Source: Techub News Column Market Dynamics

As the world's most dynamic smart contract platform, Ethereum is entering a stage of accelerated development driven by both underlying innovation and external catalysis. Its Layer 2 expansion technology is gradually maturing, and the application ecosystems such as DeFi, RWA, and social networking are booming. Coupled with the continued increase in traditional financial capital, Ethereum is becoming the core of a new round of blockchain infrastructure revolution.

However, behind the noise, what really determines the future development path of Ethereum is often not market sentiment, but the flow of on-chain technology funds and the evolution of governance philosophy. In particular, the Ethereum Foundation’s fiscal policy, its funding direction, technology bets and value preferences, are forming a “signal set” that has been underestimated by the market for a long time.

This report will take "EF's latest fiscal policy" as the main research axis, combining macro market trends and the evolution of Ethereum's expansion, to comprehensively analyze a new route that is likely to trigger a hundredfold return - Unstoppable Rollup , and its core implementer: Facet Protocol , and conduct in-depth research and investment recommendations around the most promising tokens and projects in its ecosystem.

This report attempts to answer three questions:

- Why are traditional institutions significantly increasing their Ethereum holdings at this time?

- What technical direction does the Ethereum Foundation’s financial movements suggest?

- Who is the representative project of Unstoppable Rollup? Who are the potential targets in its ecosystem?

1. Ethereum's positive news is frequent - macro trend and capital signal analysis

1.1 Traditional institutions continue to increase their holdings of Ethereum: looking at long-term value from the perspective of allocation trends

Since May 16, ETH spot ETF has achieved 15 consecutive days of net inflows, with a cumulative inflow of about $830 million, while BTC spot ETF has shown signs of continuous outflows. This shows that traditional institutions led by BlackRock are continuously increasing their allocations to Ethereum, reflecting that the capital market is recognizing Ethereum's positioning as the "world computer."

Ethereum inflows continue to release key expectations, with inflows exceeding $800 million for 15 consecutive days, indicating that current institutions tend to hold Ethereum for the long term rather than short-term speculation. Considering the upcoming Ethereum ETF pledge and RWA premium landing, this trend is expected to remain strong.

1.2 US SEC shift: What does the relaxation of pledge regulation mean?

On May 29, the U.S. SEC issued an official statement: common modes such as self-pledge, third-party entrusted pledge, and pledge by a custodian do not constitute securities transactions, and ancillary auxiliary services (such as slashing coverage, early unlocking, adjustment of reward distribution methods, asset aggregation, etc.) do not change the nature of pledge and do not constitute securities.

This clear statement clears the way for Ethereum spot ETFs to incorporate staking incentive logic. Previously, ETH ETFs lacked yields due to the inability to stake, and the latest guidance may allow the inclusion of a staking income structure at the ETF level in the future.

Taking BlackRock as an example, the current management fee of ETH ETF is 0.25%. If all of it is used for staking, the annualized rate is 3%, and the income from staking will be 12 times the management fee. It can be imagined that staking is a huge temptation for issuers, and there is enough motivation for issuers to attract more customers, thereby pushing up the price of ETH.

ETH as the main pledge asset will be more in line with the logic of long-term value placement, especially under the compliant path, it has the ability to attract long-term deposits and support prices.

1.3 The underlying chain of RWA outbreak: Ethereum is still the core carrier

RWA, or the on-chainization of real-world assets, is a key breakthrough in the integration of traditional finance and blockchain. Whether it is the securitization of real estate assets or the on-chain issuance of US dollar bonds, the underlying layer requires an execution platform that is "highly neutral and has strong procedural certainty."

Ethereum, with its high degree of decentralization, global consensus, and EVM standards, is becoming the most preferred platform for global RWA projects. For example:

- The on-chain version of the bond fund issued by Franklin Templeton is deployed on Ethereum;

- The Hong Kong Monetary Authority’s pilot project on tokenizing government bonds uses the Ethereum mainnet;

- The blockchain experiments of many sovereign funds are all based on "Ethereum compatibility".

The entry of the RWA ecosystem will further consolidate Ethereum’s position as the “world computer”.

