The Polkadot Treasury Quarterly Report may seem like a cold financial statement, but in fact it is more like a mirror, reflecting the ongoing “long-term game” of the Polkadot ecosystem:

It is the answer to whether the ecology can generate its own blood and achieve long-term sustainable development;

It is a touchstone for whether Web3 infrastructure can break out of speculative narratives and move towards real economic narratives.

A few angles that I think are particularly noteworthy:

1. The Treasury is transforming from “hoarding DOT” to “asset portfolio management”

74% of assets are still DOT, but the report shows that stablecoin purchases have been institutionalized (automated purchases, long-term swaps), which means that Polkadot is actively weakening the "kidnapping effect" of DOT price fluctuations on the treasury. This is not a short-term financial operation, but an upgrade of the governance concept - operating DAO finances in a more "institutionalized" way.

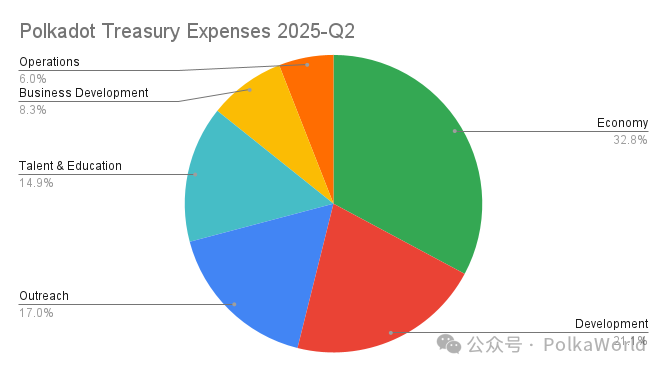

2. The spending structure is quietly changing

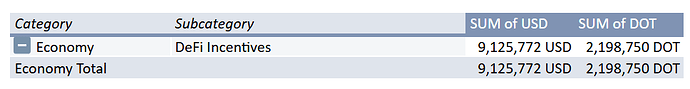

The biggest expenditure in Q2 was not development or operations, but economic incentives. Liquidity activities such as GIGAHydration and DeFi Singularity spent $9.1 million in one go. The signal behind this is very direct: Polkadot is using money to buy market share, and DeFi has officially become the top priority of the treasury's strategic expenditure.

3. OpenGov is truly a “decentralized treasury”

25% of the treasury funds flow out through the "Bounty & Collective" executive department, which shows that Polkadot's financial system is changing from "1 big wallet" to "a financial network of multiple professional departments." This is not only an optimization of division of labor, but also a decentralization of the governance structure .

4. The essence of Polkadot’s treasury is still a “public product foundation”

Two-thirds of the funds are still invested in infrastructure, talent training and ecological public resources (development, research, operation and maintenance, education, bounties, etc.), and only about one-third is used for market expansion and economic stimulation (such as liquidity incentives, BD, marketing).

This means that the role of the Polkadot Treasury is not a "venture capital" chasing short-term returns, but a source of funds that supports public interests in the long term and makes the entire network safer and more sustainable.

5. Stablecoin inflow is the "rite of passage" for the DAO treasury

Polkadot now has an inflow of $2.8 million in stablecoins every month. The DAO is moving closer to a "quasi-central bank" - it can use stablecoins to plan budgets and allocate funds across cycles. In the future, the national treasury may no longer be a vault that relies on DOT inflation to put out fires, but a "decentralized central bank" that can design fiscal policies.

Summary in one sentence:

This report not only tells us "how much money is left in Polkadot and where it has been spent", but also reveals the prototype of the first truly institutionalized DAO Treasury in the Web3 world - a decentralized treasury machine that can operate, allocate funds, understand investment, and is still exploring "how to make itself infinitely sustainable."

Summary of key information

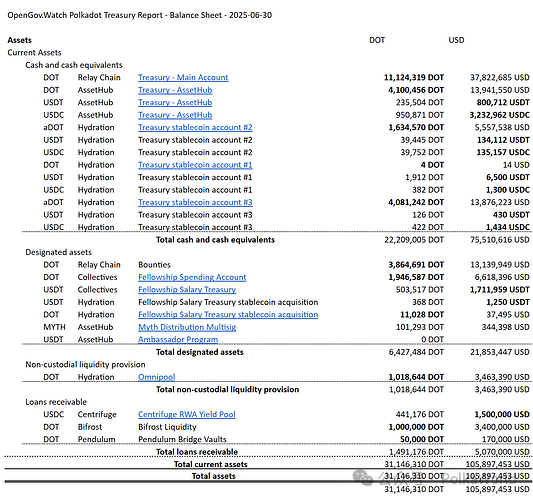

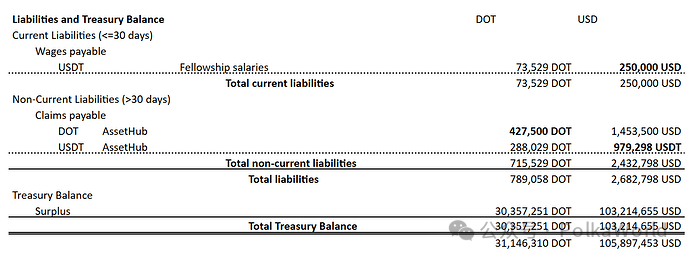

1. Balance Sheet: The current total value of treasury assets is $106 million (31.1 million DOT).

Asset structure:

$76 million (22.2 million DOTs) is discretionary funding.

