Author: Zhou Junzhi, Tian Yunong, CSC Research Macro Team

CICC believes that the total scale of stablecoins is relatively small compared to US Treasuries. The market does not need to expect that stablecoin regulatory policies can leverage the increase in US dollar assets in the short term (that is, the market expects stablecoins to save the US dollar and US Treasuries).

What the market needs to be concerned about is whether stablecoins can usher in a new era of development in the future, allowing payment needs that have escaped the U.S. dollar monetary system and circumvented digital currency systems such as Bitcoin to return to the centralized monetary system by putting on a layer of stablecoin.

Core Viewpoint

The geopolitical game has escalated after the epidemic, the unrestrained fiscal easing of the United States has raised questions about the credit assets of the United States, and the tariff war has ignited concerns about the reshaping of the financial order. In recent years, more and more payments have fled the centralized monetary system dominated by the US dollar and taken refuge in digital payment systems (such as Bitcoin).

Stablecoins are "two-sided" currencies that have the characteristics of both centralized and digital currencies. Policies aimed at promoting the development of stablecoins need to focus on strengthening the stability mechanism of stablecoins: enhancing the market's "trust consensus" on stablecoins. This is also the focus of recent stablecoin regulatory policies.

Just looking at the current comparison between the total size of stablecoins and U.S. dollars and U.S. Treasury bonds, promoting the development of stablecoins will not bring about large-scale increases in funds for the U.S. dollar and U.S. Treasury bonds in the short term.

In the medium and long term, the steady development of stablecoins will first allow fiat currencies (such as the US dollar) to take advantage of the expansion of Bitcoin's market value; secondly, it will allow fiat currencies to be covered with a layer of stablecoin's digital coat, bridging the gap between centralized credit currencies and digital currencies.

summary

Recently, the United States and Hong Kong have successively issued policies and regulations related to stablecoins, and Circle has been listed on the U.S. stock market, igniting the market's attention to stablecoins.

As the U.S. debt is weak recently, the credit assets of the United States are questioned by the world. There is a popular narrative in the current market: the development of stablecoins is to save the dollar and U.S. debt. Is this really the case?

1. What is a stablecoin?

Stablecoins have four operating elements.

1. Stablecoins run on the blockchain.

2. When issuing stablecoins, the issuer needs to have 100% real asset reserves.

3. The issuer is the private sector, not official departments such as the central bank.

4. The value of stablecoin is stable, and most of the time it is 1:1 with the anchored fiat currency.

There are three main types of stablecoins: fiat-collateralized, crypto-collateralized, and algorithmic.

The fiat-collateralized type is anchored to fiat currency assets; the crypto-collateralized type is anchored to cryptocurrency assets; the algorithmic type dynamically manages currency size and value through smart contracts.

2. How are stablecoins stable?

Stablecoins are digital currencies by nature. Historically, stablecoin crashes have been caused by the public’s distrust of the stability of their value, and crashes are not uncommon. Therefore, it is not easy for stablecoins to achieve currency stability.

The current mainstream stablecoins are anchored to fiat currencies. For this type of stablecoin, to maintain currency stability, two key points need to be grasped: sufficient reserve assets and open and transparent information.

The "stability" of stablecoins is not an absolute guarantee established by a perfectly designed stability mechanism, but a balance between a mechanism that can relatively resist risks and market trust.

In a nutshell, the key to maintaining the "stability" of stablecoins lies in "trust consensus". In other words, holders believe that they can always redeem equivalent fiat currency or collateral assets from the issuer. In order to achieve this, stablecoin issuers must hold high-quality assets with high liquidity and maintain transparency.

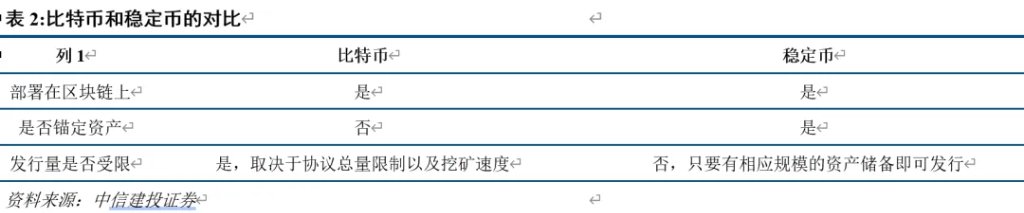

3. What is the difference between stablecoins and Bitcoin?

Stablecoins and Bitcoin are both blockchain digital currencies, so they have three similarities: virtual assets, privacy, and decentralization.

The biggest difference between stablecoins and Bitcoin lies in whether they are anchored to specific assets when issued. The end result is that the stability of the two currencies is different.

First, stablecoins have the characteristic of price stability (at least the issuer tries to ensure the stability of the currency value), and the price of Bitcoin is naturally volatile.

Stablecoins are anchored to external assets to form their value, and reserve assets are the key to maintaining the stability of their currency value. The value of Bitcoin depends on market supply and demand. Due to the low supply and the recent increase in Bitcoin’s popularity, Bitcoin has maintained an upward trend in price amid fluctuations in recent years.

Second, Bitcoin is relatively scarce, while stablecoins are generally scarce in comparison.

The issuance and total amount of stablecoins depend on the amount of reserve assets and user demand, and their scarcity is relatively weak.

The total amount of Bitcoin is fixed (21 million), and the block reward has been halved four times, so its scarcity is obvious.

Third, stablecoin regulation is more towards monetary compliance, while Bitcoin regulation is more towards virtual asset management.

Stablecoins have gradually become compliant under the strong supervision of various countries, and each country has stipulated reserve assets and issuer licenses in accordance with laws.

Bitcoin itself is a decentralized asset, and different countries have different regulatory attitudes towards Bitcoin, because different countries have different positions on virtual assets.

