Chainfeeds Briefing:

ETH and SOL are diverging under the dual drive of capital and policy, with one settling as an institutional asset and the other bursting as a consumer mainchain.

Article Source:

https://www.odaily.news/post/5205232

Article Author:

Ethan

Perspective:

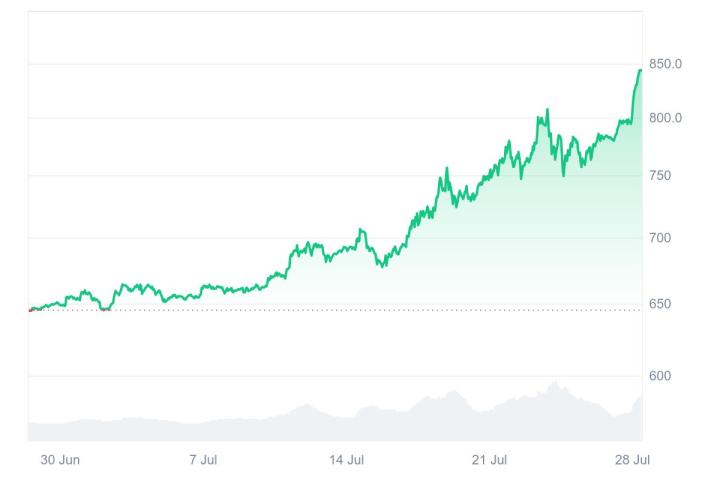

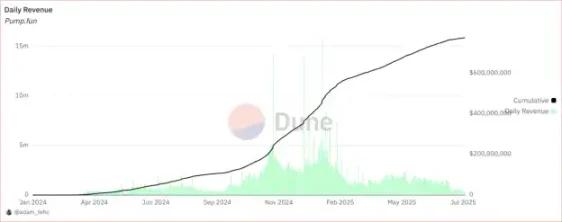

Ethan: Over the past two years, Ethereum's narrative was once caught in a stagnation doubt, from the lack of significant improvement in staking yields after the merge, to Layer2 fragmentation, high gas fees, and projects like dYdX and Celestia moving out, Ethereum seemed to have lost its growth momentum. However, ETH has not exited the stage, but instead has become increasingly intertwined with the global financial system. First, in the real-world assets (RWA) field, over $4 billion has been issued on-chain by mid-2025, with 70% deployed on the Ethereum mainnet or its L2s, and BlackRock's BUIDL, Franklin Templeton's BENJI, and others using ETH as a liquidity pegging or custody medium. Secondly, the implementation of the GENIUS Act promotes stablecoin compliance, with Circle, Paxos, and others incorporating WETH into their reserve systems. Meanwhile, institutions like VanEck and Grayscale continue to layout ETH spot ETFs, strengthening its institutional asset identity. At the developer and ecosystem level, Ethereum's monthly active developers still exceed 50,000, four times that of Solana, with a global TVL share of 61%, solidifying its position as the core platform for global DeFi and asset governance. ETH's value is shifting from narrative fluctuations to institutional repricing, with its victory not through explosion, but through sedimentation. Unlike Ethereum's institutional financial positioning, Solana is more like an on-chain consumer infrastructure, with its growth driven by a positive cycle of user participation, community enthusiasm, and transaction frequency. The MEME coin boom has propelled Solana to become the native chain for memes, with projects like PENGU, BONK, and TRUMP having a total market cap exceeding Dogecoin, demonstrating a strong community-driven effect. Solana's extremely low gas fees and high TPS support users in a closed loop of "low-threshold experiment → community spread → FOMO trading", thereby stimulating native on-chain consumption vitality. On the capital side, DeFi Development Corp and Upexi and other publicly traded companies have massively increased their SOL holdings, with total positions exceeding a million, reflecting institutions' view of it as a three-in-one bet of "trading asset + active indicator + narrative outlet". Meanwhile, the ecosystem is moving from single-point hits to a Web2 user-friendly infrastructure loop, such as Backpack wallet, Jupiter DEX, Solana phone, and App Store, further enhancing on-chain usage frequency. Although Solana's TVL is only 12% of Ethereum's, its per capita interaction, transaction frequency, and gas consumption have surpassed traditional L1s like BNB and Polygon, gradually becoming the on-chain daily active entry for crypto natives. The market in 2025 is not a simple bull market resonance, but a process of structural capital repricing. ETH and SOL are not in a substitution relationship, but are dual-track answers defining the future in different cycles: ETH is the medium to long-term allocation main axis under institutional structure, a treasury-like underlying asset for traditional capital entering blockchain assets; SOL is an explosive asset under native consumption and short-cycle gaming, a tool for capturing trading opportunities in high volatility. Giants like Grayscale, Jump Trading, and DeFi Corp have adopted hedging allocation strategies, using the former for ETF base position construction and the latter for frequent reallocation in high-activity projects like BONK and PENGU. On the policy front, ETH clearly benefits from ETF and stablecoin regulatory advancement but also faces SEC constraints on its security attributes; while SOL, though not enjoying top-tier dividends, has more flexibility due to its decentralized issuance and light staking structure, navigating the gray regulatory area. This means ETH's appreciation path is more stable but slow, while SOL's is steeper but more intense. From a cycle gaming perspective, the two are not mutually exclusive, but constitute the optimal crypto asset portfolio of institutional sedimentation + consumption explosion in this era.

Content Source