Of this, $4 million is in the form of stablecoins; another 5.7 million DOTs ($19.4 million) are allocated for automated purchases of stablecoins.

$21.8 million (6.4 million DOT) is reserved for strategic initiatives (such as marketing, DeFi tools, games, BD, etc.).

$8.5 million (2.5 million DOT) has been invested in DeFi market operations.

Liabilities: DOT 790,000 ($2.7 million) is payable by the end of the year.

2. Expenditure

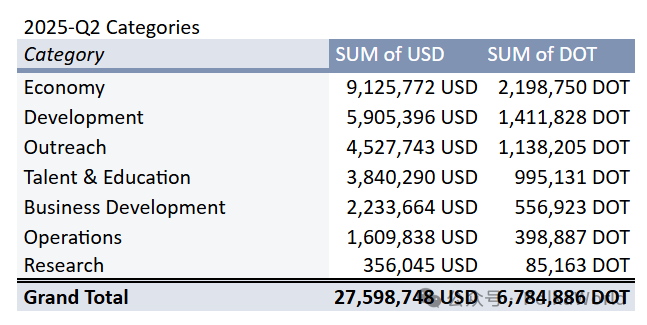

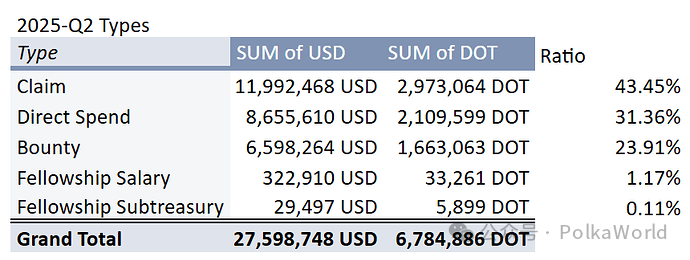

Total expenses : $27.6 million (6.8 million DOT) in Q2 2025. Operating loss: 6.7 million DOT before inflation and burns, net loss of 2.7 million DOT.

Top three spending categories : Economic ($91 million), Technology Development ($5.9 million), Outreach ($4.5 million)

Department Expenditure (Bounty & Collective) : Department expenditure accounts for 25% of total expenditure ($7 million / 1.7 million DOT).

3. Usage of stablecoins : This quarter, stablecoins worth US$9.7 million have been purchased and stablecoins worth US$10.8 million have been spent.

4. OpenGov is driving the development of the on-chain economy . Currently, $8.5 million has been injected into 4 DeFi protocols as liquidity.

5. Treasury Outlook: Stable assets and promising future . With the adjustment of the inflation model, the long-term financial outlook of the Treasury is becoming increasingly stable.

About this report

Polkadot DAO manages tens of millions of dollars in assets, so it adopts the industry's best accounting practices and introduces them to the Web3 field. This report contains a complete balance sheet and profit and loss statement:

Balance Sheet: Shows all active treasury accounts and their asset distribution.

Profit and loss statement: refine the direction and classification of treasury expenditures.

Special thanks to the Web3 Foundation for funding this report as part of the OpenGov.Watch initiative, the OpenSquare team for providing access to the dotreasury.com API, and the Parity data team for their support.

Report author: Alice und Bob, Jeeper

The strategic positioning of the Polkadot Treasury (providing background for new readers)

1. Polkadot's core mission : Committed to the Web3 vision, helping users regain Internet sovereignty, and building the "Polkadot Cloud" - a complete set of efficient and scalable Web3 service stacks that support developers to build Dapps and business applications at extremely low cost.

2. Self-sustainability and sustainable development : Polkadot does not rely on external organizations, and its core infrastructure (such as bridges, wallets, data services, SDKs, governance and developer tools, and nodes) is all funded by OpenGov.

3. Growth strategy : centered around enterprise adoption, with focus areas including:

DeFi, RWA and Fintech

Games & Entertainment

AI and DePIN

Social and identity

Government Technology (GovTech): The decentralized BD team collaborates with investors, incubators, and ecological support teams to jointly promote project implementation.

4. Talent training system : Polkadot Blockchain Academy holds offline courses several times a year to train hundreds of founders and developers; it continues to hold hackathon events around the world to promote the Polkadot technology stack.

5. Ecological communication capabilities lead the entire industry : covering native media content production, advertising distribution, market research, decentralized ambassador programs, global event participation, etc., all independently operated by DAO to avoid the risk of "single point failure".

6. OpenGov departmentalization upgrade : Specialized departments around core functions (such as markets, fintech integration, etc.) are currently being formed, staffed by professionals, to improve the efficiency of proposal processing, reduce pressure on the main OpenGov proposal track, and allow voters to focus on more macro governance decisions.

Balance Sheet

As of the end of Q1 2025, the Polkadot DAO’s asset balance is 33.5 million DOTs / $135 million.

