Written by: Long Yue, Wall Street Insights

As the S&P 500 hits a historic high of 6000 points, the market breadth is approaching its worst record ever.

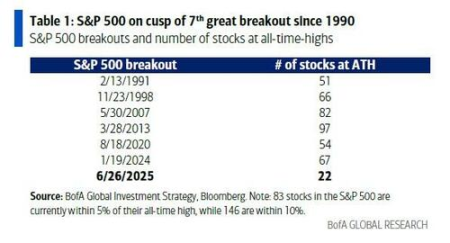

Bank of America's latest report shows that despite the S&P 500 index continuously reaching new highs, this breakthrough has extremely limited participation, with only 22 S&P 500 component stocks reaching their historical peaks.

This number is far lower than during other important breakthrough periods in history—51 stocks hit new highs in February 1991, 66 in November 1998, 82 in May 2007, an impressive 97 in March 2013, 67 in January 2024, and 54 in August 2020, all far exceeding the current 22.

Bank of America analyst Michael Hartnett noted that this is the seventh major breakthrough since 1990 with the fewest participating stocks.

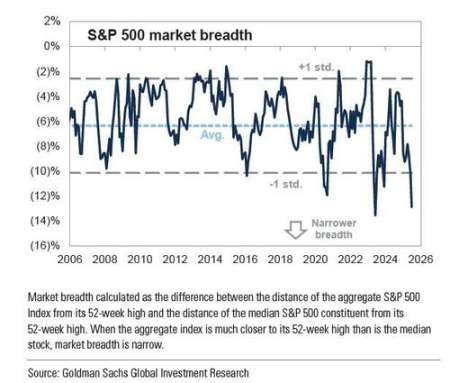

Goldman Sachs' trading team recently emphasized this unprecedented market breadth deterioration. The firm's US equity strategy head, David Kostin, pointed out in his latest report that "the S&P 500's rally shows extremely narrow characteristics, arguably one of the most concentrated rallies in the past few decades".

He warned that the S&P 500's market breadth is about to reach a historic low. Data shows that traditional market breadth indicators—measuring the divergence between index and component stock performance—are about to hit a historic low.

Extreme Concentration Led by Tech Stocks

Tech stocks once again became the primary driver of US stock gains, continuing the trend of the past year and highlighting the extremely concentrated nature of this bull market.

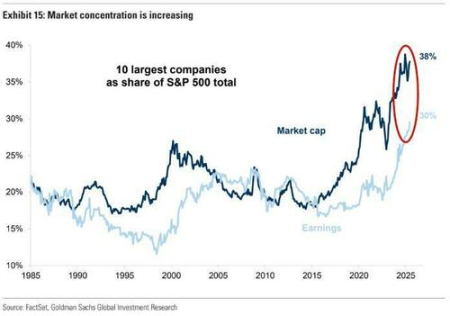

Goldman Sachs strategist Peter Oppenheimer's latest research shows that the top ten companies currently account for 38% of the S&P 500's market value and 30% of its profits, both historical records.

This extreme concentration reflects the market's over-reliance on a few tech giants, especially the so-called "Mag7" (seven major tech stocks) playing a decisive role in driving index performance.

The Russell 2000 index's performance further confirms the market's divergence. The index is currently still down about 11% from its historical high, in stark contrast to large-cap stocks' strong performance.

Future US Stock Gains May Slow

Despite strong technical momentum, Goldman Sachs has a relatively conservative outlook for the next 12 months. Kostin expects the S&P 500 to rise 5% to 6500 points in the next 12 months, which seems quite moderate considering the index has already risen nearly 5% in the past two weeks.

It's worth noting that July has historically been one of the strongest months for the S&P 500, never recording a negative return in the past decade, with an average return of 1.67%. Goldman Sachs' trading team predicts the market may peak around July 17 before a pullback, but also acknowledges that "risk events" in July could advance this timing.