Chainfeeds Briefing:

From inflationary assets to scarce reserves, Ethereum is reshaping the foundation of digital finance.

Article Source:

https://www.techflowpost.com/article/detail_27180.html

Article Author:

Artemis

Perspective:

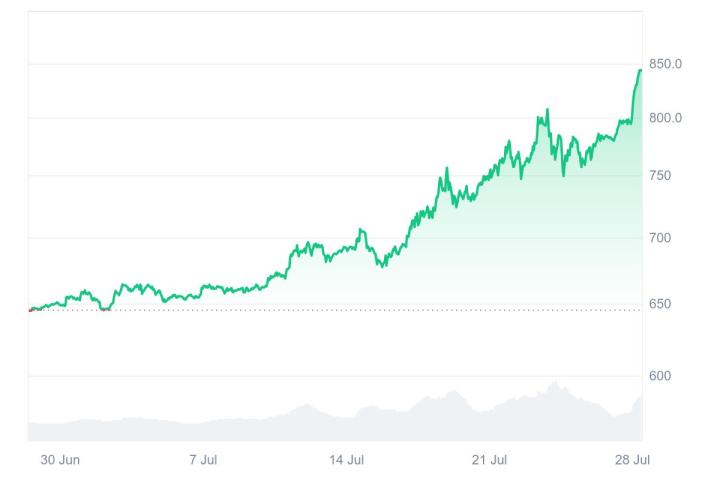

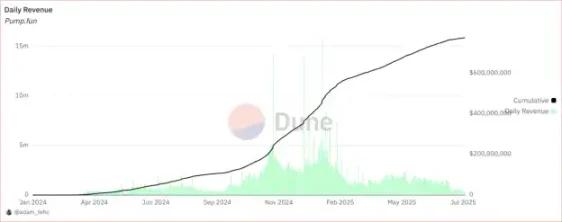

Artemis: Recently, Ethereum (ETH) has once again become the focus of market attention, especially after the emergence of the "ETH reserve asset" concept, which has triggered a reevaluation of its long-term value by institutions and the market. ETH is gradually transforming from a misunderstood asset to a scarce and programmable reserve asset, becoming the security and power source of a rapidly compliant on-chain ecosystem. ETH has an adaptive monetary policy, and it is expected that even if all ETH is staked, the inflation rate will gradually decrease and remain at an extremely low level in the long term, a monetary attribute similar to gold and far superior to the monetary supply growth of fiat currency. Large institutions such as JPMorgan and BlackRock have been deploying resources in the Ethereum ecosystem, driving continuous demand for ETH. ETH's deep composability allows it to be used not only as a staking asset but also widely as DeFi collateral, AMM liquidity pools, and the native gas token for Layer 2. In comparison, while Solana has attracted attention in the MemeCoin field, ETH still dominates the high-value asset issuance market with its stronger decentralization and security, demonstrating a more robust and enduring development potential. Understanding ETH's evolving monetary role requires placing it in the current global economic context, especially in the face of ongoing fiat currency depreciation and monetary expansion. Although official data shows a relatively moderate inflation rate, the actual decline in purchasing power far exceeds official figures. Over the past few decades, the average annual growth of the US M2 money supply has been as high as 6.36%, far exceeding the rise in consumer price index and housing prices, and even approaching the nominal returns of the stock market, indicating that nominal economic growth largely depends on monetary expansion rather than productivity improvement. Recent aggressive fiscal policies and government stimulus measures in the US have further exacerbated inflationary pressures, prompting the market to seek more reliable stores of value. In this context, assets that meet the four standards of value storage become extremely important - durability, value preservation, liquidity, and widespread adoption and trust. Under the protection of a decentralized network, ETH demonstrates excellent durability and high liquidity, becoming the crypto asset with trading volume second only to Bitcoin. However, traditional value storage standards still remain controversial for ETH, which has driven the emergence of the new concept of a "scarce programmable reserve asset", emphasizing ETH's unique economic functions and mechanism advantages. The core of the debate about ETH as a value storage asset lies in its monetary policy. Unlike Bitcoin with a fixed supply, ETH adopts an adaptive issuance model, with its supply dynamically linked to the amount of staked ETH. As the staking ratio increases, ETH's issuance speed is not linearly growing but adjusted based on the square root of the total staking amount, forming a soft upper limit on inflation rate. Even if all ETH is staked, the annual inflation rate will continue to slow down, demonstrating a high capacity for inflation control. This design effectively balances network security and inflationary pressure, endowing ETH with scarcity and adaptability, further consolidating its position as a sovereign digital asset. Through this mechanism, ETH is not just the fuel of the blockchain network but a productive asset whose value continuously accumulates and is released by guaranteeing, settling, and driving an increasingly institutionalized on-chain economy. This framework changes the traditional method of assessing cash flow and protocol revenue, prompting the market to re-recognize ETH from a commoditized perspective and revealing its enormous potential as a core reserve asset for the future digital economy.

Content Source