After deducting liabilities, the balance is 32.6 million DOT / $131 million.

assets

View the full spreadsheet here: https://docs.google.com/spreadsheets/d/12p6HLw5Mclnw93WnQH9jF-fF5wPdkDiN0_oSWzht59Q/edit?gid=949038484#gid=949038484

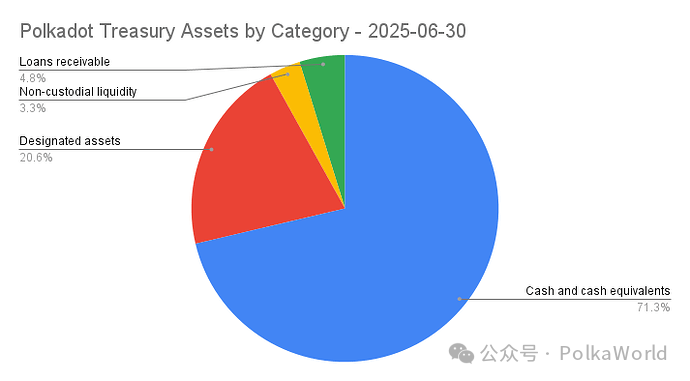

Asset Structure

We divide the asset structure into the following:

1. Cash and cash equivalents: 22 million DOT / 76 million USD

This part contains DOT, USDT and USDC that can be used immediately or quickly, which are stored on the Relay Chain and the system chain AssetHub respectively:

Relay Chain : 11.1 million DOT ($38 million)

AssetHub:

4.1 million DOT ($14 million)

800,000 USDT (equivalent to approximately 235,000 DOT)

3.2 million USDC (equivalent to about 950,000 DOT)

In addition, on the Hydration DeFi chain , there are two trustless, fully automated stablecoin acquisition programs underway:

Stablecoin Acquisition Plan #2: Approximately 1.6 million DOTs (US$5.6 million) remaining, to be redeemed by 2025

Stablecoin Acquisition Plan #3 : A total of 4.1 million DOTs (US$13.9 million), to be redeemed by Q2 2026

2. Designated assets: 6.4 million DOT / 22 million USD

Although these assets are managed by OpenGov, they have been designated for specific purposes, mainly to fund the executive departments of the DAO (such as bounties and collective organizations). In addition, Polkadot also holds $344,000 worth of MYTH tokens, which will be used to airdrop to DOT holders.

Bounty Pool : Polkadot has locked $13.1 million (3.9 million DOTs) in the bounty pool to reward teams that contribute to the ecosystem.

Technical Fellowship : Core maintainer of Polkadot Runtime, funded by DAO, with two accounts:

Salary account: 1.7 million USDT (about 503,000 DOT)

Spending Account: 1.9 million DOT (approximately $6.6 million)

MYTH Airdrop : As part of the strategic partnership with Mythical, Polkadot exchanged 1 million DOTs for MYTH tokens. $2.6 million worth of MYTH has been airdropped to DOT holders and service providers, and the remaining equivalent of approximately $345,000 is still held in the MYTH distribution account for future use.

3. Non-custodial liquidity provision: 1 million DOT / 3.5 million USD

The Treasury has deployed some of its idle funds in the Polkadot economy. Currently, 1 million DOTs are deposited in the Hydration Omnipool as DOT liquidity.

4. Loans receivable: 1.5 million DOT / 5 million USD

These are custodial liquidity provision activities:

Provide 1.5 million USDT to Centrifuge's RWA income pool

Bifrost uses 1 million DOT for its DOT Liquid staking product

Pendulum borrows 50,000 DOT for its stablecoin bridge vault

Asset Portfolio

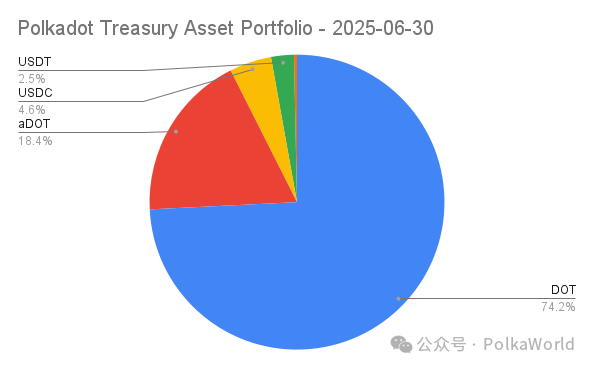

The Polkadot Treasury currently holds the following types of assets:

DOT (Native Token)

aDOT (DOT deposited in the Hydration money market, representing interest tokens)

USDT/USDC (stablecoin)

MYTH (token to be used for airdrop)

Among them, DOT is the asset with the highest current holdings, totaling about 23 million DOTs (US$79 million), accounting for 74% of the total assets of the Treasury . Although the Treasury is gradually exchanging DOTs for stablecoins, it still deposits some DOTs in DeFi currency markets (such as Hydration) to increase liquidity and earn income.

aDOT (DOT deposited in the money market) accounts for approximately 5.7 million DOT (US$19 million), or approximately 18% of total assets.

