Bitcoin is sending potential weakness signals, with three technical charts indicating a possible new weekly bottom in July. The long-term trend remains optimistic, but short-term fluctuations should be viewed cautiously.

VX: TZ7971

Currently, there is a hidden bearish divergence between Bitcoin's price and the key momentum indicator Relative Strength Index (RSI). A hidden bearish divergence occurs when the price makes a higher high, but the RSI remains unchanged or slightly decreases, suggesting that the bullish momentum is no longer sustainable.

A similar situation occurred in March 2024, leading to a 20% Bitcoin crash in just a few days. If history repeats itself, Bitcoin may soon experience another significant correction.

CME Gap Plays a Role in Price Movement

On the daily chart, there is a CME gap in the area of $114,380 to $115,635, which was formed during after-hours trading on the CME exchange, leaving an unfilled price range.

Historically, most such gaps tend to be "filled" early on. So far, 7 out of 9 CME gaps formed in 2025 have been filled, with only two remaining, including the area around $114,000.

The likelihood of filling this gap is high, further strengthening the reasons for a short-term Bitcoin pullback.

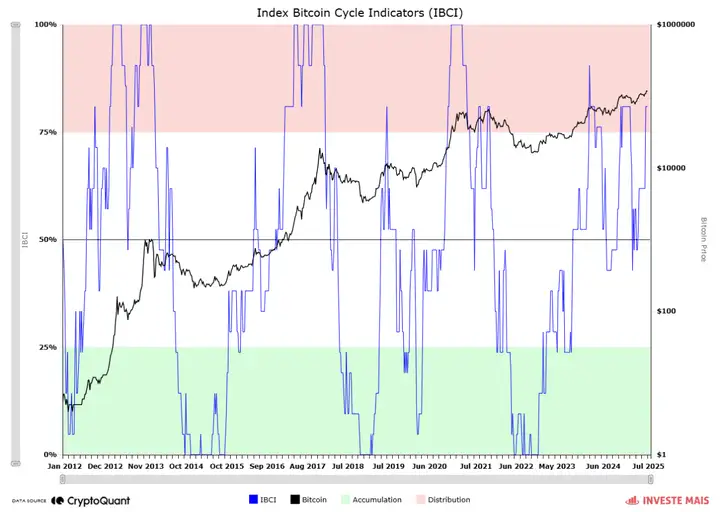

Distribution Signal in Market Cycle

The Bitcoin Cycle Index (IBCI) has entered the "distribution zone" - a phase typically associated with market euphoria and local tops. This is the third time the IBCI has entered this area in the current bull market cycle.

Although the index has only reached 80% (not reaching the absolute peak of 100% as in previous cycles), this is still a warning signal. Fundamental indicators like Puell Multiple and STH-SOPR (Short-Term Holder Spent Output Ratio) remain below neutral, indicating that speculative activity and miner profit-taking have not yet peaked.

Data Perspective

Yesterday's US economic data showed initial jobless claims were lower than expected, while the Purchasing Managers' Index (PMI) performance was mixed. The manufacturing PMI fell, indicating factory activity is contracting, but the services PMI rose, showing the service sector's resilience.

This divergence highlights the "two-speed economy" phenomenon: commodity demand remains weak under inventory adjustments and global trade pressures, while the service sector continues to benefit from a strong labor market and domestic consumption. This imbalanced situation may complicate the Federal Reserve's policy path, as even with manufacturing weakness, service sector inflation risks persist, and premature rate cuts could worsen the economy.

As a result, the three major US indices dropped after market opening, with the Dow Jones falling over 200 points. The crypto market, having experienced a major wash-out two days ago, saw a slight recovery. Notably, only ETH returned to an upward level, which is a good sign, with Ethereum and altcoins showing strength. This indirectly reflects the shift in funds after Bitcoin's decline.

As the month-end, weekend, and policy meeting week approach, wait for a pullback before positioning. Be cautious about chasing highs recently. If you have underperforming altcoins, take the opportunity during the pullback to rebalance, moving to DeFi, public chains, Ethereum ecosystem, and SOL ecosystem.