A new wave of layoffs is sweeping across industries in 2025. This suggests that the labor market may be entering its most turbulent phase since the pandemic economic downturn. This is added to the list of U.S. macroeconomic indicators affecting cryptocurrency.

Layoffs are no longer limited to tech giants or government agencies, and the real economy is sending warning signals. The stock market is stagnant, and cryptocurrency investors are clinging to hopes of interest rate cuts.

Cryptocurrency, Noting 80% Surge in Layoffs in 2025... Is Inflation No Longer the Major Threat?

Employment and job data are increasingly influencing the U.S. economic indicators affecting cryptocurrency.

The wave of layoffs that shook the market in 2022-2023 is sharply returning in 2025. According to reports, U.S. companies have announced more layoffs in the first five months of 2025 than in the same period over the past four years.

"Tariffs, budget cuts, consumer spending, and overall economic pessimism are putting strong pressure on corporate workforce. Companies are cutting expenses, delaying hiring, and sending layoff notices." – Forex Analytics, Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas.

The data also shows the deterioration of the U.S. labor market. According to Challenger, Gray & Christmas, layoffs in May 2025 increased by 47% compared to the same month last year. Year-to-date layoffs have also increased by 80% compared to 2024.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating to English.]"Layoffs are spreading to sectors other than government and occurring for reasons other than budget cuts or Doge collapse." – Outplacement Company.

"Prediction: The government will print money to save us. Expect public works projects, increased debt for this (weak dollar, expensive credit), and (on the positive side) better infrastructure." – Bravo additional statement.

Cryptocurrency-related companies are also experiencing difficulties. BeInCrypto reported that the Ethereum Foundation has laid off employees as part of a core team restructuring. This indicates that internal cost restructuring can occur even in important blockchain institutions.

Meanwhile, the venture capital (VC) sector is changing, and portfolio manager Greg Eisenberg is emphasizing broader impacts.

"Layoffs don't come at once, they come in waves. First round in Q2 (10-15%), again in Q4 (15-25%) when companies realize the first cuts weren't enough... VCs go quiet. When markets drop, LPs withdraw promises, and capital calls slow down... Corporate spending freezes or chills." – Eisenberg's warning.

Eisenberg pointed out a "double hit" for consumer startups: customers worried about economic recession are reducing spending, and tariffs increase the cost of sold goods. Direct-to-consumer (DTC) or e-commerce companies with thin margins are hit the hardest.

"Losers... high-burn DTC brands... late-stage startups prioritizing growth over unit economics... Winners... profitable companies, low-burn solo founders, startups with pricing power, AI companies solving genuine business problems." – Eisenberg's explanation.

As layoffs increase, job postings decrease, and investor risk appetite declines, the second half of 2025 may depend on employment more than inflation and interest rates. This narrative change deeply impacts cryptocurrency, capital, and consumer demand.

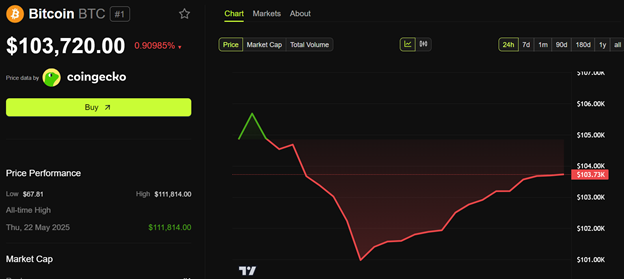

Bitcoin is currently trading at $103,720, having dropped almost 1% in the past 24 hours.