USDC accounts for 4.6% ($4.9 million).

USDT accounts for 2.5% ($2.6 million).

MYTH (for future airdrops) accounts for about 0.33% (US$345,000).

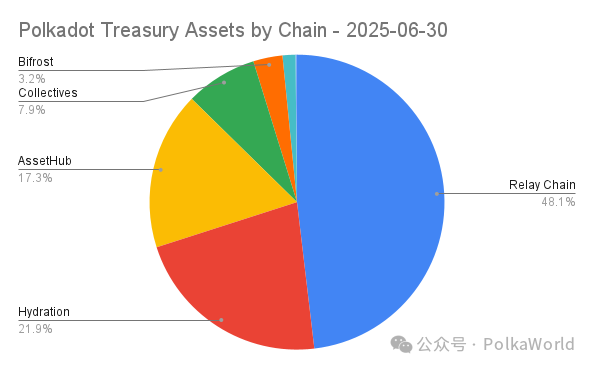

Cross-chain asset distribution

Polkadot treasury assets are currently distributed across 7 different chains.

Parachains have become an important part of treasury assets, with about 27% of assets deployed in DeFi-type parachains:

Hydration: $23 million

Bifrost: $3.4 million

Centrifuge: $1.5 million

Pendulum: $170,000

This is thanks to the cross-chain capabilities of the Polkadot governance system, which enables governance decisions to be automatically executed on all chains protected by shared security without the need for trusted intermediaries.

The remaining 73% of treasury assets are distributed across three system chains (such as the relay chain and AssetHub) and are used for daily working capital and operating expenses of various executive departments.

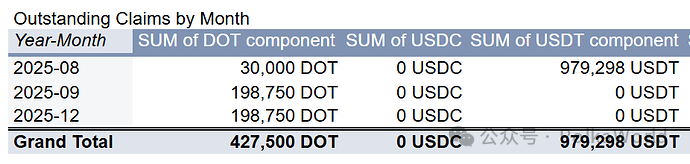

Liabilities

The Polkadot Treasury introduces a mechanism called "claims payable" to represent future committed spending obligations. Such liabilities are already represented as payable items in the balance sheet.

The current total liabilities payable are $2.4 million (720,000 DOT)

Technical Fellowship salary liabilities are limited to $250,000 (74,000 DOT) per 28-day period.

In addition, future spending claims to date total $2.7 million , including:

430,000 DOT

980,000 USDT

These payment commitments will remain in effect until December 2025.

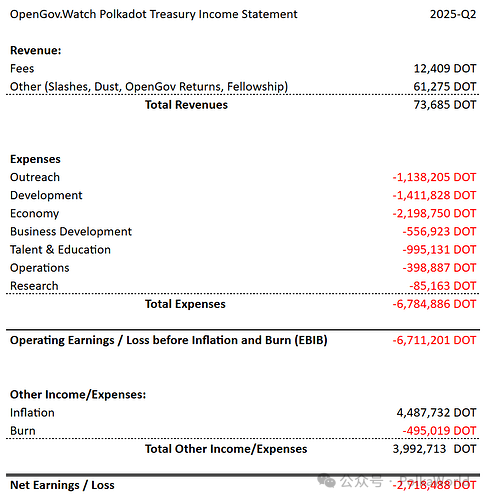

Income Statement

In the income statement, we use DOT as the main unit of account, because the main source of income for the Polkadot Treasury (i.e. inflation issuance) is denominated in DOT. In order to facilitate the understanding of the expenditure, we will also provide a comparison table denominated in US dollars in the expenditure section.

Total expenditures from the Polkadot Treasury in Q2 2025 were 6.7 million DOTs (approximately $28 million)

After taking into account revenue, inflation revenue and destruction mechanism, the net loss this quarter is 2.7 million DOT