4. What is the driving force behind the development of stablecoins?

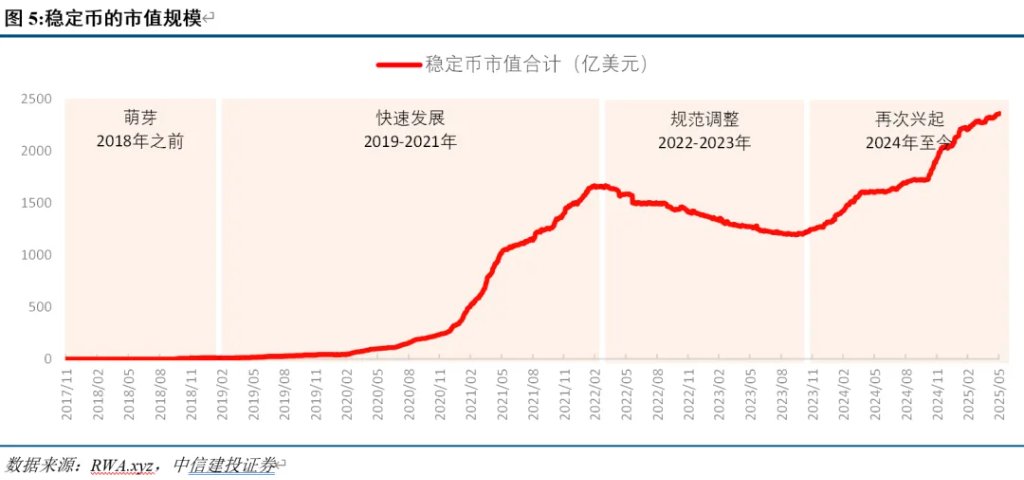

The development of stablecoins can be roughly divided into four stages: before 2018, 2019-2021, 2022-2023, and 2024 to present.

Embryonic stage (before 2018): In the initial stage, the price increase of stablecoins was limited.

The earliest batch of stablecoins were born in 2014, and USDT issued by Tether was one of them.

Rapid development stage (2019-2021): Taking advantage of the DeFi ecosystem, stablecoins are experiencing rapid expansion.

The DeFi ecosystem emerged after 2019. The "DeFi Summer" in 2020 made lending protocols such as Aave and mining popular, increasing the demand for stablecoins as pricing and payment tools in the cryptocurrency world.

Regulatory adjustment phase (2022-2023): Stablecoins will undergo adjustments due to the collapse and regulation.

In May 2022, TerraUSD (UST) lost its anchor and crashed, causing market concerns about the instability of stablecoins and attracting regulatory attention. Since then, the United States and Europe have proposed the "Stablecoin TRUST act" and the "Markets in Cryptoassets Regulation Act" (MiCA).

Re-emergence stage (2024 to present): The era of alternative currencies rises, and stablecoins usher in a major expansion.

After 2023, the cryptocurrency ecosystem developed rapidly. In early 2024, the Bitcoin spot ETF was issued after approval by the SEC. The cryptocurrency market rebounded, and the demand for stablecoins as intermediary currencies grew rapidly.

The driving forces behind the development of stablecoins are three main aspects: the development of the cryptocurrency market, payment convenience and privacy.

Stablecoins are currently the main valuation and payment tool in the cryptocurrency market. Stablecoins are more convenient to pay than other types of cryptocurrencies and legal tender, and their costs are lower. In addition, their privacy makes the demand for stablecoins stronger than legal tender in some scenarios.

The shortcomings in the development of stablecoins mainly focus on the risk of bank runs caused by the crisis of trust.

5. The direct and underlying purpose of stablecoin policy

Recently, the United States and Hong Kong have successively issued policies and regulations related to stablecoins. The introduction of policy norms attempts to guide the stablecoins to develop more stably, marking that stablecoins will enter the second era of development.

The main direction of policy making is centered around the "trust consensus" of the stablecoin's stability mechanism.

In terms of details, the policy mainly provides external credit enhancement for stablecoins, that is, it clarifies what is a standardized stablecoin and clearly regulates stablecoins.

First, eliminate the conceptual bias of stablecoins and prevent the underlying risks in the development of stablecoins.

Second, refine the specifications of stablecoin anchored assets to make the core of stablecoin more stable.

Third, build a stablecoin regulatory framework to make the development of stablecoin more official.

6. What will be the future development path of stablecoins?

Stablecoins are essentially the glue, or connecting bridge, between fiat currency (mainly the US dollar) and digital currency (mainly Bitcoin).

Therefore, the development of stablecoins can bridge the gap between digital currency and credit currency.

What kind of split has occurred between US dollar credit assets and digital currencies in the past, and how stablecoins can repair the split between the two may be the original intention of recent policies to standardize the stablecoin regulatory framework and guide the stable development of stablecoins.

Because the traditional agency banking model has defects such as low payment efficiency, high transaction costs, limited coverage, and low transparency, coupled with the geopolitical game after the epidemic that has caused some countries and regions to withdraw from the modern cross-border payment system, and the United States has implemented massive fiscal and monetary easing at home after the epidemic, abusing the credit of the US dollar, the trust in the US dollar in cross-border transaction payments has loosened.

In April 2025, the United States' reciprocal tariffs disrupted global trade rules. The global economic and trade order faced uncertainty. The global financial market based on economy and trade became more volatile, and alternative currencies ushered in a wave of development.

The rapid development of Bitcoin reflects the fact that the world is losing trust in the dollar-centered monetary system, and more and more payments are trying to escape the centralized monetary system dominated by the dollar. Digital currency that combines privacy and payment convenience happens to be the first choice for decentralized currency.

At this time, regulating the development of stablecoins can play two major roles in helping the development of fiat assets:

First, stablecoins are used as a pricing and payment tool in the cryptocurrency market, and stablecoins are anchored to legal tender (such as the US dollar). The expansion of Bitcoin requires an increase in stablecoins, and then an increase in US dollars and US bonds. This is equivalent to the development of legal tender (such as the US dollar) riding on the expansion of Bitcoin's market value.

Second, stablecoins have the typical payment convenience and privacy of digital currencies, but they are also anchored to legal tender (such as the US dollar). With the promotion of stablecoins in the trading field, legal tender assets (such as the US dollar and US bonds) can be expanded with the help of stablecoins. This is equivalent to putting a layer of stablecoin digital coat on legal tender (such as the US dollar).

The issue that the market is most concerned about at the moment is how much fiat currency assets, such as additional allocations of U.S. dollars and U.S. Treasuries, stablecoins can ultimately bring?