1.4 Why is national capital more likely to bet on the Ethereum mainnet?

Recently, Joe Lubin (Ethereum co-founder and Consensys CEO) revealed that Consensys is "in talks with major sovereign wealth funds and banks in a very powerful country about possibly building on Ethereum."

Judging from the policy trends of countries such as the UAE, Hong Kong, Singapore, and France, the attention paid to the "decentralized underlying layer" at the sovereign level is increasing significantly. On the one hand, there is a demand for technical security and anti-censorship, and on the other hand, there is a compliance exploration of the "neutral execution platform."

Against the backdrop of Bitcoin's lack of programmability and contract governance tools, Solana's inadequate stability and infrastructure, and other Layer 1s' lack of a global developer ecosystem, Ethereum is comprehensively balanced in terms of governance transparency, community inclusiveness, and technological evolution path, and is best suited to connecting with a national asset management framework .

2. Strategic Guidance in Fiscal Policy: Ethereum Foundation’s Funding Allocation Philosophy and Decentralization Priority

2.1 Fund allocation strategy preference: from centralized compromise to decentralized order

In June 2025, the Ethereum Foundation (EF) released a new Treasury Policy, which clearly expressed its preference for funding protocols that are “ permissionless, censorship-resistant, and have strong mainnet inheritance .”

EF clearly proposed to regain the "Cypherpunk Goals" in the policy document:

- (Privacy by default)

- (Censorship resistance)

- (Minimal, unstoppable base-layer execution)

- (Permissionless economic participation)

This means that the Ethereum Foundation will use most of its future funds to build systems without governance backdoors , promote the implementation of the "open source + tamper-proof + self-operating" protocol, and completely abandon the short-term behavior of exchanging centralized governance for efficiency.

2.2 Decentralization as a Financial Principle: EF as a Technology Value Investor

Judging from EF’s funding structure, it is more like a “technology value investor” that bets not on short-term effects, but on technical paths that will have a long-term impact on Ethereum’s security, sustainability, and decentralized philosophy.

This tendency has a profound impact on its funding allocation for Layer 2 solutions:

- : Oppose the sorter architecture controlled by whitelist or multi-signature;

- : Prioritize funding for protocols where key parameters cannot be changed by a small number of governance members;

- : Do not support projects with centralized governance risks to avoid becoming a censorship or regulatory attack surface;

- : Prefers systems that run on the Ethereum mainnet and directly inherit consensus and data availability.

Therefore, the Foundation is no longer inclined to support solutions such as Optimism and Arbitrum that have clear governance committees and sorter control mechanisms, but will shift its focus to decentralized routes such as Unstoppable Rollup.

2.3 Unstoppable Rollup: A Pure Extension of Ethereum Concept

On May 16, the Facet team announced that it had received the first round of funding from EF to support Unstoppable Rollup.

Combined with this round of financial updates, EF has released a clear policy signal to the outside world, that is, the foundation is strategically supporting the "Unstoppable Rollup" direction represented by the Facet protocol. This type of system has the following characteristics:

- Any node can participate in the ranking right through bidding, which has the ability to resist monopoly;

- It is impossible to forcibly upgrade the protocol logic through voting or multi-signature to enhance the stability of the protocol;

- Directly inherit the Ethereum mainnet data and consensus mechanism to avoid cross-chain bridge security issues;

- Emphasis is placed on open source governance and community-led ecological development instead of centralized control by official teams.

From this perspective, Unstoppable Rollup is no longer just a scaling option, but a pure extension of the Ethereum concept . As a pioneer of this route, Facet Protocol will play a core role in the future symbiotic evolution with the Foundation.

3. The battle for expansion routes: Analysis of the technical paradigm and competitive advantages of Unstoppable Rollup

As Ethereum Layer 2 technology enters the stage of widespread deployment on the mainnet, how to strike a balance between scalability, security, and decentralization will become the key to future ecological prosperity. Rollup is one of the most mainstream expansion paths, but not all Rollup architectures are created equal. Among them, Unstoppable Rollup is gaining more and more attention because it not only makes breakthroughs in execution efficiency, but also defines the next stage of Rollup evolution in terms of "anti-censorship" and "decentralization".

