When Apple and Tesla stocks are traded 7x24 hours on the blockchain, the boundaries between traditional finance and crypto assets are collapsing.

On June 30, 2025, a historic moment arrived in the fintech world: Robinhood, Bybit, and Kraken simultaneously launched US stock tokenization services, converting blue-chip stocks like Apple and NVIDIA into on-chain assets. When EU users trade stock tokens based on the Arbitrum network through the Robinhood app, the century-old wall between traditional stock markets and the crypto world came crashing down.

Robinhood CEO Vlad Tenev declared: "It's time to move beyond Bitcoin and MEME coins. The market is shifting towards 24/7 on-chain trading and real assets with actual utility." Behind this statement lies a comprehensive fusion of Wall Street capital and crypto technology - through blockchain technology, the traditional stock market worth $120 trillion is being recoded, and the crypto market itself is undergoing a profound restructuring of its value logic.

01 Technical Integration: Breakthrough in Stock Tokenization

Stock tokenization is not a new concept, but the core of this outbreak lies in the transformative breakthrough in technical paths and regulatory frameworks. Unlike early synthetic asset models like Mirror Protocol, mainstream platforms now adopt a "real stock-backed" tokenization architecture: licensed institutions purchase and custody real stocks, generating corresponding tokens on-chain at a 1:1 ratio.

Robinhood chose to build its own Layer 2 blockchain, Robinhood Chain, achieving full on-chain integration of issuance, clearing, and settlement. EU users can trade tokens of over 200 US stocks and ETFs, with underlying stocks custodied by third-party banks to ensure asset anchoring reliability.

Kraken and Bybit have integrated with the Swiss-compliant platform Backed Finance's "xStocks" product, covering about 60 stock and ETF tokens, deployed on Solana for efficient trading and DeFi integration. This third-party issuance model transfers compliance responsibilities to professional institutions, with exchanges focusing on matching services, forming a specialized division of labor.

Technical breakthroughs bring three revolutionary experiences:

- 24/7 trading: Breaking free from the NYSE's "9 to 5" time constraints, weekend breaking news no longer leaves investors helpless

- Fractional investing: Supporting 0.01 share-level trading, allowing Apple stock ownership with just a hundred dollars, dramatically lowering investment barriers

- Instant settlement: Blockchain enables "payment is clearing," bidding farewell to traditional T+2 settlement delays

Backed Finance co-founder Adam Levi calls it a "huge leap in financial market access democratization." As stock tokens freely circulate on the Solana chain, the expensive cross-border settlement and intermediary fees in traditional financial systems are being replaced by low-cost on-chain gas fees.

02 Regulatory Breakthrough: From Gray Area to Compliance Channel

The history of stock tokenization is fraught with challenges. In 2021, Binance's Tesla token was taken down after just three months due to regulatory pressure, and FTX's stock tokenization business ended with its bankruptcy. The turning point came during the Trump administration's deregulation policy, fundamentally changing the SEC's attitude towards tokenized assets.

The key breakthrough came from the Exodus Movement case in December 2024. After technical solution adjustments and compliance improvements, this NYSE-listed company finally received SEC approval to tokenize its common stock on the Algorand blockchain, becoming the first US-listed company to achieve stock on-chain.

Regulatory innovation is blooming in multiple areas:

- Sandbox pilot mechanism: SEC Crypto Working Group head Hester Peirce suggests tokenization pilots through a "sandbox structure"

- No-action letter system: Coinbase has submitted a pilot application to the SEC, seeking to issue tokens representing stock ownership

- Cross-border regulatory collaboration: Backed Finance uses a Swiss custody + EU access model to serve global non-US users

The Hong Kong Securities and Futures Commission adopts the principle of "same business, same risks, same rules," which, while not creating a new system, clearly applies existing Securities and Futures Ordinance to tokenized securities. This regulatory inclusiveness clears obstacles for traditional financial institutions to participate in tokenization.