Our calculations show that the total size of stablecoins is currently smaller than that of U.S. Treasuries. In the first quarter of 2025, USDT and USDC will have a total of approximately $120 billion in short-term U.S. Treasuries in their reserve assets. The current size of the U.S. short-term Treasury bond stock is approximately $6 trillion, and $120 billion only accounts for 2%.

In other words, the market does not need to expect that the stablecoin regulatory policy can leverage the increase in US dollar assets in the short term (that is, the market expects stablecoins to save the US dollar and US bonds). What the market needs to care about is whether stablecoins can usher in a new era of development in the future, allowing payment needs that have escaped the US dollar monetary system and evaded to digital currency systems such as Bitcoin to return to the centralized monetary system through a layer of stablecoins. This may also be the real intention of the current US and other governments to implement the stablecoin development framework.

introduction

On May 19, the U.S. Senate passed the Guidance and Establishment of a United States Stablecoin National Innovation Act, and the Hong Kong Special Administrative Region Government published the Stablecoin Ordinance in the Gazette on May 30, igniting the market's attention to stablecoins.

Circle Internet (USDC issuer), which was listed on the U.S. stock market on June 5, closed up 168.48% on the day, marking the beginning of a major round of stablecoin development.

The market's attention to stablecoins is accompanied by another voice. The regulation of stablecoin policies means that the future development of stablecoins is on the right track. Most stablecoins are anchored to fiat currencies (mainly the US dollar), and the underlying assets include US bonds (mainly short-term bonds) in addition to the US dollar. Does this mean that the ultimate purpose of stablecoin policy regulation is to promote the expansion of stablecoins, thereby supporting the US dollar and US short-term bonds?

As the U.S. debt is weak recently, the credit assets of the United States are questioned by the world. There is a popular narrative in the current market: the development of stablecoins is to save the dollar and U.S. debt. Is this really the case?

We start from the micro-operation logic of stablecoins, deconstruct the operating mechanism of stablecoins, and trace the development history of stablecoins. Only in this way can we deeply understand the true intention of the recent stablecoin policy and ultimately understand the future development trend and path of Bitcoin.

The text is as follows:

How are stablecoins stable?

1. Basic mechanism of stablecoin

What is a stablecoin? We can summarize it with a few keywords: digital currency (blockchain), anchored reserve assets, private issuance, and stable currency value.

The issuer of stablecoins is the private sector, not the official sector (central bank or monetary authority).

The condition for issuing stablecoins is that there must be asset reserves. When issuing stablecoins, the issuer needs to have 100% real asset reserves. Real assets are generally national bonds, legal tender, or precious metals, cryptocurrencies that are national credit carriers. One or a combination of the above can be used as reserve assets.

Stablecoins run on the blockchain, so they can be used as a medium of exchange for other cryptocurrencies on cryptocurrency exchanges. For example, after exchanging USD for USDT, you can use USDT to buy Bitcoin.

Simply put, the issuer Xiaotai (private sector) has a certain amount of real-world assets on its asset side, such as US dollars, US bonds or gold, as well as cryptocurrencies such as Bitcoin and Ethereum. After obtaining the qualification to issue stablecoins, the issuer Xiaotai can issue corresponding stablecoins at a 1:1 ratio of the reserve assets it holds. These stablecoins are all traded on the blockchain.

We can use a figurative analogy to say that stablecoins can help the cryptocurrency world express prices and serve as a bridge between the real world and the crypto world.

The price fluctuations of Bitcoin and Ethereum themselves are too drastic to be used as transaction and pricing currencies in the long term.

The emergence of stablecoins is to solve this problem. They are pegged to real assets at a 1:1 ratio. While maintaining currency value stability, they also run on the blockchain to facilitate transactions on the blockchain.

2. Three types of stablecoins

Stablecoins can be divided into three types based on the mechanisms by which they achieve stability and the differences in anchored assets.

1. Legal currency mortgage type

The collateral assets are reserved at a ratio of 1:1. The collateral assets must be legal tender or government bonds. For example, the U.S. dollar or U.S. Treasury bonds can be used as collateral assets. Representative stablecoins of this type include USDT and USDC.

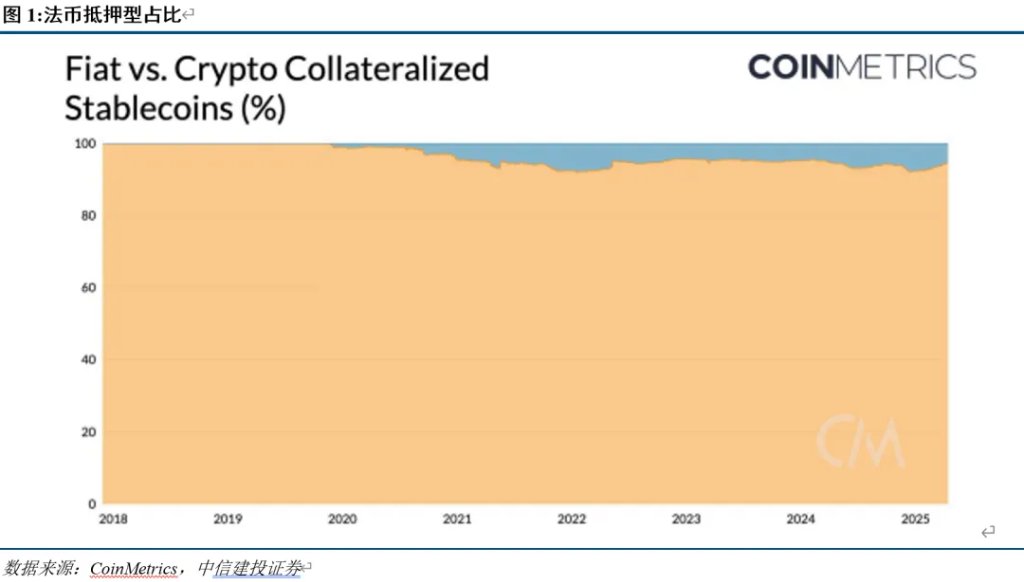

Fiat-collateralized stablecoins are currently the most mainstream type, accounting for more than 90% of all stablecoins, and most of them are pegged to the US dollar.

