- Institutional Innovation Over Technology: WFOE revenue rights isolation architecture enables compliant cross-border tokenization, reducing financing costs from 8.7% to 5.2% for energy infrastructure assets.

- Two Chains One Bridge Solution: Ant Chain’s cross-border infrastructure uses ZKP to transmit desensitized value data while keeping sensitive information onshore, solving data sovereignty issues.

- SME Financing Revolution: 83% of previously unbanked charging pile operators gained access to financing through IoT data credit scoring, replacing traditional collateral-based lending models.

China’s first cross-border new energy RWA breaks through regulatory barriers. Longshine Technology tokenizes 9,000 charging pile revenue rights, raising 100M yuan in Hong Kong’s HKMA sandbox with innovative compliance architecture.

3.THE LIQUIDITY PARADOX: WHY CAN’T 5.2% FUNDING COSTS SECURE FREE CIRCULATION?

Just as the Malu project discussed in “The Malu Grape ‘Pseudo-RWA’ Breakthrough: An Agricultural Asset Digitalization Dilemma Under Localized Compromise“, the “non-typical characteristics” revealed by Longshine Technology’s charging pile RWA project are also the inevitable result of China seeking a dynamic balance between financial opening and risk prevention.

The “institutional innovation within regulatory sandbox” path created by this project, while paying the price of liquidity sacrifice and rising costs, provides key practical evidence for subsequent policy improvements.

With the deepening of regulatory coordination mechanisms between Hong Kong and mainland China (such as the cross-border credit trial in the Guangdong-Hong Kong-Macao Greater Bay Area), the efficiency optimization space for second-generation RWA projects is worth anticipating.

3.1INVESTOR ACCESS: THE FUNDAMENTAL CONFLICT BETWEEN TECHNOLOGICAL OPENNESS IDEALS AND REGULATORY REALITY

Blockchain technology’s native philosophy advocates financial democratization, allowing global investors to participate without barriers. However, the Longshine project’s investor structure shows that professional institutions occupied 93% of subscription shares, with individual investors being completely excluded.

This result directly stems from the rigid constraints of Schedule 5 Part 2 of Hong Kong’s Securities and Futures Ordinance, which classifies charging pile revenue rights as “unlisted structured products,” mandatorily applying the same qualified investor standards as traditional private equity (individual net assets ≥ HK$8 million).

- Among actual subscribers, licensed institutions such as Standard Chartered Bank and HSBC Asset Management accounted for 76%

- Individual professional investors’ subscription amount was only HK$24 million (out of total fundraising of HK$107 million) (Source: HKMA Project Ensemble Case Database STO-2024-LX001)

Core contradiction: When technology attempts to break down financial barriers, regulation constructs even higher access barriers due to risk control needs. This contradiction essentially stems from the non-standardized nature of new energy infrastructure revenue rights, where regulatory agencies still apply traditional financial frameworks for risk assessment.

3.2LIQUIDITY DILEMMA: THE DISCONNECT BETWEEN ON-CHAIN RIGHTS CONFIRMATION AND OFF-CHAIN CIRCULATION

Despite the project adopting ERC-1400 token standards that support secondary trading, the actual liquidity index is only 0.07 (2025Q2 average), far below the Hong Kong REITs market’s 1.2. In-depth analysis reveals two major constraints:

3.2.1INSTITUTIONAL FREEZING MECHANISMS

Issue documents mandatorily set a 6-month lock-up period (based on SFO Cap.571 Article 103), and secondary transfers require resubmitting KYC materials, taking an average of over 72 hours.

3.2.2TECHNICAL FRICTION COSTS

Investor A initiates transfer → Submit identity verification to custodian (3 working days) → Law firm compliance review (2 working days) → On-chain contract unlocking (1 hour)

(Process records source: Project’s first secondary transaction audit tracking ID: LX-STO-TX002)

As of the end of June 2025, cumulative secondary market trading volume was only HK$1.2 million, proving that “fragmented circulation” under the current model has not yet broken through the liquidity bottleneck of unlisted assets.