expenditure

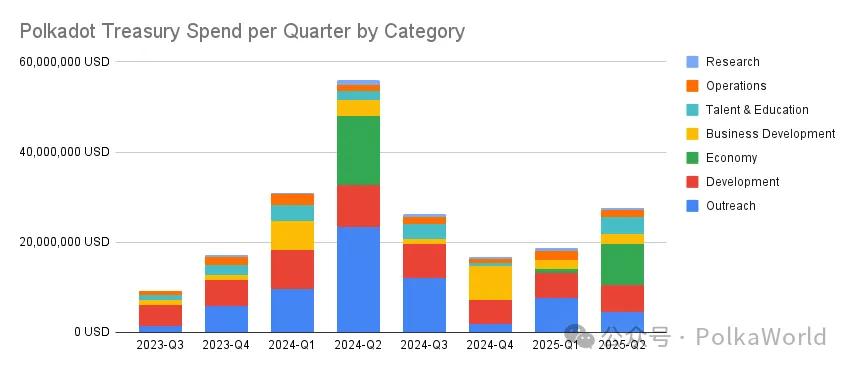

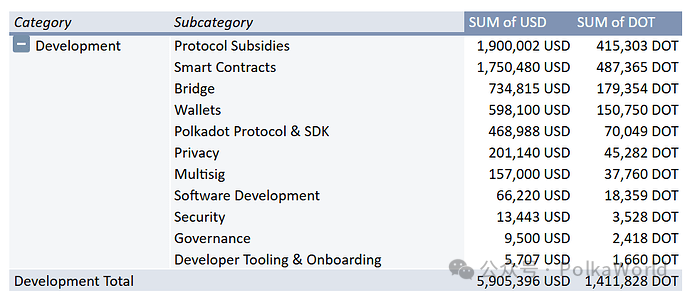

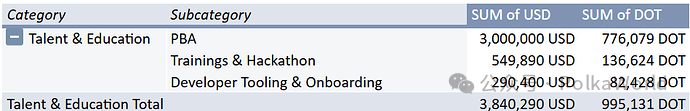

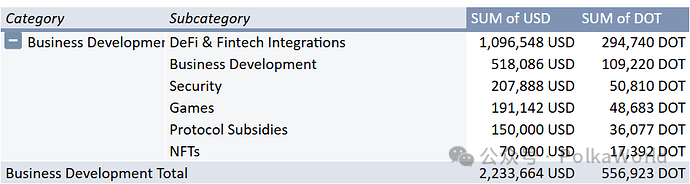

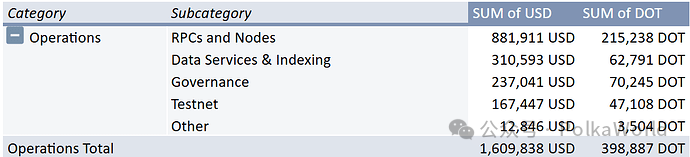

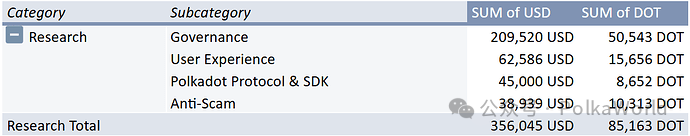

In the second quarter of 2025, Polkadot spent a total of $27.6 million (6.8 million DOT). The largest expenditure area was "ecological economy", which was as high as $9.1 million (2.2 million DOT). The second largest expenditure was software development, which was $5.9 million (1.4 million DOT). Outreach activities accounted for $4.5 million (1.1 million DOT). Talent and education expenditures were $3.8 million (1 million DOT), and business development was $2.2 million (560,000 DOT). Operating expenses were $1.6 million (400,000 DOT), and research expenses were $360,000 (85,000 DOT).

Expenditure classification description

The following are the categories and subcategories used in this report:

Research : Security, Governance, Anti-fraud, Data Reporting and Analysis, User Experience and Development Experience

Development : Polkadot protocol and its SDK, cross-chain bridges, wallets, data services and indexers, governance tools, smart contracts and other core technologies

Operations : Network operations-related software, hardware, and service costs (such as RPC, archive nodes), auxiliary services (browsers, indexers), and legal expenses

Outreach: Marketing (media, PR, advertising), community building (conference hosting and participation, offline events, local outreach, ambassador program)

Business Development : Solutions, consulting services, architecture design, developer relations in vertical fields such as games, DeFi, GovTech, music, etc.

Talent & Education : Education, hackathons, talent recruitment and incubation (such as Polkadot Blockchain Academy)

Economy : Liquidity incentives used to stimulate the on-chain economy

Expenditure details breakdown

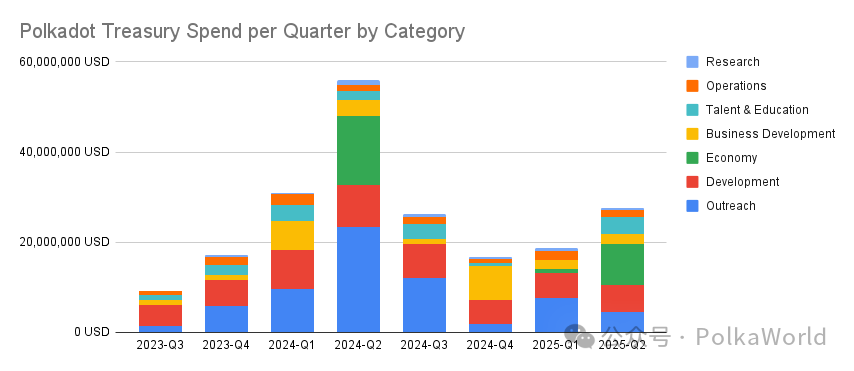

We observed an increase in spending in the second quarter, mainly due to the newly launched DeFi incentives to drive ecological economic growth . Business development and research spending remained below average, continuing the trend of the first quarter. External outreach spending was also relatively restrained. Operations remained stable and basically close to its historical average. As for the talent and education sector, after two consecutive quarters of low investment, spending resumed this quarter.

Next, we’ll dive into each expense category one by one!

1. Economy — $9.1 million

include:

GIGAHydration activity: $8.3 million

DeFi Singularity activity: $830,000

The goal is to incentivize liquidity growth on the Hydration chain and the Ethereum ecosystem bridge chain.