The issuance of USDT can be roughly divided into two steps: (1) the user deposits US dollars into Tether’s bank account; (2) Tether mints an equivalent amount of USDT in the user’s account, after which the user can use USDT.

When a user redeems USD, he first hands over USDT to Tether, and Tether destroys USDT and delivers the equivalent amount of USD to the user.

2. Crypto-collateralized

Stablecoins generated with mainstream cryptocurrency assets as collateral, such as BTC and ETH as collateral assets. The representative stablecoin is DAI.

The issuance of Dai is based on the "over-collateralization" mechanism, that is, the user sends the ETH he holds to the MakerDao system, and the system issues Dai to the user's account at a certain discount based on the value of ETH at the time.

When the value of the collateral falls below the collateral ratio (for example, 150%), users need to replenish the collateral or repay Dai in time, otherwise the system will automatically liquidate.

3. Algorithm type

Algorithmic stablecoins dynamically manage the currency scale and value through smart contracts. When supply exceeds demand, stablecoins are repurchased, and when demand exceeds supply, additional stablecoins are issued. Reserve assets can be a mix of fiat currencies and cryptocurrencies. Representative stablecoins are FRAX and AMPL.

3. How do stablecoins stabilize their value?

The two key points for stablecoins to achieve stability are high-quality reserve assets and openness and transparency.

The "stability" of stablecoins is not 100% absolute stability, but relies on designing a set of relatively risk-resistant mechanisms to gain market trust as much as possible, so as to achieve relative stability in currency value.

In a nutshell, the key to maintaining the "stability" of stablecoins lies in "trust consensus". In other words, holders believe that they can always redeem equivalent fiat currency or collateral assets from the issuer. In order to achieve this, stablecoin issuers must hold high-quality assets with high liquidity and maintain transparency.

First of all, the reserve assets of most stablecoins are mainly short-term U.S. Treasury bonds, in addition to bank deposits, commercial bills, etc.

Stablecoin issuers use a small portion of their accumulated assets for investment (mainly to collect interest) and charge exchange fees for profit. Therefore, operating stablecoins is a business that relies on scale to make profits.

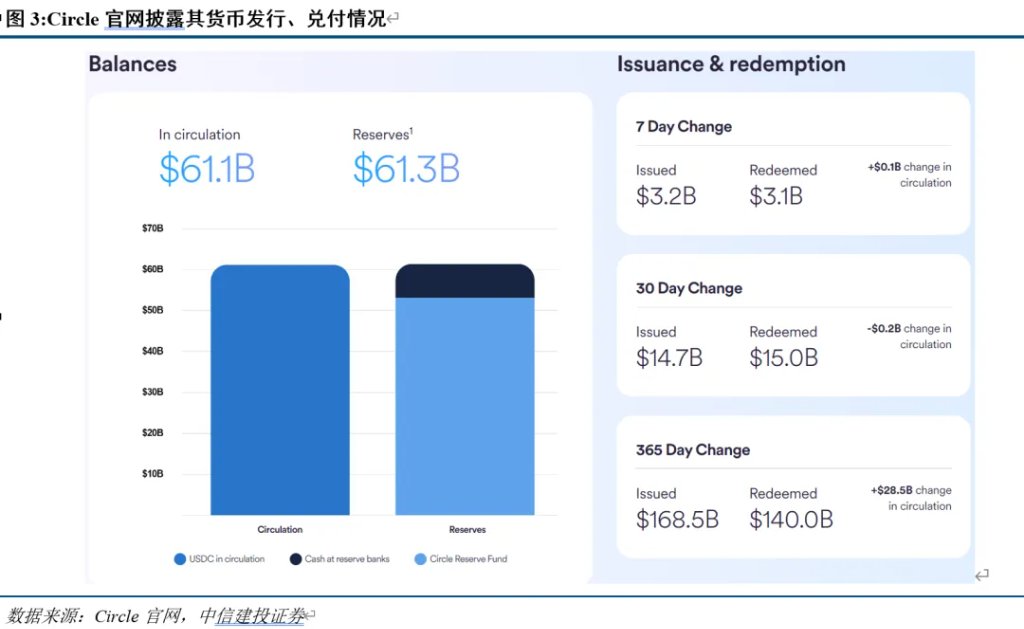

Taking Circle as an example, the current circulation of USDC exceeds US$60 billion, and the corresponding reserve assets include the US$50 billion Circle Reserve Fund (a money market fund operated by BlackRock, which mainly invests in short-term US Treasury bonds, overnight reverse repurchases and bank deposits), and more than US$8 billion in bank deposits.

Interest income is Circle's core source of income. In 2024, Circle's revenue was US$1.676 billion, and the interest on reserve assets accounted for 98.6%.

Secondly, the issuer will disclose the status of reserve assets and the circulation of stablecoins on a regular basis.

There is a "Transparency" column on the official website of most stablecoin issuers, which discloses the size and composition of their reserve assets and the current circulation of stablecoins, so as to make users believe that they can always redeem fiat currency from the issuer.

Circle’s “Transparency” column is the most intuitive way to make us feel this, with the slogan “USDC is always redeemable 1:1 for US dollars, and EURC is always redeemable 1:1 for euros. Always.” (USDC can always be exchanged for US dollars at 1:1, and can always be exchanged for euros at 1:1 (1.1422, 0.0029, 0.25%), always.)

We can understand this more clearly from the case of USDT being de-anchored and then returning to its anchor.

On March 13, 2023, USDC and the U.S. dollar decoupled, reaching a ratio of 1:0.88. The main reason was that Circle had $3.3 billion (8.25% of total reserves) in deposits at Silicon Valley Bank, and USDC holders sold their coins out of fear that they would not be able to redeem them.

Afterwards, the founder of Circle quickly tweeted that the $3.3 billion in reserves had begun to be transferred to other banks. If the $3.3 billion could not be recovered 100%, it was not ruled out that the company's resources or external capital would be used to make up for the shortfall. In short, it promised users that they did not need to worry about the reserve funds of USDC being trapped by Silicon Valley Bank.

Afterwards, USDC returned to the 1:1 anchor.

How are stablecoins different from Bitcoin?

Since the creation and spread of digital currency, discussions on transaction currencies have been divided into two major categories: decentralized digital currency and legal sovereign currency.

