- VIRTUAL increases 10.48% as spot traders buy 10.45 million USD of this altcoin during market downturn

- Large investor group (smart money) currently holds more VIRTUAL than any memecoin or AI Token, consolidating market confidence

VIRTUAL Breaks Through During Market Correction

Virtuals Protocol (VIRTUAL) recorded a 10.48% increase in the past 24 hours, driven by strong capital flow in both spot and derivative markets.

This price momentum is not isolated but reflects a shift in investor sentiment across the cryptoasset market.

Analysis of accumulation and position liquidation trends on VIRTUAL shows positive signals, indicating potential continued growth.

Spot and Derivative Trader Activities

VIRTUAL accumulation volume on the Spot Trading market increased significantly this week, with investors spending a total of 10.45 million USD to buy in, despite the broader market's sharp decline.

Source: CoinGlass

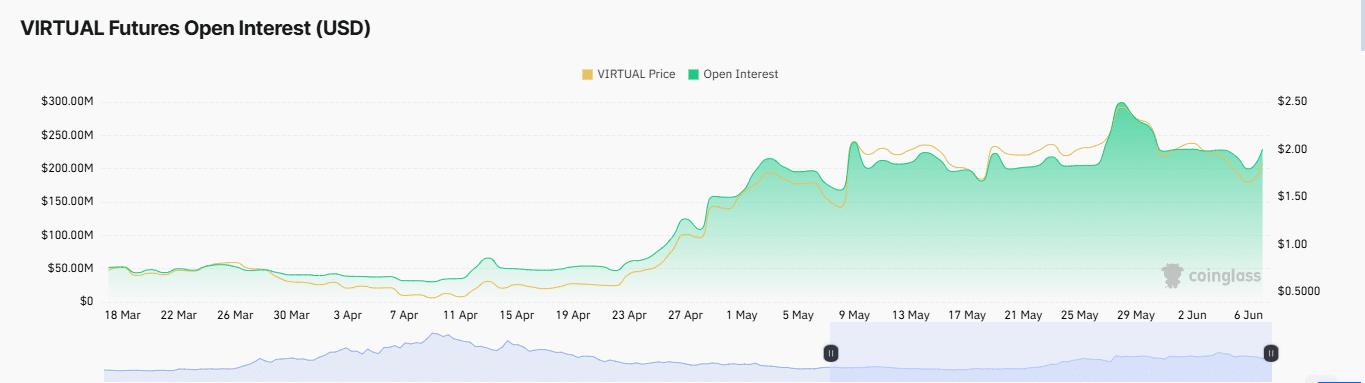

Simultaneously, the derivative market also witnessed strong buying. In the past 24 hours, Open Interest – the value of open contracts – surged to 230 million USD, equivalent to a 13.3% increase.

Source: CoinGlass

This growth was accompanied by a strong price recovery trend, simultaneously recording a large liquidation of Short positions. In just 24 hours, Short traders suffered losses of nearly 124,670 USD, double the loss of Longing positions.

Source: CoinGlass

This development signals a sentiment shift, with many traders moving to strengthen Longing positions, anticipating another price increase for VIRTUAL.

Does VIRTUAL Still Have Room for Price Increase?

4-hour chart analysis shows VIRTUAL has an opportunity to target the $2.5 mark if the upward momentum is maintained.

Currently, VIRTUAL's price has broken through a key resistance zone – a technical factor that helps consolidate price increase prospects.

Source: TradingView

The Aroon indicator also confirms the positive trend, with the Aroon Up line (orange) maintaining position above the Aroon Down line (blue). Specifically, the Aroon Up index reaches 92.86%, while Aroon Down is at 35.27% – a clear signal of an emerging Bull market.

At times, buying activities from the smart money investor group – known for generating good profits – have helped drive VIRTUAL's price increase. To date, this group holds more VIRTUAL than any meme or AI Token, creating a positive psychological foundation for continued growth.

Currently, the 90-day index has ranked VIRTUAL as the 4th best-performing cryptoasset, surpassing the entire top 10 list of cryptocurrencies by Capital.