Welcome to the US Cryptocurrency Morning Briefing. Here's a brief summary of today's key cryptocurrency developments.

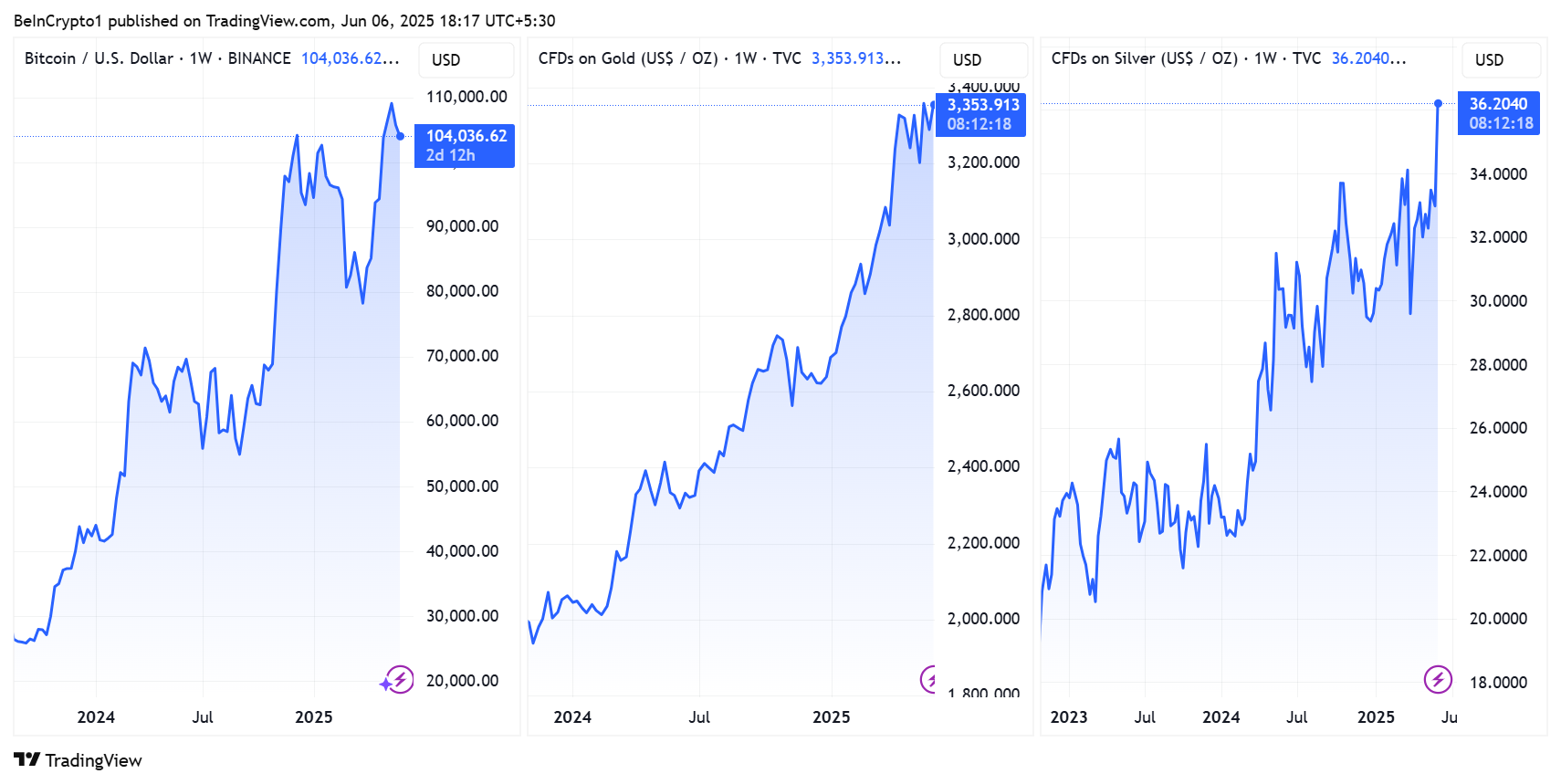

Read experts' opinions on Bitcoin (BTC), gold, and silver. These three safe assets can provide a hedge against fiat currency value decline. This comes amid recent conflicts between the world's richest Elon Musk and the most powerful President Donald Trump.

Today's Cryptocurrency News... Robert Kiyosaki Forecasts Silver to Double by 2025

The conflict between President Trump and Tesla CEO Elon Musk triggered about $10 billion in cryptocurrency liquidation. Amid public fights and collapse, stocks are falling and the cryptocurrency market is turning red.

Financial expert Robert Kiyosaki warned that an economic collapse is imminent. He urged investors to dump "fake money" and switch to physical assets like silver, gold, and Bitcoin.

"Loser's words: 'Should have... Could have... Would have.' For years, I've recommended buying gold, silver, Bitcoin. Don't be a loser saying 'Should have, could have, would have.' Owning gold, silver, Bitcoin is better than saving fake money," Kiyosaki wrote.