From the perspective of digital and decentralized characteristics, stablecoins are undoubtedly digital currencies; however, the vast majority of stablecoins are anchored to fiat currencies (especially the US dollar) and have certain fiat currency characteristics.

Because of this, stablecoins have the characteristics of decentralized digital currencies and stable fiat currencies. They can be said to be a "two-sided" currency between decentralized digital currencies and fiat currencies.

1. Stablecoins and Bitcoin: Decentralized Digital Currencies with Equal Privacy

There are three similarities between stablecoins and Bitcoin: virtual assets, privacy, and decentralization.

These three similarities are essentially because stablecoins and Bitcoin are both blockchain digital currencies, and therefore both are virtual assets.

Bitcoin is the native currency on the Bitcoin public chain.

Stablecoins are derivative tokens deployed by developers on public chains (mostly Ethereum).

Digital currencies and their transactions on the blockchain are all recorded in a distributed ledger.

The so-called distributed ledger records transactions between members of a distributed network, including digital asset exchanges or virtual currency receipts and payments. In other words, every digital asset exchange in history is accurately recorded and cannot be modified, and every member of the network can view this shared ledger.

This means that when there are enough nodes, a single sovereign entity cannot control the ledger, so it is "decentralized."

The distributed ledger only records addresses (rather than the real social information of the traders), ensuring privacy.

Taking stablecoin as an example, if Xiao A holds 1 USD of stablecoin, it means that in the distributed ledger on the public chain, every ledger records that Xiao A holds 1 USD of stablecoin in his ledger (address).

When Xiao A uses this $1 stablecoin to buy $1 of ETH from Xiao B, each ledger will record this transaction: Xiao A's address and Xiao B's address have conducted a transaction of 1 dollar of stablecoin to buy 1 dollar of ETH. All participants on the public chain do not know the identities of Xiao A and Xiao B (including A and B themselves), they only know that it happened at the address they operated.

2. The biggest difference between stablecoins and Bitcoin: Is the currency value stable?

The biggest difference between stablecoins and Bitcoin is whether they are anchored to specific assets when issued.

The supply of Bitcoin depends on the total upward volume specified by the protocol and the block reward, and is not anchored to other assets. The relationship between Bitcoin and legal currency (such as the US dollar) is not constant. This leads to a stronger asset attribute of Bitcoin, so the price of Bitcoin is more volatile.

In order to maintain currency stability, stablecoins need to be anchored to the value of real-world fiat currencies. The issuance of stablecoins under most stabilization mechanisms requires the issuer to pledge reserve assets of corresponding size.

(III) Stablecoins and Bitcoin: One focuses on transactions, the other focuses on investment

The difference in the operating logic of stablecoins and Bitcoin determines that the two have different properties.

1. The value depends on the redemption ability of the anchored assets.

Stablecoins are anchored to external assets to form their value. For example, fiat-collateralized currencies require 1:1 US dollar reserves, while crypto-collateralized currencies require ETH over-collateralization.

It should be noted that the reserve assets of stablecoins are the key to maintaining the stability of their currency value.

When the issuer of a stablecoin has sufficient reserve assets as collateral to support the issuance and redemption of the stablecoin, and its reserve asset data is open and transparent, and users know that the issuer's assets can support the issuance of the stablecoin, the stablecoin can maintain stability.

However, when the reserve assets are insufficient to cope with redemptions or even a run occurs, the value of the stablecoin will fluctuate greatly.

The value of Bitcoin depends on market supply and demand and is not backed by other assets.

Therefore, under normal circumstances, the price of stablecoins is relatively stable, while the price of Bitcoin fluctuates greatly. Stablecoins are more suitable as a payment tool than Bitcoin in normal circumstances because of their stable value scale attributes.

However, stablecoins are at risk of a sudden drop in value due to a run under certain circumstances, but Bitcoin does not.

2. The degree of scarcity depends on the anchor asset.

The issuance and total amount of stablecoins depend on the amount of reserve assets and user demand, and their scarcity is relatively weak.

The total amount of Bitcoin is fixed (21 million), and the block reward has been halved four times, so its scarcity is obvious.

3. Compliance (depending on the anchored assets, whether follow-up supervision is required)

Stablecoins have gradually become compliant under the strong supervision of various countries, and each country has stipulated reserve assets and issuer licenses in accordance with laws.

Bitcoin itself is a decentralized asset with blurred regulatory boundaries and is susceptible to policy shocks.

The difference between stablecoins and Bitcoin also determines the differentiation of their core functions. One is a payment tool and the other is an investment tool.

Stablecoins are suitable as payment tools and DeFi infrastructure, used to connect on-chain finance and real-world assets, and become the payment and settlement core of the digital world.

Bitcoin is more suitable as an asset for storing value and as an investment product under the narrative of scarcity and reconstruction of the financial order.

What is the driving force behind the development of stablecoins?

1. Four stages of stablecoin development

The development of stablecoins can be roughly divided into four stages: before 2018, 2019-2021, 2022-2023, and 2024 to present.

Embryonic stage (before 2018): In the initial stage, the scale of stablecoin expansion was limited.

The earliest batch of stablecoins were born in 2014, and USDT issued by Tether is one of them. USDT is the first large-scale legal currency-collateralized stablecoin and is also the most mainstream stablecoin at present.

In 2017, MakerDao issued DAI, which is a relatively successful crypto-collateralized stablecoin template. In the second half of that year, mainstream cryptocurrency trading platforms launched USDT trading pairs one after another.

In 2018, Circle launched USDC. Since then, stablecoins such as TUSD and GUSD have been issued one after another.

Rapid development stage (2019-2021): Taking advantage of the DeFi ecosystem, stablecoins are experiencing rapid expansion.

The DeFi ecosystem emerged after 2019, and the "DeFi Summer" in 2020 made lending protocols such as Aave and mining popular.

Stablecoins are pricing and payment tools in the cryptocurrency world, so the rapid development of the DeFi ecosystem will increase the demand for stablecoins.

Regulatory adjustment phase (2022-2023): Stablecoins will undergo adjustments due to the collapse and regulation.

