Title: Artemis Research: Why ETH Becomes the Reserve Asset of On-Chain Economy?

Author: Kevin Li

Translated by: TechFlow

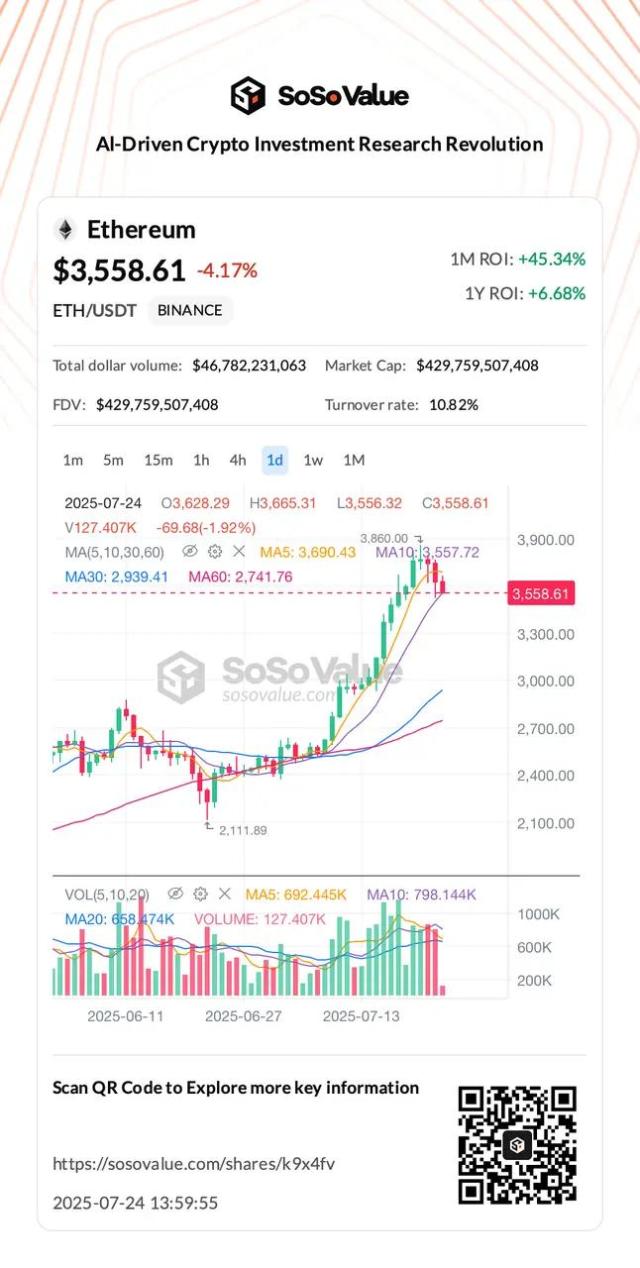

Recently, interest in Ethereum has surged again, especially after the emergence of ETH as a reserve asset. Our fundamental analysts explored the valuation framework of ETH and constructed a compelling long-term bullish forecast. As always, we are happy to connect and exchange ideas with you - remember to do your own research (DYOR).

Let's dive deep into ETH with our fundamental analyst Kevin Li.

Key Highlights

Ethereum (ETH) is transforming from a misunderstood asset to a scarce, programmable reserve asset that provides security and momentum for a rapidly compliant on-chain ecosystem.

