Chainfeeds Guide:

Utilizing trading robots to navigate volatility and steadily accumulate funds, but all of this requires patience.

Article Source:

https://www.panewslab.com/zh/articles/7o80m0rd

Article Author:

VirtualBacon

Perspective:

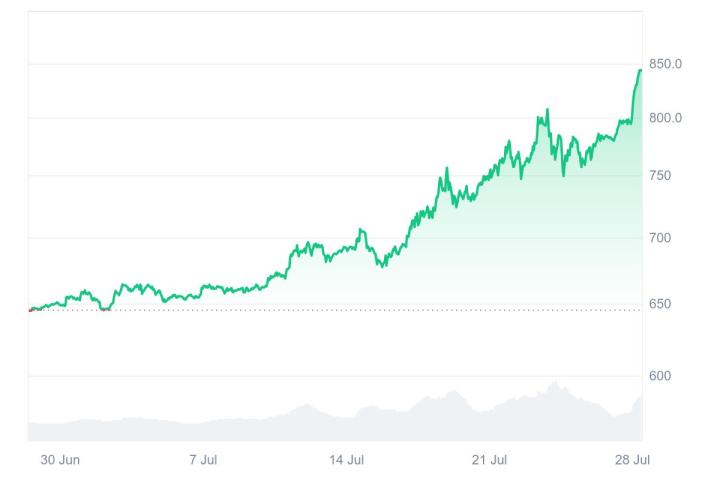

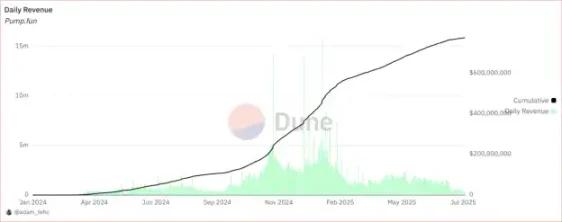

VirtualBacon: Bitcoin and Altcoins have recently experienced collective surges, but pullbacks occur in every bull market. I have updated the buy zones for all blue-chip cryptocurrencies using grid trading robots. Whether you are dollar-cost averaging or trading, these positions can help you learn to buy smartly during dips. Altcoins have finally started to gain momentum, but this is not yet considered the Altcoin season. Bitcoin's dominance has been declining for four consecutive weeks, but is now rebounding from a key support level (50-week moving average). If it drops again, that would be the trigger for the Altcoin season. For example, BTC's current buy zone is at $89,380, with a target of $200,000; this zone coincides with the 20-week moving average, a traditionally strong support area. For ETH, the buy zone is $2,200, with a target of $10,000, currently achieving a 70% compound return. SOL has chosen a conservative entry point at $112, with a target of $600. Through robot strategies, one can not only handle market fluctuations but also more efficiently build positions in batches during pullbacks, avoiding emotional trading. XRP has been stable for the past 7 months, with a current buy zone of $1.89 and a target of $6. Long-term support and clear higher lows form a robust upward channel. BNB's buy zone is set at $600, with a target price of $1,000. Currently, BNB/BTC is still at bear market levels, but the potential launch of a Trump-backed stablecoin on the BNB chain could be a major catalyst. ADA has formed a Double Bottom, with a buy zone set at $0.5 and a target of $3; growth may be relatively slow, but long-term potential is promising. DOGE is currently retesting the Double Bottom neckline and remains one of the institutional preferred meme coins, with historical significance and PoW mechanism making it more resilient. TRX maintains a steady slow upward trend, with a buy price of $0.209 and a target of $0.42. As stablecoin regulation approaches, a more conservative strategy will be more prudent. Robots on these coins adjust density based on range fluctuations, automatically executing buy and sell orders to avoid human judgment errors. TAO's buy zone remains at $160, and the strategy interval will not be easily adjusted until breaking $460. PEPE's trend is not yet confirmed, so continuing to use an automatic pullback buying strategy while waiting for a clear signal. SUPER is running well, maintaining a buy zone at $0.35 until $0.95 is effectively broken. HYPE is not intended for long-term holding, only trading volatility between $31 and $50, with profits above $50 being rolled into other blue-chip coins. Overall, although market volatility is frequent, trading robots allow us to manage positions more calmly and scientifically. Dollar-cost averaging is superior to one-time heavy positions, and each low-buying interval is derived from historical data and key technical indicators. Accumulating funds through volatility is particularly important before the potential Altcoin season, and all of this requires investors to have patience and discipline.

Content Source