3.1 Rollup’s controllability issues and potential risks

In the traditional Rollup architecture, most projects rely on upgradeable smart contract bridges that allow development teams to make changes to the system through administrator privileges. This flexibility facilitates version iteration, but it also brings two fundamental risks:

- :Most current academic or commercial Rollup projects rely on multi-signature wallets, security committees or governance contracts to implement key control logic upgrades. Once the relevant governance is attacked or tampered with, it may cause system paralysis or financial loss.

- :Mainstream Rollup relies on an exit logic based on a “time window”, allowing users to withdraw assets in the event of an attack or system failure. However, this mechanism requires users to have technical capabilities and respond in a short period of time, and is heavily dependent on the coordination of user behavior, making it difficult to deal with black swan events.

3.2 Unstoppable Rollup’s design philosophy: minimum trust assumption + minimum governance load

The core appeal of Unstoppable Rollup is to build a Rollup system that cannot be upgraded, tampered with, or frozen, so that it can still survive extreme situations such as hostile governance and contract attacks .

The core advantages of Unstoppable Rollup are:

- :The core protocol cannot be upgraded, and no governance proposal or majority vote is required, minimizing human intervention and governance attacks;

- : Any node can bid for sorting rights to avoid sorting monopoly and bribery;

- :Natively inherit the status and data availability of the Ethereum mainnet, no bridging required, no data layer split;

- :No need to rely on any third-party validator, the security is equivalent to Ethereum;

- :The sequencer behavior is transparent, the challenge mechanism is clear, and it naturally resists arbitrary packaging or omission attacks of centralized structures.

This structure reflects the typical execution of the "Ethereum first principles", which is to extend L1 consensus to L2 and no longer exchange governance compromises for throughput.

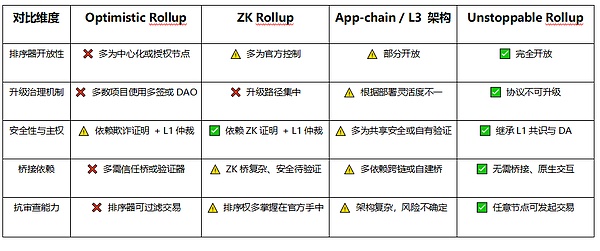

3.3 Technical Comparative Analysis: Unstoppable Rollup vs Mainstream Rollup

Note: ✅ indicates a strong advantage, ⚠️ indicates neutrality or implementation-dependent, and ❌ indicates a clear disadvantage.

Unstoppable Rollup has significant advantages in censorship resistance, minimal governance, open sorting rights and mainnet native inheritance, and has gradually become the mainstream candidate path for the next generation of Ethereum expansion.

Its greatest value does not lie in "higher performance" but in "harder to shut down", "less dependent on trust", and "more capable of taking on on-chain economic sovereignty". This also happens to echo the Ethereum Foundation's strategic funding preferences in its financial policy.

The biggest feature of Unstoppable Rollup is that it "freezes" the system in a state where no human intervention is required, allowing Rollup to operate like a natural system. Users can continue to run without relying on any entity's approval, bridging, or upgrades, just as the original design of Ethereum itself.

4. Facet Protocol - Unstoppable Rollup Lab, a heavy investment of the Ethereum Foundation

As Rollup technology continues to evolve, truly sustainable and censorship-resistant solutions are receiving great attention from the Ethereum community and core developers. Facet Protocol, a protocol lab born out of the Ethscriptions community, not only received direct funding from the Ethereum Foundation, but also made bold technical and governance attempts based on the Unstoppable Rollup concept.

4.1 Origin of Facet: Evolution from Ethscriptions to Unstoppable Rollup

- :Facet originated from the Ethscriptions community, a lightweight innovative system that implements on-chain inscriptions by burning data on "calldata". Unlike traditional ERC-721 or ERC-1155, Ethscriptions greatly reduces the cost of minting and verification, providing a highly scalable experimental platform for Rollup.

- : Driven by the community, Ethscriptions has evolved into a Rollup experimental platform with key modules such as state management, sequencer, and on-chain verification, and has officially evolved into the Facet Protocol.

