Original Author: 0xTodd, Partner of Nothing Research

Yesterday, Solana announced a new roadmap.

Essentially, as improvements across different chains have entered deep waters, leading to some noun stacking, I will try to interpret Solana's new roadmap in a way everyone can understand, along with my own analysis.

First, Solana underwent a major narrative shift in 2024, with its goal changing to building an "Internet Capital Market", whereas previously, its goal was to build a high-performance blockchain.

An Internet Capital Market, as the name suggests, aims to create a borderless, 24/7 financial market where various assets—such as stocks, bonds, currencies, and real-world assets (RWA)—are tokenized and traded seamlessly on-chain.

This serves as the overall guideline, and to achieve this guideline, tasks need to be broken down.

This Solana roadmap, to be precise, is the technical department's roadmap, which aims to help implement the concept of an "Internet Capital Market", so you won't see efforts from Solana's business or compliance departments.

You can understand it as Solana's technical department's technical roadmap.

Image source: https://www.anza.xyz/blog/the-internet-capital-markets-roadmap

Solana's technical department is not just the core developers of Solana Labs, but also includes several important roles, such as:

1. Anza, the big brother. This is a low-key Solana development company founded by former Solana Labs team members. I personally think its role is similar to the relationship between ConsenSys/Ethereum, or Blockstream/Bitcoin.

2. Jito, the second brother. This is the Solana version of Lido, but with even more power because Jito also controls almost all MEV on Solana.

3. Multicoin, at least the third brother. Although it belongs to capital, due to holding many SOL and SOL ecosystem projects, it definitely has a say in the technical field.

4. DoubleZero, a junior brother level, focusing on accelerating network speed.

5. Drift, also a junior brother level, it's a perpetual contract but also participates in some Solana feature development.

The official Solana Labs plus these three main forces and two junior warriors form the six-person group behind this roadmap, which is essentially Solana's true technical reform committee.

Next, let's look at what efforts the Solana technical department needs to make to realize the [Internet Capital Market].

The Internet Capital Market is a slogan-like concept, as it completely doesn't specify how everyone should do it.

Therefore, to help developers "work in the same direction", the technical department translated this slogan into technical language: "Application-Controlled Execution (ACE)".

This is where it starts to get difficult. What exactly is this awkward Application-Controlled Execution (ACE)?

Solana believes that an Internet financial market (especially one on par with Web2) must meet one condition: financial applications must have millisecond-level control over the sorting of their own transactions.

Note: It must have sorting rights, millisecond-level, and control rights.

Therefore, to achieve Application-Controlled Execution (ACE), Solana's technology still lacks many things. What exactly is lacking can be seen in the roadmap:

Short-term goals (1-3 months): More order book-friendly, suppress malicious MEV sandwich attacks, reduce transaction latency.

Medium-term goals (3-9 months): Reduce latency through dedicated fiber optic networks; significantly modify Solana's consensus algorithm to greatly shorten transaction finality time; reduce transaction latency.

Long-term goals (9-30 months): Transform Solana's consensus algorithm from a single leader to multiple leaders to increase system resistance to extreme risks and censorship, giving applications more sorting rights.

Next, let's discuss how to achieve the short, medium, and long-term goals?

Although 99.9% of the time, blockchain does not fail due to insufficient final confirmation time, there have indeed been such cases in history, such as when someone used ETC or BTC fork coins to scam exchanges.

However, remember, Solana wants to create an internet capital market - the financial market has extremely high requirements for finality, with zero tolerance, so 12.8 seconds is not enough, so Solana is determined to develop a new consensus mechanism.

You should know that the consensus mechanism is the foundation and soul of a blockchain. And the development task was entrusted to Anza, so now you know why I call Anza the big brother of Solana's technical team.

Anza is external, but absolutely part of the regular army.

Image source: danbaileyphoto

Solana's new consensus mechanism is called Alpenglow, meaning "the glow of the Alps", symbolizing the protocol's Swiss origin.

This Alpine mountain consensus mechanism can be simply summarized by three characteristics:

(1) Final confirmation reduced to 150 milliseconds (3x faster than competitors)

(2) No more voting (off-chain signatures, saving money for small nodes)

(3) More elegant (eliminating technical debt, preparing for multiple leaders)

Under the new Alpine mountain consensus, it is still a single leader, but:

