Welcome to the US Crypto News Morning Brief—where we provide you with the most important crypto news for the upcoming day.

Enjoy a cup of coffee, as Ethereum is no longer just for core crypto players. An increasing number of publicly listed companies are holding ETH on their balance sheets, marking a new phase of institutional acceptance.

Cryptocurrency News of the Day: New Public Companies Currently Hold a Total of 113,000 ETH

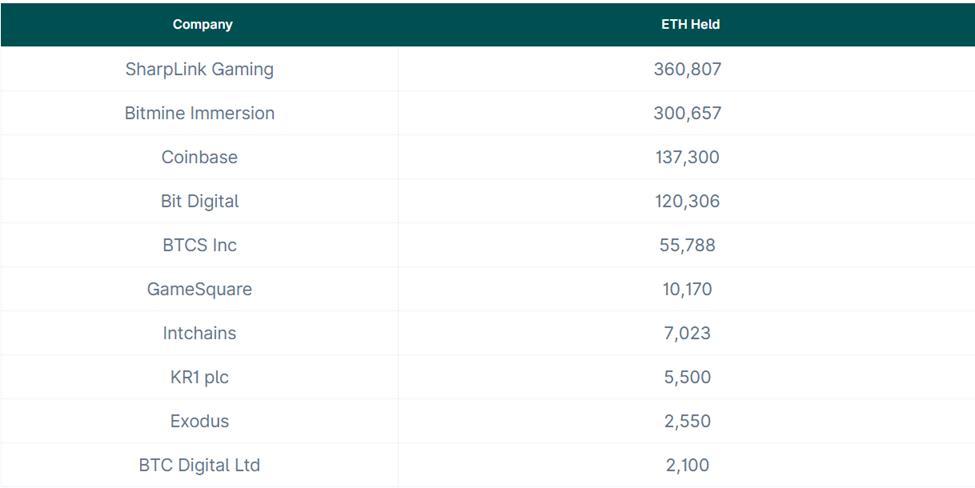

A new CoinGecko report shows that the total number of Ethereum held by public companies has increased to 1,002,666 ETH as of 07/23/2025, valued at approximately $3.70 billion.

Of this, 113,000 ETH (around $409 million) is held by companies first disclosing their position this quarter.

Leading the ranking is SharpLink Gaming, holding 360,807 ETH, currently valued at over $1.33 billion. Notably, over 95% of their ETH is deployed in staking and liquid staking platforms.

SharpLink has clearly made Ethereum its core treasury reserve, a strategy aimed at generating profit and long-term value preservation.

In second place is BitMine Immersion, with 300,657 ETH tokens valued at $1.11 billion. Led by Tom Lee of Fundstrat, BitMine has one of the most aggressive ETH accumulation targets ever recorded. The company aims to hold 5% of the total existing ETH, around 6 million ETH.

