This year, we have witnessed that the tokenization of real-world assets (RWA) has become an irreversible trend. From Kraken's plan to launch tokenized stocks to Coinbase's intention to list its own stocks; from traditional financial giants like BlackRock and JPMorgan stepping in, to top DeFi protocols incorporating RWA into their collateral frameworks - tokenization is fundamentally reshaping the liquidity and accessibility of assets.

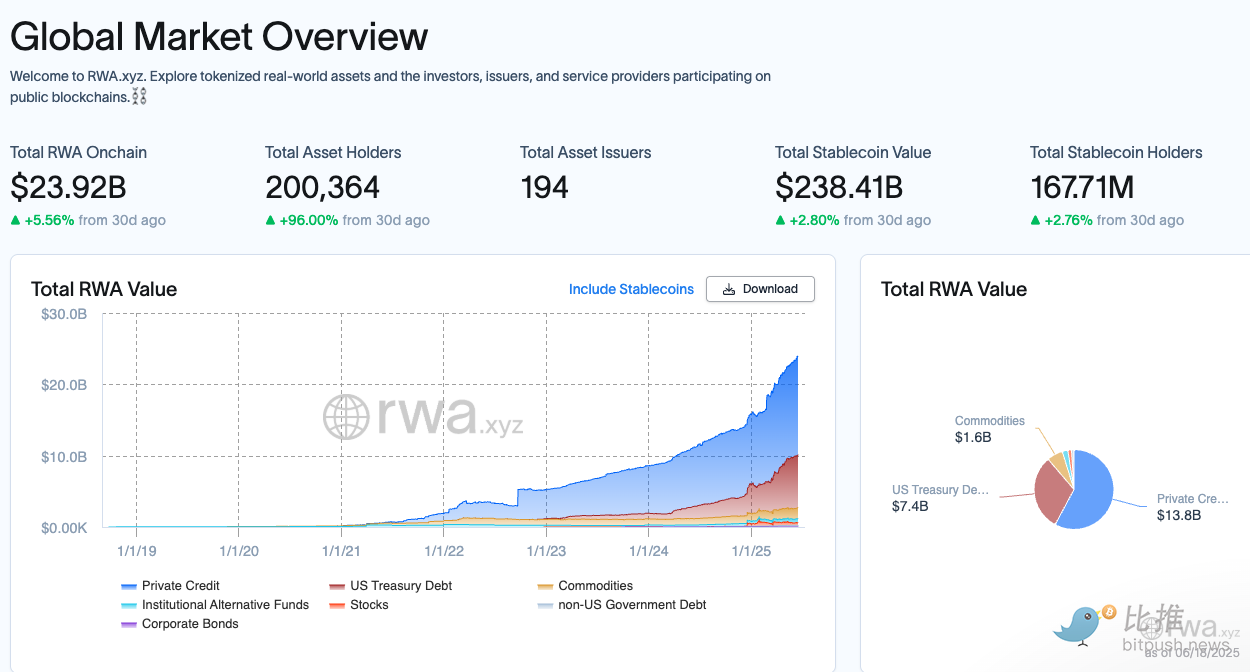

Despite challenges in regulatory adaptation and infrastructure improvement, the RWA track has shown explosive potential: the total locked value (TVL) of tokenized US Treasuries, real estate, luxury goods, and other assets has exceeded billions of dollars. According to rwa.xyz data, the on-chain total managed value of the RWA market reached $23.92 billion at the time of writing. Moreover, according to the Boston Consulting Group's prediction, the global tokenized asset scale will reach $16 trillion by 2030, accounting for 10% of all investable assets.

This article will analyze the most promising RWA sub-tracks and list the most representative leading projects in each field.

[The rest of the translation follows the same pattern, maintaining the structure and translating all text while preserving the <> tags and their contents.]Propy digitalizes real estate transactions through blockchain, allowing investors to participate in the global real estate market through tokenization. The platform has successfully conducted the world's first real estate transaction completed on blockchain.

RealT

RealT divides real estate assets into small tokens, allowing global investors to participate in the real estate market. Through tokenization, RealT enables investors to enjoy monthly rental income and provides more transparent transactions.

Parcl

Parcl combines blockchain with real estate market data, offering global real estate market investment opportunities for investors. The platform provides more diverse real estate investment options through an innovative data model.

Art & Collectibles Tokenization: New Investment Paths for Collectors

Tokenization of art and luxury goods not only breaks traditional market boundaries but also allows more investors to participate in high-value collectible investments.

Courtyard.io

Courtyard.io tokenizes art through blockchain, enabling artworks to be traded like other crypto assets. The platform attracts numerous art investors and collectors, offering a new investment approach.

Tiamonds

Tiamonds tokenizes precious items like diamonds, allowing investors to buy and trade these assets through blockchain. The platform provides investors with a highly liquid and transparent investment platform.

WATCHES.io, COLLECTOR, DVIN: These platforms focus on tokenization of luxury watches, art, and high-end collectibles, offering a new asset investment channel.

Decentralized Exchanges: A New Era of Crypto Asset Trading

Decentralized exchanges (DEX) provide a more transparent and secure trading experience for the crypto market, avoiding intermediary fees of traditional centralized exchanges.

DigiFT

DigiFT is a decentralized exchange focusing on trading financial derivatives and structured products. Through decentralization, DigiFT enables traditional financial assets to be traded on blockchain.

Swarm

Swarm is a decentralized platform supporting tokenized asset trading, providing transparent transaction records. Swarm's decentralized architecture allows global investors to participate in asset tokenization and trading.

Mauve, Stobox

These two platforms focus on building decentralized exchanges, providing digital asset management and trading services.