In May 2022, TerraUSD (UST) lost its anchor, triggering market concerns about the instability of stablecoins and attracting regulatory attention.

In 2022, the United States proposed the "Stablecoin TRUST act", requiring that the reserve assets of stablecoin issuers and the issued face value of stablecoins be 1:1, and that issuers must have a license before issuing them.

In April 2023, the European Parliament formally passed the Markets in Crypto-Assets Act (MiCA), which clarified the types of crypto-assets covered by regulation, as well as the transparency and disclosure requirements for the issuance, provision to the public and trading of crypto-assets on trading platforms.

Re-emergence stage (2024 to present): The era of alternative currencies rises, and stablecoins usher in a major expansion.

After 2023, the cryptocurrency ecosystem will develop rapidly, and various new concepts will emerge in an endless stream, laying the foundation for the rapid development of subsequent stablecoins.

In early 2024, the Bitcoin spot ETF was issued after being approved by the SEC, and the cryptocurrency market rebounded. The demand for stablecoins as intermediary currencies grew rapidly.

In May 2025, the United Kingdom, the United States, and Hong Kong successively passed stablecoin-related bills, stipulating the reserve support, audit rules, issuance licenses, etc. of stablecoins.

2. Driving forces and defects of stablecoin development

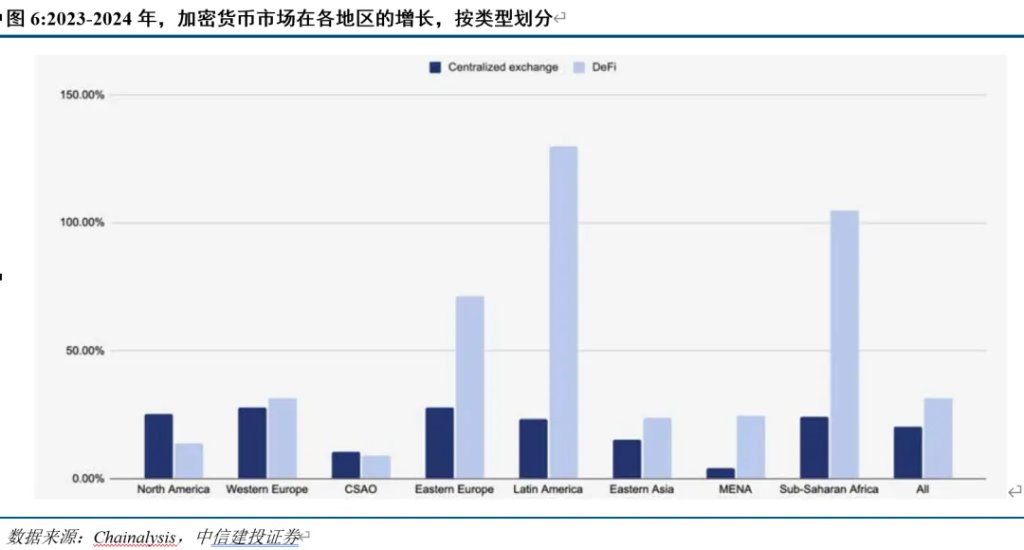

There are three main driving forces for the development of stablecoins: the development of the cryptocurrency market, payment convenience, and privacy.

Stablecoins are currently the main pricing and payment tools in the cryptocurrency market. The development of the cryptocurrency market will drive the increase in demand for stablecoins. For example, when Bitcoin is actively traded, the demand for stablecoins as intermediary currencies will also increase.

In the encrypted digital ecosystem, stablecoins are more convenient for payment than other types of cryptocurrencies and fiat currencies, and have lower costs.

Blockchain-based stablecoins can be settled instantly around the clock without the need for manual processing, and a transaction can often be completed in just a few minutes.

The peer-to-peer transaction model of stablecoins eliminates the involvement of central institutions and reduces transaction fees.

The privacy of stablecoins makes their use more demanding than fiat currencies in some scenarios.

For example, DeFi activity has grown most significantly in Sub-Saharan Africa, Latin America, and Eastern Europe in recent years.

The risks of stablecoins mainly focus on bank runs and the risk of issuing stablecoins out of thin air. Both of these risks may cause the value of the currency to quickly return to zero.

When stablecoins face large-scale redemptions, they will inevitably have to sell off their reserve real-world assets, such as government bonds, legal tender, commercial bills, etc. When redemption becomes difficult, the value of stablecoins will be decoupled, and in severe cases will drop sharply.

Since the relationship between the reserve assets and collateral assets of a stablecoin issuer and the issuance of stablecoins is actually opaque, there is a moral hazard of the issuer issuing stablecoins out of thin air.

Since 2017, Tether, the issuer of USDT, has been repeatedly questioned by the market about its reserve assets due to banking disputes with its affiliated company Bitfinex Exchange. Tether is suspected of "issuing stablecoins out of thin air" and has been subject to legal investigations.

In March 2021, Tether decided to disclose its reserve assets on a regular basis after paying a fine of $40 million.