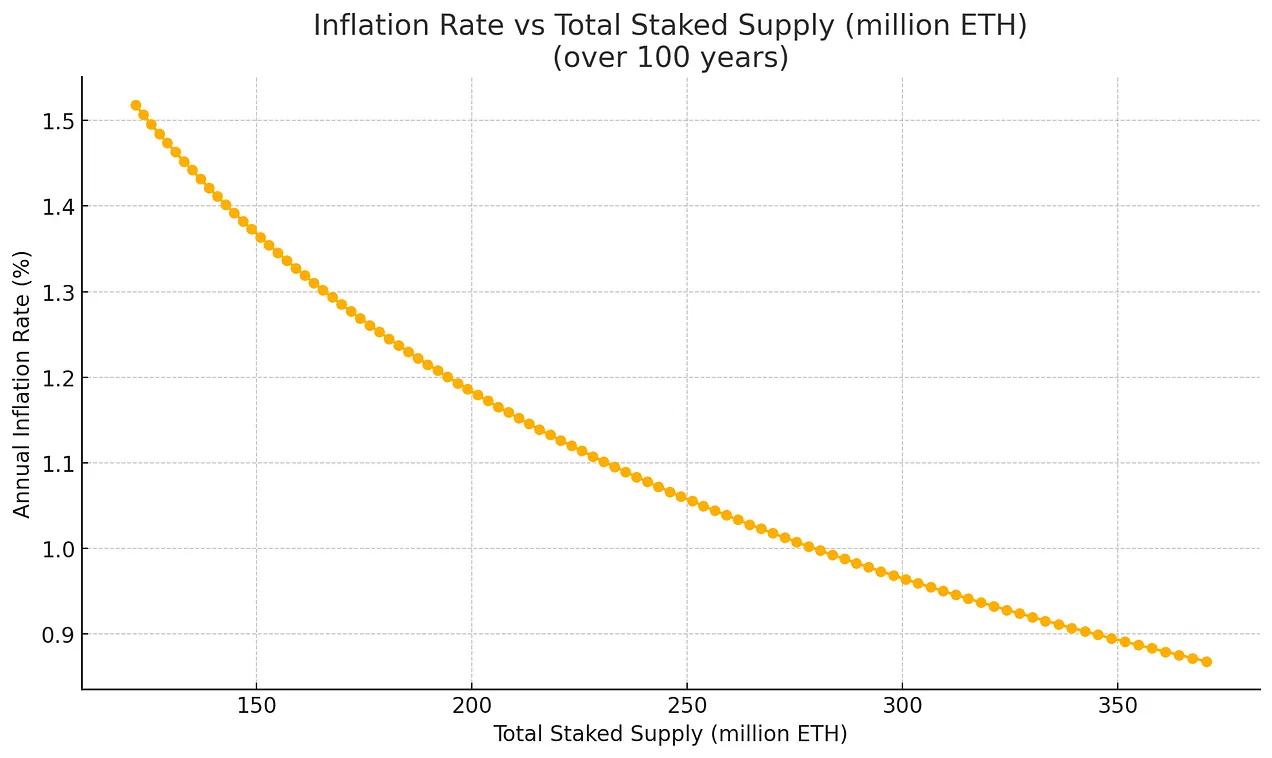

ETH's adaptive monetary policy is expected to reduce inflation rates - even with 100% of ETH staked, inflation will be at most around 1.52%, dropping to approximately 0.89% by the 100th year (2125). This is far lower than the US M2 money supply's average annual growth of 6.36% (1998-2024), and can even compete with gold's supply growth rate.

Institutional adoption is accelerating, with companies like JPMorgan and BlackRock building on Ethereum, driving continuous demand for ETH to secure and settle on-chain value.

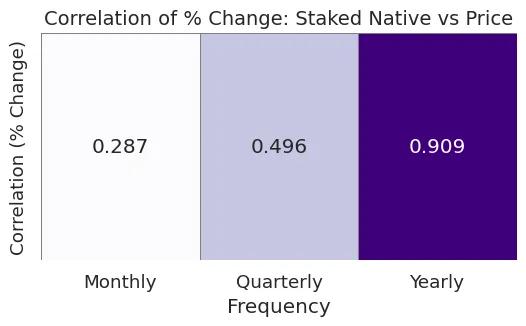

The annual correlation between on-chain asset growth and native ETH staking is over 88%, highlighting strong economic consistency.

The SEC issued a policy note on staking on May 29, 2025, reducing regulatory uncertainty. ETH ETF filing documents now include staking terms, enhancing returns and institutional alignment.

ETH's deep composability makes it a productive asset - usable for staking/restaking, as DeFi collateral (e.g., Aave, Maker), AMM liquidity (e.g., Uniswap), and as the native gas token on Layer 2.

