Every day, we see new cryptocurrency treasury strategy tools emerging. This article will analyze Bitcoin's performance as a corporate treasury strategy and key trends in crypto strategies based on Private Investment in Public Equity (PIPE).

Every region will launch its own "Bitcoin" strategy, but I'm concerned about the tail-end assets that might adopt similar strategies. Bitcoin works well as a reserve asset, but what about your favorite L1 or L2? That makes no sense. After all, who will be the marginal buyer of the 50th zkEVM L2? Moreover, tail-end assets suffer from low liquidity, and the book gains market participants see may not be truly realized. So, friends, be cautious.

Operational Mechanism

There are primarily three paths to building such treasury tools:

- Business Transformation: Companies on the brink of bankruptcy pivot to crypto financial service companies, implementing crypto strategies (such as Solana staking);

- Mergers and Acquisitions: Integrating private companies into small and medium-sized companies listed on NASDAQ/NYSE;

- SPAC Merger: Merging through Special Purpose Acquisition Companies (SPAC), redefining business and treasury strategies.

Regardless of the path, all strategies require Private Investment in Public Equity (PIPE) and convertible debt financing. Here's a typical PIPE operation:

- Target shell companies: Usually SPAC tools or failed small and medium-sized companies publicly traded on NASDAQ or NYSE

- Collaborate with the company to create reserves for Bitcoin or any other crypto asset

- Request investment banks to issue/construct two tools: i) traditional PIPE and ii) convertible bonds

- Traditional PIPE: Directly sell common or preferred shares to qualified investors at a fixed price (usually discounted)

- Convertible Bonds: Issue convertible bonds or convertible preferred shares that investors can convert to the issuing company's common shares within a certain period or under specific conditions. These typically provide downside protection and partially reduce upside returns.

For example, Trump Media & Technology Group (DJT) adopted the following structure:

- Raised $1.44 billion by selling nearly 56 million shares (at $25.72 per share);

- Issued $1 billion 0% convertible senior secured bonds maturing in 2028 (with a conversion price of $34.72 per share).

- This is a hybrid structure of stock dilution and senior convertible debt, combining PIPE and convertible bond characteristics.

Note: Compared to other issuance methods, PIPE is less regulated by the SEC but may lead to dilution of existing shareholders' equity. These shares come with registration rights, meaning the company must submit a registration statement to the SEC, allowing PIPE investors to resell shares to the public after the lock-up period.

Investor Framework

You might wonder why investors are willing to participate in such issuances? The reasons can be summarized in three points:

- Team Intellectual Property: The industry influence of the chairman or core team is crucial. For example, an ETH strategy launched by Joe Lubin (Ethereum co-founder) can easily be compared to an "Ethereum version of Microstrategy". After witnessing MSTR's success, investors eagerly participate in the ETH strategy due to Joe's industry standing, given ConsenSys's critical role in Ethereum's ecosystem.

- Asset Quality: The choice of reserve assets is crucial. A wave of tail-end assets (such as the top 50 tokens by market cap) being incorporated into small enterprise treasuries is expected. However, these tail-end asset strategies carry higher risks due to their typically higher volatility compared to Bitcoin.

- Crypto Premium: The ability of such PIPE tools to raise funds on a large scale is not because Bitcoin or Ethereum's value in corporate strategies "suddenly increased 3-4 times", but because traditional hedge funds and native crypto institutions are rushing in, fearing missing out (FOMO) on current first and second-market arbitrage opportunities. Admittedly, these strategies may generate returns or leverage effects through staking and lending, but can this support a premium 3 times the asset net value? Probably not.

Overview of Corporate Crypto Treasury Transactions in the Past Two Months

To date, the most controversial treasury transaction is the Trump Media company case. This has raised questions about "strategic Bitcoin (or digital asset) reserves" - how to handle potential conflicts of interest? At least in the short term, inspired by Microstrategy (MSTR) and Metaplanet (3350.T), both private and public investors expect such financing to bring medium to short-term high returns.

MSTR initially used Bitcoin as a value storage and inflation-resistant tool; today's crypto PIPE aims to achieve more proactive management and yield generation through staking and lending. Private investors' demand for crypto PIPE is almost fanatical, as such transactions often see stock prices rising 2-10 times upon announcement.

