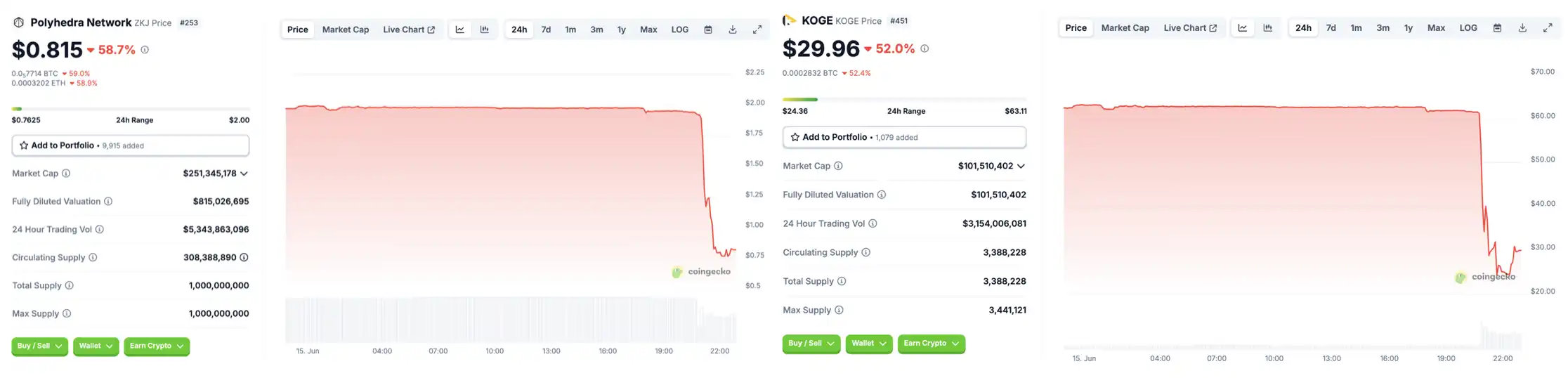

Previously, $ZKJ and $KOGE, the most popular cost-effective tokens on Binance Alpha, both suddenly collapsed.

On Binance Alpha, this token combination was once considered the most cost-effective tool tokens, with extremely high LP annual returns and extremely low slippage experience, quickly becoming the preferred pool for Alpha users. A large amount of funds pouring in and increased trading activity created an illusion of "stable growth", which also laid the groundwork for subsequent systematic trampling.

To understand the beginning of all this, one must first return to the incentive mechanism of Binance Alpha itself.

Everything Starts with Binance Alpha

Binance Alpha is an incentive mechanism launched by Binance at the end of 2024, where users obtain points by providing LP, participating in transactions, and holding interactions, which can be used to participate in platform periodic airdrops and exclusive activities.

Due to its clear incentive ratio and clear distribution rhythm, since its launch, it has gradually become a focus for users seeking benefits, with volume brushing and LP grouping becoming the most mainstream scoring methods, indirectly giving birth to token combinations specifically optimized for Alpha.

