Written by Franklin Bi, General Partner of Pantera Capital

Compiled by: Yangz, Techub News

In 2025, asset tokenization has evolved from a concept into an irreversible trend.

It’s been nearly a decade since I helped draft JPMorgan Chase’s initial proposal for tokenizing assets. At the time, the idea that securities could be settled on a public infrastructure was radical. But one thing is clear: when the rails of finance become programmable, the structure of capital markets will eventually be reshaped.

Today, this prophecy is being fulfilled at an extremely high speed.

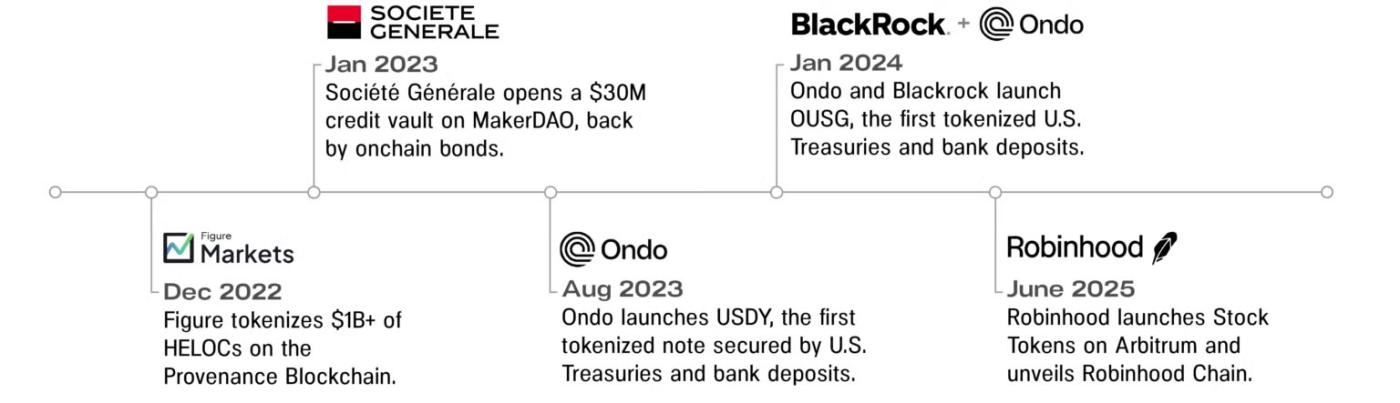

The scale of real-world assets on the chain has exceeded US$24 billion, more than three times the amount at the beginning of 2023. Nearly 200 issuers - from BlackRock and Franklin Templeton to Siemens and JPMorgan Chase - have deployed real capital on the chain. Fintech companies are no longer satisfied with being modern interfaces for traditional rails. They are building new rails themselves and issuing bonds on public chain infrastructure for the first time.

A few weeks ago, Robinhood announced the launch of "stock tokens" (tokenized stocks, ETFs and non-listed company equity issued based on Ethereum's mainstream Layer2 Arbitrum), setting a precedent in the industry. In addition, its CEO Vlad Tenev also revealed his ambition to build the "Robinhood Chain" - a network driven by Arbitrum and optimized for 24/7 global trading of tokenized assets.

A deeper transformation is taking place: capital market infrastructure is migrating on-chain. At the same time, the strategic playbooks of fintech companies, enterprises, and investors are being rewritten in real time. We are witnessing a large-scale migration of assets, issuers, and investors to a new generation of capital asset flow, clearing, and pricing infrastructure.

Gravity wells are forming around early liquidity flowing into tokenized assets. We believe the center of gravity for price discovery, capital formation, and liquidity will eventually shift from the old pipes of Wall Street to the modern blockchain track.

The question now is: How will the future unfold?

The laws of motion in financial physics

If Newton had worked on Wall Street, I believe his first law of financial physics would have been: " Assets always move in the direction of least resistance (unless there is regulatory intervention)."

In other words, assets will eventually flow to areas that meet the following conditions:

- The most free flow (global access, 24/7 operation, software-level speed)

- Lowest transaction costs (fewest intermediaries, software-level costs)

- Best pricing (maximum global price discovery, utility and composability)

Blockchain is finally making this possible. I have witnessed the traditional banking perspective at JPMorgan Chase, and now I am observing this migration through the Pantera venture ecosystem - what my Wall Street colleagues thought was a fantasy in 2015 has now become a reality and is accelerating.

Just like the Eurodollar in the 1960s, the American Depositary Receipts (ADRs) in the 1990s, and the ETFs in the 2000s, the liquidity of tokenized assets will first gather at the edge and eventually rush to the center. Tokenized government bonds, private credit, and equity assets that have just broken through are the three major signals at present.

