Goldman Sachs and BNY Mellon announced that institutional investors can now directly purchase "tokenized money market funds" and register their shares on Goldman Sachs' self-built Block chain, with BNY Mellon serving as custodian. This is the first time traditional financial infrastructure has brought the $7.1 trillion money market into a full-time digital ledger.

Digital Reform of Two Giants

According to CNBC's report, the new service has been joined by asset management companies such as BlackRock, Fidelity Investments, and Federal Hermes. After purchasing fund units, the system immediately generates equivalent Tokens, with instant settlement on Goldman Sachs' chain and BNY Mellon simultaneously updating the custody ledger. The settlement process, which previously took one to two days, has been compressed to less than a few minutes.

Policy Momentum

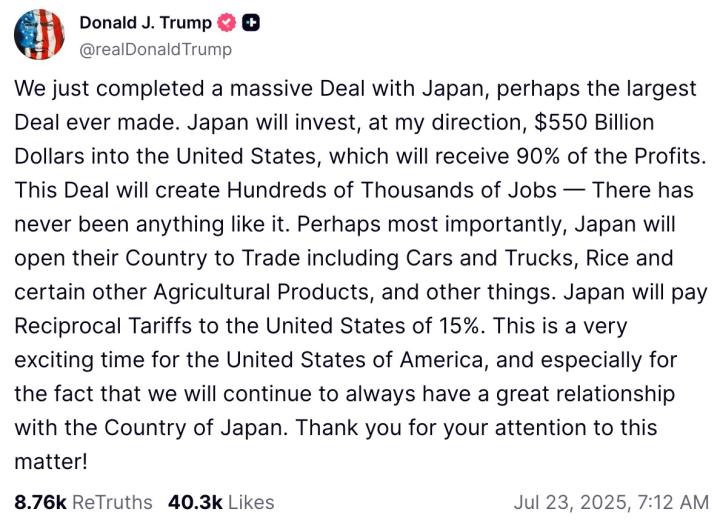

The timing of the two giants launching this service is no coincidence and has certainly been prepared for a long time. The main reason is the recently signed "GENIUS Act" by the Trump administration, which defines the compliance framework for regulated stablecoins and other digital assets, clearing regulatory uncertainties for tokenized funds.

Extended Reading: Thousand-Word Analysis: The Impact of the GENIUS Stablecoin Law is Far More Profound Than You Imagine: Rewriting Financial Rules

After the law was implemented, hedge funds, pension funds, and large corporate CFOs began looking for short-term cash parking spots that can both "earn interest and preserve value". Unlike stablecoins that only serve as a payment medium, money market funds themselves distribute returns, attracting capital back.

Since the rate hike cycle in 2022, approximately $2.5 trillion has flowed into money markets, indicating massive demand.

What Are the Benefits of Tokenization?

Tokenized money market funds can bring three direct benefits. First, instant settlement, with Tokens transferred on-chain and fund registration simultaneously updated, reducing counterparty risk. Second, 24/7 trading, allowing liquidity adjustment even during holidays and after market close (though this may create price differences after holidays). Third, automated compliance, with smart contracts instantly checking trader qualifications and conditions, lowering transaction costs for traders.

Laide Majiyagbe, Global Head of Liquidity, Financing, and Collateral at BNY Mellon, emphasized:

We have enabled clients to transfer tokenized equity across multiple fund issuers, thereby significantly reducing market friction.

Mathew McDermott, Global Head of Digital Assets at Goldman Sachs, added:

The massive market scale means tokenized funds are not just investment tools but can also serve as instant collateral in financial channels.

In the future, brokers can directly place tokenized funds into the Block chain wallet of counterparties, eliminating the process of first redeeming for cash.

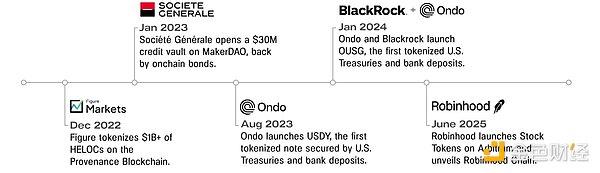

Despite future challenges in tokenization, the two most conservative financial institutions on Wall Street have already taken the first step. As more fund companies, clearing houses, and intermediaries are expected to join, tokenized money market funds are poised to become the first large-scale Block chain application in traditional finance, also laying the groundwork for future RWA tokenization and CBDC experiments.