Corporate Crypto Treasury Strategy Performance

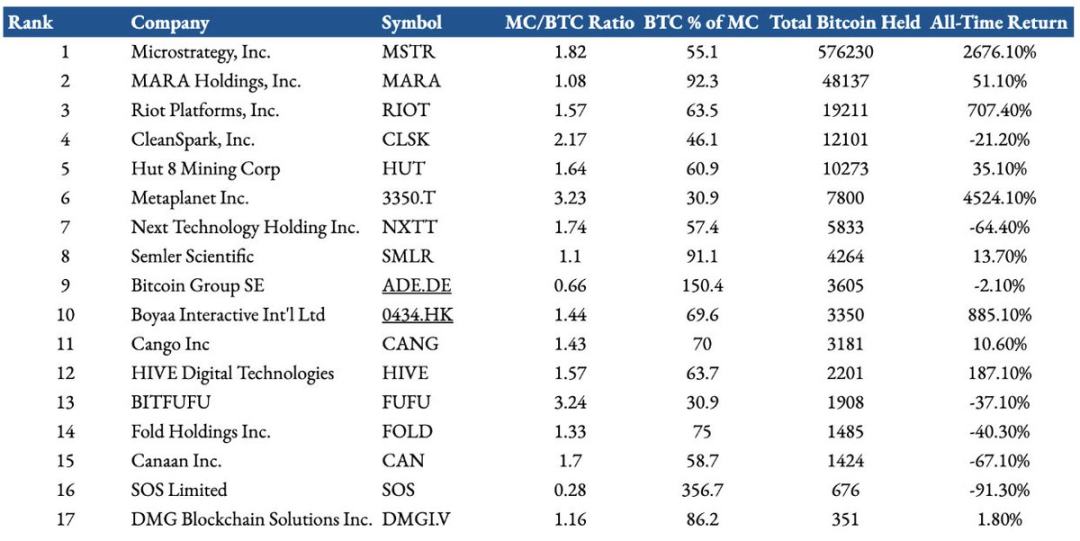

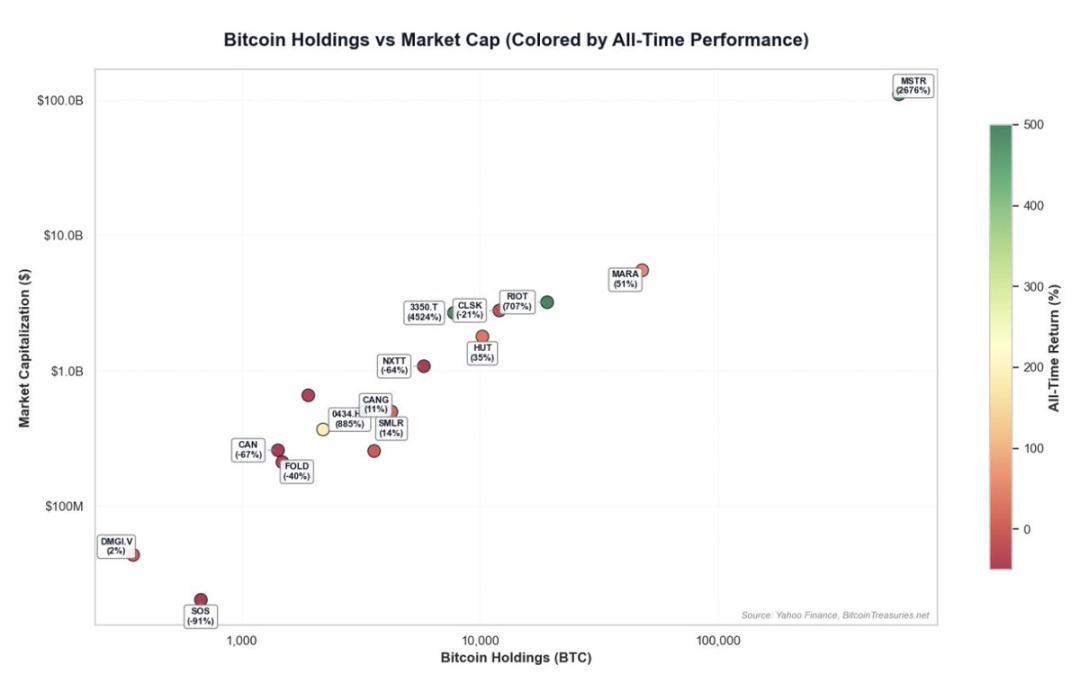

Although history cannot predict the future, there is extensive data available to analyze Bitcoin strategies. Here is a performance study of pure Bitcoin treasury strategies for 17 listed companies:

The list selected 17 listed companies with Bitcoin holdings exceeding 30% of company market value and holding over 300 BTC

