#SOL

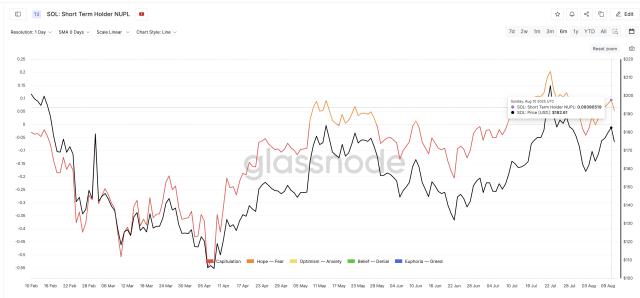

- Technical Indicators: SOL is below the 20-day MA but shows bullish MACD signals.

- Market Sentiment: Mixed with institutional support offset by short-term technical pressures.

- Price Targets: A breakout above $163.29 could push SOL toward $200.

SOL Price Prediction

SOL Technical Analysis: Key Indicators to Watch

According to BTCC financial analyst Michael, SOL is currently trading at $150.02, below its 20-day moving average (MA) of $163.29. The MACD indicator shows a bullish crossover with the MACD line at 13.21 above the signal line at 7.26, suggesting potential upward momentum. However, the price is NEAR the lower Bollinger Band at $140.82, indicating possible oversold conditions. Michael notes that a break above the middle band at $163.29 could signal a stronger bullish trend.

Market Sentiment: Mixed Signals for SOL

BTCC financial analyst Michael highlights that Solana's SOL is experiencing mixed market sentiment. Positive news includes a $1B institutional investment and a surge in on-chain activity, while technical pressures like a double-top pattern and fading memecoin trading activity weigh on the price. Michael suggests that institutional backing and new projects like CookingCity's Solana-based Memepad could provide long-term support, but short-term volatility may persist.

Factors Influencing SOL’s Price

Solana's SOL Rebounds Amid On-Chain Activity Surge

Solana's SOL token demonstrated resilience Saturday, rebounding from an intraday low of $147.13 to trade above $151 despite persistent macroeconomic pressures. The recovery coincides with heightened blockchain activity, marked by Coin Days Destroyed reaching 3.55 billion—the third-highest level recorded this year.

Technical indicators suggest bullish momentum, with a double-bottom pattern forming near $147.50 and rising trading volume supporting a short-term upward channel on 6-hour charts. The token now faces immediate resistance at $152.85, a level where sellers previously emerged. A decisive break above this barrier could test the $155–$157 range.

While Solana's network fundamentals appear robust, broader market conditions remain volatile. Geopolitical tensions and rising bond yields continue to weigh on cryptocurrency markets globally. SOL's price action reflects this dichotomy—rallying 3.95% intraday before encountering minor resistance near $152.50.

CookingCity Launches Solana-Based Memepad with $7M Backing from Major Crypto Investors

CookingCity, a new Solana-based launchpad, has secured $7 million in funding from prominent investors including Jump Crypto and Mirana Ventures. The platform aims to democratize token launches by eliminating insider advantages through its peer-to-peer design.

The project requires Phantom wallet integration and offers users the ability to earn Aura points via social media engagement and platform testing. Early participants may gain an edge as the point system expands, with current low competition for rewards.

Notable features include Cooked Card creation and on-chain token generation capabilities. The platform's transparent launch mechanism could set a new standard for fair distribution in the Solana ecosystem.

Wall Street Ponke and Solaxy Emerge as High-Potential Crypto Plays Amid Market Revival

The cryptocurrency market's resurgence has spotlighted two ambitious projects—Wall Street Ponke and Solaxy—as potential high-growth opportunities. Solaxy, a Solana-focused Layer-2 scaling solution, addresses network congestion with a $40 million presale haul, signaling strong institutional interest. Meanwhile, Wall Street Ponke leverages AI to enhance trading security, positioning itself as a disruptor in decentralized finance.

Solaxy's infrastructure-first approach resonates with developers migrating from Ethereum, while its transaction efficiency could redefine Solana's scalability limits. Wall Street Ponke's AI-driven security model taps into growing demand for trustless trading mechanisms. Both projects embody the market's appetite for innovation with tangible utility—a departure from speculative meme coin mania.

SEC Commissioner Clarifies Regulatory Stance on TRUMP Meme Coin

U.S. SEC Commissioner Hester Peirce, known as 'Crypto Mom,' has reaffirmed that meme coins like the TRUMP token fall outside the agency's regulatory scope. Speaking at the 2025 Bitcoin Conference, Peirce emphasized that investors in such assets should not expect protections under securities laws.

The Solana-based TRUMP token has drawn political scrutiny following its January launch and subsequent price surge to $75. Democrats have raised concerns about former President Donald Trump's ties to the cryptocurrency sector, but Peirce maintains that SEC intervention would constitute regulatory overreach.

'Investors must understand they're entering high-risk territory,' Peirce stated, underscoring the speculative nature of meme coins. The comments come amid growing institutional debate about cryptocurrency regulation and investor protection in volatile digital asset markets.

FTX Initiates $5B Monthly Payouts to Creditors in Second Repayment Phase

FTX's bankruptcy estate has commenced its second wave of creditor repayments, deploying $5 billion monthly through the FTX Recovery Trust. The distributions follow stringent eligibility checks, with Kraken and BitGo serving as distribution partners for rapid processing.