The direct and underlying purpose of stablecoin policy

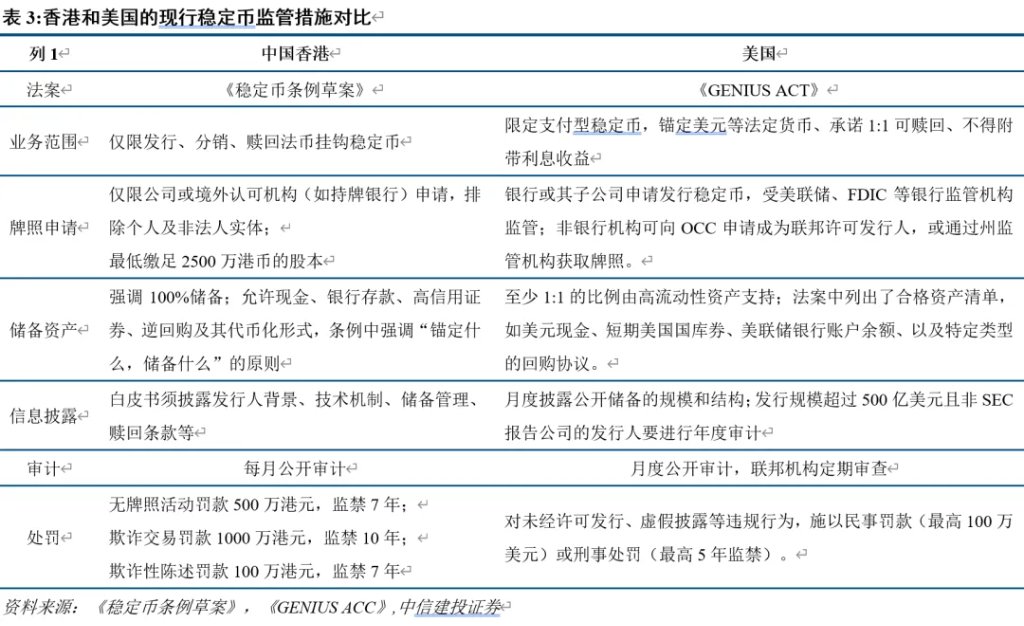

1. Deconstruction of the latest stablecoin policy

The U.S. Senate passed procedural legislation for the GENIUS Act.

On May 19th local time, the U.S. Senate passed the procedural legislation of the Guidance and Establishment of a National Innovation for a United States Stablecoin Act (GENIUS Act).

The key provisions of the GENIUS Act include three:

Federal licensing. Issuers with a circulation volume of more than $10 billion are required to obtain a federal license and be subject to regulation.

Full reserve backing. Stablecoins must be backed 1:1 by high-quality liquid assets such as U.S. Treasuries and cash.

Mandatory audits. Issuers are required to conduct monthly public audits and disclose reserve assets.

Hong Kong's "Stablecoin Ordinance" has officially become law.

The Hong Kong Special Administrative Region Government published the Stablecoin Ordinance in the Gazette on May 30, which means that the Stablecoin Ordinance has officially become law.

There are three key clauses.

Access system. Issuers (excluding individuals or unincorporated entities) must apply for a license and have a minimum registered capital of HK$25 million. Stablecoins cannot be issued without a license.

Reserve management. The reserve assets must be greater than the circulating face value of the stablecoin, emphasizing "what is anchored, what is reserved".

Audit and disclosure. The white paper must disclose the issuer’s background, technical mechanism, reserve management, redemption terms, etc., and be audited regularly.

2. The underlying logic and essential intention of the policy

The introduction of policy regulations marks the beginning of the second era of development for stablecoins, as the policy is intended to make stablecoins more stable.

In fact, the main direction of policy making is to focus on the "trust consensus" of the stablecoin's stability mechanism. In addition, the policy also provides external credit enhancement for stablecoins, that is, to clarify what is a standardized stablecoin and to clearly regulate stablecoins.

The policy makes stablecoins more stable through three levels:

First, eliminate the conceptual bias of stablecoins and prevent the underlying risks in the development of stablecoins.

The "Draft Stablecoin Regulations" stipulate that the purpose of stablecoins is payment, debt repayment and investment. Stablecoins need to be anchored to a single asset or a basket of assets and are not issued by central authorities.

The regulatory subject of the GENIUS ACT is payment-type stablecoins, which are intended to be used for payment or settlement, and issuers are not allowed to provide interest or income for stablecoins.

Second, refine the specifications of stablecoin anchored assets to make the core of stablecoin more stable.

Both the Stablecoin Regulations and the GENIUS ACT require that the issuance of stablecoins must have at least 100% real asset reserves, and require issuers to conduct regular audits and disclosures of their reserve assets. The redemption mechanism must also be disclosed in the issuance white paper.

The purpose is to standardize the issuance of stablecoins, improve the transparency of information disclosure, and reduce the risk of bank runs and the risk of issuing out of thin air. Especially in today's rapidly developing cryptocurrency market, the global stablecoin transaction volume has exceeded Visa, and regulators have taken timely action to reduce the risk of stablecoins.

Third, build a stablecoin regulatory framework to make the development of stablecoin more official.

The Stablecoin Bill stipulates that the Hong Kong Monetary Authority is the regulatory body of Hong Kong's stablecoins, responsible for overseeing their issuance to promote monetary and financial stability.

The GENIUS ACT implements a dual-track supervision system. Issuers with an issuance scale of less than US$10 billion can choose state-level supervision, while issuers with an issuance scale of more than US$10 billion are subject to federal supervision. The state-level supervision system is basically similar to the federal supervision framework. The state-level supervision regulator is the state payment stablecoin agency, and the federal supervision agencies include the Office of the Comptroller of the Currency (OCC, which manages non-bank entities) and the Federal Reserve (which manages deposit institutions).

Can stablecoins save the US dollar and US debt?

Stablecoins are essentially the glue, or connecting bridge, between fiat currency (mainly the US dollar) and digital currency (mainly Bitcoin).

Therefore, the underlying logic of the development of stablecoins is to repair the split between the US dollar and Bitcoin. For example, after the recent introduction of reciprocal tariffs in the United States, the financial order has shown signs of reconstruction again, and more and more people are investing in Bitcoin.

In order to further analyze the above logic and answer the question "What is the future development path of stablecoins?", we use four small questions to break down and try to answer this big question from the shallow to the deep:

Question 1: What has happened to the US dollar in international payments in recent years?

The international payment system with the U.S. dollar as the ultimate currency credit is loosening. An important piece of evidence is that the volume and amount of cross-border payment business continue to grow, but the number of active correspondent banks has dropped by about one-fifth.

The main reasons are: (1) the traditional agency banking model itself has defects such as low payment efficiency, high transaction costs, limited coverage, and low transparency; (2) geopolitical games have caused some countries and regions to withdraw from the modern cross-border payment system; (3) after the epidemic, the United States implemented massive fiscal and monetary easing at home and abused the credit of the US dollar.

The three most important supports of the international payment system are the US dollar, the banking system and SWIFT. After their vulnerabilities became apparent, the market began to look for other cross-border payment alternatives.

Therefore, the market value of cryptocurrencies (such as Bitcoin) and gold, which are borderless currencies, has continued to expand since the epidemic.

Question 2: What is the driving force behind the development of Bitcoin since 2023?

Since 2023, the global "de-dollarization" has intensified. The landmark event was that on April 1, 2022, Russia began to use rubles to settle natural gas payments for "unfriendly" countries.

