Original: TheRoundTrip

Compiled by: Yuliya, PANews

In the era of rapidly evolving stablecoins amid ongoing controversy, the true trends are often obscured by the noisy market voices. To restore the authentic narrative of this field, PANONY and Web3.com Ventures have jointly launched an English video program called 'The Round Trip'. Hosted by John Scianna and Cassidy Huang, this episode focuses on the global dynamics of stablecoins - from Jack Zhang, co-founder of the $6 billion fintech company Airwallex, directly stating that "stablecoins are meaningless", to Stripe investing over $1 billion in building stablecoin infrastructure; from Shopify integrating stablecoin payment solutions to Ant Group pursuing stablecoin licenses across multiple jurisdictions.

Meanwhile, a Bitcoin sidechain attracted nearly 3,000 wallets injecting $1 billion in stablecoin funds within 30 minutes. Is this a fleeting speculative frenzy or the prelude to a new financial order?

This episode will delve into the division surrounding stablecoins: on one side, financial technology giants are cautiously observing, while on the other, Web3 enterprises and global users are rapidly embracing digital dollars. This is not just an internal debate within the crypto industry, but a global competition for the dominance of next-generation financial infrastructure.

*Note: This video was published on June 13th, and some data and dynamics may differ from the current situation.

Questioning Stablecoins

Jack Zhang, co-founder of Airwallex, which just completed a $300 million Series F funding round with a valuation of $6.2 billion, holds a strong skeptical stance towards stablecoins - announcing on Twitter: "In 15 years, I haven't seen any crypto use case truly solve an actual problem."

He believes that in payments involving major currencies like USD, Euro, and Yen, stablecoins not only fail to reduce costs but actually increase transaction fees, especially during on-chain transactions and fiat conversions (such as converting USDT back to fiat on Kraken), and cannot substantially improve large-scale B2B payments.

Jack argues that the fintech sector has already achieved near-instant, low-cost cross-border payments by building proprietary banking networks and forex bridges. Stablecoins offer no significant advantages. They might have applications in emerging markets and among unbanked populations, but overall, they are more about "regulatory arbitrage" than benefiting end-users and enterprises.

(Related reading: Airwallex CEO Harshly Criticizes Stablecoins, Facing Crypto Community "Siege", Whose Cheese Did Stablecoins Touch?)

Rapid Institutional Embrace

In stark contrast to Airwallex's cautious attitude, a group of tech giants and institutions are enthusiastically embracing stablecoins:

Stripe: Acquired wallet infrastructure startup Privy and purchased stablecoin infrastructure company Bridge for $1.1 billion, committed to building a comprehensive stablecoin and crypto wallet ecosystem. Stripe is launching stablecoin products for the US, UK, and Europe, planning to cover all its merchants by year-end. Shopify and Coinbase have also joined the lineup, supporting merchants to directly accept USDC and even incentivizing merchants to retain USDC through cashback, thereby reducing currency conversion costs.

DTCC (Depository Trust & Clearing Company): As the behind-the-scenes clearing institution for almost all US securities trades, with an annual transaction volume of $200 trillion, DTCC is piloting USD-backed stablecoins to modernize settlements. This signifies the potential to move from T+2 to instant settlement, taking the first step towards tokenizing stocks.

Societe Generale: Launched USDCV, a USD stablecoin compliant with MiCA regulations and custodied by BNY, issued on Ethereum and Solana chains, marking the entry of European traditional financial institutions into the stablecoin realm.

Ant Group: Preparing to apply for stablecoin issuance licenses targeting Hong Kong, Singapore, Luxembourg, and other digital asset regulatory frontiers. Especially with Hong Kong set to implement a stablecoin issuance licensing system in August, Ant Group intends to seize market advantage. As a payment giant with significant influence in China and overseas, Ant's stablecoin launch will further drive cross-border payments, fund management, and settlement innovation.

Market Demand Explosion: Plasma's Case

Despite some fintech founders' reservations about stablecoin prospects, the market's other end presents a completely different landscape: retail investors and emerging on-chain innovations are advancing at an unprecedented speed.

In a recent token-related event by Plasma, deposit limits reached $1 billion (initially set at $500 million but doubled due to overwhelming demand). The event reportedly attracted around 3,000 wallets, with median deposits of $24,895 and $6,939 in two rounds. 58% of funds came from USDC, 40% from USDT. Some users even paid up to $100,000 in fees to ensure transaction speed. Notably, these deposits were not for direct token sales but to gain priority access to future XPL token sales.

The high participation and rapid sell-out might be related to Plasma's previous institutional support from Founders Fund, but some believe investors might misunderstand the project's actual situation. Industry professionals remain cautious about Plasma's independent chain necessity, suggesting potential market overheating.

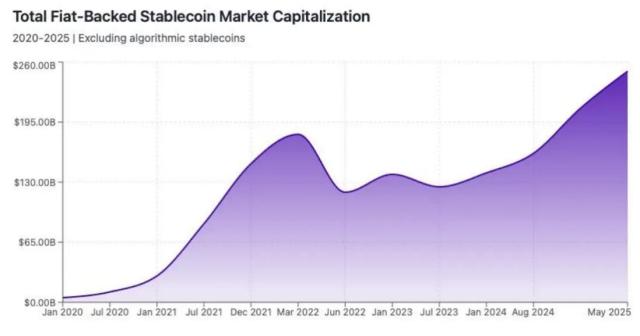

The Significance of Stablecoins: Competing for Financial Infrastructure Control

We are currently witnessing a crucial transformation in the future of financial infrastructure. Despite skepticism from traditional fintech companies like Airwallex, more financial giants from Stripe to Ant Group, from DTCC to Societe Generale, are actively positioning themselves in the stablecoin domain. This is not merely a debate about cryptocurrency but a critical battle that will determine the trajectory of next-generation financial infrastructure. In this transformation, stablecoins are gradually evolving from a controversial concept to the core infrastructure reshaping global payment systems.