- DOGE is facing increasing selling pressure as short and medium-term investors accept losses.

- 400 million DOGE transferred to Binance signals declining investor confidence across the board.

Selling Pressure Increases as DOGE Drops to $0.17

Approximately 400 million DOGE were transferred to Binance as Dogecoin (DOGE) dropped to the support level of $0.17 – a price recorded a month ago. After a 31% decline since the May peak, this movement indicates large funds are seeking to exit or cut losses.

Currently, the big question is: Will selling pressure continue to drive DOGE down, or will FOMO sentiment help maintain this support level?

This trend will determine whether DOGE successfully defends $0.17 or continues to drop lower.

Old Cycle Repeats – DOGE Encounters "Sell Wall"

On-chain data shows about 30% of DOGE addresses are currently holding coins below their purchase price, with an average buy price higher than the current trading price of $0.18.

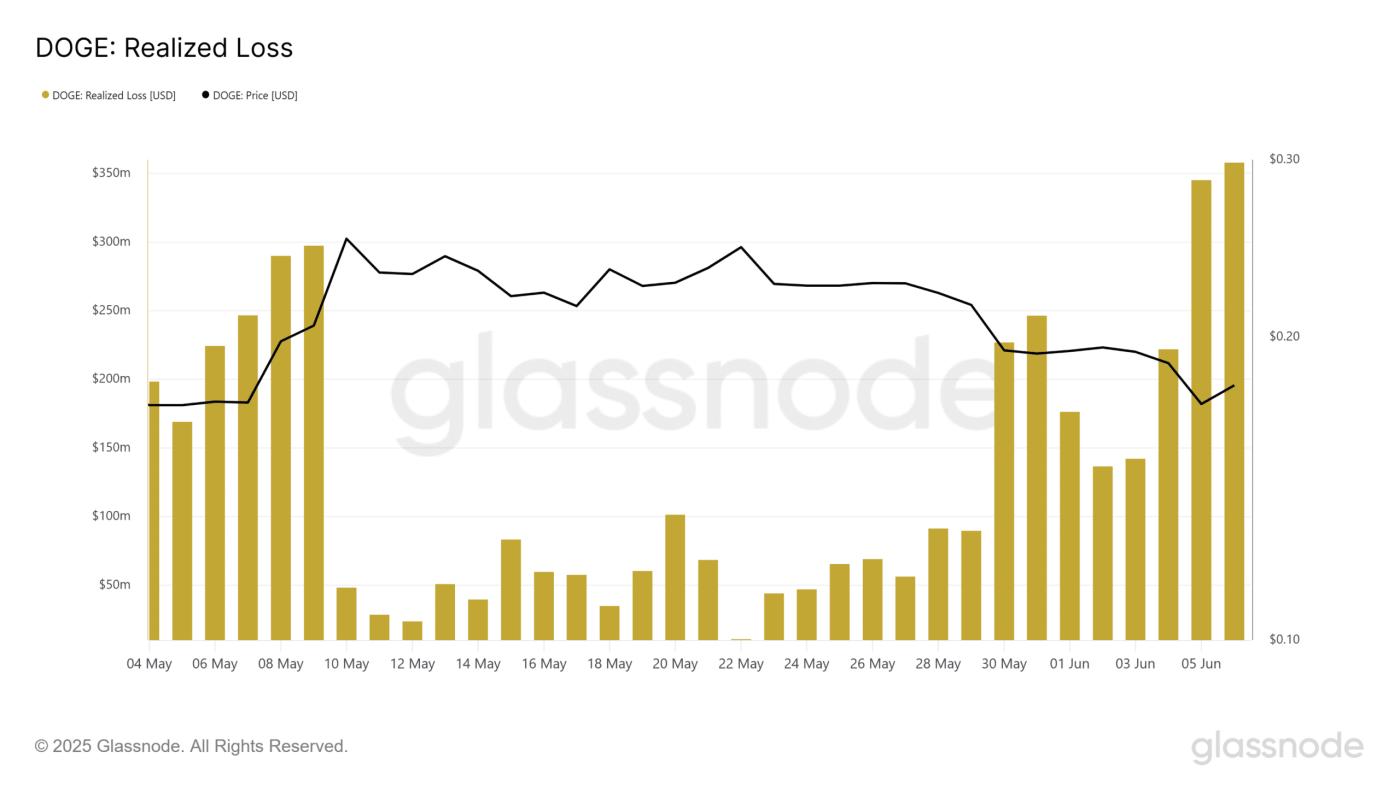

Notably, since DOGE broke below $0.20, a strong wave of "selling out" has occurred in the HODLer community. In just 3 days, the total realized loss reached over $800 million.

This movement coincides with a significant price drop to $0.1680, indicating increasing selling pressure.

Source: glassnode

Additionally, the 400 million DOGE transferred to Binance suggests many investors are ready to sell if a weak recovery emerges.

However, the current selling pressure is not from "Diamond Hands" – long-term HODLers – but primarily from short and medium-term holders.

Similar to previous cycles, traders who "buy the dip – take early profits" continue to create selling pressure when DOGE recovers, causing many holding addresses to fall into a loss-making state.

Short-Term Investors Distribute Heavily, Profits Shrink

When DOGE tested the $0.25 resistance, the NUPL indicator for short-term investors turned negative – signaling the initial capitulation phase for this group in the market.

This capitulation pressure increased, causing DOGE to break the critical $0.20 level and pushing profit margins lower, while severely eroding investor confidence.

Source: glassnode

Moreover, HODL Waves data further supports this perspective. The 3-6 month holding group, which owned 10% of DOGE supply in March, surged to 15.53% at the price peak. However, as the recovery wave ended, this group began taking profits or cutting losses; currently, the holding ratio is only 12.4% – reflecting strong market distribution.

In summary, the outflow of short-term investor funds is forcing many DOGE addresses to realize losses. If DOGE fails to break the current distribution cycle and reclaim the $0.25 threshold, the $0.17 level will continue to face significant selling pressure and risks being broken further.