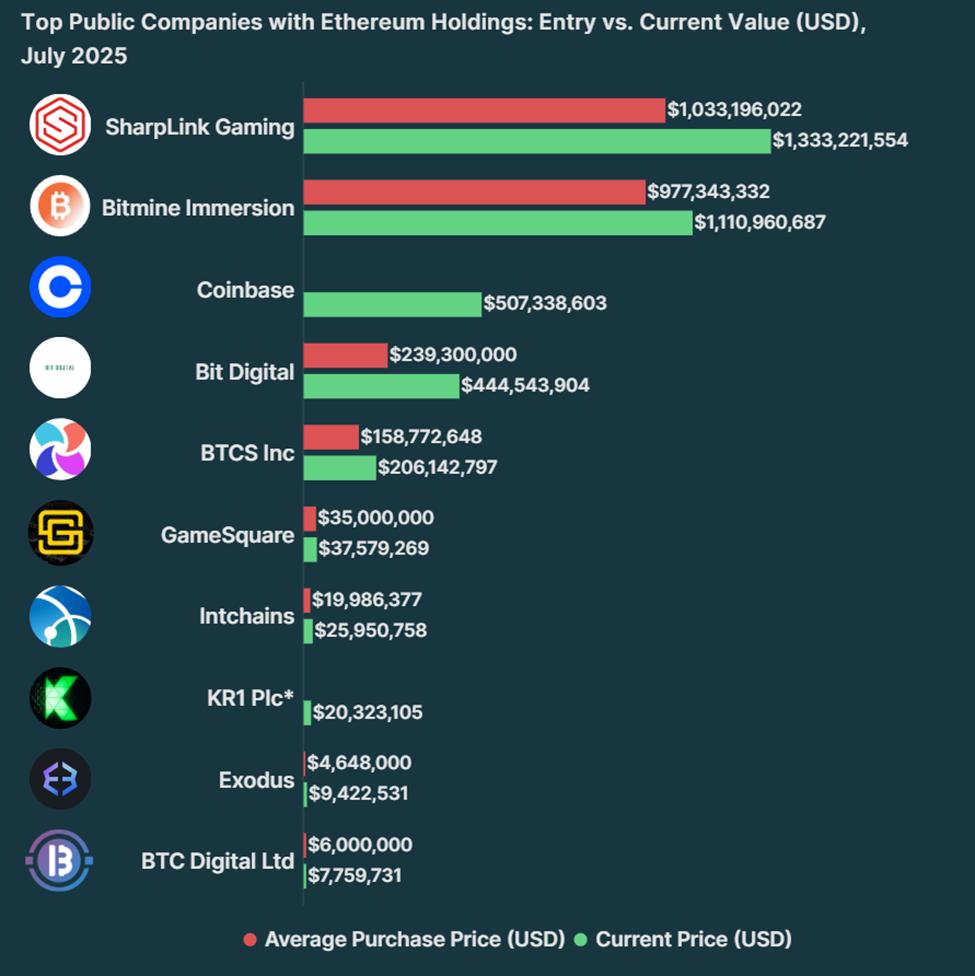

Their average purchase price is $3,251, providing an unrealized profit of 13.7% to date.

Coinbase, the largest crypto exchange in the US, holds 137,300 ETH valued at over $507 million, representing nearly 13.7% of the total ETH held by public companies. Although recently surpassed, Coinbase remains a core institutional holder.

Bit Digital, known for Bitcoin mining, has strongly shifted towards Ethereum staking, bypassing BTC. Currently, they hold 120,306 ETH (valued at $444.5 million), nearly doubling their position value with an unrealized profit of 85.8%.

Completing the top 5 is BTCS Inc., with 55,788 ETH valued at $206.1 million. The company recently issued convertible bonds to increase its ETH reserves, demonstrating strong confidence in Ethereum's long-term value.

"We have been accumulating ETH since 2021," BTCS CEO Charles Allen said recently.

This aligns with a recent publication by US Crypto News, emphasizing public companies racing to buy Ethereum.

Small Investors Signal Increasing Institutional Interest

Beyond the top 5, companies like GameSquare Holdings (10,170 ETH), Intchains Group (7,023 ETH), KR1, Exodus, and BTC Digital hold smaller but strategic positions.

GameSquare, for instance, recently expanded its treasury mission from $100 million to $250 million, suggesting plans for ETH purchases and future NFT profit strategies.

Although holding only 2,550 ETH tokens, Exodus has the largest unrealized profit of 102.7%, highlighting how early trades in a volatile market can yield significant returns.

Despite increasing ETH accumulation, Ethereum remains second to Bitcoin in terms of public treasury acceptance.

The top two companies, SharpLink and BitMine, hold over 65.9% of the publicly disclosed ETH, exceeding $1 billion. ETH acceptance from institutions remains highly concentrated.

Top 10 Ethereum (ETH) Treasuries in Public Companies. Source: CoinGecko

Top 10 Ethereum (ETH) Treasuries in Public Companies. Source: CoinGeckoHowever, with the launch of the Ethereum ETF in 2024 and the network's transition to proof-of-stake (PoS), barriers for company exposure have significantly decreased.

With Ethereum holding above $3,600 at the time of writing, after dropping to $1,383 earlier this year, company treasuries are now profitable overall, with the largest altcoin by market capitalization officially present on balance sheets.

Chart of the Day

How are publicly listed companies owning Ethereum performing today? Source: CoinGecko Research

How are publicly listed companies owning Ethereum performing today? Source: CoinGecko ResearchByte Size Alpha

Here is a summary of some US crypto news to watch today: