Chainfeeds Briefing:

Based on Ethena's current yield level, token holders can obtain a very competitive rate of return.

Article Source:

https://www.panewslab.com/zh/articles/kf6qe1h2

Article Author:

Jonaso

Perspective:

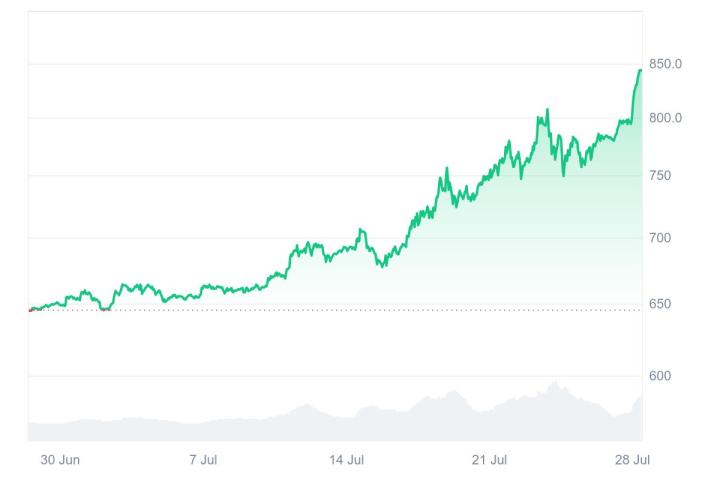

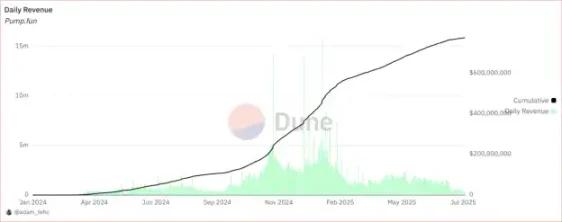

Jonaso: In less than a year, the USDe supply has risen from 0 to over $6 billion, surpassing DAI to become the third-largest decentralized stablecoin, second only to USDT and USDC. The sUSDe annual yield has reached 10%, becoming the highest sustainable yield in the current crypto field. The surge in yield is driving aggressive arbitrage strategies on Aave and other decentralized platforms. Financing rates are continuously rising, with the current Bitcoin financing rate at 19% and Ethereum at 12%, marking the first time both have broken the 11% benchmark in 6 months. Ethena's weekly income reached $7.8 million, with an expected annual income of over $400 million. Even with conservative estimates, there is still room for growth. Currently, Ethena has transferred 41% of its stablecoin reserves into higher-yield perpetual contract strategies, with the market's average funding rate reaching 14%. The higher annual yield simultaneously meets the key conditions for enabling the ENA fee switch: sUSDe's yield must be at least 5% higher than the current Sky savings rate (currently 4.5%), a milestone that has now been confirmed. Ethena has rapidly risen to become one of the top TVL DeFi protocols, with its TVL breaking $6 billion and generating nearly $400 million in income, ranking among the most profitable DeFi projects currently. Three flagship products are helping expand the Ethena ecosystem: 1) Ethereal: a decentralized perpetual contract exchange with a TVL of around $712 million. 2) Terminal: a liquidity center focused on tokenized assets, with a current TVL of nearly $129 million. 3) Strata: a structured yield product with a TVL of $13 million. Meanwhile, Ethena is conducting multi-chain expansion. The trading volume of USDe on Bybit has exceeded USDC (5.4 billion vs. 4.44 billion), and on the TON network, USDe's TVL has reached $87 million in just six weeks. Although these factors have driven ENA's rise, the true catalyst has yet to appear: the fee switch. Despite strong market performance, the ENA and sENA tokens currently lack a direct mechanism to capture this value. To address this, the Wintermute governance team has submitted a proposal to launch the fee switch mechanism, aimed at allowing token holders to share revenues. This mechanism will enable sENA holders to receive a share of protocol income. In other words, it will create actual value for token holders, elevating ENA beyond a mere governance token. To activate the rate switch, Ethena needs to meet 5 conditions. As of July 2025, 4 of the 5 conditions have been met: USDe supply exceeding $6 billion; cumulative income over $250 million; 1% of total supply reserved; spread ≥ 5%. The only remaining condition is to list USDe on Binance or OKX (the token is already listed on Bybit, MEXC, and Bitget). Once this final step is completed, the fee switch can be activated, at which point sENA holders will begin to receive a portion of Ethena project's earnings. Based on Ethena's current yield level, token holders can obtain a very competitive rate of return.

Content Source