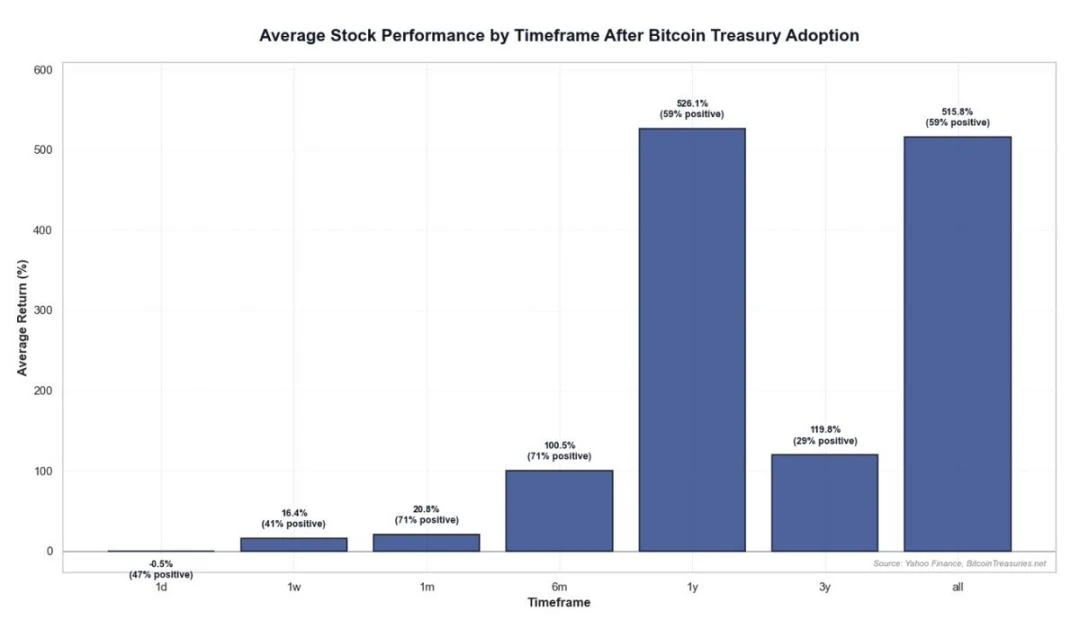

So far, the most successful company with this strategy is Microstrategy, which was the earliest to venture into corporate Bitcoin strategies. However, with the introduction of Bitcoin ETFs and new treasury strategies, its "Bitcoin/market value" premium may gradually fade. In the short term, Bitcoin strategy announcements often increase the likelihood of short-term or even long-term returns. Return rate differences are significant, even within different time frames. However, performance declines over time:

- 1-year average return: 526% (59% of companies profitable);

- 3-year average return: 119% (only 13.64% of companies profitable);

- Historical average return: 515% (59% of companies profitable).

Note: The median return is significantly lower than the mean, indicating that extreme values have pulled up the overall average. From 2020-2025, Bitcoin outperformed most asset classes, which was the core driver of these companies' high returns.

