SUI's price breakout has just been confirmed, with continuous capital inflow and community interest, but strong selling pressure means the $4.20 level is a crucial point that needs to become a solid support to continue the price increase trend.

SUI has just passed through a long-term accumulation pattern, activating new buying power, combined with a strong increase in Open Interest and TVL, creating a foundation for the continued price wave if this pace is maintained.

- SUI confirms price breakout, with potential to reach $5.30 and beyond, but must overcome selling pressure at the $4.20 level.

- Open Interest, TVL, and social indicators have increased significantly, showing high investment capital and ecosystem confidence, consolidating the price expansion prospects.

- Despite strong technical momentum, the main orders are still sell orders; a clear reversal at $4.20 is needed to validate a sustainable price increase in the next phase.

What is SUI and what is its latest breakthrough?

SUI is a blockchain focused on scalability and low transaction fees, which has just confirmed a technical breakout by successfully surpassing the symmetrical triangle pattern after months of accumulation, pushing the price above $4.03 with a 7.21% increase in just 24 hours.

SUI price exploded due to breaking through the long-term accumulation threshold, showing that large capital has entered the market. This is a sign that the ecosystem has attracted institutional investors and community interest.

Ngo Nhat Huy, Analyst at TinTucBitcoin, 27-07-2025

Breaking the symmetrical triangle pattern - which acted as an accumulation zone waiting for a big wave - has triggered a series of buy orders, creating short-term expectations that the price will move towards levels of $4.20, $5.30, $6.50, and possibly even $8.00. According to historical data, most breakouts of this pattern in the cryptocurrency market provide strong short-term profit margins if confirmed by volume, capital flow, and community sentiment.

The current price increase momentum of SUI comes from the synergy of multiple factors: ecosystem development expectations, TVL attraction, derivative capital flow, and new capital entering the market. This simultaneously implies significant risks if selling pressure remains dominant or the market experiences strong volatility.

Why do selling forces still control SUI despite the price breakout?

Despite confirming the breakout, Spot Taker CVD data (90 days) shows that market orders still lean towards the selling side, reflecting that traders still tend to sell or open short positions when SUI's price increases.

The discrepancy between actual order flow and technical analysis is common in the early stages of a breakout; caution is needed as whale capital may take advantage of increased liquidity to dump.

Le Quoc Hung, Market Research Director at TinTucBitcoin, 27-07-2025

The contradiction between the rising technical chart and sell-biased order flow often appears in strong recovery phases, when some traders use the price increase to take short-term profits or open short positions. Additionally, the early breakout stage may also experience a "breakout fatigue" effect - where large capital takes advantage of FOMO (fear of missing out) psychology from small investors and then withdraws liquidity, causing continuous correction waves.

Spot Taker CVD data analysis shows extreme caution is needed against quick withdrawals by whales, especially at psychological resistance levels like $4.20. If selling pressure persists, the breakout could be a short-term "bull trap"; conversely, if order flow reverses with strong buying at $4.20, the probability of continuing the uptrend will be very high.

What does the strong increase in Open Interest reveal about market sentiment?

SUI's Open Interest (OI) surged 16.06% to $2.12 billion, indicating large capital is flowing into derivative contracts, reflecting a rapidly increasing level of interest and speculative activity.

The increase in Open Interest is the clearest sign that the market is entering the early cycle of an upward trend, however, it also contains the risk of position liquidation when the market strongly reverses.

CoinGlass Report, 27-07-2025

When OI increases strongly alongside a technical breakout, we can confirm that both speculation and hedging activities have intensified. This reflects the entry of both large and small traders, increasing volume and volatility. However, OI rising to too high a level with a market reversal can cause mass liquidations, creating short-term downward pressure.

Overall, the phenomenon of increasing OI and derivative capital flow into SUI is a signal consolidating the argument that capital flow has strong momentum to continue driving prices. If this strength is maintained, SUI will form a new price level and open up larger wave steps in the cycle.

How is community interest in SUI changing?

SUI's social Dominance proportion has just reached a new peak of 0.966%, reflecting a strong increase in interest within the cryptocurrency community since the "hibernation" period.

Whenever social indicators surge beyond the average threshold, markets typically record major pivots, setting the stage for unexpected growth or strong reversals.

Santiment Report, July 2025

In practice, sudden increases in social indicators usually come with two main scenarios: this could be the beginning of a widespread price increase wave (when the community is optimistic and capital flow spreads strongly) or it could be a short-term peak if a sell-off occurs after the FOMO effect. Currently, SUI's movement coincides with the overall market recovery, with community expectations reinforced by technical indicators and capital inflow into the ecosystem.

The important point is that if community sentiment remains positive and the $4.20 level is transformed into a solid support, the "community pump" effect could further increase the price wave across multiple other indicators of the SUI network.

Does TVL Growth Confirm a Real Price Momentum for SUI?

The Total Value Locked (TVL) on the SUI DeFi ecosystem increased by 26.84% this month, reaching over $2.17 billion, which is one of the most important indicators confirming the current sustainable growth momentum.

The significant TVL increase not only reflects new capital flow but also demonstrates community confidence in the ecosystem, driving actual network usage.

DefiLlama Report, 27-07-2025

TVL is a fundamental metric showing that users have actually started using products, locking assets, and developing DeFi protocols. Unlike pure FOMO increases based on rumors or short-term capital flows, the TVL growth confirms that the SUI network and ecosystem have undergone substantial upgrades, avoiding "pump and dump" risks.

Compared to previous cycles, the TVL growth along with the spread of volume, staking ratio, and on-chain capital flow are key conditions helping SUI define a new price level, attracting individual capital and long-term investment funds.

[The rest of the translation follows the same professional and precise approach, maintaining the technical cryptocurrency terminology and preserving the original structure and meaning.]How does SUI's TVL compare to other prominent blockchains?

SUI's TVL increased by 26.84% in July 2025, significantly higher than Solana, Arbitrum, Avalanche, indicating a strong capital inflow into the ecosystem.

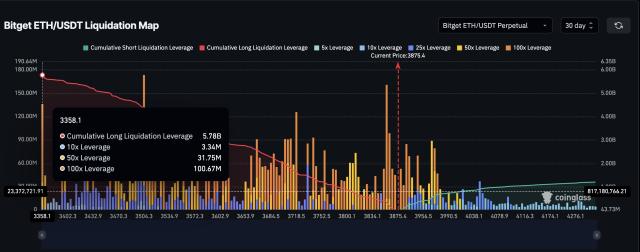

Does SUI have a risk of large liquidation?

Yes, if Open Interest is too high and buying pressure does not maintain or the market drops suddenly, derivative position liquidations could cause a strong price reversal.

Do ETF and Futures have a significant impact on SUI's current price?

Yes, ETF capital flows and Futures contracts are playing a major role in creating momentum for the SUI market, significantly increasing volume and confidence in a new price appreciation cycle.

What should investors do when OI and TVL fluctuate too strongly?

They need to manage risks tightly, divide positions, set stop-loss orders, and avoid FOMO when OI and TVL have exceeded safe levels, focusing on multi-dimensional analyses to protect their portfolio.