Last week, the most significant market impact, almost equivalent to a black swan event, was the public fallout between Trump and Musk, who exchanged heated words on social media for an entire night. With the two most influential figures in the US turning against each other, the market feared potential economic instability, causing a US stock market downturn. Due to the high correlation between the crypto market and US stocks, and the significant influence of Trump and Musk in the crypto, Bitcoin's price nearly dropped below $100,000, with the crypto market's total liquidation approaching $1 billion in a single day.

VX: TZ7971

However, Bitcoin ultimately held the $100,000 level and recovered to $105,000 within a day, without breaking the upward trend line since late April. With Trump and Musk's relationship slightly easing, and the US non-farm payrolls and unemployment rate meeting market expectations, US stocks and the crypto market rebounded strongly. The short-term negative sentiment disappeared, and the weekend crypto market remained optimistic, continuing its upward trend. Bitcoin stabilized at the $105,000 level, and Ethereum regained the $2,500 level.

Wednesday's CPI Data to Determine Interest Rate Timing

The market's current focus is on the Sino-US trade negotiations on Monday and the US CPI data on Wednesday. In recent months, tariff situations have significantly influenced market trends, especially the relationship between China and the US, which could bring a reversal. If Monday's negotiations yield positive results, the market is likely to rise. However, everything ultimately depends on Trump's statement; if he is dissatisfied with the negotiation results, market volatility will ensue.

The CPI data, an inflation indicator, will impact the Federal Reserve's interest rate cut cycle. After last week's disappointing small non-farm data, the market briefly anticipated rate cuts as early as July. However, after Friday's non-farm data and unemployment rate met market expectations, the market now predicts the earliest rate cut will be by year-end. If Wednesday's CPI shows an unexpected increase, September rate cut expectations may rise, pushing the market to favor risk investments, which would positively impact US stocks and the crypto market.

Lack of Good Speculation Targets

Since mid-2024, the blockchain and crypto industry has struggled to generate new investment narratives. While Bitcoin continues to dominate as a store of value through institutional adoption and US Bitcoin strategic reserve policies, Altcoins have failed to inspire similar enthusiasm.

Recalling the 2021 bull market, Altcoin markets surged driven by DeFi, Non-Fungible Token, and Layer 2 blockchain hype. However, these narratives have largely lost momentum in recent years. High fully diluted valuation (FDV) and low circulating supply of new projects have deterred investors, while regulatory uncertainty and concerns about malicious market manipulation of meme coins further suppressed enthusiasm.

Although Bitcoin's market cap reached $1.98 trillion in 2024 and the Altcoin market (excluding Bitcoin) grew 129% to $886 billion, only 25 top Altcoins outperformed Bitcoin. This indicates that the liquidity injected into the crypto market through Bitcoin spot ETFs did not flow into Altcoins as expected. Instead, investors seem to be redirecting funds to the US stock market, where opportunities like Circle IPO and crypto-related stocks (such as Coinbase and Strategy) offer lower-risk and more regulated crypto ecosystem investment paths.

Liquidity Shift

The US stock market has become the capital destination originally allocated to crypto. The 2024 Bitcoin spot ETF success raised over $60 billion, primarily benefiting Bitcoin, with institutional investors absorbing 4.3% of its circulating supply. However, this liquidity did not spillover to Altcoins as anticipated.

Instead, investors are attracted to crypto-related stocks that provide blockchain industry exposure under traditional market regulation and stability. Companies like Coinbase (up nearly 100% in 2024) and Strategy (up 500% in 2024) have outperformed most Altcoins, with Circle's IPO further catalyzing this trend.

Bitcoin's average correlation with the S&P 500 in 2024 was 0.51, indicating increasingly close ties between crypto and stock markets. As Bitcoin's upward trend stabilizes, investors appear to be shifting profits to the stock market, especially stocks with crypto exposure.

The 2025 appointment of crypto-friendly SEC Chair Paul Atkins is expected to promote more crypto company IPOs, further incentivizing capital flow to the stock market. Crypto market challenges include liquidity constraints, regulatory barriers, and a lack of compelling Altcoin narratives.

As the US stock market continues to offer low-risk attractive opportunities, Altcoin liquidity loss may persist in 2025 unless new narratives or technologies emerge to draw funds back to the crypto market.

Today's fear index is 62, with the market shifting to a greedy state.

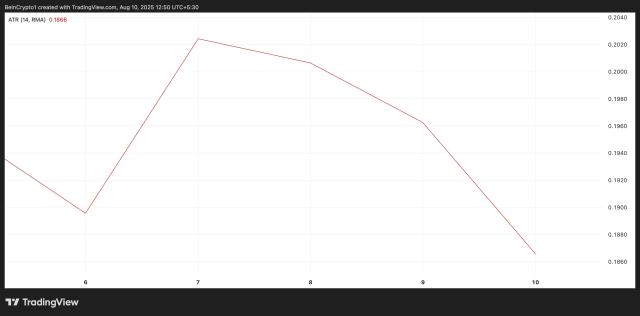

There are no significant market fluctuations. Bitcoin is currently at $105,600, Ethereum at $2,500. Those with spot positions can continue holding. Bitcoin trading volume is at a new low since 2023, indicating a very sluggish market. However, exchange reserves have dropped to a 3-year low, while whale holdings have reached a new high, showing a strong accumulation trend. Despite the poor market conditions, whales continue to buy. Without major macro negative factors, Bitcoin is more likely to continue a "slow bull" trend. It is recommended to use a "pyramid scaling" strategy, with resistance at $110,000, to avoid being left behind.