The US Treasury Bond Market Tokenized Recorded a Capital Outflow of 800 Million USD, Decreasing by 10.57% in the Past Seven Days After a Stable Growth Chain from the Beginning of the Year.

The tokenized Treasury Bond Market is experiencing its first strong adjustment since the beginning of the growth trend from early 2025. According to data from the rwa.xyz platform, the market size has decreased from the historical peak of 7.55 billion USD on July 16 to around 6.75 billion USD, marking a 10.57% drop within just one week.

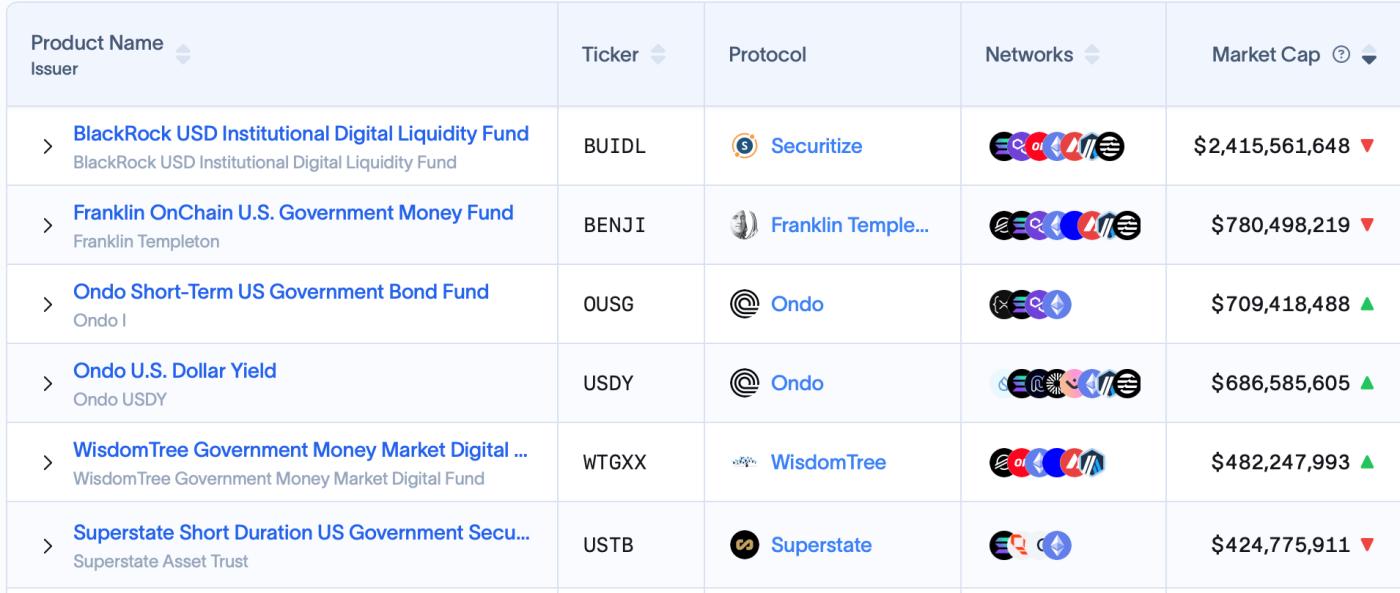

BlackRock's BUIDL Fund, the largest product in this segment, was most heavily impacted with a capital withdrawal of up to 409 million USD. BUIDL's managed assets decreased from 2.819 billion USD to 2.41 billion USD during this period, accounting for most of the total market capital outflow.

Franklin Templeton also experienced a negative impact as the company's BENJI fund lost 29.51 million USD. Similarly, Superstate Short Duration U.S. Government Securities Fund (USTB) also fell into the red with a capital outflow of 310.38 million USD, becoming the second most affected fund after BUIDL.

Some Funds Continue to Maintain Growth

In the context of a weakening overall market, some products still show the ability to attract capital. Ondo Short-Term U.S. Government Bond Fund (OUSG), currently ranked third in size, recorded a slight increase of 0.12% in the past week. Ondo U.S. Dollar Yield Fund (USDY) and WisdomTree Government Money Market Digital Fund (WTGXX) also maintained modest growth.

This differentiation suggests that investors may be restructuring their portfolios from large funds to products with different investment structures or strategies. Particularly, the continued capital inflow into Ondo funds may reflect market confidence in products with shorter terms or more flexible yield mechanisms.

Previously, the tokenized Treasury Bond Market had experienced an impressive growth phase from the beginning of the year. On June 12, the market size reached 7.34 billion USD and continued to climb to a peak of 7.55 billion USD in mid-July, demonstrating the strong attraction of traditional financial products digitized on the blockchain.

It is currently unclear whether this adjustment is just a short-term rebalancing phase or a sign of a structural weakening trend. The concentrated capital withdrawal from the two largest funds, BUIDL and USTB, suggests that investors may be seeking new investment opportunities or reassessing risks in a volatile crypto asset market. The upcoming weeks will be crucial in determining whether the market can recover or continue its downward trend.