Today, the Figure platform has processed more than $41 billion in RWA transactions and has $13 billion in on-chain custody assets, including the first blockchain-natively issued and publicly rated home equity loan-backed security (HELOC ABS); Ondo has issued more than $1 billion in tokenized government bonds and is now expanding into equity tokenization through Ondo Global Markets, with plans to launch more than 1,000 NYSE and Nasdaq stock tokens.

Tokenization is enabling the first truly global expansion of capital markets. We believe that top issuers will follow liquidity, with one-click access to global pools of capital, which is only possible with on-chain settlement. The most forward-thinking investors will demand asset portability, transparency, and utility that only on-chain primitives can provide.

New Fintech Strategy Playbook

In the past, the winning formula for disruptive fintech companies was: “Become the bank before the bank replaces you.” Now, tokenization unlocks a new way to win: instead of becoming a bank, become infrastructure.

Robinhood’s recent announcement of the launch of Robinhood Chain is a perfect example of this. It is no longer limited to the competition of front-end user experience or margin interest rates, but converts the user base into liquidity in its own blockchain space.

Robinhood’s CEO and his team described Robinhood Chain as follows: “This is the first blockchain with the technical and regulatory infrastructure to carry the entire traditional financial system into the future…Our goal for Robinhood Chain equity tokens is that in the near future, users will be able to seamlessly transfer assets in seconds, and the ability to trade will no longer be dependent on any single broker or counterparty.”

But wouldn’t reducing reliance on brokers hurt Robinhood’s core business as a digital broker?

No, but only if they take this opportunity to completely transform the capital market architecture and transform into a dominant vertically integrated platform. The logic behind this is simple: if you already control the users (distribution) and the interface (app), why not further control the underlying track (infrastructure)?

Historically, platforms like Robinhood have been constrained by:

- Custodian tax (permanent fee paid to custodians and central depositories)

- Inefficient and expensive settlement cycles (constrained by clearing houses and banks)

- Limited access to new assets (constrained by bottlenecks in exchanges and traditional financial infrastructure)

By migrating on-chain, Robinhood is breaking free from the implicit tax burden of “financial tenant farming” and the shackles of legacy infrastructure.

In addition, Robinhood is not the only company to launch its own chain. Coinbase's Layer2 Base has become one of the fastest growing ecosystems and has brought Coinbase over $100 million in revenue. More importantly, these enterprise chains are a sign that they are gradually internalizing the three major benefits of programmable finance: fees, capital flows, and future options.

Their business models are highly consistent: controlling the sequencer means controlling economic benefits. As vertically integrated market platforms, they can capture transaction spreads, custody fees, and infrastructure rents that originally belonged to traditional institutions. But controlling the sequencer means much more than charging fees. It is also about controlling liquidity, distribution channels, and ultimately capital formation.

Fintech companies that master all three will no longer need to apply for licenses from transfer agents, clearing firms, or exchanges. They will be able to launch global capital markets with just a wallet app—with composable applications, enforceable rights, and real economic gravity.

With vertically integrated blockchain, fintech companies can:

- List tokenized assets as easily and permissionlessly as calling an API

- Monetize volume in a fairer and cheaper way (like SaaS disrupted traditional industries, replacing high Wall Street fees with usage-based pricing)

- Allow third-party developers to build applications based on its liquidity pool and asset inventory (such as asset lending, structured products, insurance, portfolio management tools)

- Meet regulatory compliance requirements through transparent and programmable mechanisms

Instead of building its own securities lending arm to handle tokenized stocks, Robinhood can simply deploy protocols like Morpho on the Robinhood Chain and direct users to their smart contracts, which marks their evolution from application developers to platform operators.

We are entering a new phase in the tokenization cycle. Wall Street’s most influential distribution platform is building a new infrastructure for itself and becoming the ideal place for trading, payments and capital formation.

The underlying reconstruction of the capital market

This transformation extends far beyond fintech companies; the world’s most systemically important institutions now issue and settle assets on-chain.

I left JPMorgan’s blockchain team in 2018 partly out of impatience. I had predicted that it would take another two years for enterprises to adopt public blockchains, but that turned out to be a bit too optimistic. Now, seven years later, the inflection point has finally arrived.

Six weeks after its launch, the BlackRock BUIDL Fund has exceeded US$375 million in size, and now manages assets of over US$2.6 billion, paying dividends directly in USDC on Ethereum; JPMorgan Chase's blockchain platform processes intraday repurchase transactions through a private fork of Ethereum, reducing collateral settlement time from several days to minutes; in 2023, Siemens bypassed investment banks and issued 60 million euros of digital bonds directly on the Ethereum public chain; in the same year, Societe Generale also issued digital green bonds on Ethereum, attracting participation from regulated institutions such as AXA and Generali.

These successful pilots are the harbingers of a coming wave.

Institutions are now beginning to realize that we no longer need investment banks to facilitate access to capital, nor do we need correspondent banks to piece together global distribution networks. The T+2 settlement cycle delays liquidity and amplifies risk.

