(This is a sponsored article written and provided by XYZVerse, which does not represent the position of BlockTempo and is not an investment advice, recommendation to buy or sell. Please refer to the disclaimer at the end of the article.)

Solana's rapid transformation from a low-priced token to a high-value asset caught many by surprise, leaving them regretful for not investing earlier. This article will review four emerging Altcoins showing potential growth signs, offering early investment opportunities.

$XYZ Demand Growth, Presale Fundraising Breaks $15 Million Milestone

The official team states that XYZVerse ($XYZ) project combines sports and the cryptocurrency world, attracting significant investor interest. Unlike typical MEME coins, XYZVerse is positioned as a long-term project with a clear roadmap and active community. The project was recently recognized as the Best New MEME Project, further expanding its visibility.

The official team states that XYZVerse ($XYZ) project combines sports and the cryptocurrency world, attracting significant investor interest. Unlike typical MEME coins, XYZVerse is positioned as a long-term project with a clear roadmap and active community. The project was recently recognized as the Best New MEME Project, further expanding its visibility.

Price Dynamics and Listing Plans

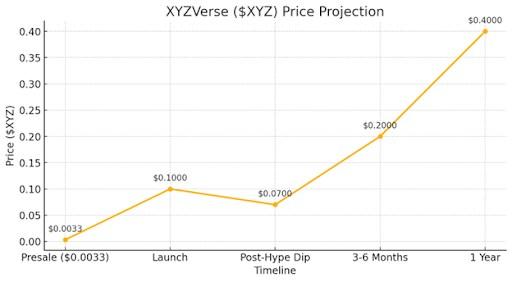

Officials claim that during the presale phase, $XYZ tokens have shown stable growth. Since launch, the price has increased from $0.0001 to $0.003333, with the 13th stage pushing the price further to $0.005. The team expects the final presale price to be $0.02, after which the token will be listed on major centralized and decentralized exchanges.

The official projection for listing price is $0.10, suggesting potential returns up to 1000 times for early investors, contingent on the project achieving the necessary market capitalization.

The presale website shows the project has already raised over the $15 million milestone and is moving towards the next $20 million milestone. This rapid progress demonstrates strong investor demand.

Champion Rewards

In XYZVerse, the community drives competitions. Active contributors are not mere spectators but receive XYZ token airdrops for their contributions. It's a competition where the most passionate players win big.

Path to Victory

Officials claim that XYZVerse is built for victory through robust tokenomics, strategic CEX and DEX listings, and continuous token burning, with each step aimed at driving further development and price growth.

Airdrops, Rewards, and More – Join XYZVerse to Unlock All Benefits

Pi Network (PI)

Over the past week, Pi Network (PI) price slightly increased by 4.48%. After a decline period, the coin dropped 7.33% in the past month and significantly 33.36% in the past six months. Currently, PI trades between $0.42 and $0.47, indicating a consolidation phase in market volatility.

Technical indicators provide mixed signals for PI's future trajectory. The 10-day Simple Moving Average (SMA) is $0.47, slightly above the 100-day SMA of $0.46, suggesting a short-term upward trend. The Relative Strength Index (RSI) at 42.37, below the neutral 50 mark, hints the price might be undervalued. Additionally, the low Stochastic Oscillator at 7.72 may indicate the coin is oversold and potentially ready for a rebound.

For PI to initiate an upward movement, it needs to break the recent resistance at $0.50. Surpassing this could open a path to the second resistance at $0.55, representing potential gains of approximately 6% and 17% from current prices. Conversely, if the price declines, recent support levels are at $0.39 and $0.34, potentially signifying drops of about 7% and 19%. Based on these factors, PI's price could rise if it overcomes resistance or fall if it breaks support thresholds.

Hyperliquid (HYPE)

Hyperliquid (HYPE) has recently experienced significant volatility. Over the past week, the price dropped 7.40%. However, in the past month, the price increased by 23.81%. Looking back six months, the coin's price more than doubled, rising 101.73%.

The current price range is between $42.73 and $49.58. The recent resistance is at $53.15, with support at $39.45. If the price breaks through resistance, it might target the second resistance at $60.00. Moving to this level would represent approximately 20% growth. Conversely, if it breaks support, it could test the second support at $32.60, potentially dropping around 24%.

Technical indicators show mixed signals. The Relative Strength Index (RSI) is 45.29, indicating neutral momentum. The Stochastic Oscillator is low at 11.73, potentially signaling oversold conditions. The MACD level is slightly negative at -0.1073, suggesting bearish momentum. The 10-day and 100-day simple moving averages are both around $40, indicating the price is hovering near its recent average levels. These data suggest Hyperliquid may be preparing to break out in either direction.

Aave (AAVE)

Aave (AAVE) has shown significant price movements recently. Over the past week, its price dropped by 7.35%. In the past month, the price increased by 32.99%. However, looking back six months, the price declined by 10.17%. These fluctuations demonstrate AAVE's volatility.

The current price range is between $307.48 and $340.26. The 10-day simple moving average is $305.62, while the 100-day SMA is $318.53. The Relative Strength Index is 40.30, indicating the coin is approaching oversold territory. The Stochastic Oscillator is 19.90, also suggesting potential oversold conditions. The MACD level is -2.626, pointing to possible bearish momentum.

If the price rises, AAVE could reach the recent resistance level of $355.60. Breaking this point might lead it to a second resistance level of $388, representing a growth of approximately 15% to 20%. If the price falls, it may find support at $290.05 or even $257.27, a decline of about 15% from current levels. These support and resistance levels are key areas to watch in the coming days.

Conclusion

PI, HYPE, and AAVE have growth potential, while XYZVerse (XYZ) has attracted market attention with its sports culture combined with meme coin characteristics and significant growth driven by community participation.

You can find more information about XYZVerse (XYZ) at the following links:

Official Website: https://xyzverse.io/

X: https://x.com/xyz_verse