2. Development — $5.9 million

Focus on core infrastructure and tool development:

Eiger Storage System: $1.9 million in subsidies for next phase of development

Smart Contract Support (OpenZeppelin): $1.8 million (supports Polkadot Hub and Cloud)

Snowbridge cross-chain bridge support: $730,000

Talisman Wallet: $600,000 (half year functional support and new development)

Other expenses:

Protocol and SDK: $470,000 (including Fellowship salary of $320,000, Rust bonus of $83,000, and Pioneer bounty of $29,000)

Incognitee (TEE solution): $200,000

Mimir multi-signature support: $160,000

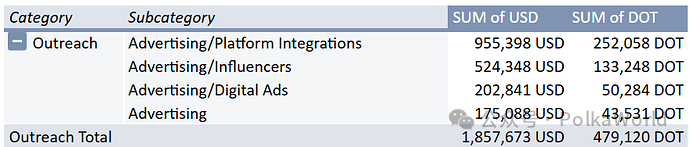

3. Outreach — $4.5 million

In terms of marketing, event hosting, and community building, Polkadot spent $4.5 million on outreach this quarter. Outreach is one of the most expensive and complex expense categories, with multiple subcategories and even sub-subcategories. The core areas are focused on "marketing" and "event operations." Let's analyze each of these.

Advertising — $1.9 million

Blast, an esports event in partnership with Nova Wallet: $920,000

Kaito KOL Marketing: $490,000, Fracas: $34,000

Omni Media: $200,000

Other advertising and marketing bounty costs: $180,000

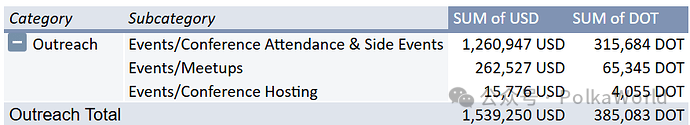

Events — $1.5 million

Blockspace Mansion (multiple locations): $360,000

Consensus Toronto: $180,000

Blockspace Brooklyn: $130,000

ETHLisbon, ETHPrague: $128,000 in total

Other 20+ activity participation expenses

Meetups & Small Events

Funded 114 Meetups with a total expenditure of $260,000

Support Polimex x Scytale Demo Day: $16,000

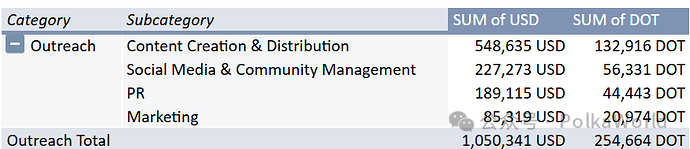

Content Creation and Media Communications — $1.1 million

Content Creation and Distribution ($550,000):

Polkaworld: $270,000

The Kusamarian: $98,000

Pala Labs (JAM trip report): $69,000

WebZero (Hacker Camp Report): $49,000

Social Media and Content Management ($230,000) : Airlyft marketing campaign ($81,000), editorial board ($40,000), community management salary

PR : Serotonin (APAC marketing agent) $183,000; includes joint marketing expenses with Acurast ($27,000) and Hyperbridge ($10,000)

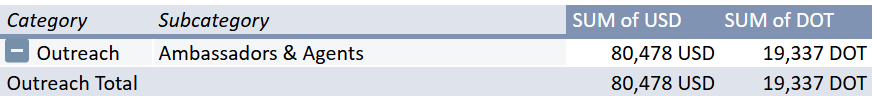

Ambassadors & Agents — $80,000

Includes funding support to the Texas Blockchain Council

4. Talent and Education – US$3.8 million

Talent and education expenses were $3.8 million, primarily used to expand Polkadot’s talent pool.

Polkadot Blockchain Academy (PBA) received $3 million in funding for the seventh offline camp, the launch of the JAM special course, university cooperation pilot, online course PBA-X and alumni program.

Of the hackathons ($550,000), EasyA ($395,000), Encode Club ($130,000), and Goa 2025 ($26,000) received funding.

In terms of developer tools and imports, OpenGuild received $290,000 to accelerate the Polkadot builder activation program in Southeast Asia and the wider Asia region

5. Business Development – $2.2 million

Business development expenditures were $2.2 million, with a focus on market penetration in multiple verticals and funding for field-specific technology and experimental projects.

DeFi and Fintech integration ($1.1 million) is the main expenditure item : Merkle Science ($330,000) was funded to provide market indexes for the soon-to-be-launched Polkadot Hub; DIA ($110,000), Uphold ($80,000), Nima Labs ($78,000), Ripio ($69,000) and many other projects received funding.

Business Development Team (US$520,000) : PoKe (US$290,000), Spanish BD Team (US$140,000), and PolkaBiz (US$83,000) received funding.

Security ($208,000) : Funded three audit projects, including frontier-srlabs ($96,000), dotpal-cg-microsr25519 ($40,000), and coinfabrik-scout ($17,000).

Game direction ($190,000) : SAGE engine received $80,000, and independent game EVRLOOT received $68,000.

Protocol Incentive Project : Robonomics received $150,000 for its RISC-V smart home device promotion campaign; DotMemo received $70,000 in the NFT category.