3.3TECHNICAL ARCHITECTURE: THE DIFFICULT BALANCE BETWEEN OPENNESS AND COMPLIANCE

The “Two Chains One Bridge” system constructed by the Longshine project is actually a special product under China’s regulatory framework:

Key compromise evidence: Mainland asset chain nodes are monopolized by licensed institutions such as UnionPay Digital Technology and Hainan Financial Regulatory Authority; the cross-chain hub synchronizes hash values daily with the Cyberspace Administration’s blockchain filing system (Filing number: Qiong Internet Information Filing 2024A1100LX).

3.4COMPLIANCE COSTS: FROM “ON-CHAIN GOVERNANCE” TO “DUAL REGULATORY TAX”

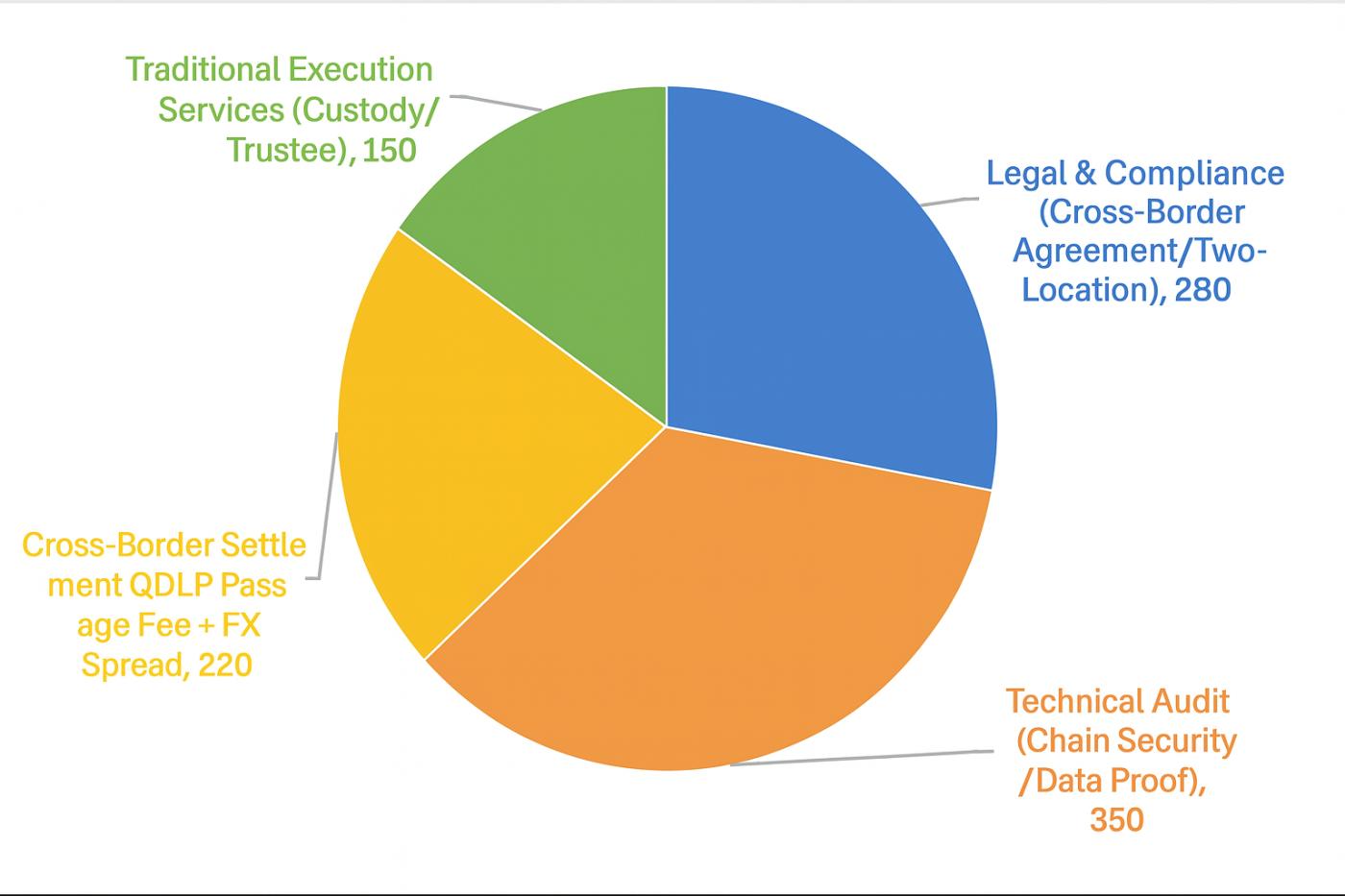

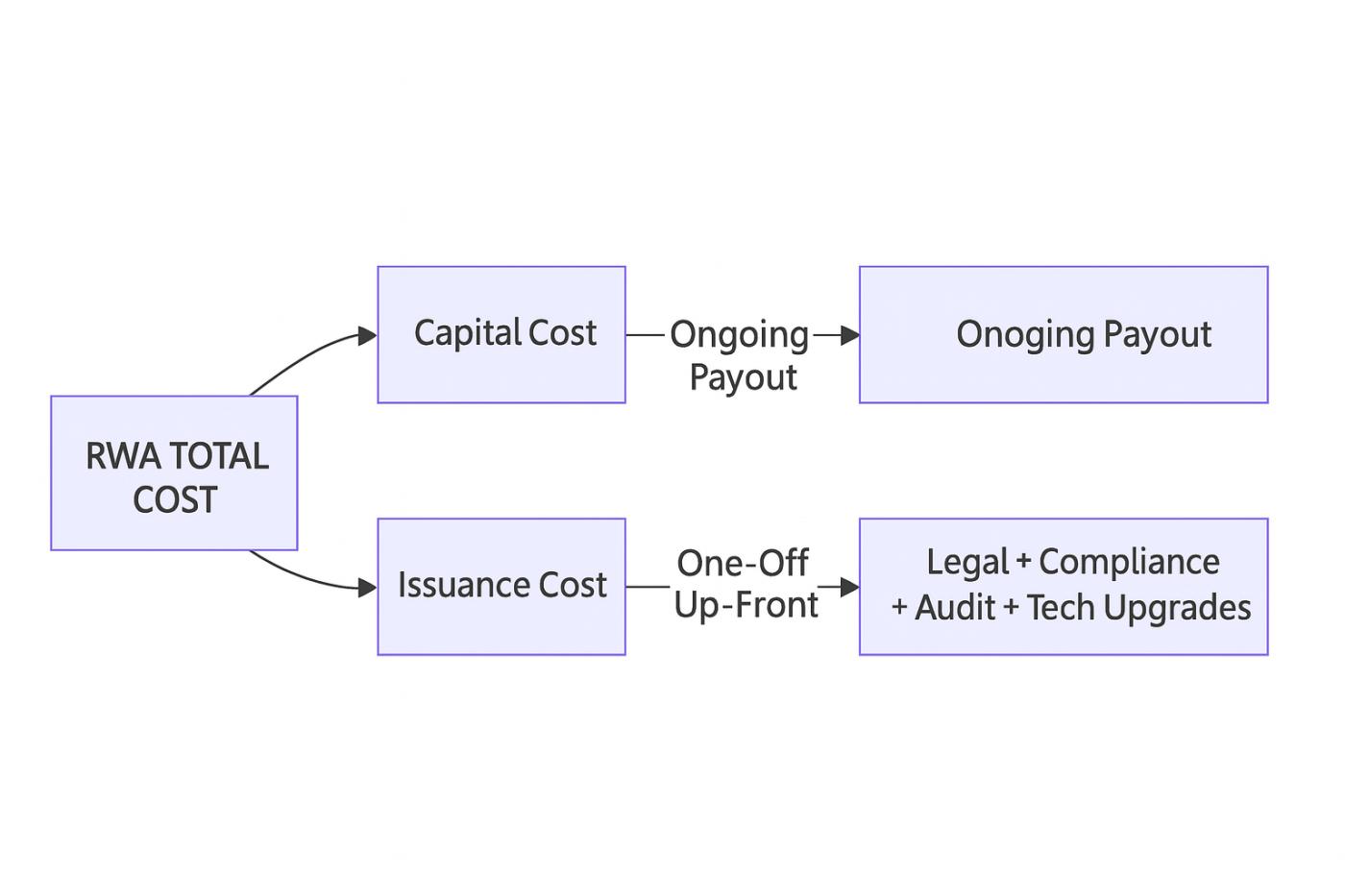

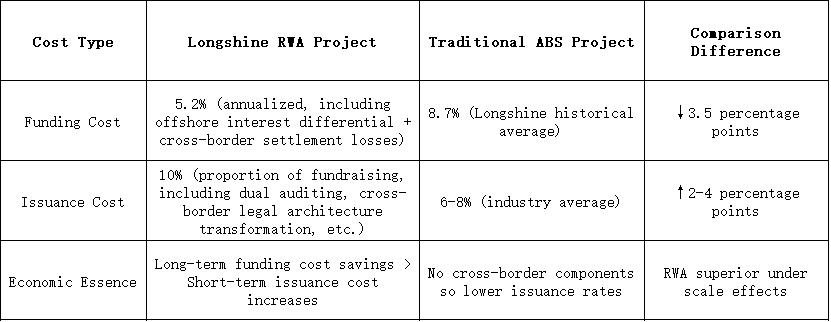