Claimants receive varying recovery rates: Dotcom customers secure 72% reimbursement, US claimants 54%, while Convenience Class creditors enjoy a 120% payout. General unsecured claims see 61% recovery—a marked improvement from February's $1.2 billion initial distribution.

Market analysts monitor the liquidity event closely, noting potential volatility should whale recipients liquidate positions on retail exchanges. The repayments mark a critical phase in unwinding one of crypto's most spectacular collapses.

Solana's SOL Dips 5% Amid Fading Memecoin Trading Activity

Solana (SOL) dropped more than 5% in the past 24 hours, slipping from $163.72 to a low of $154.99. The decline reflects broader market unease fueled by geopolitical tensions and a reversal of Trump-era tariff suspensions by the U.S. Court of International Trade, which reignited trade concerns.

Memecoin activity, once a key driver of Solana's network revenue, has sharply declined since early April. Platforms like Pump.fun saw transaction volumes nosedive, further pressuring SOL's price. Technical indicators show SOL forming a double-top pattern near $184.50, with a breakdown below critical Fibonacci support levels.

Despite the downturn, Solana Labs unveiled the Solana AppKit—an open-source React Native toolkit enabling developers to build iOS and Android apps on Solana in under 15 minutes. The kit integrates 18+ protocols, including embedded wallets and features like direct swaps powered by Jupiter Exchange, aiming to bolster ecosystem engagement.

Solana Faces Technical Pressure as Double Top Pattern Signals Potential Pullback

Solana's market trajectory shows signs of strain as a double top formation emerges on its four-hour chart. The cryptocurrency, currently trading around $162, has repeatedly failed to breach the $173 resistance level, heightening the risk of a retreat to $145. Market dynamics are exacerbated by $30 million in long position liquidations and leveraged trades reaching a four-month peak.

Technical analysts view the double top as a classic reversal signal, with a decisive break below $161 potentially accelerating downward momentum. Spot market profit-taking and forced liquidations could amplify volatility. The next critical support zone lies between $132 and $135 should the pattern fully materialize.

AI Project Donut Secures $7M Pre-Seed Funding for Solana-Based Agentic Crypto Browser

Donut, an artificial intelligence project, has raised $7 million in pre-seed funding to develop a Solana-based agentic crypto browser. The tool aims to simplify user interaction with blockchain applications through AI-driven automation.

Hongshan, BITKRAFT, and HackVC led the funding round. The browser integrates a native cryptocurrency wallet and autonomously executes on-chain operations by analyzing webpage content and user behavior. Designed to function like a trading terminal, it enables real-time transactions, trading, and yield generation.

AI agents are increasingly seen as critical to unlocking blockchain's potential, particularly in navigating complex tasks like smart contract interactions and cross-chain bridging. Donut's approach leverages this trend by embedding AI directly into the user's browsing experience.

Solana Gains Institutional Momentum with $1B Investment and Nasdaq-Listed LST Adoption

Solana's ecosystem is attracting unprecedented institutional interest as two major developments underscore its growing prominence in digital asset markets. SOL Strategies, a Canadian investment firm, has filed a $1 billion shelf prospectus to expand its Solana holdings, signaling aggressive confidence in the blockchain's DeFi and validator networks.

Meanwhile, Nasdaq-listed DeFi Development Corp. has partnered with Sanctum to launch dfdvSOL, becoming the first public company to adopt Solana-based liquid staking tokens. This strategic move allows investors to stake SOL while maintaining liquidity for DeFi activities, aligning with DFDV's SOL Per Share metric optimization.

Solana (SOL) Price Analysis: Strong Support at $170, What Next?

Solana's blockchain ecosystem gains momentum with institutional backing and technical integrations. SOL Strategies' $1 billion prospectus and $500 million ATW facility signal growing traditional finance crossover, while MetaMask's expanded support enhances retail accessibility. RedStone's RWA data integration further bolsters Solana's DeFi capabilities.

The token trades at $172.42, showing resilience despite minor short-term corrections. A 16.05% monthly gain underscores sustained bullish momentum, with the $168-$170 support zone acting as a springboard for potential upside. Trading volume remains robust at $3.66 billion, reflecting strong market participation.

Solana Secures Major Institutional Backing with $1B Fund and Liquid Staking Initiative

Solana's ecosystem is gaining institutional traction as two publicly traded companies unveiled significant commitments this week. Sol Strategies, a Canada-listed firm, filed a preliminary prospectus to raise up to $1 billion for Solana-focused investments, signaling long-term confidence in the blockchain. The move follows a recent $500 million convertible note issuance, with an initial $20 million tranche already deployed to acquire 122,000 SOL.

Separately, Nasdaq-listed DeFi Development Corp. is pioneering institutional liquid staking on Solana through Sanctum's infrastructure. The company's new dfdvSOL token will allow users to stake SOL while maintaining liquidity—a first for public companies in the Solana ecosystem. This dual development underscores growing institutional sophistication around Solana's staking mechanics and DeFi integration.

How High Will SOL Price Go?

BTCC financial analyst Michael provides a cautious yet optimistic outlook for SOL. Key technical levels to watch include the 20-day MA at $163.29 and the upper Bollinger Band at $185.76. A breakout above these levels could target $200. Institutional investments and growing ecosystem projects like Donut and CookingCity's Memepad add fundamental strength. However, Michael warns of short-term pullbacks due to technical patterns like the double top.

| Indicator | Value |

|---|---|

| Current Price | $150.02 |

| 20-day MA | $163.29 |

| Upper Bollinger Band | $185.76 |

| MACD | 13.21 (Bullish) |