While Solana gained attention in Memecoin activities, Ethereum's stronger decentralization and security enable it to dominate high-value asset issuance - a larger, more enduring market.

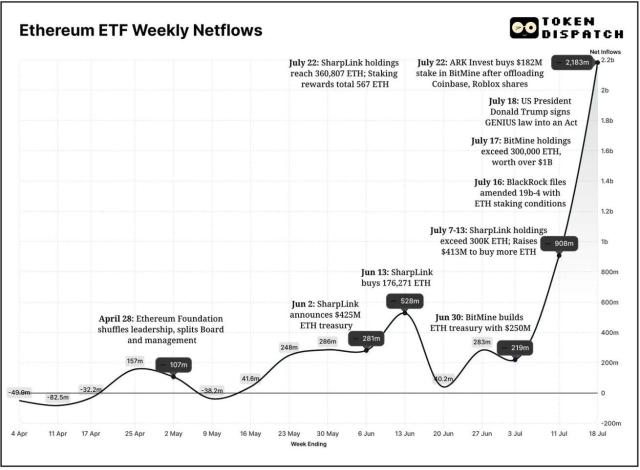

The rise of Ethereum reserve asset trading, starting with Sharplink Gaming ($SBET) in May 2025, has led to listed companies holding over 730,000 ETH. This new demand trend mirrors the 2020 Bitcoin reserve asset trading wave and has contributed to ETH recently outperforming BTC.

Importantly, even in this worst-case scenario of issuance rate, it will decrease as the total ETH supply increases, following an exponential decay curve. Assuming 100% staking and no ETH burning, the expected inflation trend is as follows:

Year 1 (2025): ~ 1.52%

Year 20 (2045): ~ 1.33%

Year 50 (2075): ~ 1.13%

Year 100 (2125): ~ 0.89%

Figure 4: Illustrative Inference of ETH Maximum Issuance, Assuming 100% ETH Staked, Starting Stake of 120 Million ETH, as Total Supply Increases

Even under these conservative assumptions, Ethereum's continuously declining inflation curve reflects its intrinsic monetary law—enhancing its credibility as a long-term value storage mechanism. If the burning mechanism introduced by EIP-1559 is considered, the situation would improve further. A portion of transaction fees will permanently exit circulation, meaning the net inflation rate could be far lower than the total issuance, sometimes even becoming deflationary. In fact, since Ethereum's transition from Proof of Work to Proof of Stake, the net inflation rate has remained below issuance and periodically dropped to negative values.

[The rest of the translation follows the same professional and precise approach, maintaining the technical terminology and preserving the original structure.]Additionally, the increase in staking volume has also affected ETH's price dynamics. As more ETH is staked and removed from circulation, ETH's supply becomes tighter, especially during periods of strong on-chain demand. Our analysis shows that the correlation between the amount of staked ETH and ETH price is 90.9% on an annual basis, and 49.6% on a quarterly basis, supporting the view that staking not only ensures network security but also creates favorable supply and demand pressure on ETH in the long term.

Figure 9: Native Correlation between Staked ETH and Price

Source: Artemis

A recent policy clarification from the U.S. Securities and Exchange Commission (SEC) has alleviated regulatory uncertainty surrounding Ethereum staking. On May 29, 2025, the SEC's Corporate Finance Division stated that certain protocol staking activities (limited to non-entrepreneurial roles, such as self-staking, delegated staking, or custodial staking under specific conditions) do not constitute a securities offering. While more complex arrangements still need to be determined on a case-by-case basis, this clarification encourages more proactive institutional participation. After the announcement, Ethereum ETF applications began to include staking provisions, allowing funds to earn rewards while maintaining network security. This not only enhances returns but also further solidifies institutional acceptance and trust in Ethereum's long-term adoption.

Composability and ETH as a Productive Asset

Another significant characteristic that distinguishes ETH from purely value storage assets like gold and Bitcoin is its composability, which in itself drives demand for ETH. Gold and BTC are non-productive assets, whereas ETH has native programmability. It plays an active role in the Ethereum ecosystem, supporting decentralized finance (DeFi), stablecoins, and Layer 2 networks.