03 Market Restructuring: Silent Revolution in Capital Flows

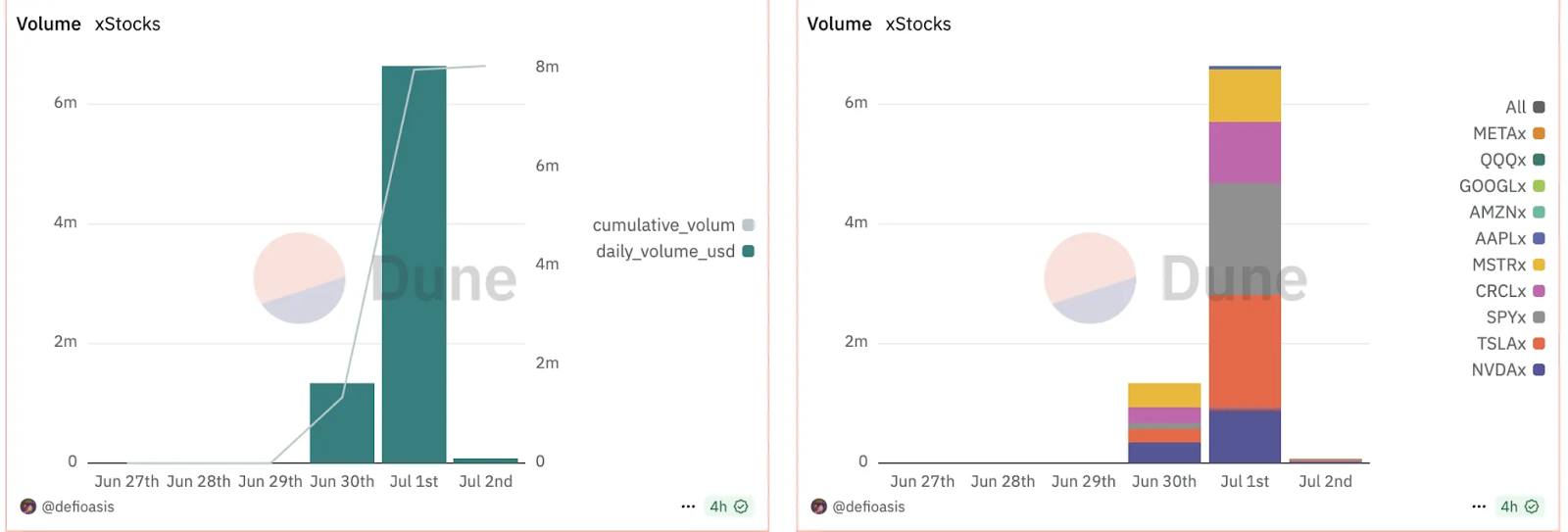

Stock tokenization is causing a structural change in crypto market capital flows. Dune data shows that Backed Finance's xStocks total trading volume is only $8.05 million, with fewer than 8,000 users, but the head effect is obvious: SPYx, TSLAx, and CRCLx tokens have 24-hour trading volumes exceeding $1 million.

This emerging asset class has a dual impact on the crypto market:

- Suction effect emerges: High-quality traditional assets on-chain siphon off altcoin funds, narrative-driven tokens face liquidity drought

- Valuation logic transforms: Investors shift from "betting on the future" to "buying reality," demanding tokens with real yield capabilities

Crypto KOL BITWU.ETH's critique hits the core: "When all traditional quality assets are tokenized, why would investors gamble on an altcoin that 'might build a product'?" This trend forces crypto native projects to rethink value support - either "generate actual application value" as Crypto_Painter says, or move towards "stock perpetual contracts" as Qiao Wang predicts.

Traditional finance is also facing impact. Robinhood plans to tokenize equity of private companies like OpenAI and SpaceX, unlocking primary market liquidity. When quality enterprises can achieve "tokenized listing" through STO, the high-cost traditional IPO model is in danger.

04 Liquidity Dilemma: Gap Between Ideal and Reality

Despite the hot concept, stock tokenization is still mired in liquidity challenges. According to RWA.xyz data, the current total stock tokenization scale is only $388 million, less than 0.003% of the global stock market's total market value of $120 trillion. Compared to traditional markets, on-chain trading volume is negligible.

Dragonfly partner Rob Hadick reveals product structural flaws: Most platforms rely on SPVs purchasing real stocks during US stock market hours, leading to lack of hedging tools for after-hours and weekend trading. Market makers must bear up to 25 basis points redemption fees and unhedgeable price risks.

Technical limitations are also evident:

- Oracle dependence: Delays and manipulation risks in bringing off-chain stock price data on-chain

- Cross-chain fragmentation: Backed's bCSPX token liquidity is scattered across Gnosis and Base chains, difficult to aggregate

- Regulatory fragmentation: US users are excluded from services, global markets are fragmented

Velocity Capital investor DeFi Cheetah points out the core of early synthetic assets' failure: "Lack of meaningful liquidity." When on-chain trading depth is insufficient, price slippage can consume the cost advantages of fractional investing.

05 Future Path: New Ecosystem of Integrated Symbiosis

The ultimate value of stock tokenization lies not just in trading convenience, but in deep integration with traditional financial infrastructure. McKinsey predicts that by 2030, the on-chain physical asset market will reach $2 trillion, with stock tokenization potentially becoming a key breakthrough.

Defensive innovation by traditional financial institutions has already begun. Nasdaq is collaborating with R3 to develop an asset management platform based on Corda blockchain, attempting to respond to crypto trading platforms with institutional-level solutions. This competitive-cooperative relationship may give birth to a hybrid trading ecosystem - traditional exchanges provide asset endorsement, while blockchain networks handle clearing and settlement.

The breakthrough opportunities for DeFi protocols are equally clear. High-dividend blue-chip stocks may become the new darlings of yield-generating DeFi protocols, such as creating an on-chain real yield scenario like Ethena's BUIDL configuration. When stock tokens enter lending protocols like Aave and MakerDAO as collateral, they will activate a liquidity cycle of "tokenization-lending-cash-out-reinvestment".

The improvement of regulatory frameworks will be the trigger point. Hong Kong is exploring the regulatory system for Virtual Asset Trading Platforms (VATP), paving the way for secondary trading of tokenized investment products. If the United States passes stablecoin legislation to solve the fiat currency channel problem, it may completely open up the last mile of traditional funds entering the chain.

On the order books of crypto exchanges, Apple stock tokens and Dogecoin are displayed side by side, with investors from Nigeria buying 0.05 shares of SpaceX private equity using USDT. Wall Street traders short Tesla tokens on Uniswap through MetaMask after the NYSE closes—these seemingly science fiction scenarios are becoming reality in the summer of 2025.

When Galaxy Digital founder Mike Novogratz announces the tokenization of his own stock, and when the Hong Kong Securities and Futures Commission opens the door wide for tokenized securities, the fault lines of financial history are being redrawn on the blockchain.

Tokenized stocks will not kill the crypto market, but they will force it to bid farewell to its wild and savage youth. Those Altcoins supported only by narrative may eventually go to zero, but Bitcoin's scarcity, Ethereum's computing power network, and blockchain applications that truly solve real-world needs will prove themselves to be the future foundation of the digital economy in competition with trillions of dollars in traditional assets.