Jessy, Jinse Finance

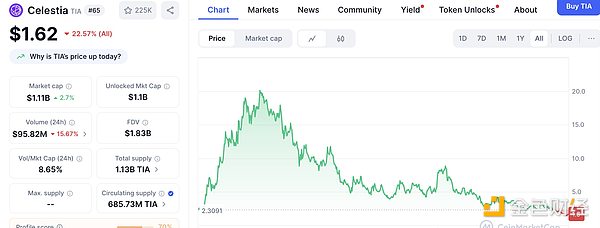

TIA, which once shone brightly with tenfold gains after listing on exchanges during the small bull market in early 2024, has now fallen below its initial listing price, currently priced at 1.62U, dropping over 90% from its peak of around 20U. As the former leader of modular blockchain, TIA is now deeply mired in negative public opinion surrounding founder sell-offs and internal management issues.

The fall of the once-stellar TIA token is not just a symbol of the decline of the modular blockchain track. The collapse of a once-hot leading project is merely a surface-level phenomenon. The deeper truth is that the narratives that were once buzzing in the crypto space are gradually being debunked.

On one side is the stock market's euphoria with Nasdaq reaching new highs, while on the other side, the narratives of crypto projects are crumbling and token prices are plummeting. The traditional crypto narratives are no longer working, and the industry has arrived at a moment of true ground-level implementation and application.

From Glory to Decline

TIA, full name Celestia, was one of the most watched modular blockchain projects from late 2023 to early 2024. During the small bull market in early 2024, the TIA token soared from single digits after airdrop to a high of $20, with its vision of combining Cosmos' sovereign interoperability with Ethereum's rollup-centric shared security.

However, from the second half of 2024, as market heat declined and project ecosystem progress slowed, CelesTIA's governance and team issues gradually surfaced. The most controversial was the collective token sell-off by top executives. Twitter user @0xCircusLover revealed that all C-level executives had unlocked tokens as early as October 2024 and began massive token sales, with co-founder Mustafa reportedly selling over $25 million in tokens off-market before quietly relocating to Dubai.

Meanwhile, CelesTIA's marketing efforts also backfired. KOL @ayyyeandy, who previously endorsed TIA, was exposed for charging substantial promotion fees. Media platform Bankless co-founder David Hoffman, despite frequently recommending TIA, showed contradictions on the key question of token ownership, further fueling community suspicions about whether the project was merely a capital-driven marketing product.

Deeper internal fractures came from management, with former developer relations head Yaz Khoury being fired for alleged sexual harassment, sparking a PR crisis. CelesTIA was reported to have bought out competitor Abstract for seven-figure sums and forced them to exit their collaboration with EigenLayer. Such "exclusive acquisitions" sparked significant controversy and exposed the team's anxiety about expansion paths.

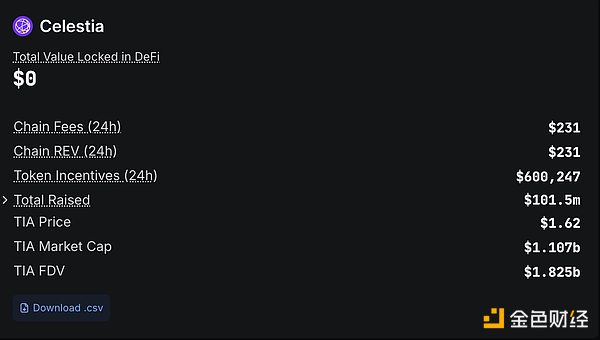

As token price collapsed and community trust neared breakdown, co-founder John Adler proposed a radical governance model of "governance as proof" in early 2025, advocating for off-chain governance voting to replace traditional proof-of-stake mechanisms to address ongoing inflationary pressures. However, before this disruptive proposal could be implemented, executive token sales were exposed, leading the community to view it as a governance facade aimed at stabilizing prices and concealing issues. As of publication, its price has dropped over 90% from its peak. According to defillama data, its on-chain gas income in the past 24 hours was merely $231.

Behind TIA's Decline: The Collapse of Crypto Industry Narratives

However, TIA's demise is not just the failure of a single project and token. It's a glimpse into the broader disillusionment of new narratives in the crypto industry.

In past cycles, modular, AI Agent, DePIN, GameFi, Non-Fungible Token, and others had blown massive bubbles, attracting waves of capital and retail investor frenzy. By 2025, we're witnessing the collective collapse of these narratives, with Altcoins in widespread decline.

Similar to TIA, once-hyped projects like Worldcoin and Helium, which were capital darlings, rapidly accumulated traffic and token price surges by riding narrative waves, only to quickly cool down after the initial hype.

The fall of these star tokens, including TIA, reflects a deeper crisis in the crypto industry: without genuine technological innovation and user adoption, narratives and trust will continue to be consumed and diluted. After modular blockchain, no new narratives are emerging at the public chain level. Looking at other tracks in the industry, most blockchain and AI integration projects remain conceptual, while RWA faces not just regulatory issues but a profound question of real demand.

Previous trends are being systematically debunked and quickly forgotten, while traditional financial markets continue to bring positive news. Crypto-compliant stocks in US and Hong Kong markets, such as stablecoins and compliant exchanges, have seen continuous rises.

On one side is the lack of native crypto innovation and token price crashes, on the other is capital and market enthusiasm for compliant crypto projects in US and Hong Kong stocks. Some believe this signals the "end of the industry," but the author believes this is actually a warning to project teams that true technological innovation and application implementation are the only ways to create real value. The old crypto playbook of storytelling, traffic generation, and pump-and-dump no longer works. Like Web2 projects, Web3 projects now compete on implementation.