Project issuance costs reached 10 million yuan RMB (10% of the fundraising amount, but the project’s significant reduction in long-term funding costs (8.7%→5.2%) will cover the upfront premium when the duration ≥3 years, forming economies of scale advantages), significantly higher than traditional ABS’s 6-8%. Cost structure analysis reveals the special burden of Chinese-style RWA:

Institutional friction mainly focuses on dual auditing (PwC needs to simultaneously execute mainland CAS 31 cash flow verification and Hong Kong HKFRS 9 financial instrument auditing) and foreign exchange losses (under SAFE QDLP mechanism requirements, RMB and wCBDC settlement has a fixed friction cost of 0.15%).

The core value of the Longshine project lies not in technological or financial innovation, but in providing key sandbox samples for policy formulation.

Based on this project case, the Hong Kong Securities and Futures Commission revised the “Security Token Offering Guidelines” in March 2025, adding: “New energy infrastructure revenue rights may apply simplified disclosure clauses” (Article 7.5b).

At the same time, mainland China’s State Administration of Foreign Exchange increased the Hainan QDLP pilot quota to US$5 billion (2025 new policy).

The Longshine paradigm proves that under the current regulatory framework, through the ‘cross-border revenue rights isolation + off-chain compliance mapping’ path, risk-controllable implementation of physical asset tokenization can be achieved. This compromise is essentially the institutional cost that financial opening pilots must pay.

4.SME FINANCING RESTRUCTURING: EMPIRICAL EVIDENCE OF RWA EMPOWERMENT FOR 83% OF UNCOLLATERALIZED OPERATORS

4.1COST DISRUPTION: DOES 5.2% FUNDING COST CRUSH TRADITIONAL FINANCING’S 8.7%?