According to Kiyosaki, silver is the most attractive opportunity in 2025, potentially doubling to $70 within the year. Currently, silver is trading at $36.20.

This urgency comes alongside widespread predictions of financial chaos. Recent US cryptocurrency news publications noted that Kiyosaki is predicting a confusing stock market collapse. According to BeInCrypto, Kiyosaki said the largest collapse in history is imminent and will continue until this summer.

However, Kiyosaki remains optimistic for those willing to act. He emphasizes silver's 60% discount compared to its all-time high and physical ownership.

Currently, gold has exceeded $3,350 per ounce, and Bitcoin has approached a new high, surpassing $104,000. Analysts say silver's poor performance indicates it is undervalued compared to gold. The gold-silver ratio exceeds 100.

Strategie and Utah Logistics Expand Bitcoin Holdings through Stock Trading

Meanwhile, Bitcoin accumulation is accelerating. Two listed companies, Strategie (formerly MicroStrategy) and Utah Logistics, have announced plans to purchase billions of dollars in BTC through stock-based funding.

MicroStrategy is known for its aggressive Bitcoin financial strategy. On June 5, 2025, it priced its Series A Perpetual Preferred Stock ("STRD stock") IPO at $85 per share. The offering consists of 11,764,700 STRD shares, expecting net proceeds of approximately $979.7 million with an annual dividend rate of 10.00%.

According to Strategie's press release, Strategie plans to use funds for "general corporate purposes, including Bitcoin purchases". STRD stock is non-cumulative, cash-dividends only, and can be redeemed under specific conditions.

Strategie mentioned the per-share liquidation preference initially at $100 but subject to daily adjustments based on trading activity. Settlement is expected on June 10, following standard closing conditions.

"Bitcoin is the future and an opportunity for everyone," MicroStrategy's Board Chairman Michael Saylor reaffirmed on X.

Meanwhile, Utah Logistics (US: RITR) is also joining the BTC accumulation race. The company announced an agreement with a Bitcoin institutional consortium to purchase up to 15,000 BTC, worth up to $1.5 billion, through common stock issuance.

The final stock quantity will depend on market factors like Bitcoin price, company stock price, and trading volume.

"Using Bitcoin as a pillar of the company's financial strategy will help establish a solid foundation for the long-term development of the PLT ecosystem," local media quoted Utah's Chairman Chen Jianzhong as saying.

These transactions indicate a major institutional shift towards using Bitcoin as a financial reserve asset.

Today's Chart

Today's Key News

Summary of today's notable US cryptocurrency news:

- Twenty-One Capital's Reserve Proof Protocol Revealed 42,000 BTC. Supported by Tether, Bitfinex, and SoftBank to Provide Transparency.

- Trump Media Submitted a $2.3 Billion Bitcoin Treasury Plan to the SEC. Aiming to Strengthen Operations and Leverage Bitcoin's Market Role.

- Bitcoin ETF Experienced a Net Outflow of $278 Million. Continued Decline After BTC Dropped Below $105,000.

- Trump-Musk Conflict Caused a 5.1% Drop in Cryptocurrency Market Capitalization. Liquidation Amount Approaching $1 Billion.

- XRP Whales Accumulated About 900 Million XRP. Valued at $1.9 Billion, Attempting to Maintain Price Above $2.00 and Prevent Decline.

- MEXC Launchpad Introduced a Transparent and Contribution-Based Model. Fostering Fair Competition and Prioritizing Quality Projects.

- Metaplanet Aims to Raise $5.4 Billion to Acquire 210,000 BTC. Targeting 1% of Total Bitcoin Supply by 2027.

- Bitcoin Price Stagnating Due to Lack of Large Holder Purchases. Small Holders Driving Demand.

- Pseudonymous Cryptocurrency Trader James Win Earned $87 Million on Hyperliquid but Lost Everything in Days. Due to Risky Leverage Trading.

- Three Cryptocurrency-Related Stocks, Minehub Technologies (MHUBF), Argo Blockchain (ARBKF), and Luxfolio Holdings (LUXFF), Are Attracting Investor Attention Today Due to Notable Developments and Positive Financial Reports.

Cryptocurrency Stock Pre-Market Overview

| Company | June 5th Closing Price | Pre-Market Overview |

| Strategy (MSTR) | $368.79 | $375.50 (+1.82%) |

| Coinbase Global (COIN) | $244.20 | $248.93 (1.94%) |

| Galaxy Digital Holdings (GLXY.TO) | $19.07 | $19.05 (-0.10%) |

| Marathon Holdings (MARA) | $14.88 | $15.14 (+1.75%) |

| Riot Platforms (RIOT) | $8.99 | $9.20 (+2.34%) |

| Core Scientific (CORZ) | $11.93 | $12.15 (+1.84%) |