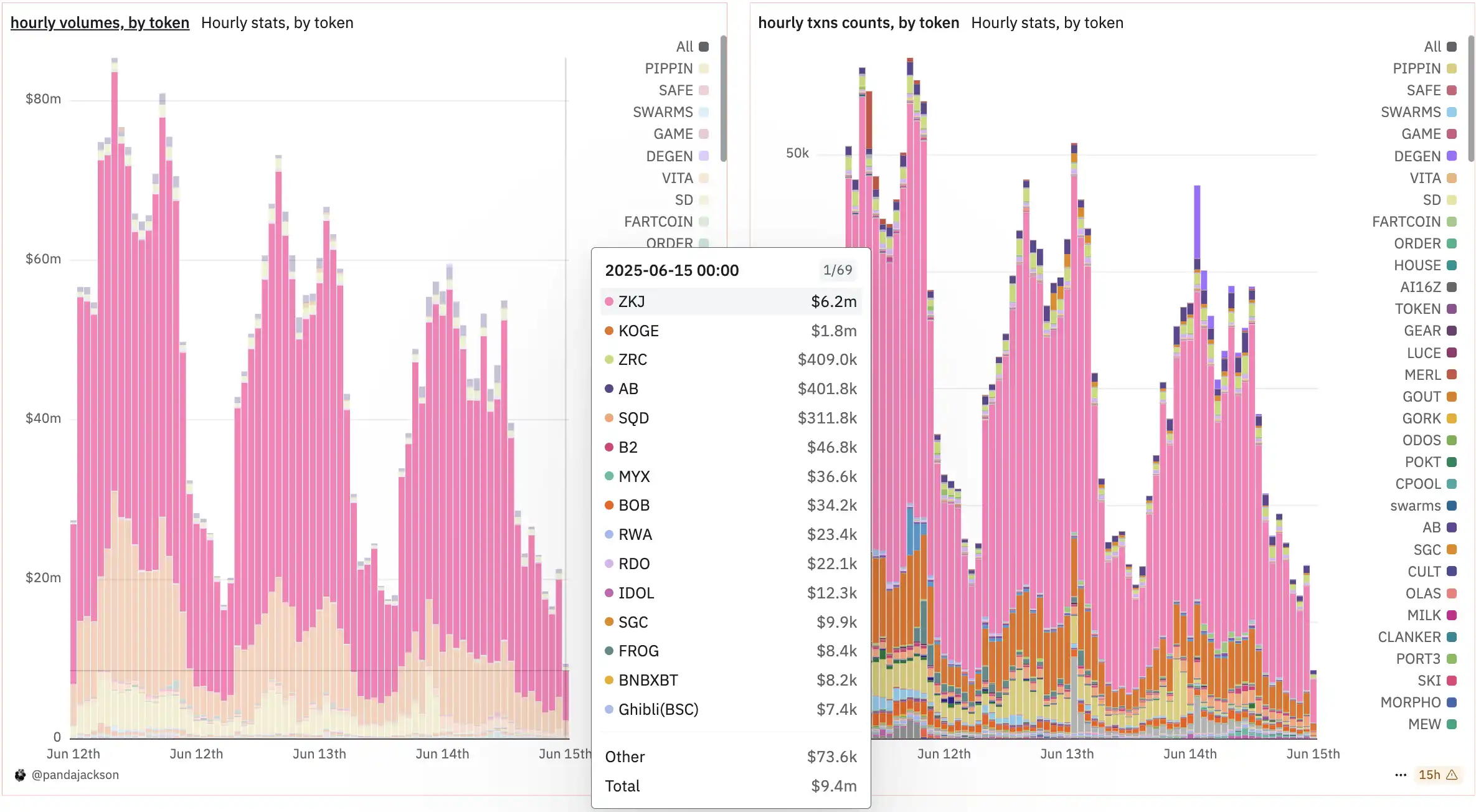

According to @pandajackson42's data panel, on June 14th alone, Binance Alpha's total trading volume reached $987 million, with ZKJ and KOGE trading volumes of $703 million and $159 million respectively, occupying the top two positions on the list.

However, after reaching a peak trading volume of $2.04 billion on June 8th, Alpha activity continued to decline, with the trading volume on the 14th sliding more than 50% from the peak. On the same day, Binance announced an upcoming adjustment to the airdrop distribution mechanism, dividing it into "qualification-based collection" and "first-come, first-served" stages, which some community members viewed as an indirect catalyst for large investors' early withdrawal and LP exit.

In the Alpha point acquisition mechanism, trading volume and liquidity provision weights are too high, triggering the prevalence of a "market-making—volume brushing—counter-trading" trio, with $ZKJ and $KOGE's dual-token pool becoming a typical sample.

A Conspiracy of Large Investors?

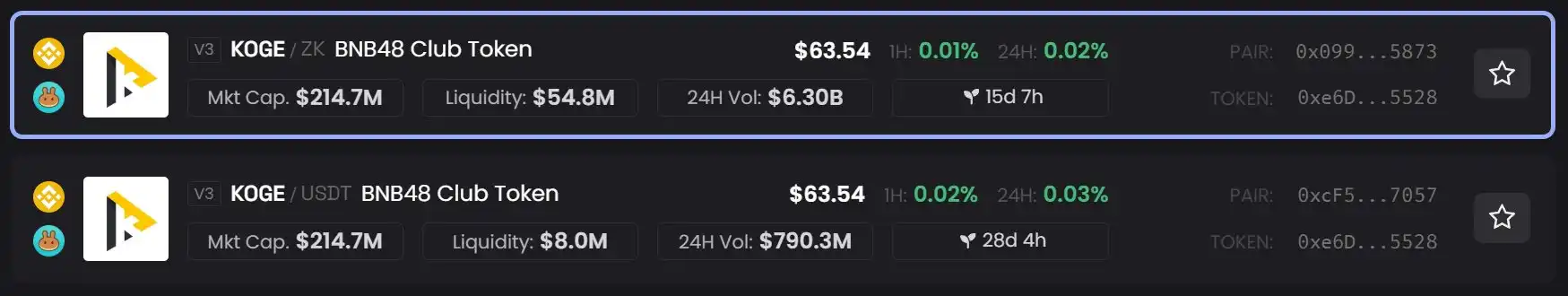

Previously, the project team constructed the KOGE/ZKJ trading pair and opened permissions to external liquidity studios, extensively guiding funds to participate in volume brushing. Meanwhile, $KOGE's liquidity in BNB and USDT pools has always been shallow, meaning even large funds would find it difficult to directly convert KOGE into mainstream assets.

Image source: @Emilia88_eth

During the period of high APY, KOGE and ZKJ's large investors continuously added LP to push up pool liquidity and encourage more users to join. Their core logic was: KOGE itself lacks sufficient trading scenarios and external demand, unable to directly sell. While ZKJ has enormous open interest in the contract market with stronger monetization capability. Based on Router's automatic path selection mechanism, constructing the KOGE/ZKJ trading pair could both enhance liquidity and lay the groundwork for subsequent selling.

[Translation continues in the same manner, maintaining the specified token translations]For Binance, Alpha remains an important tool for improving on-chain activity and guiding quality projects, but its sustainability will depend on more comprehensive risk control and incentive design.

Looking back, $ZKJ's collapse was not a black swan event, but an inevitable result under the illusion of "low fees". Liquidity does not equal legitimacy, narratives can amplify risks, and coordinated exits are never accidental. In the crypto market, high-yield structures lacking a value closed loop are scripts preset for stampedes, and the ZKJ and KOGE incidents once again confirm this rule.