The global binary tear and the undercurrent of financial order reconstruction have led to a continuous increase in the world's attention to encrypted digital currencies. Since 2023, new concepts of encrypted digital currencies have developed rapidly, such as the Ordinals protocol and Blur tokens. The price of Bitcoin also reached the $100,000 mark at the end of 2024.

In April 2025, the United States introduced "reciprocal tariffs", global trade rules and supply chain order were reshaped, and global financial markets based on economy and trade became more volatile. Bitcoin has once again risen against the backdrop of the reconstruction of the financial order.

Question 3: What does the more stable development of stablecoins mean for international payments in Bitcoin and US dollars?

Cryptocurrencies are decentralized and have a binary opposition to credit currencies such as the US dollar. However, the value of cryptocurrencies such as Bitcoin and Ethereum fluctuates too much, and the value scale is unstable. They are more suitable as investment products for storing value rather than common currencies. Stablecoins were born to establish a value scale in the cryptocurrency world, and in order to stabilize prices, they need to be anchored to the value of legal currency.

One side of stablecoin is fiat currency, and the other side is digital currency represented by Bitcoin, which is a bridge between the digital virtual world and the real world.

In the context of the reconstruction of the global financial order, the currencies used for international payments have begun to show a decentralized trend. The payment convenience of encrypted digital currencies is much higher than that of the cross-border payment system of banks, the transfer cost is also lower, and there is no risk of being sanctioned. Therefore, encrypted digital currencies have become an alternative for cross-border payments, and the international payment system with legal currency as the core is at risk of losing its position.

Stablecoins are the glue between cryptocurrencies and the dollar in international payments. Although stablecoins are also the product of blockchain technology and have decentralized characteristics, they still need to reserve national credit assets in order to maintain currency stability.

Vigorously developing stablecoins and making them the digital currency carrier for cross-border payments will give the US dollar and other fiat currencies an opportunity to firmly occupy the leading position in the international payment system. It is not difficult to understand why the United States is actively building a strategic reserve of encrypted digital currencies, introducing encouraging regulatory policies, and regulating the issuance of stablecoins.

Question 4: In the future, how much support will stablecoins provide to U.S. debt?

Currently, the total size of stablecoins is relatively small compared to US Treasury bonds.

Currently, mainstream stablecoins are all anchored to the US dollar, and in order to cope with redemption pressure and obtain interest income, reserve assets are mainly short-term US Treasury bonds.

The market value of USDT and USDC accounts for more than 85% of the total market value of stablecoins, and the two together hold US$120 billion in short-term US Treasury bonds.

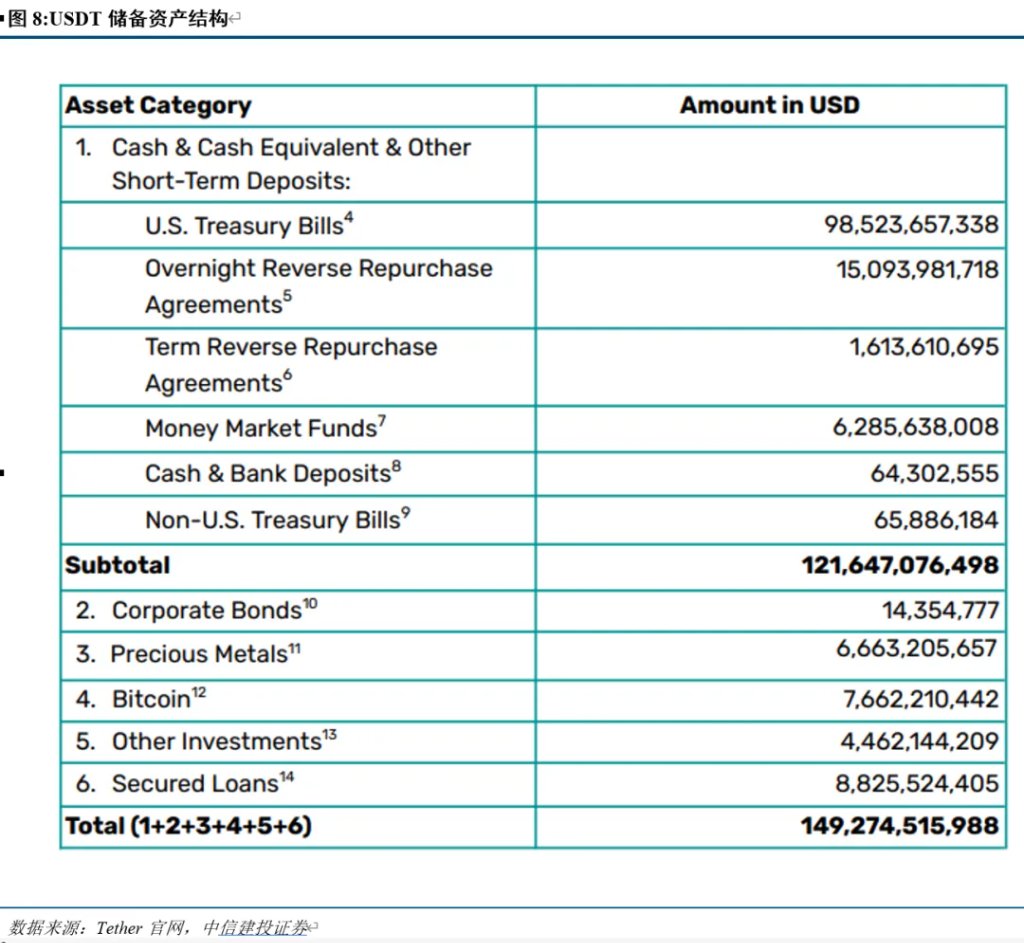

USDT's first quarter audit report for 2025 shows that its reserve assets include approximately US$100 billion in short-term U.S. Treasury bonds, accounting for about 2/3 of total assets.

Among USDC's reserve assets at the end of the first quarter of 2025, there are approximately US$20 billion in short-term U.S. Treasury bonds, accounting for 40% of total assets.

The current stock of short-term U.S. Treasury bonds is approximately $6 trillion, of which $120 billion accounts for only 2%.