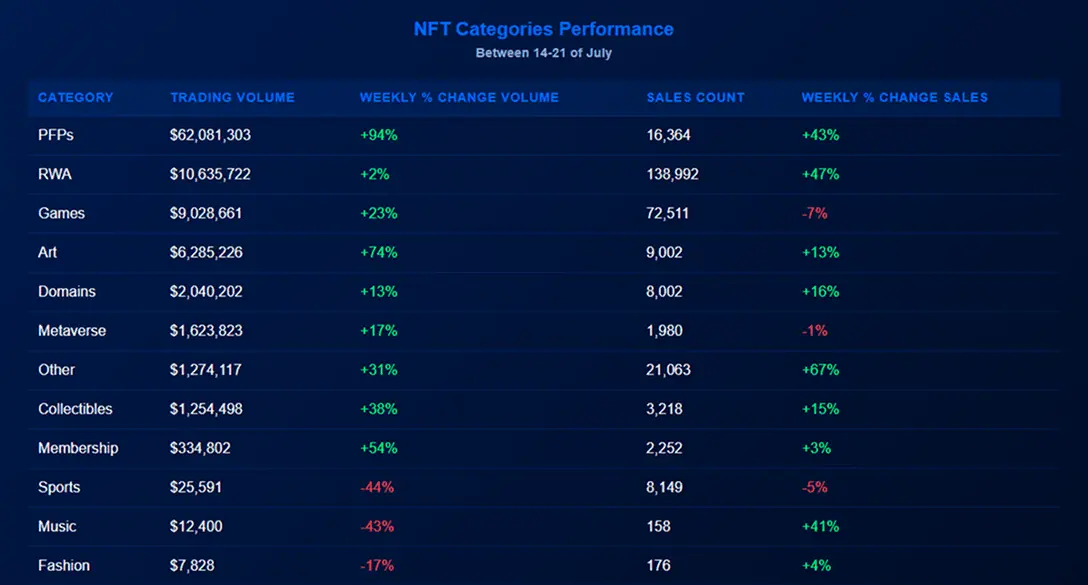

With the clear return of blue-chip token fever, this article focused on the best-performing Non-Fungible Token categories in the past week. Unsurprisingly, PFP leads, accounting for 37% of total trading volume. Following closely are RWA Non-Fungible Tokens at 11%, indicating the tokenization narrative remains alive.

Not all categories joined the upward trend. Sports, music, and fashion Non-Fungible Tokens did not see an upward momentum. Although game Non-Fungible Tokens performed steadily in the second quarter, their heat slightly cooled, with this week's sales noticeably declining.

Nevertheless, PFP's dominance aligns with current market sentiment. Whenever the Non-Fungible Token market heats up, PFP always acts first, just like in previous bull market cycles. Some things don't change easily.

3. Notable Non-Fungible Token Series This Week

This week's market focus is on top Non-Fungible Token big moves, heat revival, and a series of floor price activities.

[Rest of the translation follows the same professional and accurate approach]