Compiled by: Liam

In the eyes of conservative Wall Street professionals, the "use cases" of cryptocurrencies are often discussed with a mocking tone. Veterans have long seen it all. Digital assets come and go, often in a blaze of glory, exciting investors who are enthusiastic about memecoins and Non-Fungible Tokens. Apart from being used as tools for speculation and financial crime, their utility in other areas has also been repeatedly found to be flawed and insufficient.

However, the latest wave is different. On July 18th, President Donald Trump signed the Stablecoin Act (GENIUS Act), providing the long-desired regulatory certainty for stablecoins (crypto tokens backed by traditional assets, usually US dollars). The industry is in a period of rapid growth, with Wall Street professionals now competing to participate. "Tokenization" is also emerging, with on-chain asset trading volume rapidly growing, including stocks, money market funds, and even private equity and debt.

As with any revolution, revolutionaries are ecstatic while conservatives are worried. Vlad Tenev, CEO of digital asset broker Robinhood, stated that this new technology could "lay the foundation for cryptocurrencies to become the pillar of the global financial system". European Central Bank President Christine Lagarde's view is slightly different. She is concerned that the emergence of stablecoins is tantamount to "monetary privatization".

Both sides recognize the scale of the current transformation. The mainstream market may be facing a more disruptive change than early cryptocurrency speculation. While Bitcoin and other cryptocurrencies promised to be digital gold, tokens are merely packaging or carriers representing other assets. This may not sound exciting, but some of the most transformative innovations in modern finance have indeed changed how assets are packaged, divided, and reorganized - Exchange Traded Funds (ETFs), Eurodollars, and securitized debt are typical use cases.

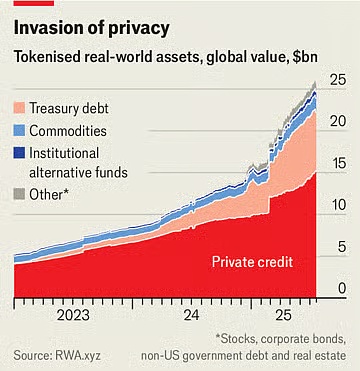

Currently, the value of circulating stablecoins is $263 billion, growing about 60% from a year ago. Standard Chartered Bank estimates that the market value will reach $2 trillion in three years. Last month, the largest US bank, JPMorgan Chase, announced plans to launch a stablecoin-like product called JPMorgan Deposit Token (JPMD), despite the long-standing skepticism of its CEO Jamie Dimon towards cryptocurrencies. The market value of tokenized assets is only $25 billion but has more than doubled in the past year. On June 30th, Robinhood launched over 200 new tokens for European investors, enabling them to trade US stocks and ETFs outside normal trading hours.

Stablecoins make transactions low-cost and fast because ownership is instantly recorded on a digital ledger, eliminating intermediary institutions that operate traditional payment channels. This is especially valuable for currently expensive and slow cross-border transactions. Although stablecoins currently account for less than 1% of global financial transactions, the GENIUS Act will provide support. The act confirms that stablecoins are not securities and requires them to be fully backed by safe, liquid assets. Reportedly, retail giants including Amazon and Walmart are considering launching their own stablecoins. For consumers, these stablecoins might be similar to gift cards, providing balances for retail purchases, potentially at lower prices. This could disrupt companies like Mastercard and Visa, which have sales profit margins of around 2% in the US.

Tokenized assets are digital copies of another asset, whether funds, company stocks, or a basket of commodities. Like stablecoins, they can make financial transactions faster and easier, especially for less liquid assets. Some products are just gimmicks. Why tokenize stocks? Perhaps to enable 24-hour trading since stock exchanges need not be open, but the advantages are questionable. Moreover, for many retail investors, marginal transaction costs are already low or even zero.

Tokenization Efforts

However, many products are not so fancy. Take money market funds that invest in Treasury bills. Tokenized versions can also serve as payment methods. These tokens, like stablecoins, are backed by safe assets and can be seamlessly exchanged on the blockchain. They are also investments yielding more than bank rates. The average US savings account rate is less than 0.6%, while many money market funds offer yields up to 4%. BlackRock's largest tokenized money market fund is currently worth over $2 billion. "I expect that tokenized funds will become as familiar to investors as ETFs one day," wrote CEO Larry Fink in a recent letter to investors.

This will have a disruptive impact on existing financial institutions. Banks may be trying to enter the new digital packaging realm, but part of the reason is recognizing that tokens pose a threat. The combination of stablecoins and tokenized money market funds could ultimately reduce the attractiveness of bank deposits. The American Bankers Association noted that if banks lose about 10% of their $19 trillion in retail deposits (their cheapest financing method), their average financing costs would rise from 2.03% to 2.27%. While total deposits, including commercial accounts, would not decrease, bank profit margins would be squeezed.

These new assets could also cause disruptive effects on the broader financial system. For example, Robinhood's new stock token holders do not actually own the underlying stocks. Technically, they own a derivative tracking the asset's value (including any dividends paid by the company) rather than the stock itself. Therefore, they cannot obtain voting rights typically granted by stock ownership. If the token issuer goes bankrupt, holders will be in trouble and need to compete with other creditors for ownership of the underlying assets. The fintech startup Linqto, which filed for bankruptcy earlier this month, encountered a similar situation. The company had issued stocks of private companies through special purpose vehicles. Buyers are now uncertain whether they own the assets they believe they own.

This is one of the greatest opportunities for tokenization, but also one of the biggest challenges for regulators. Pairing illiquid private assets with easily tradable tokens opens a closed market for millions of retail investors with trillions of dollars to allocate. They can now purchase shares of the most exciting private companies that were previously out of reach. This raises questions. Institutions like the SEC have far more influence over public companies than private ones, which is why the former are suitable for retail investors. Tokens representing private shares would transform previously private equity into assets that can be traded as easily as ETFs. However, ETF issuers promise to provide intraday liquidity by trading the underlying assets, while token providers do not. At a sufficient scale, tokens would effectively turn private companies into public companies without the typically required disclosure requirements.

Even regulatory agencies supporting cryptocurrencies want to draw clear boundaries. Hester Peirce, a commissioner of the U.S. Securities and Exchange Commission (SEC), known as the "Crypto Mom" for her friendly attitude towards digital currencies, emphasized in a statement on July 9th that tokens should not be used to circumvent securities laws. "Tokenized securities are still securities," she wrote. Therefore, regardless of whether securities are packaged in a new cryptocurrency format, companies issuing securities must comply with disclosure rules. While this seems reasonable in theory, the large number of new assets with novel structures means that regulators will perpetually be in a state of catching up.

Thus, a paradox exists. If stablecoins are truly useful, they will also be truly disruptive. The more attractive tokenized assets are to brokers, customers, investors, merchants, and other financial companies, the more they can transform finance, a change that is both exciting and worrying. Regardless of the balance between these aspects, one thing is clear: the view that cryptocurrencies have not yet produced any noteworthy innovation is already a thing of the past.