6. Operation and maintenance expenses – $1.6 million

Operating expenses were $1.6 million, which covered the software and hardware required to maintain the network.

RPC services received $880,000 in funding.

Data Services SQD received $310,000.

Governance ($237K): JUST received $235K for its contribution to OpenGov and Anaelle received $2,000.

Testnet Paseo spent $170,000 this quarter.

7. Research – $360,000

Research spending is $360,000 to support experimental, data-driven, and research-led projects.

Polkadot Ecology Research Institute received $210,000.

$63,000 was spent on UX audits, research, and improvements.

Amforc received $45,000 in a preliminary reward for the "Spammening" incident last December.

Anti-fraud bounty payouts total $39,000.

8. Executive Branch: Bounty and Collective

Executive Bodies are organizations that provide services to specific areas within the ecosystem, simplifying OpenGov operations and centralizing tasks in a certain area, thereby reducing the cognitive burden of collective voting. Since the third quarter of 2024, such executive bodies have handled about 19% of total expenditures; in the second quarter of 2025, the proportion was 25%. Please note that this part of the cost has been listed above, and it is just presented from another perspective here.

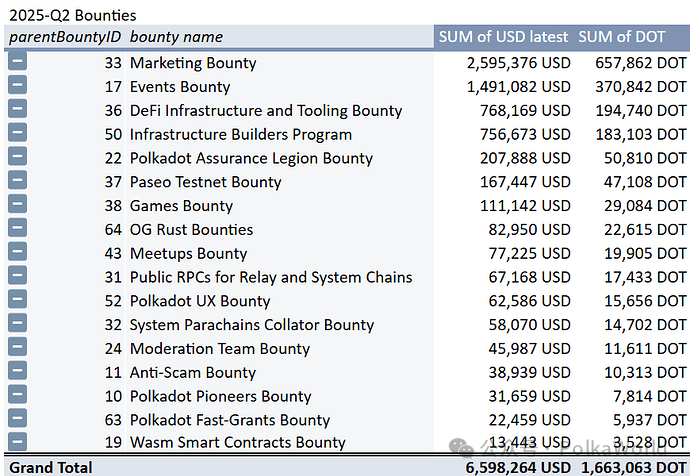

Bounty — $6.6 million

The bounty mechanism is similar to the functional departments in traditional organizations, with clear tasks and budget expenditure targets. The total bounty expenditure this quarter was US$6.6 million, accounting for 24% of the total expenditure:

Marketing bounty: $2.6 million

Event Bounty: $1.5 million

DeFi Infrastructure and Tools Bounty: $770,000, focusing on integrating financial services into the Polkadot Hub

Infrastructure Builders Program: $760,000 for critical node facility operations

Polkadot Assurance Legion: Providing $210,000 worth of security audits

Paseo testnet expenditure: $170,000

Game bounty: $110,000

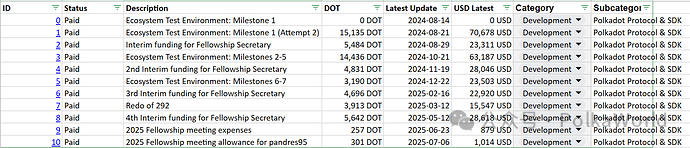

Collectives

The salary for Technical Fellowship is as follows:

April 2025: $105,000

May 2025: $107,000

June 2025: $111,000

In addition, the Fellowship Sub-Treasury paid subsidies for two additional positions in the second quarter of 2025, totaling $29,000.

analyze

Stablecoins

In this section, we will review the historical flows of stablecoins and look forward to future inflow trends.

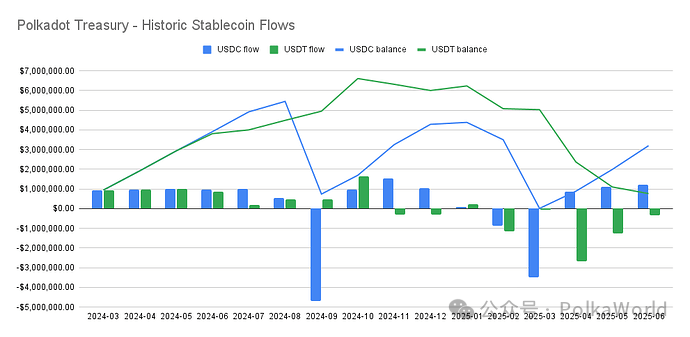

Stablecoin historical flows

From the end of the first quarter of 2024 to the end of the second quarter of 2025, the Polkadot Treasury received a total of 21 million USDC and 21 million USDT, an average of approximately US$2.5 million in stablecoins per month.

The expenditures were roughly in sync with the inflows, with 18 million USDC and 20 million USDT issued to proposers. In addition, $1.5 million of idle USDC was used to provide liquidity loans to Centrifuge.

The third round of the stablecoin procurement program was launched in the second quarter of 2025 and is expected to bring in $2.8 million in new stablecoin inflows per month.