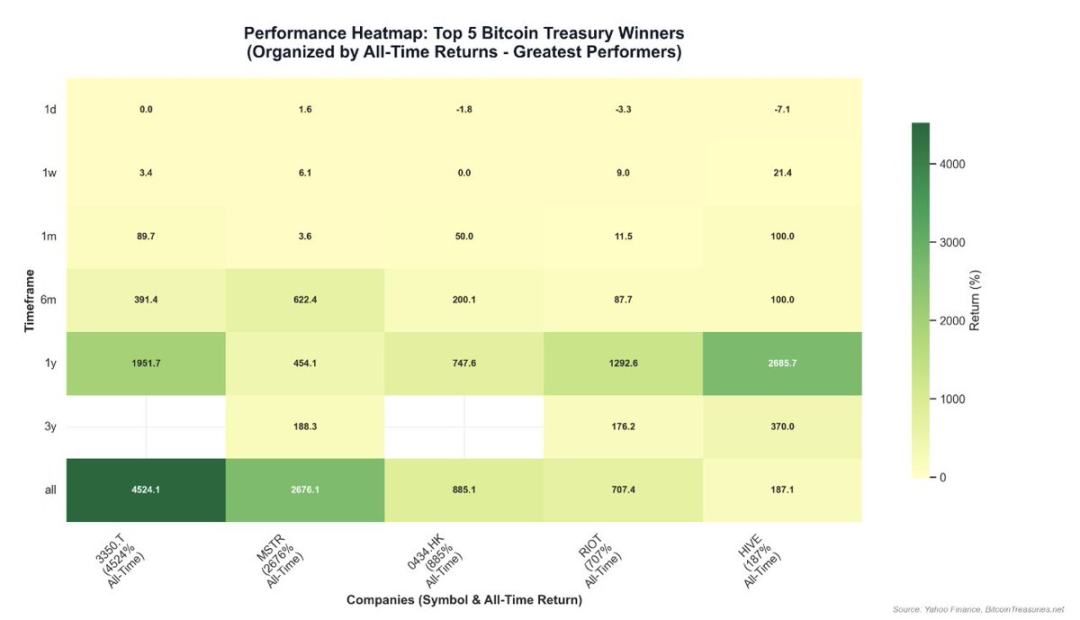

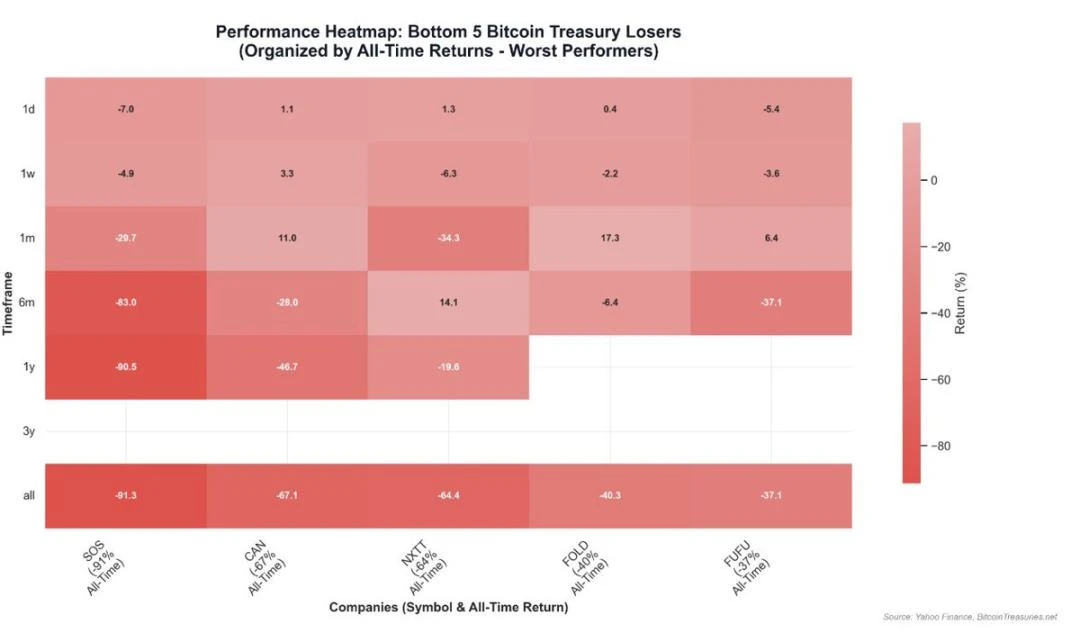

Bitcoin Strategy Performance Heat Map

- Success Cases: Companies with strong community consensus, ability to enhance "Bitcoin per share" and create financial engineering opportunities performed excellently.

- Failure Cases: Such as SOS Limited (originally a crypto mining company transformed into commodity trading), which performed poorly due to core business challenges and ineffective Bitcoin strategy implementation. It's evident that "pure Bitcoin strategy" companies are more market-recognized than "small allocation" companies.

- Risk Warning: Bitcoin-related companies may face extreme volatility and drawdowns, but opportunities for turnaround may emerge when company net asset value (NAV) exceeds market value. Note: For companies on the brink of bankruptcy, holding a small amount of Bitcoin on the balance sheet cannot reverse the downward trend.

Conclusion

With Circle's successful IPO as a pure stablecoin company, the stock market and crypto market are accelerating their integration. More high-quality crypto companies are expected to go public, along with emerging crypto strategy tools. Given the recent market enthusiasm for crypto strategies, investors can capture opportunities through frameworks of team influence, asset quality, crypto premium sustainability, and in-depth project analysis.

However, when the strategy involves tokens outside the top 20 by market capitalization, it is crucial to be extremely cautious. These tokens not only lack the hard asset attributes of Bitcoin but often lack sustained net buying demand. Structurally, investors must clarify: 1) What underlying business strategy the company is implementing; 2) The capital structure of the transaction (debt, convertible bonds, PIPE); and 3) Net asset value per share.