Public blockchain technology reshapes financial infrastructure with three advantages: global reach, instant settlement efficiency, and programmable smart contract logic. For companies facing rising financing costs and fragmented investor groups, the ability to issue debt (including equity in the future) with one click and instantly access global liquidity has become an irresistible attraction.

In this transformation, financial technology companies control distribution and monetization channels by building their own blockchains, while traditional enterprises use on-chain issuance to reduce capital costs and expand market access. Both are moving toward the same conclusion: the capital market built on public chains will become the first truly global, uninterrupted, and universally accessible capital market infrastructure.

Right of way granted, but not yet ownership

Most of the current so-called "tokenization" remains on the surface - we have built highways, but the gates to the financial core (judicial confirmation of ownership, shareholder registers, governance systems) are still locked.

Today, trading tokenized stocks and bonds on the chain has become a reality. But this is by no means complete ownership: your voting rights, audit rights, and recourse rights are still trapped in the off-chain structure, that is, the shackles of special purpose vehicles, custodians, and transfer agents. What we currently give investors is only an asset pass, not a certificate of ownership.

As liquidity grows and investors become more aware of the benefits of tokenized assets, issuers will face increasing pressure to grant full shareholder rights to token holders. Some investors will not wait and will tokenize their portfolios themselves and seek forgiveness later.

This game between the rights of issuers and investors will become the core battlefield of the tokenization process in the next decade: when assets are on-chain but the registration system is not, who controls the shareholder privileges? When token holders are no longer satisfied with the transfer right and price discovery function and begin to demand the power granted by real ownership, how will the system be reconstructed?

As SEC Commissioner Hester Peirce recently said, the vision of security tokenization is “fascinating but not magical.” Simply wrapping assets in a digital cloak is far from delivering on the promise, and it requires a radical shift in thinking from issuers—from viewing on-chain issuance as an experimental sandbox to using it as the default path to reach global capital pools.

The Tokenization Tipping Point

The rise of tokenized assets today is similar to the early days of ETFs.

When the first US stock ETF (SPY) was launched in 1993, its assets under management exceeded $1 billion within a year. But the real turning point was not the breakthrough in scale, but when ETF trading volume began to consistently match and eventually surpass mutual funds. At that moment, the market structure was completely changed, and investor behavior was reshaped accordingly.

We believe that tokenization will also usher in a similar inflection point in the transformation of market structure and the behavior of participants. The tipping point will come when any of the following situations occurs:

- The daily trading volume of on-chain stocks exceeded 1 billion US dollars (equivalent to the scale of the last tier ADR or long-tail ETF)

- The scale of tokenized stock asset management exceeds 100 billion US dollars (attracting sovereign wealth funds, pension funds and other systematic allocators to enter the market)

- The on-chain liquidity of a S&P 500 or Nasdaq 100 stock exceeds that of its home exchange or ADR channel

- Global IPOs completely bypass New York and directly choose on-chain issuance or on-chain financial centers with more friendly regulation

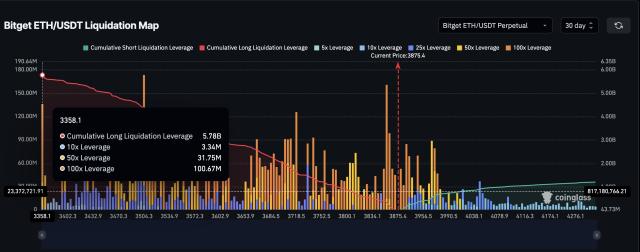

Today, we are still in the early stages, with an average monthly trading volume of about $300 million in on-chain stocks. But what is more important is the growth rate, with trading volume surging 350% in the past month, and products such as Robinhood stock tokens and Ondo Global Markets are just getting started.

If the current growth rate is maintained, the $1 billion daily trading volume threshold may be achieved within 2-4 years. This depends on several major catalysts:

- Regulatory clarity for tokenized asset packaging and native issuance of on-chain equity.

- Blockchains designed specifically for financial applications achieve scale in terms of performance and liquidity, such as Robinhood Chain, Ondo Chain, Provenance Blockchain (and more similar projects in the future).

- Eliminate user experience barriers and enable retail investors to access on-chain assets without wallet or gas fees.

- A portable compliance layer that natively binds KYC/AML checks to tokens, unlocking cross-border liquidity securely and compliantly.

When the tipping point arrives, people will eventually recognize that this is the tokenized "ETF moment". The current pioneers are focused on laying a better track, but the real epic narrative lies in the fundamental migration of the capital market structure. When the migration is completed, blockchain will become the default infrastructure for capital formation, price discovery and value transfer - the first stop and the end stop for issuers and investors.

As one of the designers of the early blueprint for tokenization, I can assert today that the track is in place, liquidity is pouring in, and the momentum is real.

The trend is set, just wait for all rivers to flow into the sea.