Overview of stablecoin quarterly spending

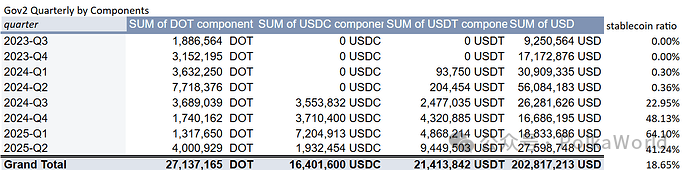

The following chart shows the amount of DOT, USDC, and USDT used each quarter, the total amount spent in USD for the entire quarter, and the proportion of stablecoins in spending in that quarter.

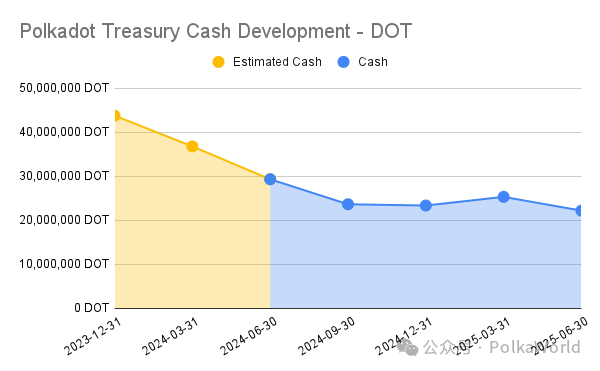

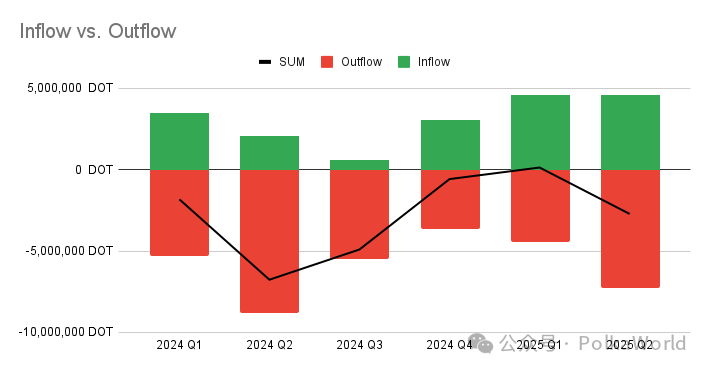

trend

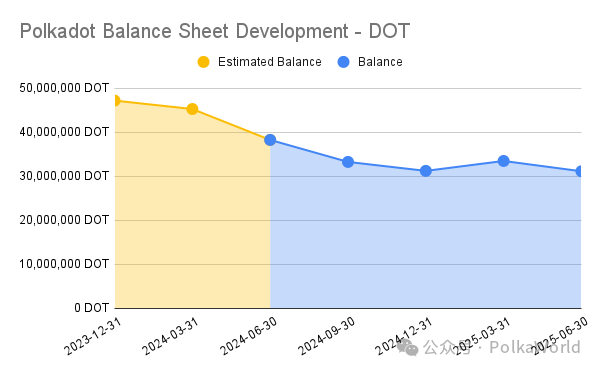

From the long-term trend point of view:

Assets and cash balances in DOT have stabilized.

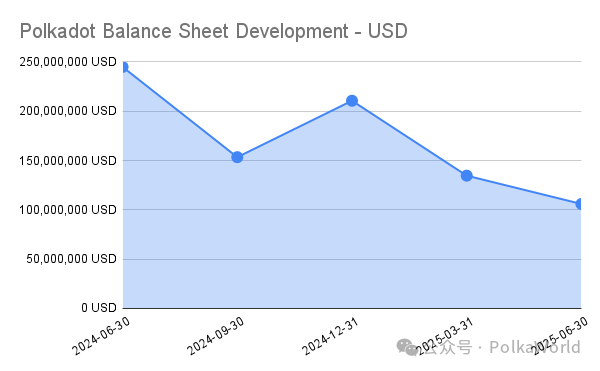

Since the treasury assets are still mainly DOT, the value of the overall treasury is still closely related to the price of DOT.

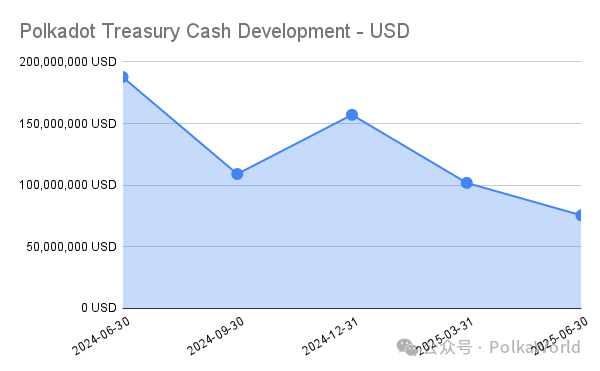

Balance sheet changes

The DOT on the balance sheet decreased by 2 million DOT this quarter, indicating that expenditures remained stable overall. The chart below, expressed in US dollars, clearly shows the impact of the DOT price on the treasury valuation.

Changes in Treasury cash flow

As for the cash component, its trend is similar to the overall asset movement, indicating that the Treasury's spending behavior is consistent with the past few quarters.