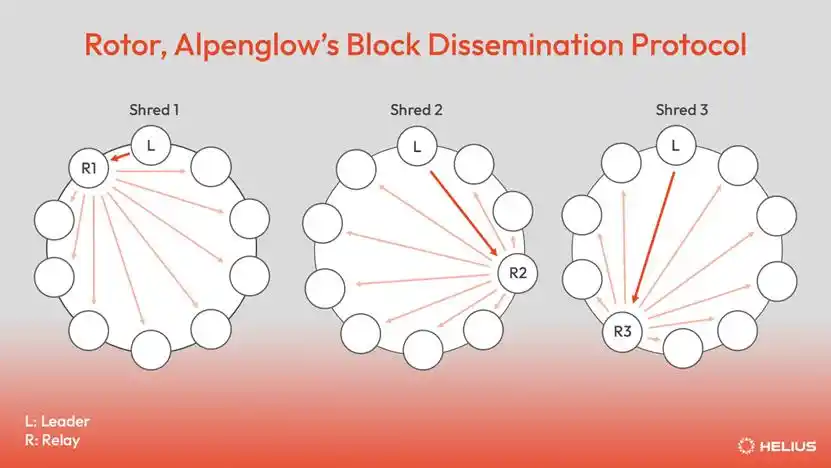

1. Propagation layer: Introduced relay nodes to help forward transactions, thus greatly reducing latency.

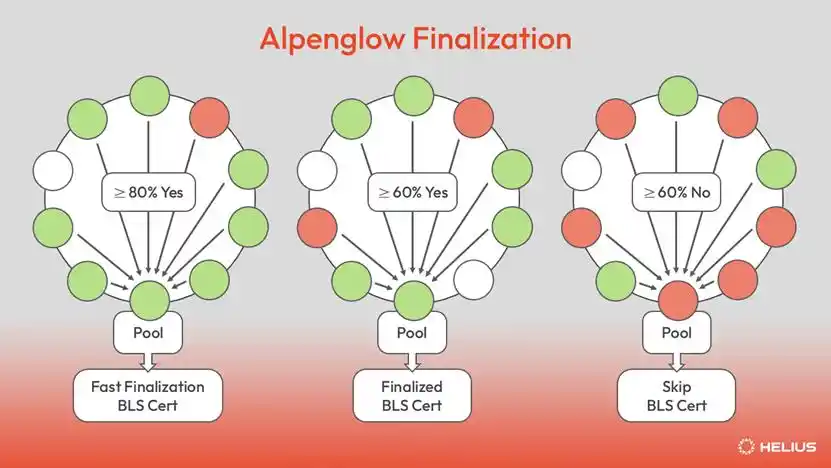

2. Voting layer: Although fault tolerance reduced from 33% to 20%, with a small sacrifice in security, final confirmation time is greatly shortened. Additionally, cryptography is used to ensure voting becomes off-chain.

New propagation layer diagram. Image source: Helius

New voting layer diagram. Image source: Helius

This way, it is hoped that the final determination time can be shortened to 150 milliseconds.

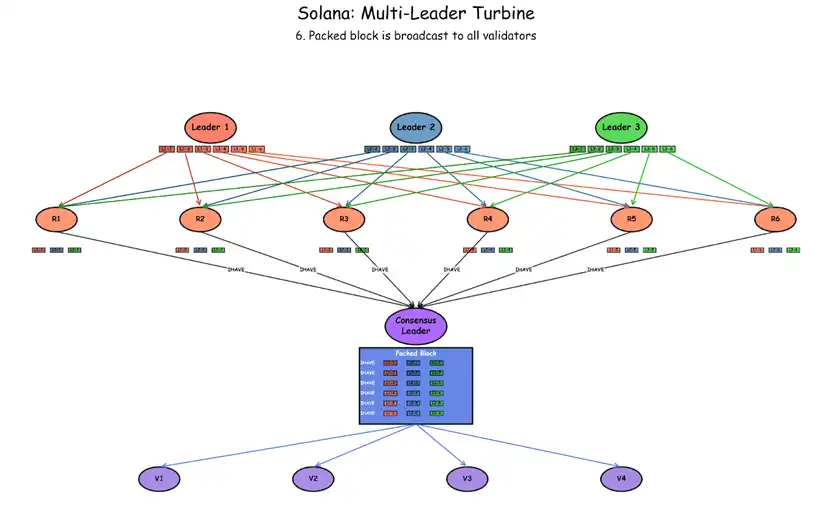

Finally, the long-term goal (9-30 months): Transform Solana's consensus algorithm from a single leader to multiple leaders to increase system resistance to extreme risks and censorship, giving applications more sorting rights.

This is understandable because the goal is to establish a free "internet capital market", so it assumes the worst-case scenario.

What is the worst-case scenario? For example, a single leader wanting to censor transactions or a single leader wanting to order transactions (instead of letting applications sort themselves).

Why is Solana so persistent about letting financial applications sort their own transactions? Let me give you an example, and you'll understand. Suppose you're trading stocks through a brokerage, and China Telecom keeps intercepting your transactions using network base station advantages - would you tolerate that? Right. MEV is actually unreasonable, but everyone is used to it. How can the power of the chain and nodes override applications?

Therefore, to avoid this worst-case scenario, Solana must introduce a multi-leader model in the future. This way, if one leader node misbehaves, including but not limited to censoring transactions (such as addresses sanctioned by the US) or ordering transactions (like creating sandwich attacks), other leaders must be able to counteract it.

Multi-leader mechanism diagram. Image source: Anza

This section is relatively short because there is currently no clear path to implement it, and it is still in the discussion of an ideal situation.

So, you see the short-medium-long term goals of the technical team, from the simplest transaction sorting to later complex consensus mechanism improvements, to ultimately adding the extremely difficult multi-leader mode, which is essentially a gradual process serving the ultimate goal of an "internet capital market".

Finally, although Solana's technical roadmap is filled with a lot of technical jargon and abbreviations, after analysis, its technical route is undoubtedly effective and feasible, and we look forward to the day when traditional financial applications truly take root on Solana!