Composability refers to the ability of protocols and assets to seamlessly interoperate. In Ethereum, this makes ETH not just a monetary asset, but the foundational building block for on-chain applications. As more protocols are built around ETH, demand for it grows—not only as Gas, but also as collateral, liquidity, and staking funds.

Today, ETH is used for multiple key functions:

Staking and Re-staking—ETH can protect Ethereum itself and can be re-staked through EigenLayer to provide security for oracles, rollups, and middleware.

Collateral in Lending and Stablecoins—ETH supports major lending protocols like Aave and Maker, and serves as the basis for over-collateralized stablecoins.

Liquidity in AMMs—ETH dominates in decentralized exchanges like Uniswap and Curve, enabling efficient exchange across the entire ecosystem.

Cross-chain Gas—ETH is the native Gas token for most Layer 2 networks, including Optimism, Arbitrum, Base, zkSync, and Scroll.

Interoperability—ETH can be bridged, wrapped, and used in non-EVM chains like Solana and Cosmos (via Axelar), making it one of the most widely transferable on-chain assets.

This deeply integrated utility makes ETH a scarce but efficient reserve asset. As ETH becomes increasingly integrated into the ecosystem, conversion costs rise, and network effects strengthen. In a sense, ETH might be more like gold than BTC. Most of gold's value comes from industrial and jewelry applications, not just investment. In contrast, BTC lacks this functional utility.

Ethereum vs. Solana: Layer-1 Divergence

In this cycle, Solana appears to be the biggest winner in the Layer 1 space. It effectively captured the meme coin ecosystem, creating a vibrant network for new token issuance and development. Despite this momentum, Solana's decentralization remains less robust than Ethereum due to its limited number of validators and high hardware requirements.

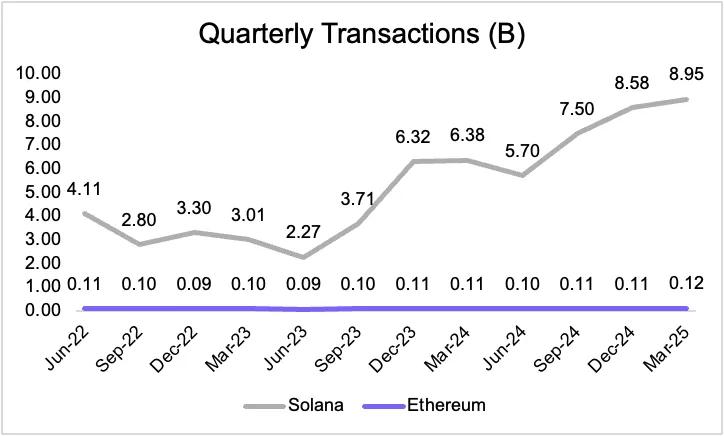

That said, demand for Layer 1 block space may present a layered scenario. In this layered future, both Solana and Ethereum could thrive. Different assets will require different trade-offs between speed, efficiency, and security. However, in the long term, Ethereum—due to its stronger decentralization and security guarantees—may capture a larger share of asset value, while Solana might dominate in transaction frequency.

Figure 10: SOL and ETH Quarterly Transaction Volume

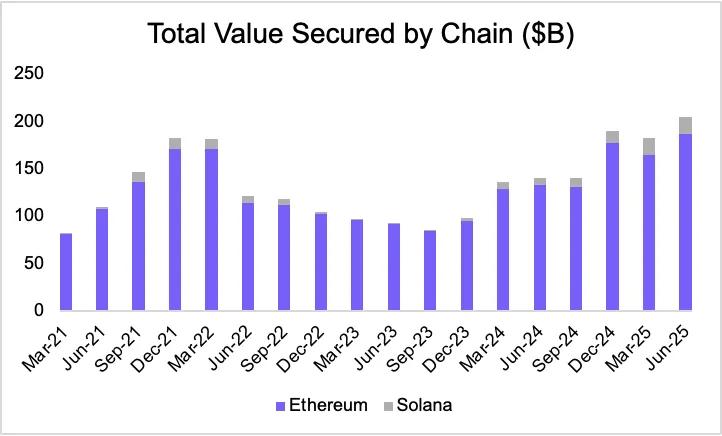

However, in financial markets, the market size for assets pursuing robust safety is far larger than those focusing solely on execution speed. This dynamic favors Ethereum: as more high-value assets move on-chain, Ethereum's role as a fundamental settlement layer will become increasingly valuable.