- :Ethscriptions’ “zero-trust issuance” and on-chain evidence storage ideas became the theoretical basis for Facet’s subsequent design, emphasizing that any asset or data should have the characteristics of being trustless, tamper-proof, and permanent.

4.2 Analysis of Facet Technical Features: No Multi-Signature, No Committee, and Decentralized Sequencing

- :Facet allows anyone to join the sorter network without whitelist authorization, solving the problem of sorters becoming a centralized bottleneck in most current Rollups.

- :The protocol itself does not introduce any off-chain governance organization, and there is no "emergency brake" or "super-authority account" in the contract, which minimizes human intervention.

- :All transactions and state data are published directly on the Ethereum mainnet, rejecting external DA solutions and ensuring that state reconstruction and anti-censorship capabilities do not rely on additional assumptions.

Through the above design, Facet does not rely on any trusted third party. Any user can verify, synchronize, and exit the Rollup state solely through the Ethereum mainnet, which is extremely rare in current Rollup projects.

The essence of this technical logic is to regard "governance" as a tool to limit power rather than an empowerment tool, providing institutional guarantees for Unstoppable Rollup.

4.3 Facet Ecosystem Status: Funding from the Ethereum Foundation and Endorsement from Zellic Security Audit

- :Facet received official funding from the Ethereum Foundation in May 2025. Its protocol logic is highly consistent with the "Defipunk Criteria" set by the Foundation (see Section 5.3 of the original EF Fiscal Policy Standards) - it is governance-free, highly censorship-resistant, and self-custodial with strong compatibility, and is a typical embodiment of "Ethereum-native modularity".

- :Zellic is one of the most authoritative security audit companies in the blockchain field. It has conducted in-depth audits for projects such as Aptos, Sui, LayerZero, Pyth, and Uniswap. In November 2024, it completed an in-depth audit of the Facet contract and issued a report. It represents that the core logic of the Facet protocol has been recognized by top experts in the security model, especially in the minimalist architecture of "no multi-signature, no administrator", which can withstand the challenges of logical integrity and anti-attack.

- : Facet quickly stood out among the new Rollup projects with its technical transparency and clear funding sources, becoming a project that has attracted much attention from the L2 community and Rollup governance researchers.

- :Facet is gradually becoming a decentralized Rollup benchmark that "does not rely on any trusted oracle and is not controlled by any off-chain organization", greatly broadening the life boundaries of Rollup technology.

Facet Protocol takes Ethscriptions as its starting point, and incorporates minimalism, security, self-sufficiency, and censorship resistance throughout the protocol. It also builds a truly Unstoppable Rollup through unmediated on-chain governance and a trustless technical architecture.

This minimalist architecture is highly consistent with Ethereum’s own “verifiability first” philosophy, making Facet the solution currently closest to the “theoretically complete Rollup” form.

5. Tracking the potential 100-fold target - Facet Ecosystem Leader

ETHS was born on June 18, 2023. It is the first token issued on the Ethereum mainnet based on the Ethscriptions protocol, with a total of 21 million tokens. It naturally has the native inscription properties of non-increase and non-tampering. As a pioneer in the field of inscriptions, ETHS has pioneered a decentralized experimental path for Ethereum native assets. Its fair launch, public key on-chain, no pre-mining, and no team allocation mechanism set a model for the subsequent Facet ecosystem.

It is the ETHS community's continuous technological advancement, ecological practice, and concept expansion that have led to the birth and rapid formation of the Facet protocol.

5.1 Symbiotic evolution of ETHS and Facet protocol

The Facet protocol was originally proposed to solve the high Gas and split problems faced by ETHS at the transaction level. It is not a traditional Layer2, but a native Rollup architecture based on inscription technology. The ETHS community and the founder of the protocol jointly constructed the initial user needs and technical direction of Facet, providing liquidity and consensus support for its cold start.

Driven by ETHS, Facet will complete the mainnet release and launch Facetswap in 2023, and launch Facet V2 in 2024 to achieve ecological compatibility between the Ethereum mainnet and the Facet protocol, opening up seamless conversion between ETH and ETHS. By 2025, Facet was awarded the "Unstoppable Rollup" status by the Ethereum Foundation, becoming the only officially funded anti-censorship Rollup protocol. Its decentralized design concept is the continuation and sublimation of the early governance culture of the ETHS community.