Under traditional financing models (2023 data), Longshine subsidiaries’ average funding cost reached 8.7% (including bank loans and ABS issuance fees, Annual Report P56). After introducing the RWA project, by raising 100 million yuan RMB through Hong Kong offshore capital channels, comprehensive costs dropped to 5.2% (Deloitte Report DTT-2025-LXRWA-001). Core optimization paths include:

- Interest rate arbitrage: Offshore RMB financing costs are 210BP lower than domestic rates (Standard Chartered Bank financing quote comparison)

- Issuance fee economies: Blockchain technology reduces intermediary links, saving 40% in underwriting fees (compared to traditional ABS)

Empirical results: Based on project scale calculations, annual financial cost savings of 3.5 million yuan can be converted to deploy 42 liquid-cooled supercharging piles (cost: 83,000 yuan per pile), directly improving the asset return rate by 1.8 percentage points (2024 ESG Report P21).

Note: The comprehensive cost reduction to 5.2% here refers only to funding costs (interest + channel fees), not including issuance costs; the total issuance costs mentioned in section 3.4 refer to one-time expenses such as legal compliance, auditing, and technical transformation costs. Together, these constitute the total cost of the RWA project.

In the short term, issuance costs are higher than ABS averages, but in the long term, cross-border RWA is more economical in long-term operations. As cross-border RWA paths mature, issuance costs are expected to see reductions.

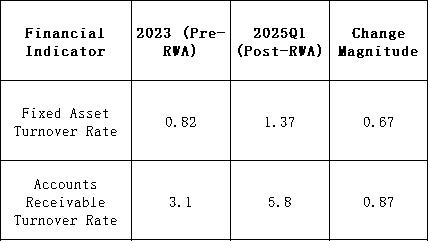

4.2TURNOVER ACCELERATION: THE ON-CHAIN SETTLEMENT ENGINE BEHIND 67% IMPROVEMENT IN FIXED ASSET EFFICIENCY

4.3CREDIT EQUALITY: 83% OF UNCOLLATERALIZED OPERATORS OBTAIN FINANCING

Partnering small and medium operators achieved financing capability upgrades through the Longshine platform:

- Cycle compression: Average financing time reduced from 126 days (bank channels) to 11 days (Xindiandu platform data)

- Threshold elimination: Minimum financing unit fragmented to 0.005 thousand yuan (one ten-thousandth of a 500,000 HKD subscription share)

- Equipment upgrades: 600 operators added 2,370 charging piles, with single pile daily revenue improving by 109% (Shanghai Jiechong case)

Core innovation: Ant Chain IoT-collected 17 dynamic indicators (such as equipment online rate ≥98%, revenue per kWh volatility σ≤0.15) replace financial statements, enabling 83% of operators without collateral to obtain financing (traditional channel approval rate only 37%).

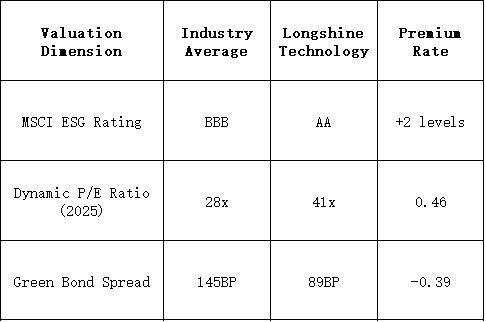

4.4ESG PREMIUM: THE CAPITAL PREMIUM CODE BEHIND MSCI RATING UPGRADE OF 2 LEVELS

Premium attribution:

- ESG rating upgrade: MSCI explicitly labeled “Global first new energy RWA practitioner” (Report No.: MSCI-ESG-300682-2025)

- Capital cost reduction: Green bond issuance spread narrowed to 89BP (March 2025 new bond terms)

- Institutional holdings growth: ESG fund holdings proportion increased from 12% to 29% (UBS holdings analysis report)

〈Cross-border RWA Success Story: Deconstructing the Compliance Architecture Behind Hong Kong Monetary Authority’s Sandbox 100 Million Yuan Fundraising Part 2〉這篇文章最早發佈於《CoinRank》。