Source: Grayscale Research; Translation: Jinse Finance xiaozou

Key Points

In a relatively calm month for cryptocurrency valuation, market focus was on fundamentals, with significant positive progress in stablecoins.

The GENIUS Bill passed with bipartisan support in the Senate and was submitted to the House for review, which will introduce regulated payment stablecoins to the United States. Meanwhile, U.S. stablecoin issuer Circle completed its listing, with its stock price rising (in contrast to the declining valuations of Mastercard and Visa), highlighting the potential disruptive impact on traditional digital payment networks. Other media reports indicate that large enterprises like Amazon and Walmart are also exploring stablecoin business.

Monetary and financial crypto asset sectors outperformed the overall crypto market, with the latter's strong performance potentially stemming from improved regulatory transparency and broader adoption prospects of DeFi technology. The prediction market Polymarket benefited from attention around the New York mayoral election and successfully secured additional venture capital.

We anticipate that improved regulatory transparency and favorable macroeconomic conditions (large budget deficits and potential interest rate cuts) will continue to support crypto assets in the second half of 2025.

Introduction

Despite continuous negative news, the market achieved strong returns in June 2025. This divergence can be explained by two characteristics of the current market context: First, although the market faces many challenges, the worst-case scenarios have not actually occurred. While the U.S. economy shows signs of slowing, global trade has not stalled; as tariff threats persist, the White House announced a trade agreement with China; and even with ongoing military conflicts in the Middle East, oil transportation has not been significantly interrupted. Since financial markets price in all possible outcomes (not just baseline scenarios), avoiding tail risks is sufficient to support valuation increases.

Secondly, the overall macroeconomic policy mix remains favorable (except for tariff increases). The U.S. federal government maintains large budget deficits despite low unemployment, and the recently passed OBBBA (One Big Beautiful Bill Act) will continue most economic stimulus measures. Moreover, the Federal Reserve is likely to ease monetary policy later this year. Such supportive macroeconomic policies help the economy and markets withstand volatility from tariffs, geopolitical conflicts, or other issues.

Asset returns in June showed a pro-growth tendency. After risk adjustment, emerging market stocks, high-yield bonds, and industrial metals led other market sectors, consistent with investors' increased risk appetite (Figure 1). The U.S. dollar exchange rate continued to weaken, dropping approximately 10% since its January peak (based on the Bloomberg Dollar Index). Bitcoin price increased by 3% that month, which is relatively limited considering the asset's typical volatility. The market-cap-weighted FTSE/Grayscale Crypto Asset Total Market Index rose 1.5% this month.

Figure 1: Most Stock and Bond Markets Achieved Strong Returns

1. Stablecoin Momentum

The crypto industry has begun describing the recent breakthroughs in this sub-sector as "Stablecoin Summer". Interestingly, stablecoins are now most widely used in emerging markets in the Global South... where it is winter. However, the latest developments indeed point to regulatory changes and corporate applications that may drive stablecoin adoption in developed economies like the United States.

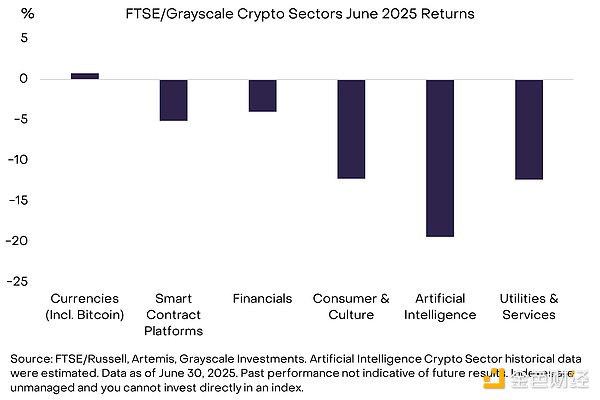

[Translation continues in the same manner...]According to the FTSE/Grayscale series index, the monetary and financial crypto asset sectors showed outstanding performance among various crypto sub-markets (Figure 4). The gains in the monetary sector mainly reflect Bitcoin's slight price increase. In the financial sector, Hyperliquid, Uniswap, Aerodrome, Maple Finance/Syrup, and Aave contributed the largest positive returns, with all these projects currently featured in the Grayscale Research Top 20 list. Decentralized exchanges (DEX) like Hyperliquid, Uniswap, and Aerodrome are now competitive with centralized exchanges (CEX) in terms of pricing and may continue to maintain an advantage in long-tail chain asset trading.

Figure 4: Monetary and Financial Crypto Asset Sectors Demonstrate More Stability

Figure 4: Monetary and Financial Crypto Asset Sectors Demonstrate More Stability

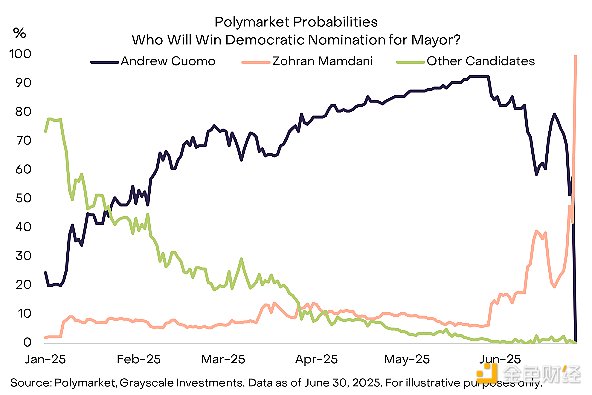

In our view, apart from stablecoins, no crypto application has achieved a more breakthrough success than prediction markets over the past year. Due to public attention from the New York mayoral election, NBA Finals Game 7, and global conflicts, Polymarket's popularity surged again in late June (Figure 5). The two largest trading prediction markets, Polymarket and Kalshi, both received additional investor funding in June: Polymarket raised $200 million from institutions like Founders Fund at a valuation exceeding $1 billion, while Kalshi raised $185 million from institutions like Paradigm at a $2 billion valuation.

Figure 5: Polymarket Captures Shift in New York Democratic Mayoral Primary

Figure 5: Polymarket Captures Shift in New York Democratic Mayoral Primary

Macro-level demand for Bitcoin can be considered the most important driver of crypto asset categories to date. However, June's developments well reminded us of the broad technological scope supporting blockchain finance, including stablecoins, decentralized exchanges, and prediction markets. Although crypto valuations slightly pulled back in June 2025, the industry's fundamentals continue to improve, and we believe this will be reflected in valuations over time.

Additionally, the macro policy background may continue to remain supportive in the coming months. In the short term, the "Big Beautiful Act" may soon be signed by President Trump. Budget experts estimate that according to the current text, the bill will increase the federal deficit by approximately $3 trillion over the next 10 years, potentially rising to $5 trillion if certain expiring provisions are extended. Moreover, Trump has repeatedly called for the Federal Reserve to cut interest rates. Although the Fed is an independent institution, Trump will have the opportunity to appoint a new chairman next year (subject to Senate confirmation). Overall, we believe that ongoing fiscal deficits, lower real interest rates, and a potentially weakening dollar will form a favorable combination of drivers for Bitcoin and crypto asset categories.