5.2 The strategic position of ETHS in the Facet ecosystem

ETHS is not only the starting point of Facet, but also the core driving force of its current ecology:

(1) The uniqueness of value genes

- As the pioneering asset of the Ethscriptions protocol, ETHS possesses an unreplicable on-chain nativeness.

- Its total amount is constant, the contract cannot be upgraded, and the inscription rules cannot be modified, forming a value anchor at the protocol level.

(2) Spillover effects of community momentum

- The ETHS community has built an early user base for the Facet protocol, accounting for more than 85% of the current ecosystem's total TVL.

- In the design of Facet's key modules, such as Facetswap, protocol promotion, and technology upgrades, ETHS holders always play a core role.

(3) Multi-dimensional ecological empowerment

- :ETHS is the core trading pair of Facetswap, and the on-chain transaction volume has exceeded 11w $ETH ($300M).

- :Holders can participate in upETHS platform governance and enjoy proposal weight bonus.

- :ETHS will share revenue dividends in the upcoming upETHS platform.

5.3 Essential Relationship: Bidirectional Nested Symbionts

ETHS provides Facet with the initial narrative resources, community soil and liquidity foundation, and Facet provides ETHS with the technical architecture, trading platform and official endorsement of the Ethereum Foundation.

The symbiotic relationship between the two is reflected in:

- :Facet realizes the scalability of ETHS assets, and the ETHS community promotes the iteration and implementation of the Facet protocol.

- :Both have decentralization, anti-censorship, and protocol nativeness as their core beliefs, which are consistent with Ethereum's long-term development philosophy.

- :Core developers including Facet founder @dumbnamenumbers have been active in the ETHS community for a long time, achieving resonance between ideas and technology.

ETHS is not a subsidiary of Facet, but the source of its soul.

In the future, ETHS will continue to stand at the forefront of Ethereum fundamentalism and anti-censorship, and become the belief anchor and value cornerstone of the Rollup ecosystem.

ETHS has completed the transition from on-chain inscription experiment to Ethereum L2 core asset, and its consensus strength and ecological traction are constantly improving. During the window period when "Unstoppable Rollups" becomes the mainstream narrative, the valuation model of ETHS is expected to be completely reshaped.

Facet is technology, ETHS is consensus, and community is fundamental. Facing the next decade of the Ethereum ecosystem, ETHS+Facet is standing at the intersection of Ethereum's core narrative.

As the only Unstoppable Rollup funded by the Ethereum Foundation, Facet is rapidly attracting the attention of developers and capital, and ETHS is the most explosive potential asset in its ecosystem.

In the future, ETHS is expected to expand along with Facet and become a dark horse in the Ethereum ecosystem.

Conclusion

Dig out value from trends and gain insight into the future from capital flows

The myth of the bull market in each cycle is not accidental, they are born from the resonance of macro trends and underlying logic. The combination of ETHS + Facet happens to stand at such a key turning point: the protocolization of inscription assets + the core evolutionary route of Ethereum decentralized expansion . The capital flow and policy orientation of the Ethereum Foundation clearly reveal that they are betting on a more censorship-resistant and decentralized future.

The flow of funds, whether it is Gitcoin’s top donation or the surge in trading volume after the mainnet launch, all reflect that the market is betting on consensus with real assets . The trend is pointing to ETHS.

Why are truly long-term projects highly related to “decentralization”?

Because only decentralization can survive any supervision, review and black swan without relying on the credit support of individuals or institutions. ETHS is not the product of a centralized airdrop game, but an ecological consensus forged spontaneously by the community . Facet is not an L2 that relies on the protection of the security committee, but a truly "unstoppable" expansion infrastructure that is self-operated by the protocol.

It is this characteristic of "not relying on others, only relying on code" that builds their moat.

History will prove that the projects that can truly complete an entire cycle, survive the bear market and black swans, and finally become 100x projects are always the “most decentralized” projects .