Figure 11: Total Value Secured On-chain (Billions of Dollars)

Source: Artemis

Reserve Asset Momentum: ETH's MicroStrategy Moment

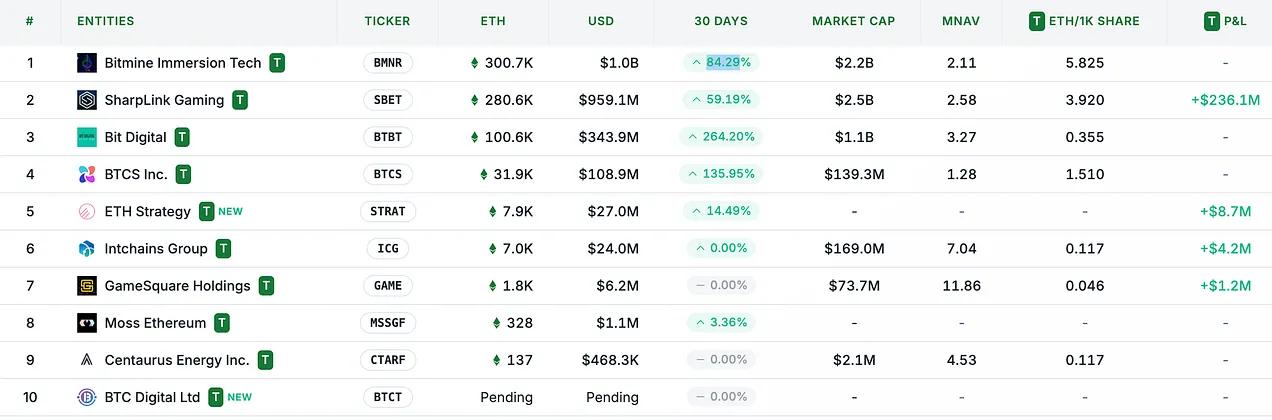

While on-chain assets and institutional demand are long-term structural drivers for ETH, Ethereum's asset management strategy—similar to how MicroStrategy (MSTR) utilizes Bitcoin—could become a continuous catalyst for ETH's asset value. A key turning point in this trend was Sharplink Gaming ($SBET) announcing its Ethereum asset management strategy in late May, led by Ethereum co-founder Joseph Lubin.

Figure 12: ETH Reserve Asset Holdings

Source: strategicethreserve.xyz

Asset management strategies are tools for tokens to acquire traditional finance (TradFi) liquidity while enhancing the per-share asset value of related companies. Since Ethereum-based asset management strategies emerged, these asset management companies have accumulated over 730,000 ETH, and ETH's performance has begun to outperform Bitcoin—which is rare in this cycle. We believe this marks the beginning of a broader trend of Ethereum-centric asset management applications.

Figure 13: ETH and BTC Price Trends

Stay tuned for our upcoming research report that will delve deeper into the evolving landscape of Ethereum fiscal adoption!

Conclusion: ETH as the Reserve Asset of the On-chain Economy

Ethereum's evolution reflects a broader paradigm shift in the concept of monetary assets in the digital economy. Just as Bitcoin overcame early skepticism to win recognition as "digital gold," Ethereum (ETH) is establishing its unique identity—not by mimicking Bitcoin's narrative, but by evolving into a more versatile and foundational asset. ETH is more than just a cloud computing security or a utility token for transaction fees or protocol revenue. Instead, it represents a scarce, programmable, and economically essential reserve asset that underpins the security, settlement, and functionality of an increasingly institutionalized on-chain financial ecosystem.